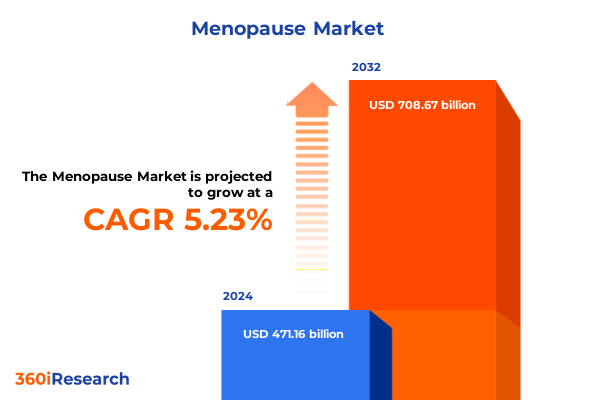

The Menopause Market size was estimated at USD 490.15 billion in 2025 and expected to reach USD 509.91 billion in 2026, at a CAGR of 5.40% to reach USD 708.67 billion by 2032.

Engaging Overview of Menopause Management Challenges and Opportunities Driving Industry Evolution and Shaping Future Directions for Stakeholders

Menopause represents a pivotal phase in women’s health marked by the cessation of menstrual cycles, typically occurring between the ages of 45 and 55. Its significance extends beyond biological transition, as it often brings a constellation of symptoms-including hot flashes, night sweats, mood fluctuations, and cognitive challenges-that can span several years and impact quality of life. In the United States alone, approximately two million women enter menopause each year, while an estimated eight to ten million experience its symptoms at any given time, underscoring the magnitude of unmet healthcare needs in this demographic.

Against this backdrop, the menopause care industry is witnessing renewed focus on developing holistic treatment paradigms. Historically dominated by hormone replacement therapies, the market is rapidly embracing non-hormonal approaches, technological innovations, and patient-centric care pathways. This evolution is propelled by growing awareness among healthcare professionals and consumers about personalized treatment options and the imperative to address disparities in access and outcomes. Transitional care models and digital health platforms are also reshaping treatment adherence and continuous monitoring, reflecting a broader commitment to improving long-term well-being for women navigating this life stage.

Pivotal Transformative Shifts Redefining Menopause Care Through Technological Innovation, Policy Reforms, and Evolving Patient Expectations Across Markets

Recent years have ushered in transformative shifts that are redefining the menopause care landscape. The rise of telemedicine and digital health has emerged as a cornerstone of patient engagement, enabling remote symptom tracking, virtual consultations, and integrated wellness programs. Telehealth providers such as Ro, Midi, and Noom have expanded beyond weight-management offerings to incorporate hormone replacement therapy services, creating seamless digital hubs where patients can access personalized care plans, medication management, and ongoing support.

Policy initiatives are also reshaping the environment for menopause treatments. Government inquiries, such as the Australian Senate’s landmark examination of menopause care, have elevated the topic within public health agendas, prompting investments in clinical guidelines, professional training, and patient education campaigns. Similarly, awareness efforts driven by healthcare advocacy groups and media influencers have intensified dialogue around treatment accessibility, stimulating reforms aimed at reducing geographic and socioeconomic disparities. Collectively, these shifts reflect a dynamic ecosystem in which innovation, policy, and patient empowerment converge to transform how menopause is understood and addressed.

Assessing the Multifaceted Cumulative Impact of Recent United States Tariff Policies on Hormonal and Non-Hormonal Menopause Treatment Supply Chains

The cumulative impact of United States tariff policies in 2025 has introduced a complex set of challenges for menopause treatment supply chains. President Donald Trump’s announcement of potential tariffs of up to 200% on imported pharmaceuticals has spurred industry deliberation about cost implications and sourcing strategies. Although the final tariff structure remains under negotiation, the mere prospect of such steep duties has accelerated discussions around onshoring production and diversifying supply chains to mitigate tariff exposure.

A separate analysis conducted by Ernst & Young indicates that a 25% tariff on finished pharmaceutical products could elevate U.S. drug costs by nearly $51 billion annually, translating to price increases of up to 12.9% if fully passed through to consumers. In addition, input tariffs of approximately 10% on active pharmaceutical ingredients, medical devices, and ancillary goods introduced in early April 2025 have already increased raw material expenses, particularly for generics that rely heavily on Chinese and Indian APIs. These combined levies place pressure on manufacturers, distributors, and healthcare providers to reassess pricing, inventory management, and contractual arrangements across the value chain.

In-Depth Segmentation Analysis Revealing How Product Types, Treatment Stages, Administration Routes, and Distribution Channels Shape Menopause Market Opportunities

A thorough segmentation analysis reveals the nuanced drivers that shape the menopause care market. By examining product type distinctions, it becomes clear that hormone replacement therapies, which encompass combined estrogen-progesterone formulations alongside standalone estrogen and progesterone options, continue to hold prominence in clinical settings. Simultaneously, interest in non-hormonal treatments has surged, highlighting antidepressants such as citalopram, escitalopram, and fluoxetine, in addition to botanical supplements, and neuromodulators like gabapentin and pregabalin, as vital alternatives for patients with contraindications or personal preferences.

Equally important is the segmentation by stage of menopause, where each phase-perimenopause, menopause, and postmenopause-presents distinct symptom profiles and treatment efficacy considerations. Tailoring interventions to a woman’s transitional stage optimizes outcomes and enhances adherence. The choice of route of administration, spanning enteral, parenteral, and topical delivery, further refines patient experience and compliance, offering flexibility for personalized therapy regimens. Finally, distribution channels-from hospital pharmacies to retail pharmacies and increasingly sophisticated online channels, including company websites and eCommerce platforms-play a decisive role in patient access and convenience. Integrating these four segmentation dimensions supports strategic decision-making for product development, marketing prioritization, and channel investment.

This comprehensive research report categorizes the Menopause market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Stage of Menopause

- Route of Administration

- Distribution Channel

Key Regional Dynamics Highlighting Distinct Market Developments and Growth Drivers in the Americas, Europe Middle East & Africa, and Asia-Pacific for Menopause Therapies

Regional market dynamics underscore distinct growth drivers and challenges across the globe. In the Americas, widespread insurance coverage for hormone therapies and a mature telemedicine infrastructure have fostered rapid uptake of both traditional and digital health-enabled menopause treatments. Nonetheless, disparities persist in rural and underserved communities, where lower treatment rates signal the need for targeted education and outreach initiatives.

Meanwhile, the Europe Middle East & Africa region exhibits a heterogeneous landscape. In the United Kingdom, heightened media attention and advocacy have amplified demand for hormone replacement therapies, but supply shortages and “postcode lottery” effects continue to undermine equitable access, prompting national health services to explore guideline updates and workforce training programs. In emerging markets across EMEA, constrained healthcare budgets and limited pharmacy distribution networks pose challenges, even as pharmaceutical companies invest in localized manufacturing and public–private partnerships to expand availability.

Across Asia-Pacific, the ageing population trajectory is accelerating the need for menopause care infrastructure. Data from China indicates that neuropsychiatric and somatic symptoms, such as insomnia and fatigue, affect nearly half of menopausal women, with hot flushes impacting around one-fourth of this population, driving interest in both established and novel treatment modalities. Governments and private sector players are responding with awareness campaigns and new clinic networks, yet logistical hurdles remain for widespread adoption of advanced therapies.

This comprehensive research report examines key regions that drive the evolution of the Menopause market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Comprehensive Insights into Competitive Strategies and Innovation Trends Among Pharmaceutical, Wellness, and Telehealth Companies Serving the Menopause Care Market

Leading companies in the menopause treatment space are deploying diverse strategies to capture market opportunities. Bayer, for instance, is advancing its non-hormonal pipeline with elinzanetant, branded as Lynkuet, which is designed to alleviate vasomotor symptoms and is currently under extended review by the U.S. FDA, signaling progress in regulatory pathways for novel alternatives to hormone therapy. Astellas Pharmaceuticals, following U.S. approval of its neurokinin-3 receptor antagonist Veozah, is consolidating its presence in the non-hormonal segment, reflecting a broader industry shift toward targeted symptom management.

Pharmaceutical incumbents such as Pfizer, AbbVie, and Merck are simultaneously leveraging their global distribution networks and R&D capabilities to refine existing hormone replacement regimens and explore next-generation transdermal and oral formulations. Telehealth innovators like Ro and Noom, which initially focused on lifestyle and chronic disease management, are increasingly embedding hormonal treatment modules into their platforms, driving direct-to-consumer access models that challenge traditional care pathways and engage new patient cohorts.

This comprehensive research report delivers an in-depth overview of the principal market players in the Menopause market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Abbvie Inc.

- Amgen Inc.

- Apotex Inc.

- Astellas Pharma Inc.

- AstraZeneca PLC

- Bayer AG

- Cipla Ltd.

- Eli Lilly and Company

- Ferring International Center S.A.

- Fervent Pharmaceuticals, LLC

- Gedeon Richter PLC

- GlaxoSmithKline PLC

- Glenmark Pharmaceuticals Ltd.

- Ipsen Group

- Merck & Co.Inc.

- Mithra Pharmaceuticals S.A.

- Novartis AG

- Novo Nordisk A/S

- Organon & Co

- Pfizer Inc.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- TherapeuticsMD Inc.

- Viatris Inc.

Actionable Strategic Recommendations Empowering Industry Leaders to Strengthen Competitive Positioning, Optimize Supply Chains, and Enhance Patient Accessibility in Menopause Care

Industry leaders seeking to capitalize on evolving menopause care opportunities should prioritize strategic onshoring and supply-chain diversification to mitigate tariff-related risks. Proactive dialogue with policymakers and stakeholders can help shape phased implementation of import duties, reducing immediate cost shocks. Additionally, investing in localized manufacturing capabilities, particularly for active pharmaceutical ingredients, will safeguard against global trade disruptions and support long-term operational resilience.

Simultaneously, companies must double-down on digital health integration by partnering with telemedicine platforms to deliver comprehensive symptom monitoring, patient education, and adherence support. Tailoring engagement strategies to segmented patient groups-by product preference, menopausal stage, and delivery route-will enhance treatment personalization and loyalty. Finally, forging alliances with healthcare providers, payers, and advocacy organizations will advance awareness campaigns, improve clinical guidelines, and streamline reimbursement pathways, collectively driving broader access and sustained market adoption.

Robust Research Methodology Detailing Primary and Secondary Data Gathering, Expert Consultations, and Analytical Frameworks Ensuring Credible Market Insights on Menopause Treatments

This analysis is built on a multi-layered research methodology designed to ensure the integrity and relevance of findings. Secondary research encompassed a review of peer-reviewed journals, industry news, regulatory filings, and government publications to map current treatment paradigms, tariff policies, and market dynamics. Proprietary databases provided historical and contextual data on product approvals, patent landscapes, and competitive pipelines.

Primary research involved in-depth interviews with key opinion leaders, endocrinologists, gynecologists, and supply-chain executives to validate trends and assess the practical implications of policy and trade adjustments. Data triangulation techniques were employed to reconcile quantitative insights with qualitative feedback, while expert panels reviewed preliminary findings to refine strategic recommendations. Rigorous quality checks, including cross-validation and scenario analysis, underpinned the final synthesis, ensuring robust and actionable intelligence for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Menopause market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Menopause Market, by Product Type

- Menopause Market, by Stage of Menopause

- Menopause Market, by Route of Administration

- Menopause Market, by Distribution Channel

- Menopause Market, by Region

- Menopause Market, by Group

- Menopause Market, by Country

- United States Menopause Market

- China Menopause Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Conclusive Synthesis of Critical Findings Underscoring the Strategic Imperatives and Future Outlook for Stakeholders Engaged in Menopause Management and Care

In summary, the menopause care landscape is undergoing a period of unprecedented transformation driven by regulatory shifts, technological innovation, and evolving patient engagement models. The dual trajectories of hormone replacement therapies and non-hormonal alternatives reflect a maturing market that values both efficacy and safety. Simultaneously, tariff policies have introduced supply-chain complexities, underscoring the importance of strategic resilience and localized production.

Segmentation by product type, menopausal stage, administration route, and distribution channel offers a nuanced lens to understand and serve diverse patient segments. Regional insights reveal varying growth catalysts-from digital health adoption in the Americas to policy-led improvements in EMEA and demographic drivers in Asia-Pacific. Competitive activity, exemplified by Bayer’s regulatory progress with Lynkuet and telehealth incumbents’ market expansions, points to a dynamic ecosystem ripe with opportunity.

Stakeholders who align organizational priorities with targeted supply-chain strategies, digital integration, and collaborative partnerships will be best positioned to navigate this complex environment. As the industry continues to converge around patient-centric care and holistic wellness, proactive leadership and data-driven decision-making will be the hallmarks of success in this evolving market.

Engaging Call to Action Encouraging Collaboration with Ketan Rohom to Acquire In-Depth Menopause Market Research and Drive Data-Driven Strategic Decision Making

To explore how these comprehensive insights can power your strategic initiatives and unlock new growth pathways in the menopause care landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your personalized copy of the in-depth market research report. His expertise in menopause market dynamics and collaborative approach will ensure you gain the data-driven perspective needed to inform product development, refine go-to-market strategies, and strengthen stakeholder engagement. Connect with Ketan today to take the next step toward driving innovation and achieving competitive advantage in the rapidly evolving menopause market.

- How big is the Menopause Market?

- What is the Menopause Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?