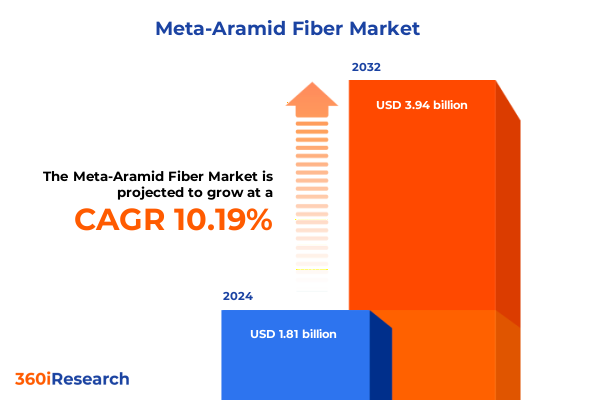

The Meta-Aramid Fiber Market size was estimated at USD 2.00 billion in 2025 and expected to reach USD 2.18 billion in 2026, at a CAGR of 10.18% to reach USD 3.94 billion by 2032.

Unveiling the Critical Role of Meta-Aramid Fibers in Modern Industries and the Forces Driving Innovation and Long-Term Resilience

Meta-aramid fibers have emerged as a cornerstone of modern material science, delivering unmatched heat resistance, tensile strength and chemical stability for critical applications. From protective apparel engineered for firefighters and military personnel to high-performance electrical insulation in transformers and EV battery packs, these fibers stand at the crossroads of safety, efficiency and technological innovation. As regulatory bodies around the globe elevate safety and sustainability mandates, manufacturers and end users increasingly turn to meta-aramid solutions to meet stringent performance criteria while navigating complex compliance landscapes.

Simultaneously, supply chain volatility driven by raw material price fluctuations and geopolitical shifts underscores the strategic importance of understanding the meta-aramid ecosystem. Recent policy developments, including the introduction of targeted tariffs on precursor chemicals and finished products scheduled for 2025, further amplify the need for a comprehensive, forward-looking perspective. This report sets the stage by illuminating the confluence of market drivers, technological advancements and regulatory frameworks that define the current state of the meta-aramid fiber domain

Exploring How Sustainability Imperatives Technological Breakthroughs and Digital Integration Are Reshaping the Meta-Aramid Fiber Landscape

The meta-aramid fiber landscape is in the midst of transformative shifts as sustainability imperatives drive a transition toward greener production practices. Manufacturers are exploring solvent-free polymerization techniques and bio-based monomers to reduce the environmental footprint of fiber synthesis. These initiatives parallel the push for closed-loop recycling systems, where chemical regeneration holds the promise of repurposing scrap material without degrading performance. In tandem, advances in fiber processing-such as electrospinning, nanofiber assemblies and AI-enabled diameter control-are unlocking novel application frontiers, from ultra-lightweight composites in aerospace to high-sensitivity smart textiles that integrate sensors for health monitoring and communication.

Moreover, digital integration and real-time analytics are reshaping operational paradigms across the value chain. Supply chain visibility platforms and blockchain-backed traceability ensure end-to-end compliance with quality and environmental standards, while predictive modeling optimizes production yields and minimizes energy intensity. As the industry pivots toward performance-driven, low-carbon formulations, collaboration among material scientists, OEMs and regulatory bodies is fostering a new era of innovation, where meta-aramid fibers not only meet but exceed the evolving demands of cutting-edge sectors.

Analyzing the Far-Reaching Consequences of the 2025 United States Tariff Regime on Meta-Aramid Fiber Supply Chains Cost Structures and Innovation

In 2025, new United States tariffs targeting key meta-aramid precursors and finished fiber imports are set to recalibrate cost structures for domestic processors. This two-tiered tariff framework encompasses both monomer feedstocks and final filament and staple fiber grades, potentially increasing landed costs by up to 15 percent. As a result, downstream manufacturers face an imperative to reassess procurement strategies, balancing the economics of import dependencies against the stability afforded by domestic or near-shore sourcing agreements.

These cost pressures have catalyzed a range of adaptive responses. Strategic partnerships and long-term off-take contracts with global producers are being negotiated to secure volume commitments and price stability, while lean manufacturing and fiber yield optimization practices gain prominence in converter operations. At the same time, the prospect of hybrid composite architectures-where meta-aramid is blended with lower-cost thermoplastics-has emerged as an innovative workaround to mitigate tariff impacts without sacrificing core performance. Collectively, these shifts underscore how the 2025 tariff regime acts not only as a cost headwind but also as a catalyst for enhanced supply chain resilience and product innovation.

Revealing Critical Application End Use Product Type and Manufacturer Segmentation Insights That Illuminate Demand Dynamics in the Meta-Aramid Fiber Market

Understanding demand nuances begins with dissecting application-level drivers, where aerospace and defense platforms leverage the exceptional heat shielding and ballistic resistance of meta-aramid fibers for critical structural components. In the automotive sector, components such as turbo hoses and brake pads incorporate electrically insulative filament grades to enhance safety and durability, while industrial belts and hoses exploit the fibers’ mechanical robustness in high-stress environments. Protective apparel, whether firefighting turnout gear, military ballistic vests or high-performance motorsport suits, remains a cornerstone application segment due to the unmatched thermal and flame resistance that meta-aramid offers.

Turning to end-use industries, aerospace primes continue to specify meta-aramid-based composites for weight reduction and flame retardancy, while defense contractors integrate staple fiber matrices in blast-resistant fabrics. Industrial end users adopt nonwoven bag filters and conveyor belts to withstand extreme temperature exposures, and transportation OEMs in both automotive and railway sectors seek reliable insulation solutions for electric propulsion systems.

From a materials perspective, filament yarns dominate in high-precision, load-bearing applications, whereas staple fibers serve the needs of nonwoven textile processes and felt-based insulation. The competitive landscape is anchored by established innovators-DuPont with its heritage in aramid development, Kolon Industries’ focus on cost-efficient production capacity and Teijin’s advancements in high-strength polymer chemistries-each deploying differentiated capabilities to address distinct customer requirements.

This comprehensive research report categorizes the Meta-Aramid Fiber market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- End Use Industry

- Application

Assessing Diverse Regional Demand Patterns and Strategic Imperatives Across the Americas EMEA and Asia-Pacific Meta-Aramid Fiber Markets

Regional performance patterns reveal distinct strategic imperatives across global markets. In the Americas, robust defense procurement budgets and a thriving automotive manufacturing base drive consistent demand for meta-aramid solutions, with stakeholders emphasizing domestic supply chain security in light of tariff developments. North American producers and converters are increasingly investing in integrated upstream capabilities to fortify resilience against import cost volatility.

Within Europe, Middle East and Africa, stringent environmental regulations and sustainability mandates propel the adoption of eco-optimized fiber chemistries and closed-loop recycling initiatives. European OEMs are collaborating with specialty producers to achieve REACH and ISO 14067 compliance, while Middle Eastern infrastructure projects leverage meta-aramid-reinforced composites for high-temperature pipelines and oil-and-gas filtration systems.

Asia-Pacific stands out as the fastest-growing region, fueled by rapid electrification of transport, expansive defense modernization programs and escalating demand for smart protective textiles. Chinese and South Korean battery manufacturers, in particular, specify meta-aramid liners for lithium-ion cells, while Indian and Japanese protective apparel brands explore cost-effective filament variants for emerging safety segments.

This comprehensive research report examines key regions that drive the evolution of the Meta-Aramid Fiber market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Meta-Aramid Fiber Manufacturers and Strategic Differentiators That Define Competitive Positions in a Rapidly Evolving Market

Leading manufacturers differentiate through a blend of proprietary chemistries, production scale and technical services. DuPont continues to leverage advanced polymer research and a global supply footprint to deliver consistent quality across high-value aerospace and defense programs. The company’s investments in circular recycling trials and bio-based precursor development underscore a commitment to long-term sustainability.

Kolon Industries, while operating a slightly lower-capacity base, excels in cost-competitive production and rapid scale-up capabilities for specialty filament offerings. Their strategic partnerships with downstream converters enable agile responses to project-specific design criteria and volume fluctuations.

Teijin’s strength lies in high-performance staple fiber systems, where unique spinning technologies yield enhanced thermal stability and improved blending performance in nonwoven insulation applications. The firm’s customer-focused R&D initiatives foster deep engagement with OEMs in the rail and automotive sectors, supporting co-development of next-generation thermal management and ballistic protection solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Meta-Aramid Fiber market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aramid Hpm

- China National Bluestar Group Co Ltd

- DuPont de Nemours Inc.

- Huvis Corporation

- Hyosung Corporation

- JSC Kamenskvolokno

- Kermel

- Kolon Industries Inc.

- Shenma Industrial Co Ltd

- SRO Group

- Teijin Limited

- Toray Industries Inc.

- Wanhua Chemical Group Co Ltd

- X-FIPER New Material Co Ltd

- Yantai Tayho Advanced Materials Co Ltd

- Zhejiang Goldencrown New Material Co Ltd

Strategic Roadmap for Industry Leaders to Enhance Supply Chain Resilience Drive Sustainable Innovation and Capitalize on Emerging Meta-Aramid Opportunities

Industry leaders should prioritize end-to-end supply chain integration to mitigate tariff-induced cost volatility. Securing strategic partnerships with precursor producers and exploring near-shore polymerization hubs will enhance resilience against external disruptions. Concurrently, investing in fiber yield optimization technologies-such as AI-driven process controls and real-time analytics-will reduce material waste and improve margin sustainability.

Advancing sustainability goals demands accelerated deployment of chemical recycling pilots and trialing bio-based monomer pathways. Collaborative consortia between manufacturers, research institutions and regulatory bodies can share risk and co-fund infrastructure upgrades that make circularity economically viable.

On the product front, engaging early with OEM customers to co-design hybrid composites and smart textile integrations will unlock new application segments. Developing scalable filament and staple portfolios tailored to specific end-use requirements ensures rapid market responsiveness. Finally, embedding rigorous traceability and environmental reporting into every stage of production will strengthen market credibility and align with evolving procurement standards globally.

Comprehensive Overview of Research Design Data Sources and Analytical Techniques Underpinning the Rigorous Meta-Aramid Fiber Market Study

This study employs a mixed-method research design, integrating extensive secondary data reviews with targeted primary interviews. Secondary sources encompass industry journals, technical white papers and regulatory filings, providing a robust backdrop of market context and historical precedent. Primary research includes structured conversations with key stakeholders-fiber producers, converters, OEMs and leading end users-to validate trends and capture real-world deployment insights.

Quantitative analysis leverages data triangulation techniques, where qualitative inputs are cross-checked against proprietary shipment records, customs filings and tariff schedules. Scenario modeling assesses the potential financial and operational impacts of the 2025 tariff adjustments, while sensitivity analyses gauge the robustness of supply chain adaptation strategies.

Supplementing these approaches, the report applies PESTEL and SWOT frameworks to frame the broader competitive and regulatory environment. Segmentation matrices dissect demand patterns across applications, industries, product types and manufacturers, ensuring granular clarity. The result is a comprehensive, data-driven view of the meta-aramid fiber landscape that underpins actionable strategic guidance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Meta-Aramid Fiber market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Meta-Aramid Fiber Market, by Product Type

- Meta-Aramid Fiber Market, by End Use Industry

- Meta-Aramid Fiber Market, by Application

- Meta-Aramid Fiber Market, by Region

- Meta-Aramid Fiber Market, by Group

- Meta-Aramid Fiber Market, by Country

- United States Meta-Aramid Fiber Market

- China Meta-Aramid Fiber Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Synthesizing Market Dynamics Key Findings and Strategic Implications to Chart the Future Trajectory of the Meta-Aramid Fiber Industry

As industries confront an era of heightened safety requirements, environmental accountability and supply chain complexity, meta-aramid fibers stand as a critical enabler of performance and resilience. The convergence of sustainability initiatives, technological breakthroughs in fiber processing and evolving tariff environments signals a market in dynamic transition.

Manufacturers who proactively integrate circularity into their operations and invest in advanced production analytics will not only manage cost pressures but also differentiate in an increasingly crowded landscape. Meanwhile, OEMs and end users benefit from strategic partnerships that co-develop application-specific solutions, ensuring that meta-aramid fibers continue to deliver unmatched value in protective apparel, electrical insulation and high-temperature industrial components.

Ultimately, the meta-aramid fiber market is poised for sustained innovation, driven by a synergy of regulatory imperatives, technological evolution and collaborative value chain initiatives. Stakeholders equipped with the insights and strategic roadmaps outlined herein will confidently navigate this complex terrain and capture the full spectrum of growth opportunities.

Connect with Ketan Rohom to Gain Exclusive Access to In-Depth Meta-Aramid Fiber Market Intelligence and Empower Strategic Decision Making

For bespoke access to comprehensive insights and strategic guidance tailored to your organization’s needs, connect with Ketan Rohom. As Associate Director of Sales & Marketing at our firm, he stands ready to guide you through the nuances of the meta-aramid fiber market. Engage directly with Ketan to secure your copy of the full market research report and arm your team with actionable intelligence that drives confident decision-making and enduring competitive advantage

- How big is the Meta-Aramid Fiber Market?

- What is the Meta-Aramid Fiber Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?