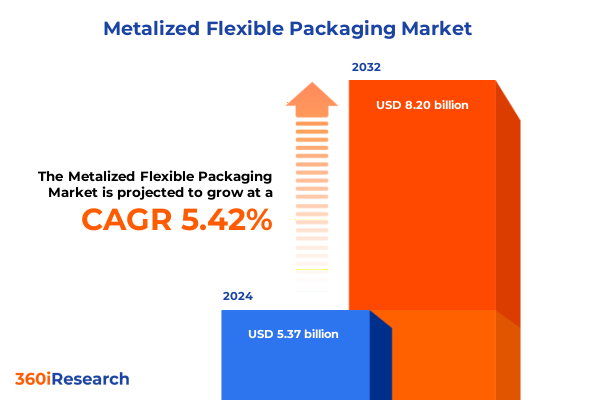

The Metalized Flexible Packaging Market size was estimated at USD 5.65 billion in 2025 and expected to reach USD 5.94 billion in 2026, at a CAGR of 5.47% to reach USD 8.20 billion by 2032.

Revolutionizing Packaging with Metalized Flexible Films: Balancing Barrier Performance, Sustainability, and Consumer Appeal

Metalized flexible packaging has emerged as a cornerstone of modern packaging solutions by offering exceptional barrier protection, lightweight durability, and enhanced aesthetic appeal. Across consumer goods, pharmaceuticals, and food and beverage channels, the integration of thin metallic films onto polymer substrates has redefined standards for freshness preservation and shelf-life extension. As global supply chains adapt to shifting consumer behaviors and heightened regulatory scrutiny, stakeholders are placing renewed emphasis on materials that balance performance with sustainability commitments, making metalized films a focal point of innovation.

Through technological refinements in adhesion layers and vacuum deposition techniques, manufacturers have refined the interface between metal and polymer to improve seal integrity and puncture resistance. Concurrently, advancements in printing and decorating capabilities have elevated brand differentiation by delivering high-resolution graphics directly onto the metalized surface. This convergence of functional enhancement and visual appeal underscores the transformative potential of metalized flexible packaging as it continues to reshape market expectations and retailer specifications across diverse end-use sectors.

Emerging Drivers Transforming the Metalized Flexible Packaging Landscape with Cutting-Edge Technology, Sustainability Push and Regulatory Evolution

The landscape of metalized flexible packaging is undergoing transformative shifts driven by converging trends in consumer demand, regulatory frameworks, and technological breakthroughs. In response to the proliferation of e-commerce and a surge in single-serve formats, supply chain agility has become paramount, prompting converters to adopt rollstock formats and sachet constructions that enable rapid line changeovers and reduced waste. Parallel to this, the circular economy imperative is influencing substrate selection and metallization processes, with emphasis on recyclable polymers and solvent-free metallization to mitigate environmental impact.

Digital printing has risen from niche application to mainstream adoption, offering converters the flexibility to execute short-run, customized packaging runs without sacrificing barrier performance. This shift is further bolstered by innovations in print-through metallized films that harmonize graphic fidelity with oxygen and moisture resistance. At the same time, regulatory scrutiny around microplastics and packaging recyclability is accelerating the development of alternative chemistries and mono-material constructions, thereby charting a new course toward resource efficiency and compliance with evolving environmental standards.

Assessing the Ripple Effects of 2025 United States Tariffs on Metalized Flexible Packaging Supply Chains, Pricing Dynamics and Market Stability

The imposition of new United States tariffs in early 2025 has reverberated across the metalized flexible packaging supply chain, reshaping procurement strategies and cost structures for both converters and end users. As import duties on select metallized films and raw materials increased, packaging converters have been compelled to diversify their supplier base, exploring regional sourcing options to alleviate tariff-related margin pressure. This reorientation has, in turn, influenced lead times, freight negotiations, and inventory planning as companies seek to strike a balance between cost containment and uninterrupted production.

Amid these adjustments, some manufacturers have leveraged tariff relief programs and bonded warehouse arrangements to mitigate the immediate fiscal impact, while others have accelerated investments in domestic metallization capacity to localize production. The cumulative effect has been a dip in import dependency, a gradual uptick in near-shoring initiatives, and a recalibration of pricing strategies for end-use industries, particularly in food and pharmaceutical sectors where supply chain security is non-negotiable.

Decoding the Metalized Flexible Packaging Market Through Film Type, Metallization Method, Printing Technology, Thickness Range, End-Use Demands and Application Formats

A nuanced understanding of market segmentation reveals distinct performance attributes and value propositions associated with each product category, starting with film type. Biaxially oriented polypropylene (BOPP) continues to lead in applications requiring clarity and printability, whereas polyamide (PA) offers superior puncture resistance important for heavy-duty pouches. Polyester (PET) films provide a balance of mechanical strength and barrier properties suited for high-temperature retort processes, and polyethylene (PE) excels in cost-sensitive rollstock configurations requiring weld integrity.

Metallization method further delineates product performance, as aluminum foil lamination delivers unmatched barrier properties but can pose challenges for recyclability, while vacuum metallization offers a thinner, more uniform metal layer that enhances print-through clarity. In printing technology, digital printing has catalyzed customization and inventory optimization, although flexographic and rotogravure processes maintain economies of scale for high-volume runs and premium graphic requirements. Thickness variations influence both material handling and barrier attributes, with films under 30 microns catering to lightweight, flexible pouches and films above 60 microns providing reinforced protection for aerosol and retort applications.

End use industry dynamics underscore divergent priorities: food and beverage manufacturers are intensifying focus on moisture and oxygen barriers to extend freshness, personal care and cosmetics brands demand high-definition metallic finishes for luxury appeal, and pharmaceutical converters require stringent compliance with regulatory standards for tamper-evidence and sterility. Application formats such as lidding films, stand-up pouches, rollstock, sachets, and stick packs each demand tailored lamination architectures and sealant layers, reflecting evolving consumer preferences and on-shelf merchandising strategies.

This comprehensive research report categorizes the Metalized Flexible Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Film Type

- Metallization Method

- Printing Technology

- Thickness

- End Use Industry

- Application

Unveiling Regional Growth Patterns in Metalized Flexible Packaging Across the Americas, Europe Middle East and Africa and the Asia-Pacific

Regional dynamics within metalized flexible packaging underscore the Americas’ leadership in e-commerce adoption and high-performance barrier solutions, where food safety regulations and consumer convenience drive the uptake of zip-lock pouches and resealable stand-up formats. Shoppers in North America demonstrate a heightened willingness to pay premium for sustainably sourced films, prompting converters to introduce recyclable BOPP metallized structures and solvent-free coatings that align with producer responsibility mandates.

In Europe, Middle East and Africa, regulatory frameworks such as the European Union’s Packaging and Packaging Waste Regulation are catalyzing material innovation, while the Middle East’s growing retail infrastructure and Africa’s expanding packaged goods sector present high-growth opportunities for cost-effective, mono-material metallized films. Asia-Pacific markets, led by China and India, remain focused on scalability and cost competitiveness, driving investments in large-scale vacuum metallization lines and upstream polymer extrusion capabilities to serve both domestic and export demand. Across these regions, the common thread is an acceleration toward sustainable solutions, whether through increased material recovery targets or through the adoption of bio-based polymer blends compatible with metal deposition.

This comprehensive research report examines key regions that drive the evolution of the Metalized Flexible Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Movements and Competitive Strategies of Leading Players Shaping the Metalized Flexible Packaging Landscape

Leading players in the metalized flexible packaging arena are deploying a mix of strategic partnerships, capacity expansions, and sustainability initiatives to fortify their market positions. Some innovators are forging alliances with resin producers to co-develop high-barrier, recyclable films, while others are retrofitting existing metallization lines with energy-efficient vacuum systems to reduce carbon footprint and operating costs. Strategic acquisitions of regional converters have enabled global packaging conglomerates to broaden their end-use coverage and accelerate supply chain localization.

Furthermore, cross-industry collaborations between packaging suppliers and consumer goods companies are yielding co-innovations in smart packaging, integrating metalized layers with functional inks and sensors for tracking freshness and authenticity. As competition intensifies, companies that align technical expertise in multilayer laminates with robust customer support and design services are distinguishing themselves and setting new benchmarks for value creation in the metalized flexible film segment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Metalized Flexible Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M company

- Aluflexpack AG

- Amcor PLC

- Avery Dennison Corporation

- Bondline Electronics Ltd.

- Caltex Plastics Inc.

- Covestro AG

- Dunmore Corporation

- ESTER INDUSTRIES LIMITED

- Huhtamäki Oyj

- Hulamin Limited

- Jindal Poly Films Ltd.

- Kendall Packaging Corporation

- Nissha Metallizing Solutions

- Norsk Hydro ASA

- Ouma Industrial Limited

- Pactiv Evergreen Inc.

- Polinas Plastik Sanayii Ve Ticaret A.S.

- Polyplex Corporation Limited

- Shako Flexipack Private Limited

- Smurfit Kappa Group

- Sonoco Products Company

- Taghleef Industries SpA

- Toray Industries, Inc.

- Transcontinental Inc.

- Uflex Limited

- United Company RUSAL PLC by Glencore

- Wicklow, Inc.

- Wyda Packaging (Pty) Ltd.

Strategic Roadmap for Industry Leaders to Capitalize on Innovation Trends and Strengthen Their Position in Metalized Flexible Packaging

Industry leaders must adopt a proactive stance on sustainability by championing recyclable metallized film architectures and participating in industry consortia that establish clear collection and recovery pathways. By integrating advanced digital printing capabilities, converters can offer differentiated packaging experiences while reducing inventory carrying costs through shorter run lengths and on-demand production. To further mitigate tariff exposure, companies should evaluate near-shore manufacturing partnerships and explore bonded facility strategies that preserve cost competitiveness.

Additionally, unlocking the full potential of digital transformation will hinge on investing in data analytics and supply chain visibility platforms. Real-time intelligence on raw material availability and freight conditions can drive agile decision-making and minimize disruption. Finally, forging collaborative research alliances with polymer scientists and metallization equipment suppliers can accelerate the development of next-generation barrier films that meet stringent environmental and performance targets, thereby future-proofing product portfolios in an evolving regulatory landscape.

Comprehensive Methodological Framework Combining Primary Intelligence and Secondary Data Analysis for Packaging Market Insights

This research integrates primary insights gleaned from in-depth interviews with senior executives across packaging converters, raw material suppliers, and brand owners, supplemented by quantitative data gathered through targeted surveys. Secondary data sources include peer-reviewed journals, industry association reports, and regulatory databases to ensure comprehensive coverage of technological, environmental, and policy dimensions. The methodological framework applies a rigorous triangulation approach, cross-verifying qualitative narratives with documented market developments and patent filings.

Market segmentation analysis is underpinned by a detailed examination of product applications, material properties, and end-use requirements, while regional dynamics are assessed through macroeconomic indicators, trade flows, and regulatory benchmarks. Strategic company profiling leverages financial disclosures, press releases, and proprietary deal databases to map competitive positioning and recent strategic initiatives. This multi-pronged methodology ensures that findings are not only robust but also actionable for decision-makers seeking to navigate the complex metalized flexible packaging landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Metalized Flexible Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Metalized Flexible Packaging Market, by Film Type

- Metalized Flexible Packaging Market, by Metallization Method

- Metalized Flexible Packaging Market, by Printing Technology

- Metalized Flexible Packaging Market, by Thickness

- Metalized Flexible Packaging Market, by End Use Industry

- Metalized Flexible Packaging Market, by Application

- Metalized Flexible Packaging Market, by Region

- Metalized Flexible Packaging Market, by Group

- Metalized Flexible Packaging Market, by Country

- United States Metalized Flexible Packaging Market

- China Metalized Flexible Packaging Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings on Metalized Flexible Packaging Trends, Challenges and Growth Pathways for Informed Decision-Making

In synthesizing the key developments, it is clear that metalized flexible packaging stands at the intersection of performance demands and environmental imperatives. Technological advancements in metallization methods and printing technologies are enabling unprecedented design and functional capabilities. At the same time, tariff policies and sustainability regulations are redefining supply chain strategies and material innovations. By understanding the nuanced interplay between segmentation dynamics, regional variances, and competitive maneuvers, stakeholders are equipped to make informed strategic choices.

With consumer expectations evolving rapidly and regulatory landscapes tightening, companies must remain agile, continuously evaluating new materials and process technologies. Ultimately, the confluence of operational excellence, technological innovation, and sustainability leadership will determine the market winners in the metalized flexible packaging domain.

Connect with Ketan Rohom to Unlock Exclusive Metalized Flexible Packaging Insights and Drive Strategic Growth Opportunities

Elevate your strategic initiatives in the metalized flexible packaging domain by securing direct access to proprietary insights and actionable intelligence. Engage with Ketan Rohom, Associate Director of Sales & Marketing, to discover how this comprehensive market research report can empower your organization to anticipate emerging trends, optimize supply chain resilience, and identify high-potential growth avenues. Schedule a consultation today to unlock tailored guidance, real-world case studies, and expert projections that will inform your next phase of innovation and expansion without delay

- How big is the Metalized Flexible Packaging Market?

- What is the Metalized Flexible Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?