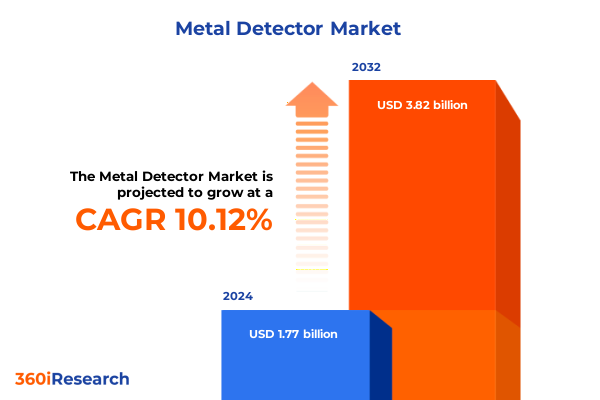

The Metal Detector Market size was estimated at USD 1.94 billion in 2025 and expected to reach USD 2.14 billion in 2026, at a CAGR of 10.13% to reach USD 3.82 billion by 2032.

Exploring the Current Metal Detector Market Dynamics Amidst Technological Advancements Security Demands and Evolving Industrial Applications

The metal detector market stands at a pivotal juncture, driven by an increasingly complex amalgamation of security concerns, industrial requirements, and recreational interests. Modern detectors leverage digital signal processing, lightweight materials, and enhanced user interfaces to meet the divergent demands of airports, event venues, archaeological sites, and hobbyists. As nations prioritize border security and critical infrastructure protection, the role of advanced detectors has expanded far beyond simple treasure hunting. Moreover, the growing interest in construction and mining applications underscores the versatility of these devices in detecting subsurface anomalies and ensuring workplace safety. This convergence of technological enhancements and broadening use cases has set the stage for sustained innovation in the sector.

Building on this momentum, the market’s evolution has been further propelled by strategic partnerships between sensor manufacturers and data analytics firms. Collaborative ventures have accelerated the integration of cloud-based monitoring, enabling real-time diagnostics and remote calibration of detection systems. At the same time, end users are demanding devices that strike an optimal balance between sensitivity, portability, and cost-efficiency. Regulatory bodies, too, are tightening performance standards, prompting manufacturers to invest in more precise discrimination algorithms. Consequently, the industry is witnessing a shift toward modular platforms that can be upgraded through software enhancements, creating a more responsive ecosystem geared toward continuous improvement.

Unveiling the Pioneering Shifts Reshaping the Metal Detector Landscape Through AI Integration Sustainability Focus and Enhanced Sensory Precision

The landscape of metal detection is undergoing transformative shifts as artificial intelligence and machine learning algorithms are increasingly embedded into detection systems. These intelligent solutions deliver improved target identification and false-alarm reduction, enabling operators to focus on critical threats rather than routine screening. Concurrently, developments in Internet of Things connectivity allow detectors to form part of integrated security networks, offering seamless data exchange with access control and surveillance platforms. This interconnectivity has not only elevated overall security postures in sensitive environments but has also opened up new opportunities for predictive maintenance and lifecycle management of equipment through remote diagnostics.

Sustainability concerns are reshaping material choices and power management strategies for handheld and portable detectors alike. Advanced composite casings, energy-efficient circuitry, and rechargeable battery innovations have extended operational uptime while reducing environmental impact. At the same time, manufacturers are investing heavily in miniaturization, enabling more compact vehicle-mounted and walk-through systems that retain high sensitivity but occupy a smaller physical footprint. These converging trends underscore an industry pivot toward more intelligent, eco-friendly designs that can adapt to the evolving requirements of security, archaeological, and industrial applications.

Assessing the Cumulative Impact of 2025 United States Tariffs on Metal Detector Supply Chains Manufacturing Costs and Competitive Pricing Structures

The introduction of cumulative Section 232 tariffs on steel and aluminum and Section 301 levies on select imported components has significantly affected the metal detector industry’s supply chains through 2025. Many detector housings, coil assemblies, and structural frames traditionally sourced from low-cost producers have faced increased import duties, driving up landed costs. Domestic manufacturers have partially offset these increases by reshoring certain production stages; however, this transition has required substantial capital investments in tooling and workforce training. As a result, some smaller producers have struggled to maintain competitive pricing, reinforcing the market leadership of globally diversified firms with robust in-house fabrication capabilities.

Additionally, the heightened tariff environment has prompted procurement managers to diversify supplier portfolios and negotiate long-term agreements to lock in favorable rates. End users, facing these incremental cost pressures, have shown a willingness to shift toward higher-performance models with lower maintenance expenses spread over their operational lifecycles. Simultaneously, several major distributors have expanded consignment inventory programs to buffer customers from abrupt price fluctuations. Overall, these tariff-driven adaptations have not only influenced cost structures but have also accelerated innovation, as manufacturers seek to differentiate through design efficiencies that minimize reliance on tariff-exposed inputs.

Illuminating Critical Segmentation Insights Across Device Types Technologies Applications End Users Distribution Channels and Price Tiers

Segmenting the market by device type reveals distinct growth trajectories, with handheld units maintaining broad appeal among hobbyists and security personnel while portable and vehicle-mounted systems are increasingly favored by mining and construction operations for their extended range and rugged design. Walk-through detectors continue to dominate high-throughput venues such as airports and public events, where rapid screening is essential for crowd management. Each form factor demands tailored design considerations-from ergonomic handles and intuitive interfaces in portable devices to robust mounting options and weatherproofing in vehicle-mounted installations.

A parallel segmentation by detection technology underscores diverging performance characteristics; beat frequency oscillation models remain cost-effective for general-purpose use, whereas pulse induction systems excel in depth penetration for archaeological and industrial applications. Very low frequency detectors strike a balance between sensitivity and mineralization resistance, meeting the needs of outdoor enthusiasts and security deployments alike. Across application areas spanning archaeology and mining to security and defense, the interplay of technology choice, end-user priorities-whether in banking, retail checkpoints, event security, immigration control, or military operations-and distribution channels, both offline and digital, has driven nuanced purchasing behaviors. Price range segmentation further influences buying patterns, with high-tier offerings commanding premium pricing based on advanced features, mid-tier models prioritizing reliability and ease of use, and entry-level solutions catering to cost-conscious consumers.

This comprehensive research report categorizes the Metal Detector market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Application

- End User

- Distribution Channel

- Price Range

Highlighting Regional Performance Trends and Growth Drivers Shaping the Metal Detector Market Across the Americas EMEA and Asia-Pacific Territories

In the Americas, elevated investments in homeland security, public event safety, and petroleum industry inspections have sustained demand for both portable and walk-through detectors. The region’s infrastructure modernization programs and heightened airport security benchmarks have also driven procurement of advanced, network-enabled screening systems. North American hobbyist communities continue to fuel interest in pulse induction detectors for deep-seeking explorations, while Latin American border control agencies prioritize versatile handheld and vehicle-mounted solutions to deter illicit crossings.

Europe, the Middle East, and Africa present a tapestry of regulatory harmonization efforts and diverse security challenges that have accelerated adoption of sophisticated detection platforms. In Western Europe, strict compliance standards for military and law enforcement usage have elevated demand for devices with robust data logging and remote monitoring capabilities. Meanwhile, in the Middle East and Africa, large-scale infrastructure projects and archaeological initiatives have favored versatile detector portfolios capable of handling mineralized soils and harsh environmental conditions. Across EMRA, strategic partnerships between local integrators and global manufacturers continue to enhance after-sales support and localization of technical services.

Asia-Pacific’s rapid urbanization and expanding transportation networks have stimulated demand for scalable walk-through systems at transit hubs and commercial centers. Emerging economies in Southeast Asia and India are investing in vehicle-mounted detectors for tunnel and pipeline inspections, while East Asian security agencies are pioneering AI-driven screening algorithms for high-traffic terminals. Concurrently, domestically based producers in China and South Korea are strengthening their regional supply chains, reducing lead times and offering competitively priced alternatives to international brands.

This comprehensive research report examines key regions that drive the evolution of the Metal Detector market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Players Strategies Collaborations and Product Innovations That Are Redefining Competitive Dynamics in the Global Metal Detector Industry

Global industry leaders are pursuing multifaceted strategies to fortify their market positions. Companies such as Garrett and Minelab have ramped up research partnerships with universities and defense research labs to co-develop next-generation sensing techniques and discriminatory algorithms. Fisher and NEL have focused on strategic acquisitions, integrating niche startups to expand their product portfolios and geographic reach. Meanwhile, several emerging players are forging alliances with electronics and battery specialists to enhance portability and operational runtime, addressing the growing demand for detectors that can sustain prolonged field use without compromising sensitivity.

In response to tariff-induced cost pressures, top-tier manufacturers have also diversified manufacturing footprints, establishing facilities in tariff-advantaged jurisdictions. Simultaneously, key players are leveraging subscription models and data-driven service offerings-such as cloud-based performance analytics and predictive maintenance packages-to build recurring revenue streams and deepen customer relationships. Through branded training programs and certification initiatives, companies are further solidifying their ties with end-user communities, ensuring sustained loyalty amidst intensifying competition.

This comprehensive research report delivers an in-depth overview of the principal market players in the Metal Detector market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bizerba GmbH & Co. KG

- C.Scope International Ltd

- COSO

- Deteknix Pty Ltd

- Dongguan Lianxin Electronics Co., Ltd.

- Dongguan Shanan Electronics Co., Ltd.

- Easyweigh

- Explorer Metal Detectors, Inc.

- Fisher Research Laboratory, Inc.

- Fortress Technology, Inc.

- Gaojing

- Garrett Metal Detectors, LLC

- Ishida Co., Ltd.

- Juzheng Electronic Technology Co., Ltd.

- Mesutronic Gerätebau GmbH

- Minelab Electronics Pty Ltd

- Multivac Group

- Nokta Makro Detectors, Inc.

- Qingdao Baijing Electronics Co., Ltd.

- Shanghai Shenyi Technology Co., Ltd.

- Shanghai Techik Instrument Co., Ltd.

- Tesoro Enterprises, Inc.

- Thermo Fisher Scientific Inc.

- White's Electronics, Inc.

- WIPOTEC‑OCS GmbH

- XP Metal Detectors SAS

Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities Address Supply Chain Challenges and Accelerate Innovation in Metal Detection

Industry leaders should prioritize investment in artificial intelligence and edge-computing capabilities to differentiate their product offerings and achieve superior threat discrimination. By embedding adaptive learning algorithms, companies can deliver devices capable of progressively refining detection profiles based on real-world performance data. At the same time, manufacturers must diversify their supply chain networks, incorporating dual-sourcing strategies for critical components to mitigate the risk of future tariff escalations or geopolitical disruptions.

To capture new market segments, stakeholders are advised to develop modular detector platforms that can be upgraded via downloadable software, enabling customers to scale functionality without full device replacement. Strengthening partnerships with regional distributors and integrators will also prove crucial in tailoring solutions to local regulatory frameworks and field conditions. Finally, embedding sustainability into product roadmaps-through eco-conscious materials, energy-efficient design, and end-of-life recycling programs-will resonate with environmentally focused end users and support broader corporate responsibility goals.

Outlining the Rigorous Research Methodology Employed to Analyze Market Trends Validate Data and Ensure Comprehensive Coverage of Metal Detector Industry Insights

This study combines primary research through in-depth interviews with security managers, archaeologists, and industrial procurement directors alongside secondary research from trade journals, government publications, and technical white papers. Structured surveys were conducted to capture end-user preferences across device types, detection technologies, applications, and price sensitivities. Data integrity was assured through cross-validation against public patent filings and detailed analysis of product specifications from leading manufacturers.

Market segmentation was meticulously defined by type, technology, application, end-user, distribution channel, and price range, ensuring a granular understanding of demand drivers and competitive positioning. Regional analyses were supported by country-level import and export data as well as localized interviews with regional distribution partners. Quality control protocols, including double-data entry and consistency checks, were implemented to maintain analytical rigor and deliver reliable, actionable insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Metal Detector market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Metal Detector Market, by Type

- Metal Detector Market, by Technology

- Metal Detector Market, by Application

- Metal Detector Market, by End User

- Metal Detector Market, by Distribution Channel

- Metal Detector Market, by Price Range

- Metal Detector Market, by Region

- Metal Detector Market, by Group

- Metal Detector Market, by Country

- United States Metal Detector Market

- China Metal Detector Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Summarizing Key Takeaways and Future Outlook Emphasizing Technological Evolution Regulatory Impacts and Strategic Imperatives for Metal Detector Stakeholders

In conclusion, the metal detector market is characterized by rapid technological evolution, expanding application scopes, and dynamic regional growth patterns. The integration of AI, connectivity, and sustainable materials is reshaping product roadmaps, while cumulative tariffs continue to influence cost structures and strategic sourcing. Segmentation insights highlight the tailored needs of hobbyist explorers, industrial inspectors, security professionals, and defense agencies, underscoring the importance of modular, upgradeable platforms in addressing diverse requirements.

As manufacturers refine their operations to navigate tariff environments and intensify R&D collaborations, end users stand to benefit from detectors that offer higher sensitivity, operational flexibility, and lower total cost of ownership. Regional nuances further underscore the need for localized strategies and partnerships to maximize market penetration. With the industry poised for continued innovation and consolidation, stakeholders equipped with detailed market intelligence and strategic foresight will be best positioned to capture emerging opportunities and drive sustainable growth.

Engage with Ketan Rohom to Unlock Exclusive Metal Detector Market Intelligence and Secure Your Customized Report Tailored to Your Strategic Business Objectives

To explore deeper insights, customized data points, and strategic guidance tailored to your business’s unique objectives, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. By partnering with him, you gain access to our comprehensive metal detector market research report, which is meticulously crafted to address the nuances of device innovations, regulatory landscapes, and end-user requirements. Ketan’s deep industry expertise ensures that your company benefits from actionable intelligence, exclusive trend analyses, and personalized support in implementing strategic initiatives. Take the next step toward informed decision-making and competitive advantage by scheduling a consultation with Ketan Rohom today and secure the specialized report that will drive your growth in the metal detector sector.

- How big is the Metal Detector Market?

- What is the Metal Detector Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?