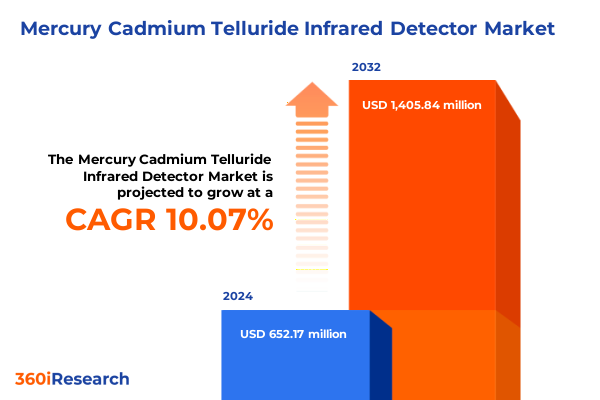

The Mercury Cadmium Telluride Infrared Detector Market size was estimated at USD 712.48 million in 2025 and expected to reach USD 787.00 million in 2026, at a CAGR of 10.19% to reach USD 1,405.84 million by 2032.

Emerging Dynamics and Core Imperatives Shaping Mercury Cadmium Telluride Infrared Detector Technologies in a Rapidly Evolving Industry Environment

Emerging as a cornerstone of modern sensing technology, Mercury Cadmium Telluride infrared detectors deliver unmatched sensitivity across a broad infrared spectrum, facilitating applications from precision medical diagnostics to strategic defense systems. These detectors harness the unique tunable bandgap of Mercury Cadmium Telluride alloys, enabling high quantum efficiency in low-photon flux environments while simultaneously supporting both cooled and uncooled operational modes. The result is a versatile platform capable of addressing the exacting requirements of diverse scientific research agendas, industrial process controls, and critical surveillance operations.

Over the past decade, miniaturization and advanced material engineering have converged to elevate the performance envelope of these detectors. Thin-film deposition techniques, refined crystal growth processes, and integration with cryogenic cooling assemblies have driven thermal noise reduction to unprecedented levels. Meanwhile, recent innovations in microbolometer arrays foster on-chip integration of signal processing circuits, streamlining system footprints and lowering overall deployment costs. These technical leaps not only expand the operational viability of detectors in remote or constrained environments but also catalyze new use-case scenarios in emerging markets.

Against this backdrop of rapid innovation, heightened demand has been fueled by stringent military and aerospace requirements, accelerated medical imaging advancements, and a renewed focus on energy efficiency within industrial automation. Supply chain considerations and regional policy frameworks have further shaped investment flows, underlining the importance of robust strategic planning for manufacturers and end-users alike.

This executive summary distills the most salient developments, market shifts, and strategic imperatives governing the Mercury Cadmium Telluride infrared detector landscape. Each section uncovers critical insights that empower decision-makers to chart a course toward sustainable growth and technological leadership.

Transformational Forces Redefining the Mercury Cadmium Telluride Infrared Detector Market Landscape Across Technological, Regulatory, and Competitive Frontiers

The Mercury Cadmium Telluride infrared detector market stands at the cusp of transformational change, driven by a synergy of technological breakthroughs, evolving regulatory expectations, and intensified competitive dynamics. On the technology front, next-generation nanofabrication methods have ushered in ultra-thin MCT layers with superior uniformity, boosting pixel densities and improving signal-to-noise ratios. Concurrently, integrated system architectures that marry infrared detectors with advanced digital signal processors are accelerating in-field data analysis, enabling real-time decision-making for defense, industrial monitoring, and environmental sensing.

Regulatory landscapes have also shifted substantially, reflecting growing concerns over supply chain transparency, critical material sourcing, and cross-border security protocols. National governments are expanding export controls on sensitive detector technologies, challenging global suppliers to navigate complex compliance requirements while maintaining operational agility. This environment has prompted leading manufacturers to forge strategic partnerships, invest in localized production capabilities, and implement rigorous certification processes to ensure uninterrupted market access.

On the competitive front, market incumbents and agile new entrants alike are exploring collaborative R&D models, joint ventures, and platform licensing to accelerate innovation cycles. These cooperative strategies mitigate development risks, distribute capital expenditure burdens, and foster knowledge transfer across the value chain. Meanwhile, vertical integration initiatives are gaining traction, as system integrators seek to consolidate detector design, cryogenic cooling, and calibration services under unified technology stacks, optimizing both cost efficiency and performance consistency.

Collectively, these transformative shifts underscore a dynamic environment where technological prowess, regulatory finesse, and collaborative agility define market leadership. Stakeholders must remain vigilant in monitoring these forces to effectively calibrate their strategic roadmaps.

Assessing the Far-reaching Consequences of 2025 United States Tariff Measures on the Production, Supply Chain, and Cost Structure of Infrared Detector Systems

In 2025, the implementation of additional United States tariffs on critical semiconductor components, including Mercury Cadmium Telluride infrared detectors, has had profound implications throughout the value chain. Industry participants have encountered escalating input costs as duties on imported MCT wafers and related materials rose sharply, exerting upward pressure on manufacturing expenses. Procurement teams have been compelled to reassess sourcing strategies, balancing near-term cost spikes with long-term supplier reliability and compliance considerations.

These tariff measures have reverberated across supply chains, spurring a wave of localization efforts among leading detector manufacturers. Facilities in North America have received renewed investment to insulate operations from import duties, while joint ventures with domestic material producers have accelerated the development of alternative MCT crystal growth capacities. Although this localization delivers strategic benefits, the capital intensity and extended timelines associated with ramping new production sites present transitional challenges that demand meticulous financial and operational planning.

Beyond direct production impacts, the tariff landscape has reshaped downstream pricing structures, influencing procurement decisions for end-users in defense, aerospace, and industrial automation sectors. Organizations dependent on infrared detection modules have begun exploring modular system architectures that decouple detector elements from expensive assembly subsystems, optimizing lifecycle costs amid volatile trade conditions. Simultaneously, service-oriented business models, such as detector calibration and maintenance contracts, have grown more attractive as tools for mitigating total cost of ownership and buffering against raw material price fluctuations.

Looking ahead, the cumulative effect of these tariffs necessitates an agile strategic posture. Market participants must leverage scenario-based forecasting, cultivate supply base resilience, and integrate tariff-neutral sourcing options to safeguard margin performance and sustain innovation trajectories.

Unveiling Critical Insights Through Product Type, Spectral Range, Detector Technology, and End-User Perspectives to Guide Strategic Decision Making

A comprehensive examination of the Mercury Cadmium Telluride infrared detector market reveals distinct opportunities and challenges across multiple segmentation dimensions. When evaluated by product type, detectors that require cryogenic cooling demonstrate superior sensitivity for high-precision applications but entail elevated system complexity, driving innovation in compact cryocooler integration to reduce package size and power consumption. Conversely, uncooled infrared detectors appeal to a broad range of cost-sensitive deployments, especially in portable devices and environmental monitoring, prompting ongoing development of thermally robust MCT compositions that maintain performance without active cooling.

From a spectral range perspective, long-wave infrared detectors dominate initiatives in thermal imaging for defense and industrial inspections, while mid-wave infrared variants deliver the optimal balance of resolution and atmospheric transmission for gas detection and remote sensing projects. Short-wave infrared sensors have gained momentum in emerging scientific research fields, such as photonic spectroscopy and semiconductor wafer inspection, where their ability to capture fine material signatures is invaluable. Each spectral band demands tailored material doping and bandgap engineering to align detector responsivity with application-specific requirements.

Considering detector technology, photoconductive devices continue to offer cost efficiency and rapid prototyping cycles, making them suitable for high-volume production and consumer-grade thermal cameras. In contrast, photovoltaic detectors provide intrinsic low-noise performance and rapid response times, rendering them indispensable for defense-grade surveillance systems and high-frame-rate scientific instrumentation. Efforts to hybridize these technologies are underway, exploring new junction architectures that combine the benefits of both approaches.

In end-use scenarios, the aerospace sector relies on MCT detectors for aircraft safety systems and satellite‐based earth observation, while medical imaging applications harness the material’s sensitivity for non-invasive diagnostics. Military and defense investments sustain demand for advanced night vision and target acquisition modules, and scientific research facilities deploy these detectors to push the boundaries of astrophysics and environmental science. Each user segment places unique demands on pricing models, certification standards, and service lifecycles, underscoring the necessity for targeted product roadmaps that resonate with diverse stakeholder priorities.

This comprehensive research report categorizes the Mercury Cadmium Telluride Infrared Detector market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Spectral Range

- Detector Technology

- End-User

Regional Differentiators and Strategic Considerations Across the Americas, Europe, the Middle East & Africa, and Asia-Pacific Infrared Detector Markets

The infrared detector ecosystem exhibits pronounced regional distinctions shaped by regulatory climates, R&D investments, and industrial demand patterns. In the Americas, North America spearheads innovation through government-backed research initiatives and defense-driven procurement programs, leveraging robust semiconductor infrastructure and established supply networks. Canada’s emerging engagement in academic collaborations further augments the region’s access to cutting-edge material science expertise, while Latin American industrial automation sectors explore mid-wave infrared solutions for process optimization and safety monitoring.

Across Europe, the Middle East, and Africa, advanced manufacturing hubs in Western Europe emphasize stringent quality standards and sustainability goals, driving the adoption of environmentally responsible MCT fabrication methods. The Middle East is channeling sovereign wealth into strategic defense modernization, creating new demand for high-performance cooled infrared detectors, while African research centers seek affordable uncooled options for wildlife conservation and border surveillance, catalyzing distribution partnerships that bridge technology gaps.

The Asia-Pacific region remains a pivotal force, with East Asian economies leading volume manufacturing and aggressive R&D expenditure. China continues to expand domestic MCT production capabilities under national technology policies, supporting rapid deployment in commercial drones, smart city infrastructure, and healthcare diagnostics. Meanwhile, Japan and South Korea invest heavily in high-precision production equipment and advanced component integration, underpinning collaborations with materials research institutes. Southeast Asian nations, recognizing the intersection of industrial automation and security needs, are gradually building capacity to assemble and calibrate infrared modules locally.

These regional insights underscore the importance of nuanced market entry strategies that account for distinct regulatory requirements, technology adoption rates, and local partner ecosystems. Tailored go-to-market plans, bolstered by region-specific value propositions, will be instrumental for stakeholders seeking to capture share in this multifaceted landscape.

This comprehensive research report examines key regions that drive the evolution of the Mercury Cadmium Telluride Infrared Detector market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Industry Players Steering Innovation, Collaboration, and Competitive Positioning in the Mercury Cadmium Telluride Infrared Detector Sector

The competitive landscape of Mercury Cadmium Telluride infrared detectors is defined by a blend of established semiconductor powerhouses and specialized technology innovators. Industry leaders maintain a competitive edge through vertically integrated operations that control MCT crystal growth, wafer fabrication, and detector assembly under unified quality protocols. Meanwhile, agile mid-tier organizations carve niches by offering customized detector arrays and specialized calibration services, addressing the precise demands of scientific research facilities and customized defense platforms.

Strategic collaborations between material suppliers and system integrators have become commonplace, enabling cross-domain expertise to converge on next-generation detector modules. Joint ventures focused on cryogenic cooler development, advanced packaging solutions, and on-chip signal processing exemplify the collaborative ethos driving performance enhancements and cost optimization. Concurrently, acquisitions of niche technology firms with proprietary thin-film deposition or nanostructuring capabilities accelerate product roadmaps, reinforcing incumbent positions in both traditional and emerging application segments.

Innovation partnerships with academic institutions and national laboratories provide a steady pipeline of breakthroughs in novel compound semiconductors, metamorphic buffer layers, and surface passivation techniques. These alliances not only bolster R&D throughput but also help secure government grants and tax incentives aimed at maintaining domestic competitiveness. At the same time, open licensing arrangements for key intellectual property enable ecosystem expansion, inviting third-party developers to integrate advanced MCT detectors into broader sensing platforms.

Overall, the sector’s competitive dynamics emphasize a balance between scale and specialization, where firms that can blend deep material science expertise with system-level integration capabilities are best positioned to capture the evolving opportunities in defense, aerospace, medical imaging, and scientific exploration markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mercury Cadmium Telluride Infrared Detector market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acal BFi Group

- EPIR Technologies Incorporated

- Excelitas Technologies Corp.

- Global Sensor Technology Co., Ltd.

- Hamamatsu Photonics K.K.

- InfraRed Associates, Inc.

- Kolmar Technologies, Inc.

- Leonardo DRS, Inc.

- Lynred S.A.

- Murata Manufacturing Co., Ltd.

- Ningbo Healthy Photon Technology Co., Ltd.

- Nippon Ceramic Co., Ltd.

- OMRON Corporation

- Teledyne Technologies Incorporated

- Thorlabs, Inc.

- VIGO Photonics S.A.

Actionable Strategies for Industry Leaders to Capitalize on Technological Advances, Market Shifts, and Regulatory Developments in Infrared Detection

To thrive amid escalating competitive pressures and dynamic regulatory environments, industry leaders must adopt targeted strategies that emphasize agility, collaboration, and customer-centric innovation. First, prioritizing investment in novel MCT material formulations and modular detector architectures can accelerate time to market while mitigating production complexity, enabling rapid customization for diverse end-user requirements. Coupling these efforts with digital twins and advanced modeling tools streamlines R&D workflows, reducing iteration cycles and fostering more reliable performance outcomes.

Second, companies should reinforce supply chain resilience by cultivating a diversified supplier base that spans domestic and allied international partners. Strategic sourcing agreements, strategic equity stakes in critical material producers, and dual-sourcing frameworks can buffer against tariff shocks and geopolitical disruptions. Additionally, integrating supplier risk analytics into procurement systems ensures real-time visibility into potential bottlenecks and facilitates proactive contingency planning.

Third, forging cross-sector alliances is instrumental for capturing adjacent market opportunities. Collaborations with medical device manufacturers, defense contractors, and space exploration agencies can unlock co-development pathways, driving joint certification processes and shared go-to-market initiatives. Aligning product roadmaps with regulatory roadmaps-such as export control revisions and sustainability mandates-further bolsters stakeholder confidence and accelerates commercial adoption.

Finally, organizations should institutionalize customer feedback loops and value-added service offerings that extend beyond core detector sales. Calibration, extended warranties, and performance benchmarking services not only deepen customer relationships but also create recurring revenue streams that insulate margins. By embracing these actionable imperatives, industry leaders can position themselves for sustainable growth and technological leadership in the evolving Mercury Cadmium Telluride infrared detector market.

Robust Research Methodology Ensuring Comprehensive, Objective, and Rigorous Analysis of the Mercury Cadmium Telluride Infrared Detector Market

The insights presented in this report rest upon a rigorous, multi-layered research methodology designed to ensure both comprehensiveness and objectivity. The foundational layer involved an extensive review of secondary sources, including peer-reviewed journals, regulatory filings, patent databases, and technical standards documentation, providing a broad view of historical developments and emerging trends in Mercury Cadmium Telluride detector technologies.

Complementing this desk research, primary engagements were conducted through semi-structured interviews with industry veterans, materials scientists, system integrators, and end-user procurement specialists. These dialogues yielded firsthand perspectives on supply chain dynamics, application-specific performance metrics, and barriers to adoption, enriching the quantitative findings with qualitative nuances. Interview subjects were selected for their domain expertise and geographic diversity to capture a balanced representation of global market realities.

To validate the collected data, a triangulation process was employed, comparing insights from multiple independent sources and cross-referencing contradictory findings. Market sizing models and scenario analyses were stress-tested under alternative assumptions, while technical claims were benchmarked against consensus performance thresholds derived from established industry test protocols. This iterative validation approach underpins the reliability of the strategic recommendations and regional assessments that follow.

The cumulative methodological rigor ensures that the report’s conclusions reflect a high degree of analytical confidence, enabling stakeholders to make informed decisions grounded in robust evidence and expert consensus.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mercury Cadmium Telluride Infrared Detector market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mercury Cadmium Telluride Infrared Detector Market, by Product Type

- Mercury Cadmium Telluride Infrared Detector Market, by Spectral Range

- Mercury Cadmium Telluride Infrared Detector Market, by Detector Technology

- Mercury Cadmium Telluride Infrared Detector Market, by End-User

- Mercury Cadmium Telluride Infrared Detector Market, by Region

- Mercury Cadmium Telluride Infrared Detector Market, by Group

- Mercury Cadmium Telluride Infrared Detector Market, by Country

- United States Mercury Cadmium Telluride Infrared Detector Market

- China Mercury Cadmium Telluride Infrared Detector Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesis of Insights and Strategic Takeaways Emphasizing Innovation, Market Dynamics, and Future Outlook in Infrared Detection Technologies

Bringing together technological insights, market segmentation analyses, regional profiles, and competitive dynamics reveals a coherent picture of an industry poised for sustained innovation and strategic realignment. The transformative breakthroughs in material science and system integration are unlocking new application frontiers, from high-resolution thermal imaging to hyperspectral environmental monitoring, expanding the addressable market beyond traditional defense and aerospace domains.

At the same time, external forces such as trade policies and supply chain disruptions are reshaping strategic priorities, compelling organizations to adopt resilient sourcing strategies and localized production frameworks. These shifts underscore the importance of flexible business models that can seamlessly adapt to fluctuating cost structures and regulatory landscapes without stifling R&D momentum.

Segmentation insights have illuminated the nuanced performance trade-offs and value propositions across product types, spectral ranges, detector technologies, and end-user markets, enabling stakeholders to tailor their offerings for maximum market resonance. Regional intelligence has further highlighted the need for bespoke go-to-market strategies that align with local regulatory requirements, infrastructure capabilities, and customer expectations.

Ultimately, the convergence of these factors points toward a future in which Mercury Cadmium Telluride infrared detector technologies will play an increasingly pivotal role in advanced sensing ecosystems. Companies that can balance deep technical expertise with strategic agility and customer-driven service models will be best positioned to lead the industry into its next phase of growth and innovation.

Take the Next Step Towards Market Leadership in Infrared Detection Technologies by Securing Comprehensive Insights from Our Detailed Research Report

For organizations seeking to navigate complexities in the infrared detection sector, securing a comprehensive and forward-looking analysis is essential. To gain unparalleled insights into technology trends, competitive positioning, regional dynamics, and actionable strategic recommendations, engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise ensures you receive tailored guidance on how to leverage Mercury Cadmium Telluride infrared detector advancements to sharpen your competitive edge and drive growth. Reach out today to explore flexible licensing options, senior-level briefings, and bespoke data solutions designed to empower your decision-making and position your organization for long-term success.

- How big is the Mercury Cadmium Telluride Infrared Detector Market?

- What is the Mercury Cadmium Telluride Infrared Detector Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?