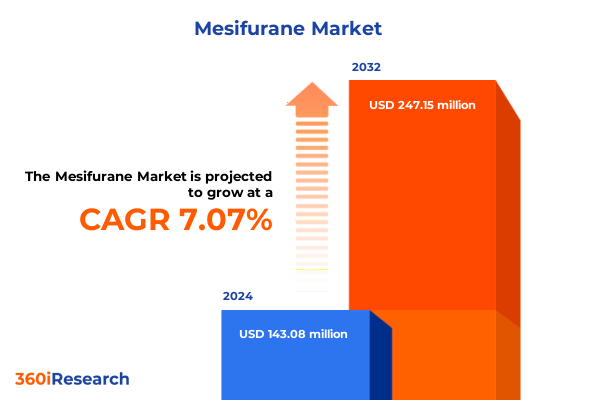

The Mesifurane Market size was estimated at USD 151.69 million in 2025 and expected to reach USD 166.73 million in 2026, at a CAGR of 7.22% to reach USD 247.15 million by 2032.

Exploring the Strategic Significance and Emerging Opportunities of Mesifurane Across Food, Fragrance, Cosmetic, and Pharmaceutical Applications

Mesifurane, formally known as 2,5-dimethyl-4-methoxy-3(2H)-furanone, is a key flavor and aroma compound first identified in arctic bramble in the early 1970s and now recognized for its sweet, caramel-like profile in a wide range of fruits such as strawberries, mangoes, and pineapples. As a globally traded ingredient in food, beverages, cosmetics, and pharmaceutical formulations, its versatile sensory characteristics and low odor detection threshold have rendered it indispensable for flavor houses and consumer goods manufacturers alike.

Increasing consumer demand for clean-label, natural ingredient declarations has elevated interest in mesifurane derived via biotechnological routes, with botanically sourced and synthetically produced variants both vying to meet transparency and sustainability mandates. The trend toward natural and organic flavor solutions continues to accelerate across personal care and food sectors, driven by heightened health awareness and environmental consciousness.

Technological advancements in enzymatic synthesis, continuous flow chemistry, and green extraction techniques have enhanced the cost-effectiveness and environmental footprint of mesifurane production. These innovations enable manufacturers to scale capacity while maintaining rigorous grade specifications for cosmetic, food, and pharmaceutical applications.

This executive summary distills transformative market shifts, U.S. trade policy impacts, segmentation nuances, regional dynamics, leading competitor strategies, actionable recommendations, research methodology, and concluding insights to equip stakeholders with a holistic perspective on the mesifurane landscape.

Examining the Transformative Drivers Shaping the Evolution of the Mesifurane Industry Amid Regulatory Shifts, Technological Innovations, and Evolving Consumer Preferences

The mesifurane industry is experiencing profound transformations driven by regulatory reforms, sustainability imperatives, and evolving consumer expectations. In June 2025, the European Commission amended Regulation (EC) No 1334/2008 to expand the Union list of approved flavoring substances by authorizing naringenin and to remove 4-Methyl-2-phenylpent-2-enal due to safety considerations, underscoring the increasing rigor of safety and transparency standards in key markets.

Simultaneously, sustainability remains a strategic priority as flavor producers invest in renewable feedstocks, traceable supply chains, and eco-friendly production processes to align with global clean-label and net-zero commitments. Companies are forging partnerships with sustainable agriculture initiatives to secure reliable sources of precursor compounds and reduce the carbon intensity of their operations.

Digitalization and Industry 4.0 principles have permeated flavor manufacturing, enabling real-time process monitoring, predictive yield optimization, and agile batch control for mesifurane synthesis. These technologies facilitate cost reductions, quality consistency, and accelerated time-to-market.

Consumer palates are also evolving, favoring layered, global flavor experiences that blend traditional profiles with novel twists. The rise of functional and indulgent beverage innovations has stimulated demand for mesifurane in high-protein drinks, global snack line extensions, and reduced-sugar formulations, reflecting broader food and beverage trends toward sustainability and sensory complexity.

Assessing the Cumulative Effects of 2025 U.S. Trade Tariffs on Mesifurane Supply Chains, Cost Structures, and Industry Competitiveness

In April 2025, the U.S. instituted a universal 10% tariff on all imported goods under an executive order, with reciprocal duties on select trading partners and a 25% levy on automobiles and auto parts, fundamentally altering the cost structure for imported chemical intermediates and specialty ingredients like mesifurane.

These measures have escalated input costs for chemical feedstocks critical to flavor production. For instance, freight cost increases of 170–228% for key raw materials such as monoethylene glycol and ethanol are projected to drive base chemical prices higher by 33–37%, compounding pressure on downstream flavor manufacturers operating on thin margins.

The beauty and personal care sector has not been immune: an across-the-board 10% tariff on imported cosmetic ingredients has elicited industry concern over supply chain disruptions, with tariffs reaching as high as 54% on Chinese-origin materials, prompting reformulation and near-sourcing strategies to mitigate input cost volatility.

Amid this uncertainty, industry leaders are diversifying sourcing geographies, establishing domestic production hubs, and accelerating digital procurement platforms to restore resilience. Although legal challenges such as V.O.S. Selections, Inc. v. United States have temporarily enjoined certain tariff orders, long-term supply chain realignments are firmly underway.

Unlocking Critical Segmentation Perspectives to Illuminate Mesifurane Demand Patterns Across Application Sectors, Molecular Types, Product Grades, Distribution Channels, and End Users

Demand for mesifurane spans a variety of applications, with its sweet, caramel-like profile enhancing product appeal in cosmetics and personal care formulations, elevating aroma complexity in niche and mass-market fragrances, adding richness to beverages, confectionery, dairy, and bakery goods, and imparting desirable flavor notes in specialized pharmaceutical syrups.

In terms of molecular origin, both natural and synthetic mesifurane capture market interest: the natural variant capitalizes on consumer affinity for plant-derived ingredients, while synthetic production leverages chemical consistency and cost efficiencies to meet high-volume requirements in food and beverage manufacturing.

Products are classified across cosmetic, food, and pharmaceutical grades, each governed by stringent purity and safety standards. Cosmetic-grade mesifurane must comply with EU and U.S. regulations for topical applications, food-grade material requires adherence to GRAS and FCC specifications, and pharmaceutical grade demands pharmacopeial compliance for medicinal formulations.

Distribution networks are evolving to support diverse buying behaviors: manufacturers continue to rely on direct supply agreements for custom formulations, while distributors and wholesalers specializing in chemical and food ingredients bridge market access to smaller brands. Simultaneously, online channels-via company websites and e-commerce platforms-are gaining traction for standard packaging sizes and expedited ordering.

End users encompass major food and beverage producers seeking flavor differentiation, personal care manufacturers integrating authentic aroma profiles, and pharmaceutical companies optimizing palatability of liquid formulations. Each vertical pursues tailored quality, supply reliability, and compliance to drive product innovation and brand loyalty.

This comprehensive research report categorizes the Mesifurane market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Grade

- Application

- End User

- Distribution Channel

Highlighting Key Regional Dynamics Influencing Mesifurane Markets in the Americas, Europe Middle East & Africa, and Asia Pacific Regions

The Americas region, led by the United States, remains at the forefront of mesifurane innovation, supported by advanced R&D infrastructure, strong regulatory frameworks, and a robust flavor house presence. However, new U.S. tariff regimes are reshaping sourcing strategies and encouraging onshore production of key flavor intermediates.

Europe, the Middle East, and Africa benefit from harmonized regulations under EU Regulation 1334/2008 and its 2025 amendments, fostering a stable environment for both natural and synthetic mesifurane. Robust sustainability mandates in Western Europe drive investment in green chemistry and supply chain transparency, while emerging markets in the Middle East and Africa provide growth potential for flavor applications in packaged foods and beverages.

Asia-Pacific is marked by surging consumer interest in premium flavors, propelled by rising disposable incomes in China and India. Domestic flavor manufacturers are scaling production capacity, refining natural extraction methods, and aligning with clean-label trends to capture market share. Regional trade collaborations and free trade agreements are also influencing cross-border ingredient flows.

This comprehensive research report examines key regions that drive the evolution of the Mesifurane market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Strategic Initiatives and Competitive Strengths of Leading Mesifurane Producers Driving Innovation and Market Positioning

The competitive landscape is defined by global ingredient suppliers with extensive flavor and fragrance portfolios. Firmenich and Givaudan lead with deep R&D pipelines and broad application expertise, shaping formulary innovations in mesifurane deployment. BASF leverages its chemical manufacturing scale and supply chain integration to ensure consistent feedstock availability, bolstering price stability in volatile markets.

Symrise has committed to sustainability through renewable resource frameworks and circular economy initiatives, aligning its mesifurane production with eco-design principles. The Robertet Group, renowned for natural raw materials, enhances its offering by sourcing botanically derived mesifurane precursors, meeting the preferences of clean-label brand owners.

International Flavors & Fragrances (IFF) continues to expand its mesifurane capabilities through strategic acquisitions and partnerships that enhance biotechnological synthesis methods. Likewise, Takasago and Mane are intensifying investment in clean-tech routes, leveraging enzymatic catalysis and metabolic engineering to diversify their flavor portfolios.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mesifurane market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Biotech

- Firmenich SA

- Givaudan SA

- International Flavors & Fragrances Inc.

- Kerry Group plc

- Mane SA

- Merck KGaA

- Natural Advantage, LLC

- Penta Manufacturing Co.

- Robertet SA

- Sensient Technologies Corporation

- Shandong Yaroma Perfumery Co., Ltd.

- Symrise AG

- T. Hasegawa Co., Ltd.

- Takasago International Corporation

Formulating Actionable Strategic Recommendations to Capitalize on Emerging Opportunities and Mitigate Risks in the Global Mesifurane Landscape

Industry leaders should prioritize investment in green production technologies to reduce dependency on tariff-exposed imports and reinforce supply chain resilience. Collaborating with academic and governmental research centers can accelerate development of advanced biocatalytic processes for mesifurane synthesis.

Establishing integrated digital procurement and supplier relationship management systems will enable real-time visibility into global ingredient flows and facilitate rapid response to policy shifts. By leveraging data analytics, companies can optimize inventory levels, predict cost fluctuations, and negotiate favorable supply contracts.

To capture evolving consumer preferences, organizations must enhance transparency through clean-label certification and sustainability disclosures. Proactive engagement with regulatory bodies and industry associations will ensure alignment with emerging flavor approvals and safety guidelines.

Finally, forging strategic partnerships across the value chain-from raw material suppliers to end-product manufacturers-will unlock co-innovation opportunities, enabling joint development of differentiated mesifurane-enhanced offerings that resonate with target demographics.

Detailing the Comprehensive Research Methodology Employed to Ensure Robust, Accurate, and Insightful Mesifurane Market Analysis

This report is grounded in a rigorous research methodology combining comprehensive secondary research, primary expert interviews, and systematic data triangulation. Secondary sources included regulatory documents, peer-reviewed journals, industry publications, and news articles to capture the latest trends and policy developments.

Primary insights were obtained through structured interviews with flavor chemists, regulatory specialists, and procurement executives across major ingredient suppliers and end-user organizations. These dialogues validated market dynamics, supply chain challenges, and technological innovations.

Quantitative and qualitative data points were cross-verified using a triangulation approach, ensuring consistency and reliability. Analytical frameworks such as PESTEL and SWOT were employed to synthesize macro-environmental factors and competitive forces shaping the mesifurane market.

Our methodology emphasizes transparency and replicability, with clear documentation of sources and validation steps, enabling stakeholders to confidently leverage the findings for strategic planning and operational execution.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mesifurane market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mesifurane Market, by Type

- Mesifurane Market, by Grade

- Mesifurane Market, by Application

- Mesifurane Market, by End User

- Mesifurane Market, by Distribution Channel

- Mesifurane Market, by Region

- Mesifurane Market, by Group

- Mesifurane Market, by Country

- United States Mesifurane Market

- China Mesifurane Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Core Insights and Strategic Implications to Guide Stakeholders in Navigating the Complex Mesifurane Market Environment

Mesifurane’s expanding role across food, fragrance, cosmetic, and pharmaceutical segments underscores its strategic importance in crafting compelling sensory experiences. The intersection of regulatory evolution, trade policy shifts, and sustainability imperatives is driving market realignments that demand agility from all stakeholders.

Segment-specific insights reveal that while natural and synthetic variants each address distinct market needs, the convergence of clean-label expectations and supply chain resilience considerations necessitates integrated product strategies. Regionally, the Americas, EMEA, and Asia-Pacific present unique regulatory and consumer landscapes that require tailored approaches.

Competitive profiling highlights that leading producers are differentiating through green chemistry investments, digitalization, and collaborative innovation. Actionable recommendations have been provided to guide resource allocation, technology adoption, and partnership development.

Together, these insights form a cohesive framework to inform decision-making, enabling organizations to navigate the complex mesifurane market with confidence and capitalize on emerging growth vectors.

Engage with Our Sales and Marketing Leader to Secure the Full Mesifurane Market Research Report and Drive Strategic Advantage

For a comprehensive understanding of the strategic imperatives, supply chain considerations, and competitive landscape in the mesifurane market, we invite you to engage with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan’s expertise in flavor and fragrance research will guide you through the full report’s insights, ensuring you capitalize on emerging opportunities and mitigate risks. Connect with Ketan to explore tailored solutions that empower informed decision-making and position your organization at the forefront of mesifurane innovation and market growth

- How big is the Mesifurane Market?

- What is the Mesifurane Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?