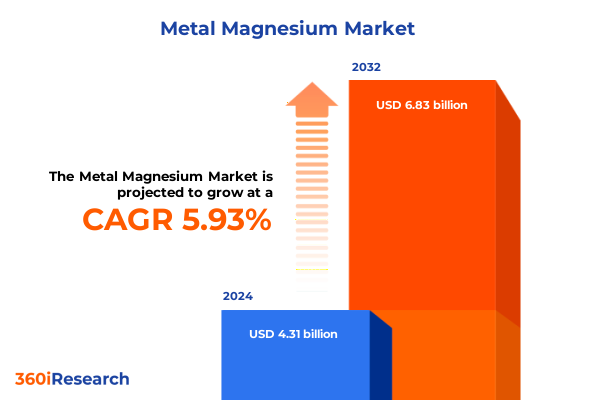

The Metal Magnesium Market size was estimated at USD 4.56 billion in 2025 and expected to reach USD 4.81 billion in 2026, at a CAGR of 5.94% to reach USD 6.83 billion by 2032.

Understanding Metal Magnesium Dynamics Across Industries Emphasizing Its Strategic Importance in Lightweighting, Thermal Management, and Advanced Applications

Metal magnesium has emerged as a critical material for industries seeking weight reduction without compromising structural integrity. Its low density and high specific strength have propelled its adoption in airframe components, automotive body panels, and electronic thermal management solutions. Recent innovations in alloy development and powder metallurgy have further broadened the scope of applications, enabling complex geometries and enhanced performance in medical implants and precision connectors. As industries pivot toward sustainability, the recyclability and potential for closed-loop manufacturing of magnesium-based components have become compelling advantages for original equipment manufacturers and material engineers alike.

Amid escalating global demand for lightweight materials and tighter emissions regulations, stakeholders require a detailed exploration of supply dynamics, technological advancements, and evolving regulatory frameworks. This executive summary distills the most relevant insights, addressing shifts in trade policies, segmentation nuances, and regional market drivers across the Americas, EMEA, and Asia-Pacific. By presenting a concise yet comprehensive overview, this analysis equips decision-makers with the foundational context needed to navigate competitive pressures, mitigate supply chain risks, and capitalize on emerging opportunities.

As competition intensifies, understanding the interplay between production processes, material grades, and purity specifications is essential for aligning procurement strategies with performance requirements. The transition toward electric vehicles, advanced aerospace platforms, and next-generation electronics underscores the need for materials that deliver both mechanical robustness and thermal stability. Therefore, this report offers a multi-faceted perspective, illuminating the key trends and strategic considerations that will define the trajectory of the global metal magnesium market in the coming years.

Recognizing the Transformational Shifts in Metal Magnesium Supply Chains Driven by Sustainability, Recycling Innovations, and Evolving Regulatory Frameworks

The metal magnesium landscape is undergoing transformative shifts driven by an increasing focus on sustainability and circular economy principles. Manufacturers are investing in closed-loop recycling processes that recover magnesium scrap from end-of-life components and reintegrate it into high-value applications. This shift is bolstered by innovations in purification and remelting technologies that minimize energy consumption and reduce greenhouse gas emissions. As a result, secondary production is gaining traction alongside conventional electrolytic and thermal reduction routes, redefining traditional supply chain structures and enabling more resilient material sourcing strategies.

Simultaneously, digitalization is reshaping the way stakeholders track and trace material flows. The integration of blockchain-enabled platforms and advanced analytics provides unprecedented visibility into origin, purity, and process lineage. This enhanced transparency not only facilitates compliance with emerging environmental regulations but also supports the development of digital product passports, fostering trust between OEMs and suppliers. In parallel, advancements in process engineering-such as the refinement of flash reduction reactors and optimization of Pidgeon furnace parameters-are driving incremental efficiency gains and expanding capacity for specialized alloy grades.

Moreover, regulatory initiatives focused on carbon border adjustments and material stewardship are exerting increasing influence over strategic decision-making. Policymakers in major consumption regions are considering import duties linked to carbon intensity metrics, which may alter cost competitiveness across production hubs. In turn, producers are aligning their R&D roadmaps with decarbonization targets and embedding eco-design criteria into product development. These converging forces are forging a more sustainable, transparent, and technologically sophisticated metal magnesium ecosystem poised to meet the demands of the next generation of high-performance applications.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Metal Magnesium Trade, Production Cost Structures, and Strategic Sourcing Decisions Across Industries

The imposition of new United States tariffs in early 2025 has introduced a complex set of variables into the metal magnesium supply equation. With additional duties targeting primary imports, cost structures for downstream manufacturers have experienced upward pressure, prompting strategic realignments in procurement and inventory management. Companies previously reliant on high-volume sourcing from regions subject to increased duty rates have begun reallocating volumes to jurisdictions offering more favorable trade terms, while domestic producers seek to capitalize on the resulting cost arbitrage.

In response to higher import levies, some original equipment manufacturers have negotiated long-term offtake agreements with domestic facilities, spurring capacity expansion projects that aim to address shortfalls in localized supply. While this shift enhances supply chain resilience, it also introduces a lead time challenge, as greenfield projects and process optimizations require significant capital investment and technical validation. Moreover, the redistribution of trade flows has triggered ripple effects in allied markets, influencing scrap values, alloy premiums, and transportation economics across maritime and over-the-road segments.

Concurrently, the tariff environment has catalyzed renewed dialogue between industry associations and policymakers regarding classification criteria and duty exemptions for recycled content. Stakeholders are advocating for carve-outs that recognize the lower carbon footprint of recovered magnesium, underscoring the potential for alignment between trade policy and decarbonization goals. As this dialogue evolves, market participants are monitoring regulatory proceedings closely, readying contingency plans that blend domestic sourcing, near-shoring partnerships, and recycled content strategies to mitigate risk and preserve competitive positioning.

Deriving Critical Segmentation Insights by Application, Form, Production Process, Grade, Purity, and Sales Channel to Inform Targeted Strategies in Metal Magnesium Markets

The metal magnesium market encompasses a diverse array of applications, each with its own performance requirements and material specifications. Within aerospace, demand is distributed among airframe structural elements, engine component assemblies, and landing gear systems, all of which require alloys tailored for specific load-bearing and fatigue-resistance characteristics. In the automotive sector, body panels, engine components, chassis frames, transmission elements, and wheels draw upon both high-strength and ductile variants to meet evolving design criteria driven by vehicle electrification and lightweighting mandates. Electronic applications focus on connectors, heat sinks, and housing solutions that leverage magnesium’s thermal conductivity and electromagnetic shielding properties. The medical field, meanwhile, relies on equipment components and implantable devices that benefit from biocompatible alloy formulations and precise surface treatments.

Form factors further segment the market, ranging from alloy ingots and granules used in bulk casting operations to foil and ribbon products for specialized forming processes. Powder metallurgy and additive manufacturing applications depend on high-quality alloy powders, while ribbon and foil grades are often selected for vibration damping and shielding applications. Within the alloy category, AM50, AZ61, and AZ91 have emerged as industry standards, each offering a balance of strength, ductility, and corrosion resistance suited to distinct use cases.

Production processes such as electrolytic extraction, flash reduction, and the Pidgeon thermal reduction technique impart unique cost and purity profiles to the final product. Similarly, material classifications-commercial, high-purity, and ultra high-purity-define the level of impurity tolerances acceptable for critical applications. Purity grades span from 99.00 percent to ultra-refined levels exceeding 99.99 percent, addressing stringent requirements in electronics and medical components. Finally, procurement channels bifurcate into direct engagements with producers and distributor networks, each offering trade-off considerations in lead time, technical support, and volume flexibility. Understanding the interplay among these segmentation layers is essential for aligning supply strategies with product innovation goals.

This comprehensive research report categorizes the Metal Magnesium market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Form

- Production Process

- Grade

- Sales Channel

Uncovering Key Regional Dynamics in the Americas, Europe, Middle East & Africa, and Asia-Pacific to Reveal Market Drivers, Challenges, and Opportunities for Metal Magnesium

Regional analysis reveals divergent trajectories in metal magnesium demand and supply. In the Americas, strength in automotive electrification programs and aerospace modernization initiatives has driven increased consumption of high-performance alloys, while domestic producers respond by optimizing electrolytic and thermal reduction operations to capture displaced import volumes. Supply chain resilience has become a priority, with companies exploring strategic partnerships across the hemispheric trade corridor to secure secondary feedstocks and mitigate logistical bottlenecks.

Europe, the Middle East, and Africa present a multi-faceted landscape shaped by stringent environmental regulations, advanced manufacturing clusters, and nascent renewable energy projects. European Union initiatives targeting industrial decarbonization have incentivized investments in green production pathways and recycling infrastructures, particularly in proximity to major aerospace and automotive production hubs. Meanwhile, Middle Eastern petrochemical complexes are evaluating diversification strategies that leverage by-product magnesium streams, and African ventures are emerging around raw material extraction and emerging manufacturer partnerships aimed at serving regional demand.

In the Asia-Pacific arena, robust capacity expansions in China and Southeast Asia continue to underpin global supply volumes, even as policymakers introduce quality control standards and environmental compliance measures to address emissions intensity. India’s infrastructure development programs and Japan’s electronics manufacturing sector are increasingly significant sources of demand, while South Korea’s advanced alloy innovation efforts are forging new pathways for high-purity and specialty formulations. Across each region, these factors converge to create both competitive pressures and collaborative opportunities for stakeholders striving to capture growth in a dynamic global ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Metal Magnesium market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Metal Magnesium Producers and Their Strategic Initiatives Including Capacity Expansions, Technology Developments, and Collaborative Partnerships to Advance Market Position

Leading producers are implementing ambitious expansion and innovation programs to maintain market leadership. One major North American facility recently commissioned advanced electrolytic cells that deliver improved yield and reduced energy consumption, positioning itself to meet growing domestic demand spurred by trade realignments. In China, capacity optimization investments in both flash reduction and Pidgeon operations are intended to enhance feedstock flexibility and respond to tighter environmental regulations. Several manufacturers have also broadened alloy portfolios through partnerships with aerospace OEMs, focusing on next-generation compositions that deliver superior fatigue resistance and thermal stability.

Collaboration between material producers and downstream integrators is becoming more prevalent, with pilot projects exploring recycled magnesium streams and joint development agreements targeting additive manufacturing applications. Innovation centers in Europe are driving new process control systems that leverage real-time analytics, while research consortia in Asia-Pacific are advancing high-purity extraction techniques to address the most stringent electronics and medical specifications. Distributor networks are also evolving, offering value-added services such as technical advisory, just-in-time delivery, and localized warehousing to support regional manufacturing ecosystems.

This competitive landscape underscores a broader trend toward vertical integration and strategic alliances, as companies seek to secure intellectual property, streamline supply chains, and accelerate time-to-market for high-performance magnesium solutions. For stakeholders across the value chain, these initiatives highlight the importance of forging partnerships that align technology roadmaps with end-market needs, ensuring sustained innovation and resilience in an increasingly complex operating environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Metal Magnesium market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Magnesium LLC

- China Magnesium Corporation Ltd

- Dead Sea Magnesium Ltd

- Fu Gu Yi De Magnesium Alloy Co Ltd

- IMA Industrial S/A

- Jayesh Industries Ltd

- Magnesium Elektron Ltd

- Magontec Limited

- Metallic Corporation of India

- Nanjing Yunhai Special Metals Co Ltd

- RIMA Group

- Shanxi Bada Magnesium Co Ltd

- Shanxi Shuifa Zhenxin Magnesium Industry Co Ltd

- Solikamsk Magnesium Works OAO

- Taiyuan Tongxiang Magnesium Co Ltd

- Taiyuan Yiwei Magnesium Co Ltd

- US Magnesium LLC

- VSMPO‑AVISMA Corporation

- Wenxi YinGuang Magnesium Industry Co Ltd

- Western Magnesium Corporation

Actionable Recommendations for Industry Leaders to Address Supply Chain Resilience, Technological Innovation, Sustainability, and Regulatory Compliance in Metal Magnesium Ecosystems

To navigate the evolving market dynamics and regulatory environment, industry leaders should prioritize diversification of raw material sourcing by establishing relationships with producers in multiple regions and incorporating recycled magnesium streams into their portfolios. Embracing circular economy principles will not only enhance ESG credentials but also buffer against future tariff fluctuations and supply disruptions. Concurrently, companies are advised to invest in research and development programs focused on high-purity alloy formulations and next-generation production techniques, thereby strengthening their competitive advantage in emerging application areas.

Developing digital supply chain capabilities is equally critical. Implementing real-time tracking and analytics platforms will improve visibility into material provenance, facilitate compliance with carbon-related trade measures, and enhance predictive planning. Strategic alliances with technology providers and logistics partners can yield integrated solutions that optimize inventory levels, shorten lead times, and reduce total landed cost. In addition, engagement with regulatory bodies to shape classification criteria and incentive frameworks can help align policy outcomes with industry decarbonization objectives.

Finally, stakeholders should pursue collaborative pilot projects with OEMs and research institutions to accelerate the adoption of magnesium-based additive manufacturing and advanced composite systems. These initiatives can demonstrate performance benefits, unlock new value streams, and solidify the role of magnesium in next-generation mobility, aerospace, and electronics platforms. By adopting a proactive and holistic strategy that balances innovation with operational resilience, companies can secure leadership positions in the rapidly evolving metal magnesium landscape.

Comprehensive Research Methodology Emphasizing Primary Interviews, Secondary Data Analysis, Expert Panels, and Triangulation Techniques to Ensure Robust Metal Magnesium Market Insights

This analysis is grounded in a rigorous research methodology combining primary and secondary data collection, along with robust validation processes. Primary inputs were gathered through in-depth interviews with executives from leading production facilities, supply chain specialists, and original equipment manufacturers across key regions. These conversations provided nuanced insights into capacity expansion plans, technology adoption timelines, and evolving sourcing strategies.

Secondary research encompassed the systematic review of industry publications, trade association reports, patent filings, and regulatory filings to ensure comprehensive coverage of global operational trends and competitive activities. Data triangulation techniques were employed to cross-verify quantitative and qualitative findings, minimizing potential biases and reinforcing the reliability of key conclusions. Supplementary intelligence was sourced from specialized engineering journals and process technology vendor white papers, providing contextual depth on emerging innovations in electrolytic, flash reduction, and Pidgeon processes.

To ensure analytical rigor, all segmentation frameworks were validated through iterative feedback loops with subject-matter experts, and regional insights were stress-tested against macroeconomic indicators and trade developments. This structured approach underpins the credibility of the insights presented, offering stakeholders a transparent view of assumptions, data sources, and methodological considerations that support strategic decision-making in the metal magnesium domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Metal Magnesium market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Metal Magnesium Market, by Application

- Metal Magnesium Market, by Form

- Metal Magnesium Market, by Production Process

- Metal Magnesium Market, by Grade

- Metal Magnesium Market, by Sales Channel

- Metal Magnesium Market, by Region

- Metal Magnesium Market, by Group

- Metal Magnesium Market, by Country

- United States Metal Magnesium Market

- China Metal Magnesium Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Strategic Imperatives to Provide a Cohesive View of the Future Metal Magnesium Landscape and the Pathways for Sustainable Growth and Competitive Advantage

The convergence of supply chain realignment, evolving tariff landscapes, and sustainability imperatives has redefined the strategic contours of the metal magnesium market. By examining the distinct segmentation layers-from aerospace and automotive applications to foil and powder forms, and from production methods to purity grades-this analysis highlights the critical variables that influence procurement and innovation decisions. Regional dynamics further contextualize these findings, revealing how policy, infrastructure, and demand drivers vary across the Americas, EMEA, and Asia-Pacific.

Leading producers are responding with capacity expansions, technology partnerships, and supply chain diversification initiatives, underscoring a shared emphasis on resilience and cost optimization. The impact of 2025 tariffs has accelerated domestic sourcing and prompted industry-wide advocacy for recycled content exemptions, illustrating the delicate balance between trade policy and decarbonization goals. In this environment, actionable recommendations centered on circular economy integration, digital supply chain adoption, and collaborative R&D emerge as key strategic levers for growth.

Looking ahead, the metal magnesium ecosystem is poised for continued transformation as stakeholders leverage advanced process innovations, adopt rigorous environmental standards, and forge cross-sector collaborations. The insights distilled in this summary provide a cohesive roadmap for navigating these complex dynamics, equipping decision-makers with the strategic imperatives necessary to harness the full potential of magnesium as a lightweight, sustainable, and high-performance material.

Connect Directly with Ketan Rohom to Purchase the Detailed Metal Magnesium Market Research Report and Accelerate Strategic Insights for Your Business

To explore the full-depth analysis, proprietary data, and specialized insights into how tariff shifts, segmentation nuances, regional dynamics, and corporate strategies are reshaping the metal magnesium market, reach out to Associate Director, Sales & Marketing, Ketan Rohom, to purchase the comprehensive market research report. His expertise in materials markets can guide you through licensing options, customized data packages, and strategic consulting engagements tailored to your organization’s unique needs. Initiate a conversation today to secure timely access to actionable intelligence that will support your investment decisions, supply chain planning, and product development roadmaps with the clarity and confidence required to succeed in a rapidly evolving industry.

- How big is the Metal Magnesium Market?

- What is the Metal Magnesium Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?