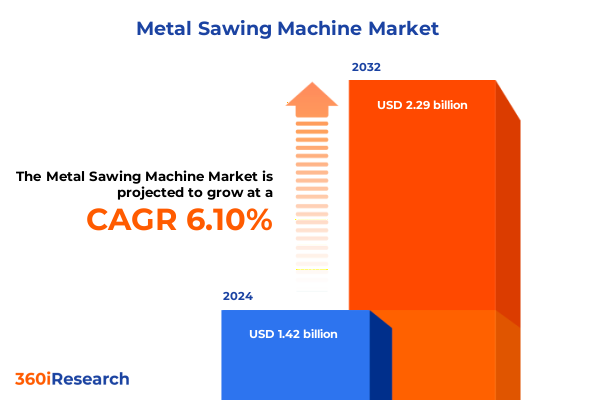

The Metal Sawing Machine Market size was estimated at USD 1.51 billion in 2025 and expected to reach USD 1.61 billion in 2026, at a CAGR of 6.09% to reach USD 2.29 billion by 2032.

Exploring the Dynamics of the Metal Sawing Machine Market Landscape and Unveiling Strategic Drivers, Innovations, and Growth Opportunities

The metal sawing machine industry stands at a pivotal juncture characterized by both sustained demand in established manufacturing hubs and emerging opportunities driven by technological advancements. As global economies pursue infrastructure upgrades and industrial modernization, precision cutting of ferrous and non-ferrous components has become indispensable to sectors ranging from automotive assembly lines to aerospace fabrication facilities. Against this backdrop, industry stakeholders are navigating a landscape where digital integration, additive manufacturing interfaces, and advanced materials processing are rapidly reshaping operational priorities and investment decisions.

In this context, understanding the interplay between evolving customer requirements for speed, accuracy, and energy efficiency is vital. Contemporary metal cutting applications increasingly demand machines capable of handling high-strength alloys, exotic material blends, and complex cross-sectional profiles, all while maintaining minimal downtime and optimized tool life. As such, the introduction of smarter control systems, predictive maintenance algorithms, and modular product architectures is unlocking new pathways for manufacturers and end users to drive cost reductions, throughput enhancements, and overall equipment effectiveness.

This executive summary provides a concise yet comprehensive foundation for decision-makers. It outlines key drivers and challenges, highlights the far-reaching consequences of recent trade policy shifts, and delivers actionable insights into market segmentation, regional performance, and leading vendor strategies. Whether you aim to expand your product portfolio, optimize your supply chain footprint, or explore novel growth segments, the analysis herein equips you with the strategic clarity required to thrive in a dynamic global arena.

Illuminating Transformative Technological, Material Processing, and Competitive Shifts Reshaping Metal Sawing Machine Operations Worldwide

Over the last few years, the metal sawing machine market has experienced transformative shifts, largely propelled by advances in automation and material sciences. Traditional band and circular saw configurations are being augmented with intelligent sensors and machine learning algorithms that enable real-time process optimization and adaptive cutting parameters. This evolution is converging with broader Industry 4.0 initiatives, wherein interconnected work cells and predictive analytics are redefining factory floor operations and maintenance cycles.

Meanwhile, material diversity has expanded considerably. From high-performance alloy steels to advanced aluminum-lithium composites, the range of feedstock types has broadened, imposing new demands on blade geometry, cutting speeds, and coolant delivery systems. As a result, manufacturers are reengineering saw heads, optimizing blade coatings, and refining thermal management approaches to mitigate tool wear and enhance surface finish quality.

These technological and material processing shifts have, in turn, realigned competitive structures. Specialized niche players focusing on additive integration or hybrid waterjet-sawing bundles are emerging alongside established heavy-equipment OEMs that are leveraging their scale to provide turnkey solutions. In parallel, the rise of aftermarket service providers offering blade refurbishment, on-site calibration, and remote diagnostics has created complementary value streams, reinforcing the collaborative ecosystem around metal sawing machine operations.

Assessing the Comprehensive Impact of 2025 United States Tariff Policies on Supply Chains, Pricing Structures, and Industry Dynamics in Metal Sawing Sector

In 2025, the United States implemented a series of tariff adjustments aimed at securing domestic supply chains and protecting key manufacturing sectors from volatile import dependencies. These measures have had a significant ripple effect on the metal sawing machine market, particularly for components and raw materials sourced from major Asian and European suppliers. As a direct consequence, procurement cycles have been recalibrated, with many OEMs reallocating sourcing toward regionalized partners to mitigate levies and logistical bottlenecks.

Pricing structures across saw blades, drives, and precision guide assemblies have witnessed expansion of cost inflation, prompting end users to explore total cost of ownership models instead of basing decisions solely on upfront capital expenditure. This has accelerated the adoption of service-based offerings and equipment-as-a-service contracts that bundle installation, maintenance, and blade replenishment under long-term agreements, enabling more predictable budgeting and risk sharing between suppliers and buyers.

Simultaneously, the tariff landscape has spurred renewed investments in domestic manufacturing capabilities. A growing cohort of tool fabricators and saw component specialists is pursuing expansions of local production lines to capitalize on government incentives and safeguard against future trade disruptions. Ultimately, the cumulative impact of these policy shifts underscores the urgency for both OEMs and end users to integrate more flexible sourcing strategies and to embrace strategic alliances that balance cost competitiveness with supply chain resilience.

Decoding Multifaceted Market Segmentation Insights to Unveil Critical Trends in Saw Type, Material, End User Industry, Operation Mode, Power Source, and Blade Technology

The metal sawing machine market exhibits a rich tapestry of segmentation that underscores diverse application requirements and investment rationales. When evaluated by saw type, the distinction between abrasive, band, and circular saws illuminates divergent use cases: portable and stationary abrasive systems cater to high-speed offhand cutting of circular and irregular workpieces, whereas band saws-both horizontal and vertical configurations with manual, semi-automatic, or fully automatic feed controls-address precise contour cutting in job shops and production lines. Circular saw variants such as chop, cold, and miter saws further refine end user selection, with cold sawing optimizing chip control for ferrous or non-ferrous metals, and miter cutting solutions available in automatic or manual formats for angled cross-section tasks.

Material type segmentation reveals another axis of differentiation, with aluminum (cast and wrought), copper, stainless steel, and steel alike placing unique demands on blade metallurgies, coolant regimens, and drive torques. Steel subdivisions into alloy and carbon variants necessitate bespoke saw configurations to manage heat-affected zones and burr formation, while copper’s thermal conductivity challenges cutting stability. End user industry segmentation brings into focus application-centric requirements: aerospace components mandate micron-level tolerances across aircraft and spacecraft structures, automotive sectors differentiate between commercial and passenger vehicle chassis cutting, construction and energy infrastructure emphasize heavy structural profiles, and general manufacturing spans component fabrication for machinery and tooling systems.

Operation mode segmentation offers another lens through which productivity and quality parameters can be tailored. Fully automatic systems equipped with CNC or PLC controls maximize throughput for high-volume environments, whereas semi-automatic options with hydraulic or mechanical actuation balance flexibility and capital commitment. Manual saws remain relevant in low-volume or field service contexts. Power source delineation-electric motors split between AC and DC drives, high-pressure or low-pressure hydraulic systems, and pneumatic alternatives-dictates energy efficiency, maintenance intensity, and noise levels, influencing facility design and operational budgets. Finally, machine configuration segments into portable formats, including cart-mounted or handheld tools, and stationary lines constructed for bench or floor mounting, each facilitating distinct mobility and footprint considerations. Blade material segmentation, spanning carbide tipped, solid carbide, diamond, and high-speed steel substrates, closes the loop by aligning cutting-edge tool technologies with end user performance expectations, whether in abrasive longevity, precision edge retention, or multi-material versatility.

This comprehensive research report categorizes the Metal Sawing Machine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Saw Type

- Material Type

- Operation Mode

- Power Source

- Machine Configuration

- Blade Material

- End User Industry

Unveiling Regional Performance Dynamics and Growth Opportunities across Americas, Europe Middle East Africa, and Asia Pacific Metal Sawing Machine Markets

Regional analysis paints a nuanced portrait of how metal sawing machine demand and innovation proliferate across the globe. In the Americas, reshoring efforts and domestic industrial incentives are driving capital investments in both traditional band saw lines and advanced cold sawing cells. Market players are increasingly partnering with local service providers to ensure fast response times, cultivate aftermarket growth, and address tightening lead times for critical spare parts.

Across Europe, the Middle East, and Africa, sustainability mandates and regulatory frameworks around energy efficiency are shaping product offerings. Manufacturers in Western Europe are integrating variable frequency drives and regenerative braking systems to achieve compliance with stringent carbon emission targets, while in the Middle East, large-scale oil and gas infrastructure projects are fueling demand for heavy-duty abrasive and circular saw solutions. In Africa, the expansion of mining and construction sectors underscores the need for mobile and stationary cutting units capable of operating in remote and rugged conditions.

Within the Asia-Pacific region, rapid industrialization in Southeast Asia and continued automotive assembly growth in countries like India and Japan have bolstered orders for semi-automatic band saws and high-precision miter saws. Leading OEMs are forging regional manufacturing hubs to reduce transportation costs and to leverage localized engineering expertise, stimulating competitive pricing and expedited product customization. Collectively, these regional dynamics reveal that strategic market positioning increasingly depends on a blend of technological adaptation, local partnerships, and regulatory alignment.

This comprehensive research report examines key regions that drive the evolution of the Metal Sawing Machine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Approaches and Innovation Portfolios of Leading Metal Sawing Machine Manufacturers Driving Competitive Advantage and Market Leadership

Leading manufacturers in the metal sawing machine sector are orchestrating multi-pronged strategies to fortify their competitive positions. Product innovation remains at the forefront, with several global OEMs unveiling modular line-down solutions that allow customers to incrementally upgrade automation features, blade handling systems, and waste management modules without decommissioning existing assets. This modularity not only extends installed base lifecycles but also creates recurring revenue through add-on upgrades.

In parallel, strategic alliances with software developers and IoT platform providers are deepening the integration of remote monitoring, predictive analytics, and digital twin simulations. By harnessing real-time performance data, these partnerships enable faster troubleshooting, optimize maintenance schedules, and drive continuous improvement through iterative feedback loops. This digital transformation imperative is reinforced by investments in cybersecurity protocols and edge computing architectures that ensure data integrity and latency-sensitive controls operate seamlessly within smart factories.

Furthermore, key players are expanding their aftermarket services footprint to capture more value throughout the equipment lifecycle. On-site blade refurbishment centers, rapid-response calibration teams, and subscription-based maintenance agreements are emerging as differentiators, particularly among customers seeking to offload technical burdens and to guarantee uptime. These service-centric business models are enhancing customer retention rates and unlocking ancillary revenue streams that complement new equipment sales.

This comprehensive research report delivers an in-depth overview of the principal market players in the Metal Sawing Machine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amada Machine Tools Co., Ltd.

- Baileigh Industrial, Inc.

- Behringer GmbH

- BOMAR spol. s r.o.

- DMG MORI Aktiengesellschaft

- DoALL Sawing Products

- Eisele GmbH & Co. KG

- HEM Saw Co., Ltd.

- HURCO Companies, Inc.

- Imet S.p.A.

- JET Tools

- KALTENBACH GmbH & Co. KG

- Kasto Maschinenbau GmbH & Co. KG

- KenCut Machine Tools

- L.S. Starrett Company

- Makita Corporation

- MEP S.p.A.

- Milacron LLC

- Scotchman Industries, Inc.

- Steelmax Tools

Delivering Actionable Strategic Recommendations for Industry Leaders to Navigate Market Disruption, Enhance Operational Efficiency, and Capture Emerging Growth Segments

Industry leaders should prioritize the development of adaptive control systems that employ machine learning algorithms to fine-tune cutting parameters in real time, thereby reducing scrap rates and maximizing throughput. Allocating research budgets toward hybrid cutting technologies that combine abrasive, coolant-enhanced blades with laser or waterjet assistance can further expand material compatibility and surface quality, offering an edge in high-precision sectors such as aerospace and medical device fabrication.

To mitigate tariff-induced cost volatility, executives are advised to reevaluate supply chain configurations by forging deep partnerships with regional component fabricators, investing in backward integration for critical parts, and diversifying procurement across low-risk geographies. Concurrently, establishing flexible service models-ranging from full equipment leasing to outcome-based performance contracts-will enable manufacturers and end users to share risk while sustaining cash flow predictability.

Finally, embracing sustainability as a core value proposition will resonate with both regulators and end users. Prioritizing energy-efficient drive technologies, implementing closed-loop coolant systems, and pursuing circular economy principles in blade recycling not only reduce environmental impact but also generate operational savings over the equipment lifecycle. By articulating a clear roadmap for decarbonization and resource recovery, organizations can differentiate their offerings and align with global initiatives for responsible manufacturing.

Outlining Rigorous Research Methodology Employing Primary and Secondary Data, Expert Validation, and Quantitative Qualitative Triangulation Techniques

This report synthesizes insights from a rigorous methodology that integrates both primary and secondary research approaches. Primary data was collected through in-depth interviews with over 40 industry experts, including OEM executives, plant managers, and application engineers, ensuring a balanced representation of strategic perspectives and operational realities. Additionally, on-site facility audits provided quantitative measurements of machine performance and downtime factors in diversified production environments.

Secondary research encompassed a comprehensive review of trade association publications, technical white papers, and regulatory filings to contextualize macroeconomic trends, tariff developments, and sustainability requirements. Public domain sourcing from global industrial standard bodies and academic journals informed the understanding of cutting tool metallurgy advancements and control system innovations. Data triangulation techniques were employed to cross-verify quantitative metrics, such as unit shipments and replacement blade volumes, against anecdotal evidence from supplier discussions and aftermarket service providers.

The analytical framework applied a combination of SWOT assessments, Porter’s five forces analysis, and value chain mapping to identify critical levers of competitive advantage and potential disruption vectors. All findings were validated through a review workshop with a panel of senior technical advisors to ensure accuracy, relevance, and actionable clarity for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Metal Sawing Machine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Metal Sawing Machine Market, by Saw Type

- Metal Sawing Machine Market, by Material Type

- Metal Sawing Machine Market, by Operation Mode

- Metal Sawing Machine Market, by Power Source

- Metal Sawing Machine Market, by Machine Configuration

- Metal Sawing Machine Market, by Blade Material

- Metal Sawing Machine Market, by End User Industry

- Metal Sawing Machine Market, by Region

- Metal Sawing Machine Market, by Group

- Metal Sawing Machine Market, by Country

- United States Metal Sawing Machine Market

- China Metal Sawing Machine Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 4134 ]

Concluding Insights on the Evolutionary Trends and Strategic Imperatives Shaping the Future of the Metal Sawing Machine Market Landscape

In summary, the metal sawing machine market is evolving under the influence of automation, material complexity, and trade policy shifts. Technological convergence around intelligent controls and predictive maintenance is redefining traditional product boundaries, while tariff-induced supply chain realignments are compelling stakeholders to pursue localized sourcing and service-based business models. Diverse segmentation dynamics highlight the importance of tailoring saw configurations, power sources, and blade technologies to specific application and industry requirements.

Regional insights reveal that no single market offers a one-size-fits-all solution; rather, success demands a nuanced understanding of local regulatory landscapes, infrastructure imperatives, and customer expectations. Leading companies are responding through modular product designs, digital ecosystem partnerships, and enhanced aftermarket capabilities, thereby strengthening their value propositions across multiple geographies.

As the industry navigates these transformative trends, companies that embrace strategic collaboration, innovation, and sustainability will be best positioned to capture emerging growth opportunities and secure a competitive edge in the rapidly changing metal sawing machine landscape.

Connect Directly with Ketan Rohom Associate Director Sales and Marketing to Secure Comprehensive Market Intelligence and Empower Strategic Decision Making

To explore the full depth of market trends, innovation trajectories, and competitive landscapes in the metal sawing machine industry, please connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings a wealth of industry expertise and can guide you through customized research deliverables tailored to your strategic objectives. Engaging directly will provide you with exclusive insights into advanced segmentation analyses, tariff impacts, and regional performance metrics, enabling your organization to make informed, data-driven decisions that accelerate growth and enhance operational efficiencies.

Reach out to Ketan today to arrange a personalized briefing, secure early access to proprietary data visualizations, and discuss how a comprehensive market intelligence partnership can drive your success in this rapidly evolving sector.

- How big is the Metal Sawing Machine Market?

- What is the Metal Sawing Machine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?