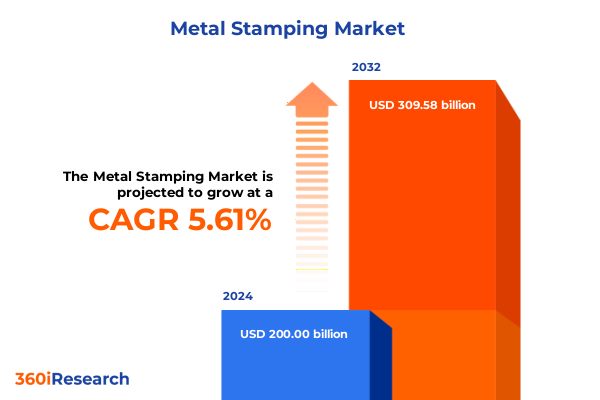

The Metal Stamping Market size was estimated at USD 210.37 billion in 2025 and expected to reach USD 221.28 billion in 2026, at a CAGR of 5.67% to reach USD 309.58 billion by 2032.

Unlocking the Foundations of Metal Stamping Manufacturing with a Comprehensive Introduction to Key Processes, Applications, and Industry Drivers

Metal stamping is a multifaceted manufacturing process that transforms flat metal sheets into intricate shapes and components through a sequence of precise operations such as punching, blanking, embossing, bending, flanging, and coining. Specialized dies and stamping presses exert high pressures that deform the metal into exact configurations, delivering consistency and repeatability essential for high-volume production. This methodology remains foundational in modern manufacturing, offering both speed and precision when creating parts for diverse industries.

Tracing its origins to early coinage struck by the Lydians in the seventh century B.C., metal stamping evolved significantly during the Industrial Revolution and further accelerated with the advent of the screw press in the 16th century. By the late 19th century, stamping displaced machining and forging in mass-produced bicycles, and Henry Ford’s Model T production later underscored its critical role in the automotive sector. Continuous innovation in press technology, die design, and automation has driven the industry forward, enabling deeper draws, rapid cycle times, and enhanced worker safety.

Today, metal stamping underpins component manufacturing across the automotive, aerospace, electronics, construction, medical, industrial machinery, and telecommunications sectors. Its versatility accommodates materials ranging from aluminum and steel to brass, copper, and even titanium, facilitating the production of structural panels, electronic connectors, engine mounts, medical device housings, and telecommunication brackets with unfailing reliability and tight tolerances.

As industry leaders demand lighter, stronger, and more complex parts to meet fuel-efficiency standards, miniaturization trends, and sustainability goals, metal stamping continues to adapt. Converging forces such as automotive electrification, aerospace expansion, and the rise of smart devices accelerate the adoption of advanced automation, digital engineering, and novel alloys, positioning metal stamping at the intersection of traditional manufacturing and Industry 4.0 innovation.

Navigating the Industry Transformation in Metal Stamping: Digitalization, Automation, Advanced Materials, and Supply Chain Innovations Driving Change

The metal stamping industry is undergoing a paradigm shift driven by the integration of artificial intelligence, robotics, and advanced automation. Automated stamping machines equipped with robotic presses and arms replace manual operations to dramatically boost cycle speeds, precision, and throughput while minimizing human intervention. Predictive maintenance platforms leverage real-time sensor data to identify potential equipment failures before they occur, safeguarding uptime and maximizing production efficiency. Simultaneously, computer vision systems inspect each stamped component for microscopic defects, ensuring superior quality control at scale. Collaborative robots, or cobots, now work side-by-side with human operators to execute repetitive or ergonomically challenging tasks, empowering the workforce to focus on higher-value engineering, programming, and oversight duties.

Beyond robotics, the dawn of digital twins and Industry 4.0 connectivity is transforming stamping operations into agile, data-driven enterprises. Virtual replicas of production lines allow engineers to simulate and refine stamping processes, optimizing die designs and material flows prior to physical trials. IoT-enabled devices network presses, feeders, and auxiliary systems to transmit performance metrics and environmental conditions to centralized analytics platforms. Real-time dashboards and advanced analytics enable continuous process tuning, adaptive scheduling, and rapid root-cause analysis, effectively reducing unplanned downtime and material waste. As the industry matures, self-optimizing control loops promise near-autonomous production with minimal human oversight.

Material innovation is another transformative driver. The pursuit of lighter, stronger components has accelerated the adoption of advanced high-strength steels, aluminum alloys, and even titanium in metal stamping. These high-performance materials deliver superior strength-to-weight ratios critical for electric vehicles and aerospace applications while maintaining formability under high-tonnage presses. Concurrently, copper and brass remain indispensable for electronics and telecommunications hardware due to their electrical conductivity and corrosion resistance. The development of novel alloy chemistries and coatings enhances tool life, reduces friction, and expands the design envelope for complex geometries.

Environmental and regulatory pressures are steering the industry toward more sustainable practices. Energy-efficient servo-drive presses have supplanted many hydraulic systems to cut power consumption by up to 50 percent, while closed-loop cooling and waste-oil filtration systems address environmental compliance. Circular economy principles encourage the use of recycled scrap and remanufactured tooling, reducing raw material consumption and waste. As manufacturers seek carbon-neutral operations, investments in renewable energy and life-cycle assessments become integral to long-term competitiveness.

Assessing the Cumulative Impact of the United States’ 2025 Tariff Landscape on Metal Stamping Manufacturers and Downstream Industries

In February 2025, the United States reinstated a uniform 25 percent Section 232 tariff on all steel imports and elevated aluminum duties from 10 percent to 25 percent in a bid to fortify domestic production of critical metals. The proclamation eliminated previous country exemptions, terminated general approved exclusions, and expanded coverage to include downstream products containing steel and aluminum inputs, assessed based on material content rather than total value.

Effective March 12, 2025, the administration broadened these tariffs to subsume derivative steel articles from major trading partners, including Canada, the European Union, Japan, and South Korea, after determining that existing alternative arrangements failed to safeguard national security interests. The move applied ad valorem duties to a wide array of steel and aluminum components, curtailing tariff loopholes and restricting transshipment practices.

Further escalation ensued in June 2025 when tariffs on steel and aluminum imports rose to 50 percent, with the higher rate effective June 4. Imports from the United Kingdom, however, remained subject to a 25 percent duty pending finalization of the U.S.–UK Economic Prosperity Deal. The adjustment underscored the administration’s strategic emphasis on energy-intensive industries and the protection of domestic metal manufacturing.

These tariff measures have intensified cost pressures on downstream manufacturers in automotive, construction, and industrial machinery sectors, where steel and aluminum constitute major input expenses. Equipment suppliers report rising input costs that risk passing through to end users, potentially dampening capital expenditure. Conversely, U.S. steel and aluminum producers have experienced increased order volumes and have ramped up capacity utilization. Nevertheless, concerns about inflationary impacts and retaliatory trade actions persist, adding complexity to global supply chain planning and procurement risk management.

Deep-Dive into Market Segmentation: Insights Across Material Types, Process Variations, Press Technologies, Thickness Ranges, and End-Use Verticals

The material composition of stamped components has evolved to meet stringent performance requirements. Steel remains the workhorse of heavy-duty applications, prized for its strength, durability, and cost-effectiveness in automotive body panels and industrial machinery. Aluminum has surged in popularity for its lightweight profile and corrosion resistance, finding extensive use in consumer electronics enclosures and transport-sector structural parts. Copper and brass continue to serve critical roles in electrical connectors and telecommunications hardware, while titanium stampings cater to aerospace applications demanding high strength at elevated temperatures.

Across process variations, blanking and punching lay the groundwork for producing initial shapes, removing material efficiently to yield precise outlines with minimal waste. Embossing imparts aesthetic and functional textures to component surfaces, while flanging and bending operations create intricate edges and structural ribbing. Coining delivers high-precision surface finishes suited to precision instruments, and multi-step compound dies integrate several of these processes to streamline operations and cut tooling changeover times.

Press technologies underpin the stamping workflow, each offering distinct capabilities. Mechanical presses excel at high-speed, high-volume production, delivering consistent force and rapid cycle times ideal for automotive and appliance parts. Hydraulic presses provide superior tonnage control and deep-draw performance for thicker sections, making them indispensable for industrial and construction components. Servo presses combine the best of both worlds, offering programmable ram motion profiles for delicate materials, tight tolerance work, and quick adaptation between stamping stages.

Material thickness is another critical consideration. Thicker gauges above 0.4 millimeters support heavy-load and structural parts in commercial vehicles and industrial machinery where strength and rigidity are paramount. Conversely, thinner sheets at or below 0.4 millimeters empower the fabrication of small-scale electronics components, medical device housings, and decorative trim requiring precision bends and minimal springback. These thickness thresholds guide equipment selection and process parameters to ensure optimal forming performance and final part quality.

End-use industry demands further define stamping requirements. Aerospace specifications drive the need for highly reliable parts stamped from exotic alloys for commercial and military aircraft. Automotive production lines stamp components for passenger vehicles and commercial fleets under rigorous cycle-time constraints. Construction projects require durable brackets and frames for both commercial buildings and residential housing. Consumer and industrial electronics favor miniature stamped connectors and shielding parts, while medical and telecommunications sectors demand stringent precision and traceability for implantable devices and network hardware.

This comprehensive research report categorizes the Metal Stamping market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Materials Used

- Process Type

- Press Type

- Material Thickness

- End-Use Industry

Uncovering Regional Dynamics in Metal Stamping: Comparative Insights from Americas, Europe Middle East & Africa, and Asia-Pacific Markets

The Americas region exhibits robust manufacturing clusters that span the automotive heartland of the United States, aerospace hubs in the southeastern corridor, and emerging nearshoring corridors in Mexico. Regional integration under USMCA and ongoing supply chain realignment drive demand for metal-stamped parts sourced domestically, even as tariff measures influence sourcing decisions for Canadian and European producers. Investments in advanced stamping lines and reshoring initiatives aim to reduce lead times and mitigate trade policy risks.

In Europe, Middle East & Africa, stamping operations leverage the region’s deep engineering expertise and proximity to major automotive, aerospace, and industrial equipment OEMs. German and Italian manufacturers maintain leadership in precision stamping technologies, supported by government incentives for Industry 4.0 adoption and sustainability projects. The Middle East’s infrastructure boom injects demand for construction-grade stampings, while North African free trade zones position the region as a gateway between Europe and sub-Saharan markets.

Asia-Pacific remains the largest stamping production base, anchored by China’s expansive capacity and competitive labor costs, India’s growing automotive footprint, and Japan’s focus on high-precision and servo-driven presses. OEMs in the region have increasingly invested in automation and digital twins to enhance productivity, with contract stamping facilities in Southeast Asia serving global supply chains. The region’s rapid adoption of electric vehicles and consumer electronics underscores an ongoing shift toward lightweight and miniaturized stampings.

This comprehensive research report examines key regions that drive the evolution of the Metal Stamping market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Competitive Landscape in Metal Stamping: Profiles of Leading Equipment Manufacturers, Automation Providers, and Contract Stamping Specialists

Leading equipment manufacturers shape industry innovation. AIDA Engineering remains at the forefront of servo press technology, advancing direct-drive systems that deliver rapid ram acceleration and high positional accuracy, enabling OEMs to meet tight tolerances on complex automotive panels and electronics enclosures. Their DSF series presses integrate strain monitoring feedback to reduce scrap by nearly 20 percent, reflecting a deep commitment to precision and operational efficiency.

Schuler Group, now operating as ANDRITZ Schuler, combines mechanical, hydraulic, and laser blanking solutions to offer integrated forming and handling platforms. Their TwinServo technology, developed in collaboration with Siemens, has demonstrated energy savings of over 35 percent in high-volume stamping lines, while digital twin integration facilitates predictive maintenance programs that slash unplanned downtime by more than 70 percent.

Komatsu Industries targets material flexibility and quick die change capabilities, with adaptive die cushion systems supporting advanced high-strength steel and aluminum alloy processing. Their Quick Die Change system leverages RFID tooling identification to achieve sub-four-minute changeovers, maintaining above 99 percent availability even in high-mix production environments. This versatility is crucial for Tier 1 automotive suppliers seeking just-in-time delivery and mixed-model assembly lines.

Critical robotics and automation integrators such as ABB and FANUC partner with press builders to deliver turnkey stamping cells. ABB’s IRB 7600FX robotic stamping line pairs with servo presses to automate material handling at speeds exceeding 12 strokes per minute, while FANUC modules synchronize press cycles with in-line inspection and part stacking. These collaborations underscore the shift toward fully automated, lights-out manufacturing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Metal Stamping market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAPICO Hitech Public Company Limited

- Acro Metal Stamping Company Inc.

- AK Stamping Company, Inc.

- Bishop Metal Stamping, Inc.

- Caparo

- CIE Automotive S.A.

- Clow Stamping Company

- Compass & Anvil Sales and Engineering Inc.

- Crosby Company

- D&H Industries, Inc. by Celestica Inc.

- ESI Engineering Specialties Inc.

- Gestamp Automoción, S.A.

- Shiloh Industries, Inc.

Actionable Recommendations for Metal Stamping Industry Leaders: Strategies to Enhance Competitiveness, Resilience, and Technological Advancement

Industry leaders must prioritize integrated digital strategies by adopting IoT platforms, digital twins, and AI-driven analytics to achieve real-time visibility into stamping operations. Investing in unified data architectures will enable rapid process adjustments, predictive maintenance, and continuous improvement initiatives that drive cost reductions and throughput gains.

Mitigating tariff impacts requires proactive engagement with exclusion processes and supply chain diversification. Manufacturers should evaluate alternate sourcing in tariff-free jurisdictions, adjust bill-of-material calculations to maximize in-house material content exemptions, and negotiate strategic partnerships to secure stable material supplies under evolving trade policies.

Technology roadmaps must include the gradual integration of servo-drive presses and advanced press monitoring systems to balance energy efficiency with production flexibility. Establishing collaborative R&D programs with press OEMs and automation partners will accelerate the adoption of lightweight alloys and novel forming techniques that can unlock design advantages for electric vehicles and aerospace components.

Finally, workforce transformation is essential. Upskilling and reskilling programs focused on automation engineering, data analytics, and robotics maintenance will empower employees to manage complex systems effectively. Partnering with vocational institutions and leveraging digital training simulators can bridge talent gaps and cultivate the next generation of stamping experts.

Transparent Research Methodology: Our Rigorous Primary and Secondary Research Approach to Deliver Reliable Metal Stamping Industry Insights

Our research methodology combines extensive primary and secondary research to ensure robust and reliable insights into the metal stamping industry. Secondary research included the review of industry publications, government trade data, company white papers, and regulatory filings to establish a comprehensive market foundation.

Primary data collection involved in-depth interviews with C-level executives, plant managers, design engineers, and procurement officers across leading stamping OEMs, contract manufacturers, and end-use industries. These discussions provided qualitative insights into strategic priorities, investment plans, and operational challenges.

Quantitative analysis employed a triangulation approach, leveraging bottom-up and top-down techniques to validate trends and segmentation. We cross-referenced shipment volumes, equipment orders, and capacity utilization metrics to confirm process adoption rates, material preferences, and regional demand patterns.

Finally, data validation workshops with industry experts and advisory panels refined our findings and ensured that our conclusions reflect the latest market dynamics and technological developments. This rigorous methodology underpins the accuracy and relevance of our metal stamping market research report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Metal Stamping market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Metal Stamping Market, by Materials Used

- Metal Stamping Market, by Process Type

- Metal Stamping Market, by Press Type

- Metal Stamping Market, by Material Thickness

- Metal Stamping Market, by End-Use Industry

- Metal Stamping Market, by Region

- Metal Stamping Market, by Group

- Metal Stamping Market, by Country

- United States Metal Stamping Market

- China Metal Stamping Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Conclusion: Synthesizing Metal Stamping Trends, Challenges, and Opportunities to Inform Strategic Decision Making in a Rapidly Evolving Industry

The metal stamping industry stands at a crossroads of tradition and innovation, propelled by transformative technologies, shifting trade policies, and evolving end-use demands. As the sector embraces AI, automation, and digital engineering, the ability to execute rapid die changeovers, optimize material usage, and implement predictive maintenance will distinguish market leaders from followers.

Tariff measures in 2025 have highlighted the importance of supply chain resilience and strategic sourcing, while advanced materials and sustainability mandates continue to reshape process design and equipment selection. Regions that successfully integrate digital capabilities, streamline regulatory compliance, and foster workforce adaptability will capture emerging opportunities in automotive electrification, aerospace modernization, and consumer electronics miniaturization.

Ultimately, alignment of technology strategy with end-use requirements and geopolitical considerations will define the competitive landscape for years to come. Organizations that invest in data-driven decision making, adaptive manufacturing systems, and collaborative ecosystems will be best positioned to thrive in this dynamic and demanding market.

Take the Next Step with Ketan Rohom to Secure Your Comprehensive Metal Stamping Market Research Report Today and Gain Strategic Competitive Advantage

Ready for a deeper dive into the metal stamping market landscape and to equip your organization with the insights necessary to navigate competitive pressures, regulatory shifts, and technological transformation? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of our comprehensive metal stamping market research report. Partner directly with Ketan to discuss tailored solutions that address your specific organizational challenges and strategic goals. A robust understanding of market segmentation, regional dynamics, competitive benchmarks, and actionable recommendations lies at your fingertips-take advantage of this opportunity to empower decision-makers with data-driven guidance and unparalleled industry intelligence.

- How big is the Metal Stamping Market?

- What is the Metal Stamping Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?