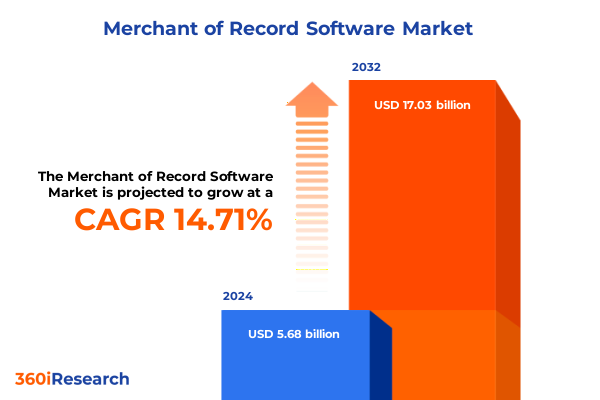

The Merchant of Record Software Market size was estimated at USD 6.46 billion in 2025 and expected to reach USD 7.38 billion in 2026, at a CAGR of 14.83% to reach USD 17.03 billion by 2032.

Merchant of record software emerges as the strategic backbone of compliant global commerce amid escalating regulatory and tariff complexity

Merchant of record software has evolved from a niche enabler of cross-border payments into a central pillar of digital commerce infrastructure. As companies expand globally, monetize through subscriptions, and navigate proliferating digital services rules, the model of appointing a specialist entity to act as the legal seller of record has gained renewed strategic relevance. Instead of building and maintaining complex payment, tax, and compliance capabilities in-house across dozens of jurisdictions, organizations increasingly look to merchant of record platforms to absorb operational and regulatory complexity on their behalf.

This shift is occurring against a backdrop of accelerating regulatory change. Governments are tightening enforcement of indirect taxes such as VAT, GST, and sales tax, while also redefining thresholds and obligations for digital services providers and marketplaces. At the same time, card networks, acquiring banks, and regulators are raising expectations around fraud prevention, dispute management, data protection, and sanctions compliance. Merchant of record software sits at the nexus of these developments, orchestrating payment processing, tax determination, invoicing, and reporting while ensuring that commercial models such as recurring billing and usage-based pricing remain compliant.

Consequently, executive teams now view merchant of record software less as a back-office utility and more as a strategic risk and revenue lever. The ability to launch in new markets without establishing local entities, to adapt quickly to new tariff and tax rules, and to deliver localized payment experiences has become a source of competitive differentiation. This executive summary explores how transformative shifts in policy, technology, and buyer expectations are reshaping the merchant of record landscape, with a particular focus on the cumulative impact of recent United States tariff measures on cross-border digital commerce.

Transformative shifts redefine merchant of record platforms from basic payment facilitators into integrated engines of compliance, risk control, and recurring revenue

The merchant of record landscape is undergoing fundamental transformation as market participants respond to a confluence of regulatory tightening, evolving buyer expectations, and technological innovation. Historically, many providers focused primarily on payment processing and basic tax handling, treating compliance as an add-on to a checkout solution. Today, the model is shifting toward deeply integrated platforms that combine payment orchestration, tax and regulatory compliance, subscription management, and advanced fraud controls in a single environment.

Several forces are driving this evolution. First, global regulators have intensified scrutiny of platforms that aggregate many merchants under a single merchant of record umbrella. The failure of some smaller platforms after disputes with payment processors or fines linked to the behavior of just one high-risk seller illustrates how concentrated liability can destabilize entire ecosystems. In practice, this has encouraged providers to invest more heavily in merchant onboarding, continuous risk assessment, and content screening, while narrowing their focus to better-understood segments such as software-as-a-service and established digital products.

Second, there is a clear migration from standalone software tools toward integrated platforms. Merchants increasingly expect unified environments that can handle compliance and regulation, tax determination, subscription billing, dispute workflows, and fraud prevention without complex custom integration. This preference has spurred platforms to expand their native capabilities and to open richer APIs, enabling deeper connection with enterprise resource planning, customer relationship management, and data analytics systems.

Third, subscription and usage-based models continue to proliferate across industries, from software and digital media to connected devices and professional services. Merchant of record platforms are adapting by supporting sophisticated recurring billing logic, seat-based licensing, and hybrid models that blend one-time fees with ongoing usage charges. At the same time, there is heightened sensitivity to involuntary churn, leading to greater investment in billing retries, card updater services, and intelligent routing to optimize authorization rates.

Lastly, risk management and fraud prevention are becoming defining differentiators. As card-not-present fraud, synthetic identities, and refund abuse evolve, merchant of record software is increasingly incorporating machine learning and behavioral analytics to detect anomalies in real time. This is complemented by tighter rule sets around high-risk categories, including certain forms of AI-generated content and digital goods, where providers must balance growth opportunities with reputational and regulatory risk. The result is a market gravitating toward fewer, more capable platforms that treat compliance and risk as core product features rather than ancillary services.

Cumulative impact of evolving United States tariff measures in 2025 elevates landed-cost precision and compliance demands on merchant of record platforms

Tariff policy in 2025 has materially altered the economics and operational requirements of cross-border commerce into the United States, with far-reaching implications for merchant of record software. A series of measures, including broad-based import duties and the tightening or removal of duty-free thresholds for low-value shipments, has raised costs and administrative burdens for many e-commerce flows, particularly those involving consumer goods shipped directly from Asia to U.S. buyers. Proposed rules targeting the extensive use of de minimis exemptions for small parcels have forced platforms and logistics partners to capture more granular product data, such as 10-digit tariff classifications, and to reconcile duty liabilities more precisely at the transaction level.

For merchant of record platforms that sit between foreign sellers and U.S. consumers, these changes translate into a heightened need to manage tariffs alongside conventional indirect taxes. Software must now account not only for sales tax and digital services rules, but also for dynamic tariff schedules that vary by country of origin, product category, and trade regime. The cumulative effect of additional duties on goods sourced from specific countries, combined with retaliatory measures from trading partners, has increased price volatility and made landed cost calculation a critical capability.

In parallel, tariff uncertainty has begun to reshape digital commerce strategies. Some marketplaces and social commerce platforms have experienced slower growth or shifts in seller composition as tariffs on certain imported goods fluctuated dramatically, with reported peaks well above prior levels before partial rollbacks. This volatility has encouraged a portion of merchants to rebalance supply chains toward nearshore production or U.S.-based inventory, changes that in turn alter the tax nexus, invoicing, and reporting footprints that merchant of record solutions must support.

From an operational standpoint, these developments elevate the importance of configurable rules engines and real-time data exchange between merchant of record platforms, logistics providers, and customs brokers. Executives can no longer treat tariffs as a static parameter set once at onboarding; instead, they require continuous monitoring and rapid updating of duty rules, as well as transparency mechanisms so that merchants and end customers can see how duties contribute to final prices. In addition, higher landed costs may fuel more frequent disputes and refund requests, placing greater emphasis on integrated dispute management capabilities that align payments data, shipment records, and tariff documentation to resolve claims efficiently.

Taken together, the 2025 tariff environment has expanded the scope of what it means to be a merchant of record for U.S.-bound commerce. Providers that can seamlessly integrate tariff calculation, tax management, and compliance reporting within their platforms will be better positioned to help merchants preserve margins, maintain price competitiveness, and remain compliant amid ongoing trade policy shifts.

Segmentation insights reveal diverging priorities across functionality, software design, deployment, pricing, and end-user verticals in merchant of record adoption

Understanding the structure of demand for merchant of record software requires examining how organizations prioritize functionality across the transaction lifecycle. On the front end, payment processing remains foundational, as platforms must support a wide range of cards, wallets, and alternative payment methods while achieving high authorization rates in multiple regions. Yet payment acceptance alone is no longer sufficient. Buyers increasingly seek embedded capabilities for compliance and regulation, spanning know-your-customer checks, sanctions screening where relevant, and alignment with local rules that distinguish between marketplaces, facilitators, and direct sellers.

Beyond acceptance, dispute management is gaining prominence as card networks refine chargeback rules and as consumers grow more accustomed to frictionless refunds. Merchant of record platforms that centralize evidence collection, coordinate with acquirers, and apply analytics to identify root causes of disputes can materially reduce loss rates and operational overhead. At the same time, risk management and fraud prevention have become intertwined with compliance, as providers deploy behavioral analytics and device intelligence to distinguish legitimate cross-border transactions from fraudulent or high-risk activity.

Subscription billing and recurring payments form another critical functional pillar. As more businesses adopt subscription or usage-based models, they demand sophisticated tools for plan management, proration, add-ons, seat expansions, and dunning workflows. Merchant of record software is being selected not only for its ability to bill periodically, but also for its capacity to handle complex lifecycle events such as upgrades, downgrades, and contract renewals while keeping tax and invoicing compliant across jurisdictions. Tax management itself has become a standalone evaluation dimension, as organizations seek automated determination, filing support, and audit-ready reporting in the face of increasingly granular rules for digital services and remote sellers.

From the perspective of software type, there is an ongoing shift toward integrated platforms that combine these functions within a unified environment. Many enterprises, especially those with multi-region operations, favor such platforms to simplify governance, data management, and vendor oversight. Nevertheless, standalone solutions continue to play a role where organizations have already invested heavily in payment infrastructure and seek targeted enhancements, for instance in tax management or chargeback optimization, that can integrate with existing stacks.

Pricing models also shape adoption patterns. Subscription-based offerings, whether aligned to transaction volume, revenue tiers, or feature bundles, are increasingly attractive because they align with how digital businesses generate revenue and provide predictability for budgeting. One-time or perpetual licensing persists in specific segments, particularly where buyers prefer capital expenditure treatment or operate in environments with stringent procurement rules, though even there, maintenance and support contracts introduce recurring elements.

Deployment mode preferences reflect broader enterprise IT trends. Cloud-based solutions dominate new deployments due to their scalability, rapid update cycles, and ability to incorporate evolving regulatory and tariff rules without lengthy upgrade projects. On-premises deployments remain relevant for organizations with strict data residency, security, or integration requirements, including certain financial institutions and public sector entities, where direct control over infrastructure is non-negotiable.

Organizational size further differentiates requirements. Large enterprises typically demand extensive configurability, multi-entity support, and deep integration with ERP and CRM platforms, while small and medium enterprises value fast onboarding, opinionated best practices, and low operational overhead. For many smaller organizations, the merchant of record model itself is a way to access enterprise-grade compliance and tax capabilities that would otherwise be out of reach.

Finally, end-user industries exhibit distinct usage patterns. Banking, financial services, and insurance institutions often emphasize risk management, auditability, and alignment with stringent regulatory frameworks. Government and public sector users prioritize transparency, data sovereignty, and adherence to public procurement standards. IT and telecommunications companies focus on recurring billing for software, connectivity, and cloud services, while retailers and e-commerce operators require robust support for dynamic catalogs, promotions, and high-volume seasonality. Subscription-based businesses across media, productivity, and vertical SaaS seek fine-grained control over entitlements and customer lifecycle events. Collectively, these segmentation dimensions highlight why one-size-fits-all solutions struggle, and why modular, configurable platforms are gaining ground across the merchant of record landscape.

This comprehensive research report categorizes the Merchant of Record Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Functionality

- Software Type

- Pricing Model

- Payment Method

- Deployment Mode

- Organizational Size

- End-Use

Regional perspectives highlight contrasting regulatory, tax, and payment realities across the Americas, EMEA, and Asia-Pacific for merchant of record platforms

Regional dynamics play a pivotal role in shaping how merchant of record software is specified, deployed, and governed. In the Americas, the United States anchors demand, driven by a dense concentration of software publishers, online retailers, and digital platforms that monetize globally. The complexity of state and local sales tax rules, combined with evolving nexus standards for remote sellers, has made automated tax and compliance capabilities particularly critical. In addition, recent shifts in tariff policy and scrutiny of low-value imports have heightened the need for transparent landed-cost calculations and accurate classification of goods entering the U.S. market.

Across Latin America, payment fragmentation and regulatory nuances further influence platform design. Countries in the region often feature strong domestic card schemes, installment-based purchasing behaviors, and local real-time payment rails, all of which must be orchestrated by merchant of record software. At the same time, currency volatility and capital controls in certain markets require careful structuring of settlement, reconciliation, and treasury functions to ensure that cross-border collections remain both compliant and economically viable.

In Europe, the Middle East, and Africa, a different mix of drivers is at work. Within the European Union, harmonized VAT rules coexist with national implementation differences, compelling merchant of record platforms to maintain country-level logic for tax rates, invoicing, and reporting while adhering to broader regulatory frameworks for payments and data protection. Strong enforcement of consumer protection laws and refund rights, as well as regulatory initiatives around platform accountability, are encouraging providers to invest heavily in dispute management and customer communication features.

In the Middle East and parts of Africa, digital transformation agendas are accelerating demand for modern payment and tax infrastructure, though adoption patterns vary widely. Some Gulf states have implemented VAT systems over the past decade, creating fresh requirements for accurate tax calculation on digital and physical goods. Elsewhere, the rapid adoption of mobile wallets and alternative payment methods calls for flexible payment orchestration and risk controls tailored to local fraud patterns and identity frameworks.

Asia-Pacific represents both a growth engine and a source of added complexity for merchant of record solutions. The region hosts some of the world’s largest e-commerce platforms and super-app ecosystems, as well as a large base of small merchants exporting directly to consumers abroad. Divergent tax regimes, a wide variety of local payment methods, and differing rules around data localization and cross-border flows make unified compliance particularly challenging. For merchants targeting consumers in the region, merchant of record platforms must adapt to local expectations for mobile-first checkout experiences, instant refunds, and region-specific promotional mechanics.

For cross-border sellers exporting from Asia-Pacific into the Americas and Europe, tariff developments in 2025 add another layer of complexity, especially where new or higher duties apply to certain categories of goods. In this environment, regional insight is not limited to knowledge of tax codes and payment preferences; it also encompasses awareness of trade policy, customs practices, and evolving enforcement priorities. Merchant of record providers that combine global reach with deep regional expertise are therefore better equipped to support clients as they expand, restructure supply chains, or respond to geopolitical and regulatory shifts.

This comprehensive research report examines key regions that drive the evolution of the Merchant of Record Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key company insights reveal a reshaped competitive landscape where strategic guidance and compliance depth rival pure payment capabilities

The competitive landscape for merchant of record software is characterized by a mix of established global providers, payment processors with managed services offerings, and specialized platforms targeting particular customer segments. A number of prominent payment companies now offer managed or merchant-of-record-style services that bundle payment processing, tax handling, and compliance under a single commercial relationship. These offerings typically appeal to startups and mid-market software vendors seeking rapid international reach, as well as to digital-first retailers looking to test new markets without setting up local entities.

Alongside multi-purpose payment platforms, dedicated merchant of record providers focus on acting as the legal seller on behalf of software and digital goods companies, particularly those that monetize through subscriptions and in-app transactions. These platforms differentiate through depth of subscription management, integrated tax and invoicing automation, and finely tuned reporting designed for finance and revenue operations teams. In recent years, some providers have narrowed their target segments, prioritizing SaaS and established digital businesses over high-risk or less predictable categories such as user-generated content marketplaces and certain creator-focused platforms.

At the same time, legacy e-commerce and digital commerce providers that historically served as resellers or fulfillment partners have modernized their technology stacks and business models to operate more explicitly as merchant of record platforms. However, market feedback indicates that not all incumbents have executed this transition smoothly, with some facing criticism from long-standing clients around contract changes, payout reliability, or support quality. These experiences have prompted a portion of merchants to reevaluate vendor relationships and to explore migration to more agile competitors that can offer greater transparency and customer responsiveness.

Newer entrants are also reshaping expectations. Some focus on delivering lightweight, developer-friendly tools for software companies that want to outsource tax and compliance but retain control of user experience. Others emphasize no-code or low-code onboarding for small businesses that require rapid go-live and guided compliance. In parallel, niche providers are emerging to serve specialized communities, including AI-focused SaaS products and digital creator platforms, while navigating heightened policy scrutiny over certain types of content.

Across this competitive field, several themes stand out. Vendors are increasingly judged on their ability to act as a true strategic partner rather than a transactional processor, providing consultative guidance on regulatory changes, tariff implications, and optimal billing models. Robust risk management frameworks, transparent communication during incidents, and clear alignment of incentives around chargebacks and fraud losses are becoming decisive selection criteria. As consolidation and partnerships continue, executives should expect further blurring of lines between payment processors, tax automation providers, and merchant of record specialists, with value accruing to those that combine technical depth with regulatory fluency and customer-centric operating models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Merchant of Record Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- VeriFone, Inc.

- Paddle.com Market Ltd.

- Cleverbridge Inc.

- Stripe, LLC

- Lemon Squeezy, LLC

- Brandpath Group

- Xsolla (USA), Inc.

- Block, Inc.

- Dodo Payments

- Nexway

- Global-e Online Ltd.

- Teknasyon Yazılım Sanayi ve Ticaret A.Ş.

- FastSpring

- Comgate a.s.

- Gapp Group, LLC

- 1D3 DIGITECH OÜ

- BlueSnap, Inc. by Payroc World Access, LLC

- ExpandNow Ltd

- Fungies Inc.

- Gigapay Sweden AB

- Kyshi Limited

- ModusLink Corporation by Steel Connect, Inc.

- Number X LLC

- PayPro Global, Inc.

- Payrexx AG

- Reach UK Ltd.

- Stax Payments, Inc.

- SubscriptionFlow

Actionable recommendations empower industry leaders to treat merchant of record strategy as a core pillar of risk management, pricing, and customer experience

Against this backdrop of regulatory change, tariff volatility, and evolving competition, industry leaders need to move beyond incremental optimization and adopt a deliberately strategic approach to merchant of record decisions. The first priority is to view the merchant of record platform not solely as a payments vendor but as an extension of the organization’s legal, tax, and compliance posture. This means involving finance, legal, risk, and operations stakeholders early in vendor selection, ensuring that contractual arrangements, liability allocations, and data flows align with the organization’s broader governance framework.

Secondly, executives should prioritize platforms that offer granular configurability in areas such as tax rules, tariff handling, and risk thresholds. Given the fluid nature of 2025 trade measures and the likelihood of further policy adjustments, organizations benefit from systems that can rapidly incorporate new duty rates, update exemptions, or reconfigure routing logic without large-scale redevelopment. Scenario planning exercises that test the impact of different tariff or tax configurations on margins, pricing, and customer experience can help guide both technology and commercial strategy.

Third, leaders should adopt a holistic view of customer experience. While merchant of record software operates largely behind the scenes, its configuration has direct implications for checkout friction, payment acceptance rates, subscription renewal success, and dispute resolution journeys. Investing in capabilities such as localized payment methods, intelligent retry logic, and transparent tax and duty breakdowns on invoices can simultaneously enhance compliance and build trust with end customers. In an environment of rising prices due to tariffs and taxes, clear communication of charges becomes a key differentiator.

Risk management requires similarly proactive attention. Organizations should work with their merchant of record providers to define risk appetites, establish monitoring dashboards, and align on escalation protocols for fraud spikes, policy changes, or payment partner issues. Where the platform aggregates multiple merchants, it is especially important to understand how one seller’s behavior can influence risk assessments and potential actions affecting others, and to ensure there are safeguards and communication channels that prevent unexpected disruptions.

Finally, leadership teams should incorporate merchant of record strategy into broader digital transformation roadmaps. As organizations modernize ERP, CRM, and data analytics systems, there is an opportunity to integrate merchant of record data flows more tightly, enabling richer insight into customer lifetime value, revenue recognition, and tax exposure. Regular joint reviews with platform providers, focused on upcoming regulatory developments, tariff negotiations, and product roadmaps, can help ensure that merchant of record capabilities continue to support long-term growth and resilience rather than lag behind the pace of change.

Research methodology integrates regulatory analysis, stakeholder interviews, and vendor assessment to map the evolving merchant of record landscape

Delivering a robust view of the merchant of record software landscape requires a structured, multi-source research methodology designed to capture both the strategic context and the operational realities facing buyers and vendors. The analytical framework begins with extensive secondary research, drawing on regulatory texts, government announcements, trade policy updates, payment network rules, and publicly available information from merchant of record providers and their technology partners. This baseline is complemented by ongoing monitoring of tariff developments, particularly those affecting imports into the United States and cross-border digital commerce, to ensure that the assessment reflects current policy and enforcement conditions.

Building on this foundation, the research incorporates qualitative and quantitative insights from industry stakeholders. In-depth interviews and discussions with executives at software companies, online retailers, payment firms, tax specialists, and legal advisors help illuminate how organizations are experiencing and responding to changes in tax, tariff, and platform regulation. These conversations provide detail on implementation challenges, vendor performance, and emerging best practices that are not always captured in public documentation.

Vendor analysis focuses on understanding product capabilities, roadmaps, and positioning through a combination of public materials, demonstrations, and, where available, customer feedback. The evaluation considers functional breadth across payment processing, compliance and regulation, dispute management, subscription billing and recurring payments, risk management and fraud prevention, and tax management, as well as architectural factors such as deployment mode, integration approaches, and scalability. Special attention is paid to how different providers address the needs of large enterprises versus small and medium organizations, and how they tailor offerings for specific end-user sectors including financial services, government, telecommunications, retail, and subscription-based businesses.

Throughout the research process, findings are triangulated to increase reliability. Regulatory interpretations are cross-checked against multiple sources, while vendor claims are assessed in light of customer experiences and independent technical analysis. Care is taken to distinguish between established capabilities and forward-looking statements, and to avoid extrapolating short-term developments into unwarranted long-term conclusions. The result is a methodology designed to provide decision-makers with a balanced, evidence-based understanding of merchant of record software trends, limitations, and strategic options in a rapidly evolving environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Merchant of Record Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Merchant of Record Software Market, by Functionality

- Merchant of Record Software Market, by Software Type

- Merchant of Record Software Market, by Pricing Model

- Merchant of Record Software Market, by Payment Method

- Merchant of Record Software Market, by Deployment Mode

- Merchant of Record Software Market, by Organizational Size

- Merchant of Record Software Market, by End-Use

- Merchant of Record Software Market, by Region

- Merchant of Record Software Market, by Group

- Merchant of Record Software Market, by Country

- United States Merchant of Record Software Market

- China Merchant of Record Software Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Conclusion underscores merchant of record software as a pivotal lever for managing regulatory risk, tariff complexity, and cross-border digital growth

The merchant of record software ecosystem stands at a critical juncture, shaped by converging forces that include intensifying regulatory scrutiny, unprecedented shifts in tariff policy, and ongoing transformation of digital business models. What once functioned primarily as a specialized payment facilitation layer has become a central element of how organizations manage legal responsibility, tax and duty obligations, and customer experience across borders. This evolution brings both opportunity and exposure: the same platforms that enable rapid international expansion also embody concentrated compliance and operational risk if not selected and governed carefully.

Analysis of functional and structural segmentation reveals that organizations are demanding more from their merchant of record partners. They expect comprehensive coverage of compliance and regulation, dispute management, payment processing, risk management and fraud prevention, subscription billing and recurring payments, and tax management, delivered through integrated platforms that can be deployed flexibly across cloud and on-premises environments. At the same time, the diversity of needs across large enterprises and small and medium businesses, as well as across sectors such as financial services, government, telecommunications, retail, and subscription-based services, ensures that no single model dominates every niche.

Regionally, differing tax regimes, payment preferences, and regulatory frameworks in the Americas, Europe, the Middle East, Africa, and Asia-Pacific create distinct adoption patterns and solution requirements. The cumulative impact of United States tariff measures in 2025 underscores that trade policy is now a first-order consideration for cross-border commerce technology, with merchant of record platforms increasingly expected to manage tariffs alongside traditional indirect taxes and payment rules.

In this context, leadership teams that treat merchant of record strategy as a core component of risk management, pricing, and customer experience are better positioned to navigate uncertainty and capture opportunity. By selecting partners with deep compliance capabilities, robust risk controls, and transparent operating models, and by integrating merchant of record data flows into broader digital transformation efforts, organizations can convert regulatory complexity into a managed, strategic advantage. The path forward will favor those who proactively align technology, policy awareness, and commercial strategy rather than reacting to each new regulatory or tariff change in isolation.

Secure decisive advantage in merchant of record strategy by engaging with expert-led insights and partnering with Ketan Rohom to access the full report

Merchant of record software sits at the intersection of payments, tax, and regulation, and the pace of change across all three domains has never been higher. Organizations that rely on fragmented tools or manual workarounds face growing exposure to penalties, revenue leakage, and reputational damage, particularly as tariff regimes, indirect taxes, and platform rules continue to tighten.

To navigate this environment with confidence, leadership teams need a structured, evidence-based view of where the merchant of record model is heading, how functionality, deployment, and pricing models are evolving, and what emerging regulations mean for cross-border revenue. A comprehensive market study provides that foundation, translating a complex set of policy changes, technology shifts, and competitive moves into clear strategic options.

To move from high-level awareness to practical action, engage directly with Ketan Rohom, Associate Director, Sales & Marketing. He can guide you through the full report’s structure, highlight the sections most relevant to your organization’s size, industry, and geographic footprint, and outline available licensing and customization options.

By securing access to the complete merchant of record software study, you enable your organization to move beyond reactive compliance and toward proactive orchestration of global commerce. With tailored insights into tariff risk, functionality trends, deployment choices, and vendor positioning, decision-makers can align technology roadmaps and go-to-market strategies with the new realities of digital trade and regulation.

- How big is the Merchant of Record Software Market?

- What is the Merchant of Record Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?