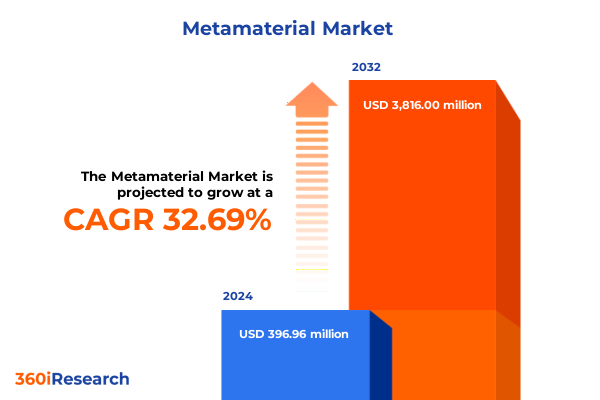

The Metamaterial Market size was estimated at USD 396.96 million in 2024 and expected to reach USD 518.71 million in 2025, at a CAGR of 32.69% to reach USD 3,816.00 million by 2032.

Unveiling the Metamaterials Revolution: Exploring Core Innovations, Applications, and Market Drivers Shaping the Future of Advanced Functional Materials

Metamaterials represent a groundbreaking class of engineered structures whose extraordinary properties arise from their meticulously designed internal architecture rather than their chemical composition. By manipulating electromagnetic waves, mechanical vibrations, and acoustic patterns in unconventional ways, metamaterials have unlocked new frontiers in imaging, communications, vibration control, and beyond. This introduction provides a concise yet comprehensive overview of how metamaterials have evolved from academic curiosities to high-impact technologies, driven by surging demand for miniaturized antennas, precision medical diagnostics, adaptive vibration damping systems, and next-generation cloaking devices.

At the heart of this transformation lies an interdisciplinary fusion of physics, materials science, and advanced manufacturing. Recent breakthroughs in 3D micro- and nano-fabrication techniques have enabled the scalable production of complex unit cells, paving the way for commercial prototypes. Simultaneously, sophisticated simulation tools and artificial intelligence-driven design platforms are accelerating the discovery of novel metamaterial configurations with tailored spectral responses. Together, these innovations are catalyzing a paradigm shift in product development cycles, enabling companies to rapidly iterate from concept to marketable solutions.

Looking ahead, metamaterials are poised to redefine the boundaries of what is possible across multiple industries. From ultra-thin antennas that enhance wireless connectivity in autonomous vehicles to acoustic barriers that mitigate seismic risk for critical infrastructure, the potential applications are both broad and profound. This section sets the stage for an in-depth exploration of key drivers, emerging use cases, and strategic considerations that will influence the trajectory of metamaterials adoption over the next decade.

Mapping the Transformative Shifts in Metamaterials Technologies and Industry Dynamics Redefining Innovation Trajectories Across Multiple Application Domains Worldwide

Over the past several years, metamaterials research has matured from proof-of-concept experiments into a landscape defined by disruptive breakthroughs and intensified commercialization efforts. Traditionally confined to laboratory demonstrations of negative refraction and cloaking phenomena, the field has diversified into tunable metasurfaces, active devices, and hybrid platforms that marry metamaterial functionality with electronics and photonics. As a result, stakeholders across defense, healthcare, telecommunications, and energy are forging strategic partnerships to translate these innovations into deployable systems.

One of the most transformative shifts involves the integration of machine learning algorithms into metamaterial design workflows. Generative adversarial networks and topology optimization techniques are now routinely employed to identify optimal geometries that satisfy complex performance targets, dramatically reducing development timelines. Meanwhile, advancements in additive manufacturing have expanded the range of printable materials-spanning polymers, ceramics, and metals-allowing designers to fabricate intricate three-dimensional architectures with submicron precision. This confluence of AI-driven design and high-resolution manufacturing is unlocking multi-functional metamaterials capable of adaptive responses to environmental stimuli.

Furthermore, the emergence of scalable roll-to-roll manufacturing processes is accelerating the production of flexible metasurfaces for wearable applications and conformal antennas. These methods leverage continuous deposition techniques on polymer substrates to achieve centimeter-scale patterning speed, bridging the gap between prototype yield and industrial throughput. Concurrently, investments in high-volume pilot lines are enabling the validation of repeatability, quality control, and cost metrics essential for mass market adoption. Taken together, these developments underscore a seismic realignment in the metamaterials ecosystem-from niche academic projects to an increasingly robust industry with growing relevance across end-user segments.

Assessing the Cumulative Effects of 2025 United States Tariff Policies on Metamaterials Supply Chains, Cost Structures, and Competitive Positioning in Key Industries

In early 2025, the United States implemented a series of tariffs targeting key raw materials and specialized components integral to metamaterials manufacturing. These measures, enacted in response to evolving trade tensions and supply-chain vulnerabilities, have reverberated across the global value chain. Import duties on high-purity dielectric substrates, rare-earth elements, and precision photoresist chemicals have elevated production costs for domestic manufacturers and imposed new compliance requirements on multinationals with U.S. operations.

The tariffs have incentivized greater vertical integration, prompting leading suppliers to develop in-house capabilities for precursor synthesis and substrate fabrication. This strategic shift has mitigated exposure to import fluctuations but has also driven incremental capital expenditure on specialized equipment. Simultaneously, some companies have redirected sourcing to allied markets offering more favorable trade terms, thereby diversifying supplier portfolios. While these adjustments have alleviated immediate cost pressures, they have introduced operational complexity and lengthened lead times for critical components.

On the demand side, end users in aerospace and defense are re-evaluating procurement strategies to balance cost, reliability, and geopolitical risk. Government agencies have initiated targeted funding programs to support domestic production of advanced functional materials, further influencing investment patterns. As a result, market participants are accelerating R&D collaborations with national laboratories and consortia to develop next-generation metamaterials that can be manufactured within U.S. borders. Although these efforts have helped to offset some tariff-induced hurdles, stakeholders continue to monitor policy changes closely as part of long-term strategic planning.

Decoding Market Segmentation Patterns in Metamaterials: Insights by Material Types, Integration Modes, Application Areas, End Users, and Distribution Channels

A nuanced understanding of market segmentation is critical for identifying high-growth opportunities and tailoring value propositions. When analyzed by material classification, the landscape encompasses acoustic metamaterials optimized for vibration damping and seismic protection, electromagnetic metamaterials featuring subcategories such as bi-isotropic and chiral structures as well as double negative, double positive, electronic bandgap, frequency-selective surface-based and single negative designs, and photonic metamaterials engineered to manipulate light at the nanoscale. Each type brings distinct performance advantages and manufacturing complexities, influencing commercialization timelines and target applications.

Segmentation by integration modality highlights the contrast between active devices, which incorporate external stimuli such as voltage or magnetic fields to achieve tunability, and passive platforms designed for fixed operational bandwidths with inherently lower power requirements. Active metamaterials are gaining traction in reconfigurable antennas and adaptive optics, whereas passive variants remain dominant in structural vibration control and fixed-frequency filtering solutions.

Examining applications reveals a broad spectrum that spans antennas and wireless communication systems seeking enhanced beam steering capabilities; cloaking devices aimed at reducing radar cross sections; medical imaging and diagnostic tools leveraging superlens effects for subwavelength resolution; seismic protection structures designed to redirect ground vibrations; solar absorbers improving photovoltaic efficiency; superlenses for high-fidelity optical microscopy; vibration damping modules for industrial machinery; and wireless power transmission networks enabling contactless energy transfer. These diverse use cases underscore the versatility of metamaterials across technology domains.

End-user analysis shows aerospace and defense organizations prioritizing stealth and communications enhancements, automotive manufacturers exploring metamaterial-based sensors for autonomous driving, construction and architecture firms evaluating seismic isolation solutions for critical infrastructure, consumer electronics companies integrating miniaturized metasurfaces into next-generation wearables, energy and power producers investigating solar absorber coatings, healthcare and medical device developers adopting superlens-enabled diagnostic platforms, and telecommunications providers deploying metamaterial-enhanced antennas to support 5G and emerging 6G networks.

Finally, distribution channels are bifurcated into offline sales-dominated by direct partnerships and specialized systems integrators with custom procurement requirements-and online platforms that facilitate standard component acquisition and small-batch orders. This dual-channel model enables both large-scale deployments and rapid prototyping by research institutions and startups.

This comprehensive research report categorizes the Metamaterial market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Integration Type

- Frequency Band

- Application

- End-User

- Distribution Channel

Unveiling Regional Dynamics Shaping Metamaterials Adoption Across Americas, Europe Middle East Africa, and Asia-Pacific Innovation Ecosystems

Regional dynamics play a pivotal role in shaping the trajectory of metamaterials adoption, driven by varying regulatory environments, R&D ecosystems, and industry incentives. In the Americas, robust defense and aerospace budgets coupled with proactive government initiatives have established the United States as a leading hub for metamaterials research and early commercial deployments. Collaborative frameworks between federal laboratories, academic institutions, and private enterprises have accelerated the maturation of laboratory prototypes into field-ready assets, particularly in radar stealth and adaptive antenna subsystems.

Across Europe, Middle East, and Africa, the market is characterized by a blend of mature research clusters and emerging innovation centers. European nations have leveraged long-standing expertise in precision manufacturing and photonics to explore metamaterials for high-resolution imaging and energy harvesting applications. Regional consortia are fostering standardization efforts, ensuring interoperability and easing regulatory pathways. In the Middle East, sovereign investment funds are underwriting ambitious smart city and infrastructure projects that integrate seismic isolation and energy-efficient façade systems based on acoustic and photonic metamaterials. Africa’s market remains nascent but is witnessing growing interest from mining and renewable energy sectors seeking advanced vibration control and solar concentration solutions.

In the Asia-Pacific region, expansive consumer electronics supply chains and aggressive national R&D programs have driven rapid prototyping and pre-commercial trials. Countries such as China, South Korea, and Japan are investing heavily in semiconductor-compatible metamaterials, targeting applications in on-chip photonics and next-generation display technologies. Simultaneously, Australia and Singapore are cultivating centers of excellence focused on metamaterial-enabled acoustic systems for underwater communications and seismic risk mitigation. Overall, the Asia-Pacific landscape is marked by significant public and private funding streams, facilitating scale-up from bench-scale research to pilot-scale manufacturing deployments.

This comprehensive research report examines key regions that drive the evolution of the Metamaterial market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators in Metamaterials: Strategic Moves, Product Portfolios, Collaborations, and Competitive Differentiators Driving Technological Leadership

Major players in the metamaterials sector are differentiating through targeted investments in proprietary design platforms, strategic partnerships, and vertical integration. Established industry leaders have expanded their portfolios by acquiring specialized startups focused on tunable metasurfaces and additive manufacturing capabilities. These acquisitions have furnished them with advanced simulation tools and scalable production techniques, enabling rapid commercialization of new product lines.

In parallel, dedicated metamaterials firms are forging alliances with academic research centers to co-develop application-specific prototypes. By leveraging lab-scale expertise in bi-isotropic and chiral electromagnetic structures, these collaborations have yielded high-performance antennas and sensors for defense and telecommunications customers. Moreover, joint ventures with semiconductor manufacturers are driving the integration of metamaterial layers into standard fabrication processes, paving the way for seamless co-production with electronic components.

Innovative consortiums comprising government agencies, private firms, and universities are also emerging as critical enablers of market growth. These collaborative structures facilitate shared testing facilities, standardization of measurement protocols, and collective navigation of regulatory landscapes. Through coordinated roadmaps, participating organizations are aligning on performance metrics for superlens devices, cloaking systems, and vibration damping modules, accelerating time-to-market for next-generation metamaterial solutions.

Finally, technology incumbents outside the traditional metamaterials space-spanning semiconductor foundries, optical equipment manufacturers, and industrial machinery OEMs-are embarking on pilot projects to validate the incorporation of metamaterial components within existing product lines. These cross-industry experiments signify a broader recognition of metamaterials as a strategic lever for unlocking new functionality and performance enhancements across mature technology domains.

This comprehensive research report delivers an in-depth overview of the principal market players in the Metamaterial market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acoustic Meta Materials

- Acoustic Metamaterials Group Limited

- Applied Metamaterials

- BAE Systems PLC

- Echodyne Corp.

- Fractal Antenna Systems, Inc.

- Kymeta Corporation

- Lockheed Martin Corporation

- Lumotive

- Metaboards

- MetaShield LLC

- MetaSonixx

- MetaWaves Group

- Mitsubishi Electric Research Laboratories

- Multiscale Systems, Inc.

- Multiwave Technologies AG

- Murata Manufacturing Co., Ltd.

- Nanohmics Inc.

- Nanoscribe GmbH & Co. KG

- Phoebus Optoelectronics LLC

- Phononic Vibes S.R.L.

- Pivotal Commware

- Pixie Dust Technologies Inc.

- SRI International Inc.

- TeraView Limited

- The Boeing Company

- Zhuhai Guangyu Technology Co., Ltd.

Actionable Strategic Recommendations to Catalyze Growth, Enhance R&D Collaboration, Optimize Supply Chains, and Accelerate Commercialization of Metamaterials

To maintain a competitive advantage in the rapidly evolving metamaterials space, executives should prioritize the expansion of AI-driven design capabilities through strategic partnerships with software pioneers and academic labs. Investing in machine learning toolchains that can optimize unit-cell geometries for multi-objective performance criteria will be critical for accelerating innovation cycles and reducing experimentation costs.

Simultaneously, organizations must reconfigure supply-chain architectures to mitigate the impact of trade policy volatility. Establishing dual-sourcing agreements for essential substrates and precursor chemicals, as well as forging joint manufacturing ventures in allied geographies, can shore up production resilience while preserving cost efficiencies.

Collaboration models that bring together industry consortia, government research programs, and end-user communities should be leveraged to co-develop standardized performance benchmarks and validation protocols. Such shared frameworks will not only reduce technical barriers to entry but also expedite regulatory approvals for metamaterial-based systems in sectors like healthcare diagnostics and seismic protection.

Furthermore, executives should explore emerging end-use applications by allocating dedicated innovation budgets to cross-functional teams. Embedding metamaterial expertise within product development cycles for consumer electronics, automotive sensors, and renewable energy modules can uncover high-value use cases and foster early adopter commitments.

Lastly, cultivating strong relationships with regulatory bodies and standards organizations will be essential for shaping policy environments that support safe deployment of advanced functional materials. Active engagement in standards development can ensure that new regulations account for the unique properties and performance characteristics of metamaterials.

Describing Rigorous Research Methodology Employed for Comprehensive Data Collection, Analysis Techniques, and Validation Processes in Metamaterials Market Study

This report synthesizes insights derived from a rigorous dual-phase research methodology combining primary interviews, secondary data mining, and multi-point validation. In the primary phase, industry executives, academic researchers, and end-user representatives participated in structured interviews and workshops to surface qualitative trends, strategic priorities, and anticipated adoption barriers. These interactions yielded foundational perspectives on manufacturing maturity, application-specific performance requirements, and competitive dynamics.

In parallel, an exhaustive review of technical publications, patent filings, regulatory filings, and trade associations provided quantitative context on technology readiness levels, IP landscapes, regional R&D investments, and import-export flows. Data from public sources was calibrated using proprietary databases that track corporate financials, partnership announcements, and manufacturing capacity expansions.

To ensure analytical rigor, data triangulation techniques were applied at each stage, cross-referencing stakeholder inputs with external market intelligence and historical precedent. Key variables such as material throughput rates, simulation accuracy, and pilot production yields were benchmarked against industry performance standards. Any discrepancies were reconciled through follow-up consultations and sensitivity analyses, ensuring that the final insights reflect a consensus view grounded in empirical evidence.

Finally, the report’s findings were subjected to a multi-tiered review process involving subject-matter experts in materials science, mechanical engineering, and telecommunications. This vetting process confirmed the validity of technological assessments and reinforced the credibility of strategic recommendations. By adhering to this comprehensive research framework, the report delivers a robust, evidence-based foundation for informed decision-making in the metamaterials arena.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Metamaterial market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Metamaterial Market, by Type

- Metamaterial Market, by Integration Type

- Metamaterial Market, by Frequency Band

- Metamaterial Market, by Application

- Metamaterial Market, by End-User

- Metamaterial Market, by Distribution Channel

- Metamaterial Market, by Region

- Metamaterial Market, by Group

- Metamaterial Market, by Country

- United States Metamaterial Market

- China Metamaterial Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Concluding Perspectives on Metamaterials Trajectories, Emerging Challenges, and Strategic Imperatives for Sustaining Innovation Momentum in Advanced Functional Materials

As metamaterials continue to transition from academic curiosities into commercial realities, the industry stands at a pivotal juncture. The convergence of AI-enabled design, advanced manufacturing, and evolving policy landscapes represents both unprecedented opportunities and complex challenges. Stakeholders who can navigate regulatory shifts, secure resilient supply chains, and forge collaborative ecosystems will be best positioned to capture emerging value.

Key imperatives include sustaining investment in multi-disciplinary R&D to push the boundaries of tunability and scalability, while simultaneously building shared testing standards that reduce adoption friction across end-user industries. The alignment of public-private partnerships will remain critical for de-risking early-stage applications and demonstrating proof of concept in high-stakes environments such as defense, infrastructure protection, and medical diagnostics.

Looking forward, the ability to integrate metamaterials seamlessly into existing product architectures-ranging from semiconductor wafers to structural damping systems-will define competitive differentiation. Organizations that prioritize modular design frameworks, open innovation networks, and proactive regulatory engagement are likely to emerge as market leaders. In this dynamic context, real-time intelligence and agile strategy execution will be essential for sustaining innovation momentum and capturing the full breadth of metamaterials’ transformative potential.

Seize Advanced Metamaterials Market Insights – Engage with Ketan Rohom Associate Director Sales & Marketing to Acquire Your Comprehensive Industry Report

To delve deeper into the intricacies of the metamaterials landscape and harness actionable intelligence for strategic decision-making, connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the full market research report. This comprehensive resource offers a nuanced exploration of technological advances, competitive dynamics, regulatory impacts, and emerging opportunities essential for maintaining a competitive edge in an evolving industry. Engage with Ketan’s team today to discuss tailor-made research add-ons, bespoke insights, and priority access to upcoming updates that will keep your organization at the forefront of metamaterials innovation.

- How big is the Metamaterial Market?

- What is the Metamaterial Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?