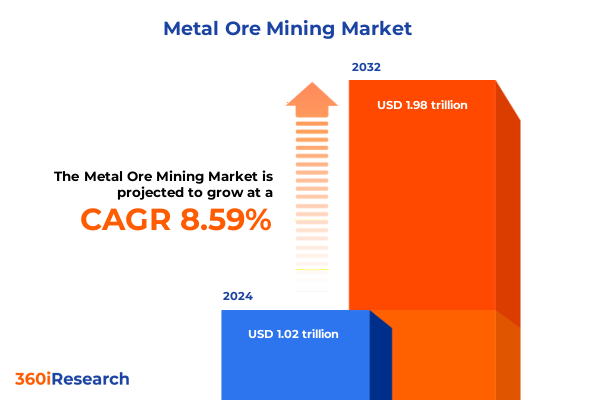

The Metal Ore Mining Market size was estimated at USD 1.08 trillion in 2025 and expected to reach USD 1.15 trillion in 2026, at a CAGR of 8.95% to reach USD 1.98 trillion by 2032.

Unlocking the Potential of Global Metal Ore Mining by Exploring Core Industry Dynamics Emerging Market Trends and Strategic Drivers Shaping Future Investment Decisions

The global metal ore mining sector stands at a critical juncture, propelled by evolving demand patterns, technological breakthroughs, and an increasing imperative for sustainable operations. As the bedrock of industrial and infrastructure development, metal ores underpin everything from electric vehicle batteries to high-strength steel components. Against this backdrop, industry stakeholders face mounting complexity driven by fluctuating raw material prices, shifting regulatory landscapes, and intensifying pressure to reduce carbon footprints. Moreover, geopolitical tensions and supply chain disruptions have elevated the strategic importance of securing reliable ore sources.

This executive summary offers a concise yet comprehensive overview of the metal ore mining environment, distilling the most salient trends, challenges, and strategic considerations. It highlights how transformative shifts-from digitalization to regulatory recalibrations-are redefining competitive dynamics. In addition, this introduction sets the stage for an in-depth exploration of segmentation insights, regional differentiators, and the cumulative implications of recent tariff measures introduced by the United States in 2025. Through this narrative, decision makers will gain a clear, contextualized understanding of where the market stands today and where it is headed tomorrow. Ultimately, this section lays the foundation for a nuanced examination of actionable recommendations and the research methodologies that underpin these insights.

Recognizing the Rapid Evolution of Metal Ore Mining Driven by Advanced Technologies Rigorous Sustainability Standards and Innovative Business Models

In recent years, the metal ore mining industry has undergone a rapid and profound metamorphosis influenced by technological innovation, environmental mandates, and shifting stakeholder expectations. Automation and robotics are redefining extraction processes, enabling operators to achieve greater precision, minimize safety risks, and optimize resource recovery. Concurrently, digitalization initiatives-ranging from real-time data analytics to predictive maintenance algorithms-are enhancing efficiencies and driving down unit costs. These advancements, in conjunction with blockchain-based traceability platforms, are elevating transparency across complex supply chains, fostering greater trust among buyers and end users.

Simultaneously, the industry’s environmental and social governance agenda has accelerated, prompting mining companies to embrace renewable energy integration, water stewardship, and rehabilitation best practices. Such commitments are reshaping capital allocation decisions, as financiers increasingly favor projects that demonstrate credible decarbonization roadmaps. Furthermore, circular economy principles are gaining traction, with greater emphasis on recycling and secondary sourcing of critical minerals. This shift not only alleviates pressure on primary ore deposits but also catalyzes innovation in processing technologies. Collectively, these transformative forces are recalibrating competitive dynamics and forging new pathways for growth, while underscoring the importance of agility and strategic foresight in a rapidly evolving landscape.

Analyzing the Cumulative Impact of United States Tariff Measures on Supply Chains Pricing Volatility and Strategic Sourcing Decisions in 2025

The cumulative effects of the United States tariff measures implemented in 2025 have exerted significant influence on global metal ore supply chains, pricing structures, and strategic sourcing paradigms. By imposing additional duties on key ore imports, the policy has elevated landed costs for end users, prompting downstream processors to reassess procurement strategies. This cost inflation has translated into heightened price volatility, compelling manufacturers to hedge raw material exposure and explore alternative suppliers in regions unaffected by the duties. Consequently, several processing entities have accelerated their investment in domestic ore beneficiation facilities to mitigate dependency on higher-tariff imports.

In addition, the tariff landscape has incentivized greater collaboration between mining companies and downstream consumers within the domestic market. Joint ventures and long-term supply agreements have become more prevalent, as stakeholders seek to secure stable raw material access while sharing project risks. At the same time, the measures have catalyzed increased interest in nearshoring and regional cluster development across the Americas, where free trade agreements and geostrategic alliances offer tariff waivers or reductions. While bolstering domestic value chains, these shifts also underscore the need for agile policy navigation and proactive engagement with governmental bodies to optimize duty relief opportunities and maintain competitive advantage.

Deriving Key Market Segmentation Insights by Assessing Ore Types Mining Methods Grade Classifications End Use Industry Requirements and Distribution Channels

Diving into market segmentation reveals a nuanced interplay of demand drivers and operational considerations across ore types, mining methods, grade classifications, end use industries, and distribution channels. Bauxite, copper ore, gold ore, iron ore, and nickel ore each exhibit distinct production geographies and processing requirements, influencing both capital intensity and regulatory complexities. For example, copper ore operations have seen robust investment in sulfide and oxide processing technologies, whereas gold ore extraction strategies continue to prioritize low-impact, high-efficiency leaching solutions.

Surface mining and underground mining approaches present divergent cost structures and environmental footprints, with open pit methods typically enabling large-scale production and underground techniques offering access to deeper, higher-grade veins. Grade differentiation further intensifies competitive dynamics, as high grade deposits command price premiums but often face accelerated depletion rates, whereas low grade resources require innovative beneficiation to achieve economic viability. End use industries-from automotive through electronics and infrastructure-exert tailored requirements on ore specifications, with the steel sector’s plates, rebar, sheets, and wire rods demanding consistent metallurgical properties.

Finally, distribution channels shape market access and pricing flexibility. Direct sales agreements foster stronger producer–consumer alignment and enable just-in-time logistics, while online sales platforms are gaining traction for niche ore products and specialty minerals. Third-party distribution networks remain integral for reaching fragmented end user markets and facilitating bulk commodity trading, though digital marketplaces are gradually redefining traditional intermediation models.

This comprehensive research report categorizes the Metal Ore Mining market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ore Type

- Mining Method

- Grade

- End Use Industry

- Distribution Channel

Uncovering Regional Market Nuances across the Americas Europe Middle East Africa and Asia Pacific to Inform Strategic Expansion and Supply Chain Localization

Regional distinctions within the metal ore mining landscape underscore the strategic significance of local resources, regulatory frameworks, and demand ecosystems. In the Americas, abundant iron ore deposits in North America complement robust steelmaking capabilities in Brazil, while growth in battery-related minerals across South America positions the region as a critical player in electrification supply chains. Trade agreements within the hemisphere further facilitate tariff relief and logistical optimization, enabling mining firms to develop vertically integrated operations that span extraction, processing, and distribution.

Across Europe, the Middle East, and Africa, diverse resource endowments-from Africa’s rich cobalt and copper terrains to Europe’s emerging green metallurgical initiatives-intersect with varying policy environments. African nations are increasingly adopting resource nationalism measures, compelling joint ventures and local beneficiation investments. Meanwhile, the European Union’s carbon border adjustment mechanism and Middle Eastern sovereign investment funds are reshaping capital flows into critical mineral projects, fostering partnerships that blend financial muscle with technical expertise.

In the Asia-Pacific arena, Australia’s world-class iron ore and bauxite reserves coexist with burgeoning exploration across Southeast Asia. China’s dominant refining capacity and India’s rapid infrastructure expansion drive demand for a broad array of ores, while geopolitical recalibrations have prompted Japan, South Korea, and Taiwan to diversify upstream supply through strategic investments. These regional nuances collectively influence global trade patterns and inform portfolio diversification strategies for mining companies worldwide.

This comprehensive research report examines key regions that drive the evolution of the Metal Ore Mining market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Metal Ore Mining Companies by Evaluating Strategic Initiatives Scalability Technological Adoption and Sustainability Leadership

Leading metal ore mining companies continue to redefine industry benchmarks by blending scale with innovation and sustainability. Global majors have prioritized portfolio optimization, divesting noncore assets to concentrate on high-potential deposits and low-carbon operations. In parallel, mid-tier and junior miners have carved out niches by focusing on critical minerals essential to the energy transition, leveraging agile project development approaches and strategic joint ventures with processing integrators.

Technological leadership has emerged as a key differentiator, with top-tier firms deploying advanced earth observation tools for exploration and unmanned equipment for remote site operations. Strategic partnerships with technology providers and academia bolster research into next-generation beneficiation and recycling processes. Simultaneously, companies with robust sustainability credentials have captured preferential access to capital markets and off-take agreements, reflecting the rising influence of ESG ratings among institutional investors.

Emerging entrants and regional champions are also reshaping competitive dynamics by localizing supply chains and forging downstream integrations. These players demonstrate that scale is not the sole determinant of market influence; rather, adaptability, stakeholder alignment, and transparent governance structures increasingly define leadership in metal ore mining.

This comprehensive research report delivers an in-depth overview of the principal market players in the Metal Ore Mining market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anglo American plc

- Barrick Gold Corporation

- BHP Group Limited

- Freeport-McMoRan Inc.

- Glencore plc

- Kinross Gold Corporation

- KIOCL Limited

- Newmont Corporation

- Nippon Steel Corporation

- POSCO International

- Public Joint Stock Company "MMC Norilsk Nickel"

- Rio Tinto Group

- Tata Steel Mining Limited

- Vale SA

- Zijin Mining Group Co., Ltd.

Formulating Actionable Recommendations for Industry Leaders to Drive Growth Optimize Operations and Enhance Sustainability in the Evolving Metal Ore Mining Sector

To navigate the evolving metal ore mining landscape, industry leaders must embrace a multifaceted strategy that aligns operational excellence with sustainability imperatives. First, integrating end-to-end digital platforms-from intelligent asset management to AI-driven exploration analytics-will unlock productivity gains and mitigate operational disruptions. Coupling these capabilities with rigorous emissions monitoring and renewable energy adoption will not only meet regulatory requirements but also differentiate brands in capital markets.

Second, fostering deeper collaboration across the value chain-through strategic off-take agreements, co-investment vehicles, and consortium-based R&D-will enhance supply security and accelerate technology deployment. These partnerships can be further strengthened by aligning incentives around circular economy initiatives, such as urban mining and recycling of spent materials. Third, companies should prioritize workforce reskilling programs to address the growing talent gap, ensuring that teams possess the digital fluency and sustainability expertise required for future operations.

Finally, proactive engagement with policymakers and community stakeholders will create a conducive environment for project approvals and maintain social license to operate. By strategically positioning themselves at the intersection of innovation, sustainability, and collaboration, industry leaders can secure resilient growth trajectories and deliver value across the entire metal ore mining ecosystem.

Outlining a Robust Research Methodology Integrating Primary Data Collection Secondary Research Expert Interviews and Advanced Analytical Frameworks

This research integrates a structured methodology designed to deliver robust and actionable insights. Primary data collection involved in-depth interviews with key industry executives, technical experts, and policy makers across major producing and consuming regions. These qualitative inputs were complemented by site visits and multimedia surveys to capture real-world operational nuances and technology adoption patterns.

Secondary research sources encompassed regulatory filings, corporate sustainability reports, trade journal articles, and public databases maintained by governmental and intergovernmental agencies. A rigorous data triangulation process reconciled disparate information streams, ensuring consistency and reliability. Quantitative analyses applied statistical modeling to historical production and trade data, enabling trend identification without relying on market size estimations.

Furthermore, scenario planning workshops engaged cross-functional stakeholders to validate assumptions and explore potential market disruptions. Advanced analytical frameworks, including value chain mapping and risk heat mapping, provided structural clarity on competitive positioning and emerging opportunities. Collectively, this multilayered approach assures that the findings and recommendations presented herein are grounded in empirical evidence and strategic foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Metal Ore Mining market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Metal Ore Mining Market, by Ore Type

- Metal Ore Mining Market, by Mining Method

- Metal Ore Mining Market, by Grade

- Metal Ore Mining Market, by End Use Industry

- Metal Ore Mining Market, by Distribution Channel

- Metal Ore Mining Market, by Region

- Metal Ore Mining Market, by Group

- Metal Ore Mining Market, by Country

- United States Metal Ore Mining Market

- China Metal Ore Mining Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding with Strategic Reflections on Metal Ore Mining Industry Resilience Innovation Imperatives and Collaborative Opportunities to Navigate Future Market Complexities

In sum, the metal ore mining industry stands resilient amid a confluence of transformative forces. Technological breakthroughs, sustainability mandates, and evolving trade dynamics continue to reshape competitive landscapes and strategic priorities. Companies that harness digital innovation, align with environmental objectives, and engage collaboratively across the value chain will be best positioned to navigate future uncertainties.

Looking ahead, the industry’s capacity to adapt to shifting regulations, tariff structures, and consumer expectations will determine its long-term trajectory. Embracing agility in operational execution and strategic planning will enable organizations to capitalize on emerging growth areas, from battery minerals to green steel feedstocks. Ultimately, success will hinge on a balanced approach that integrates rigorous risk management, stakeholder partnership, and a forward-looking sustainability vision. Armed with the insights and recommendations presented in this executive summary, decision makers can chart a clear course toward enduring competitive advantage and responsible resource stewardship.

Engage with Ketan Rohom to Access Tailored Metal Ore Mining Research Insights That Drive Strategic Decisions and Competitive Advantage

For organizations seeking to transform raw intelligence into strategic advantage, engaging directly with Ketan Rohom, Associate Director of Sales and Marketing, offers a personalized path to deeper market understanding and actionable insights. His expertise in aligning research outcomes with client objectives ensures that each question you have is addressed with precision and depth, whether you seek granular segmentation data, competitive benchmarking, or tailored strategic frameworks. By initiating a consultation, you unlock the opportunity to explore custom extensions of the report, delve into bespoke scenario analyses, and secure ongoing advisory support as market conditions evolve.

Take the next step in equipping your team with the definitive resource on metal ore mining dynamics. Contact Ketan Rohom to discuss your specific research needs, request an executive briefing sample, and arrange priority access to the full report. His role in bridging comprehensive data with strategic decision-making means you will move from insights to impact more swiftly. Elevate your investment confidence, optimize your sourcing strategies, and gain a competitive edge in the rapidly evolving metal ore mining sector.

- How big is the Metal Ore Mining Market?

- What is the Metal Ore Mining Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?