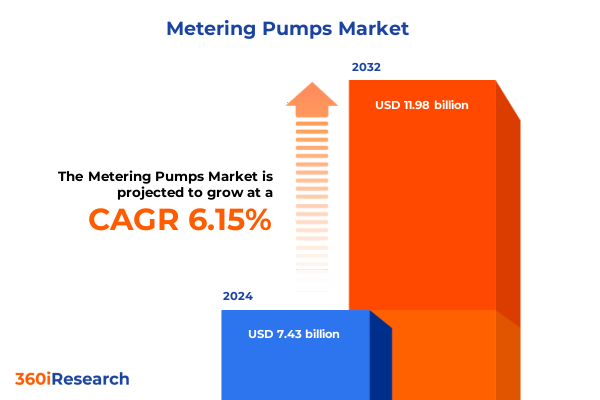

The Metering Pumps Market size was estimated at USD 7.88 billion in 2025 and expected to reach USD 8.36 billion in 2026, at a CAGR of 6.16% to reach USD 11.98 billion by 2032.

Understanding the Critical Role of Metering Pumps in Modern Industry Landscapes and Emerging Application Demands Across Diverse Sectors

Metering pumps have become indispensable across a spectrum of industrial environments, underpinning critical processes that demand precise fluid control and unwavering reliability. These devices are engineered to administer exact volumes of liquids or chemicals, enabling manufacturers to adhere to stringent quality and safety standards. From dosing corrosion inhibitors in oil and gas pipelines to delivering high-purity reagents in pharmaceutical production, the functionality of metering pumps directly influences operational integrity and end-product consistency.

Over the past decade, regulatory requirements and technological breakthroughs have collectively expanded the scope of metering pump applications. Stringent environmental guidelines now mandate exact chemical dosing to minimize waste and prevent ecological harm, while the pharmaceutical and biotechnology sectors rely on these pumps to achieve precise reagent delivery for complex syntheses and analytical testing. Concurrently, the oil and gas industry has intensified its focus on corrosion management, further elevating the importance of metering pumps in downstream operations.

Looking ahead, the introduction of novel materials and advanced control systems is set to redefine standards for pump performance and durability. As industries pursue greater automation, seamless integration with digital monitoring platforms will become a prerequisite for maintaining competitive advantage. In this context, understanding the evolving demands placed on metering pumps is essential for decision-makers seeking to optimize process efficiency, reduce total cost of ownership, and comply with ever-tightening regulatory frameworks.

Revelations of Transformative Shifts Reshaping Metering Pump Technologies and Market Dynamics in Response to Sustainability and Digitalization Drivers

The metering pump sector is undergoing a profound transformation driven by the convergence of digitalization, sustainability imperatives, and evolving end-user expectations. Embedded sensor technologies and the proliferation of the Industrial Internet of Things (IIoT) are enabling real-time performance monitoring, predictive maintenance algorithms, and remote diagnostics. As a result, pump manufacturers are transitioning from purely mechanical offerings to integrated systems that deliver actionable insights on flow rates, pressure fluctuations, and component wear.

Simultaneously, an increasing emphasis on resource efficiency has accelerated material innovations within pump design. High-performance polymers and composite coatings are supplanting traditional metal alloys to provide superior corrosion resistance and extended service life, particularly in aggressive chemical environments. This shift not only reduces maintenance cycles but also aligns with circular economy principles by lowering the frequency of part replacements.

Moreover, the drive toward net-zero energy consumption has spurred the development of energy-optimized drive mechanisms, such as variable-frequency motor control and low-friction hydraulic components. These technologies not only curtail operational expenditure but also support corporate sustainability targets by lessening electricity usage in continuous process applications. In parallel, additive manufacturing techniques are being harnessed to produce intricate pump components, expediting prototyping and enabling bespoke solutions for niche applications.

Collectively, these transformative shifts are redefining market expectations, compelling manufacturers to adopt agile production models, foster cross-industry collaborations, and prioritize software-driven value propositions over traditional hardware-centric offerings.

Unpacking the Cumulative Impact of United States Tariffs in 2025 on Metering Pump Supply Chains and Cost Structures and Competitive Positioning

In 2025, the United States implemented a new tranche of tariffs targeting key components and raw materials integral to metering pump manufacturing. These measures have introduced an incremental levy on imports of specialized alloys, polymers, and electronic control modules, creating significant headwinds for supply chain cost structures. Producers that had previously relied on competitively priced overseas suppliers are now facing elevated procurement expenses, which are being amplified by currency fluctuations and global shipping bottlenecks.

The cumulative effect of these tariffs has manifested in longer lead times and increased logistical complexity. Manufacturers have had to navigate a fragmented sourcing landscape, often splitting orders across multiple vendors to mitigate duty exposure. This approach has introduced variability in material specifications and extended cycle times for component qualification, placing additional strain on product launch timelines.

In response, industry players are accelerating nearshoring initiatives and forging strategic partnerships with domestic suppliers to reduce tariff liabilities. While this realignment supports broader supply chain resilience objectives, it has also necessitated capital investments in local production facilities and process re-engineering. Small and mid-sized enterprises, in particular, have experienced margin compression as they absorb a greater share of these transitional costs.

Looking forward, the restructured supply network is expected to yield long-term benefits in terms of responsiveness and quality assurance. However, companies must continue to refine their pricing strategies, optimize inventory buffers, and leverage value engineering practices to preserve competitive positioning amid evolving trade policies.

Illuminating Key Segmentation Insights Revealing How Product Type Drive Mechanism Material Type End-Use and Sales Channel Shape Metering Pump Demand Trends

A nuanced appraisal of market segmentation underscores divergent growth trajectories and value propositions across distinct product and drive mechanism categories. Diaphragm pumps, renowned for leak-free operation and compatibility with volatile chemicals, are gaining traction in the chemical and petrochemical industries, whereas peristaltic pumps, with their minimal contamination risk and gentle flow control, are increasingly adopted in pharmaceutical and biotechnology processes. In contrast, piston and plunger pumps continue to serve high-pressure applications such as oil and gas extraction, where robust performance under extreme conditions is non-negotiable.

Drive mechanism preferences further delineate market behavior. Motor-driven units maintain broad appeal due to their ease of integration and scalable power delivery, while pneumatic-driven pumps are favored in hazardous or explosion-prone environments, balancing intrinsic safety with reliable actuation. Solenoid-driven models, although less prevalent, are carving out a niche in microdosing scenarios where precise, intermittent flow pulses are required.

Material selection plays a pivotal role in application suitability, with composite materials and specialized coatings offering an optimal balance of chemical resistance and weight reduction. Metallic pumps, particularly those featuring aluminum for lightweight portability or stainless steel for corrosion resilience, remain the backbone of industrial installations. Meanwhile, non-metallic variants constructed from polypropylene or polytetrafluoroethylene are displacing metals in highly corrosive wastewater treatment and chemical dosing operations, driven by their superior inertness and ease of maintenance.

Across end-use sectors, the aerospace industry demands uncompromising precision and certification compliance, agriculture and fertilizers benefit from high-volume fertilizer injection systems, and the chemical and petrochemical segments leverage advanced metering pumps for catalyst injection. Meanwhile, end-users in food and beverage prioritize sanitary designs, oil and gas processing entities emphasize material traceability, and pharmaceutical and biotechnology companies seek low-pulsation, sterilizable solutions. Water and wastewater treatment operations rely on durable, maintenance-friendly pumps, whereas automotive manufacturers integrate metering pumps for fluid management in engine cooling and emission control.

The distribution landscape is evolving alongside these product and application trends. While traditional offline sales channels retain their importance-particularly for complex system integrations and aftermarket service contracts-the rapid expansion of digital commerce platforms is enabling smaller enterprises to procure standardized pump packages more efficiently, shortening lead times and enhancing price transparency.

This comprehensive research report categorizes the Metering Pumps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Drive Mechanism

- Material Type

- End-Use

- Sales Channel

Highlighting Regional Dynamics and Growth Drivers Across Americas Europe Middle East Africa and Asia-Pacific in the Global Metering Pump Market

Regional dynamics reveal a tapestry of growth drivers and operational challenges that require customized strategic approaches. In the Americas, the United States remains the principal market, buoyed by robust spending on energy infrastructure rehabilitation, stringent environmental compliance mandates, and a trend toward decentralized water treatment facilities. Latin American markets, while smaller in absolute terms, are exhibiting pockets of rapid expansion driven by agricultural modernization and investments in mining operations requiring precise chemical dosing.

Over in Europe, Middle East, and Africa, regulatory ecosystems are tightening, especially around chemical handling and water reuse standards. Europe’s drive toward circular economy objectives has elevated demand for closed‐loop chemical injection systems and corrosion monitoring pumps. Middle Eastern oil and gas sovereign wealth funds are channeling capital into next-generation metering solutions to optimize refining processes, while African utilities are exploring scalable, low‐maintenance metering pumps to address urban water scarcity issues.

Asia-Pacific stands out as the fastest-growing region, underpinned by extensive manufacturing capacity in China, India, and Southeast Asia. Government-led infrastructure initiatives, such as water sanitation projects in India and coastal resilience programs in Southeast Asia, underscore the critical role of metering pumps in achieving public health and environmental targets. Additionally, the proliferation of high-growth industries-automotive manufacturing hubs in Thailand and electronics fabrication in Taiwan-creates ongoing demand for precision fluid delivery systems.

Despite disparate regional drivers, common themes emerge: supply chain localization to mitigate geopolitical risk, digital integration to optimize performance, and sustainability considerations to align with global decarbonization goals. These shared imperatives underscore the importance of a cohesive, region-sensitive go-to-market strategy.

This comprehensive research report examines key regions that drive the evolution of the Metering Pumps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Insights on Strategic Initiatives Innovations and Collaborations Driving the Metering Pump Industry Forward Globally

The competitive landscape is characterized by a blend of long-established industrial pump manufacturers and innovative niche players. Leading incumbents have fortified their positions through strategic acquisitions that broaden product portfolios and deepen regional footprints. In parallel, specialized firms are differentiating through bespoke solutions that address the unique requirements of high-growth verticals such as pharmaceutical manufacturing and water treatment.

Key industry players are prioritizing digital service offerings, bundling advanced analytics and remote monitoring capabilities with hardware sales. These initiatives not only generate recurring revenue streams but also foster deeper customer engagement by delivering continuous performance insights. Moreover, several organizations are investing heavily in research partnerships with academic institutions to pioneer novel materials and additive manufacturing techniques, accelerating time-to-market for next-generation pump designs.

Collaborative alliances with control system integrators and engineering procurement contractors are likewise gaining prominence, enabling pump manufacturers to embed their products within comprehensive automation frameworks. Such collaborations are critical for penetrating large-scale infrastructure projects and capital-intensive process plants.

At the same time, agile start-ups are capitalizing on the demand for compact, energy-efficient pump solutions by leveraging lean development cycles and digital-first marketing channels. Their ability to iterate rapidly and customize designs for emerging applications positions them as formidable competitors in segments where speed and flexibility outweigh the advantages of established scale.

This comprehensive research report delivers an in-depth overview of the principal market players in the Metering Pumps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aalborg Instruments & Controls, Inc.

- Adhesive Systems Technology Corporation

- Anko Products, Inc.

- AquFlow

- Ark Electric & Mechanical Co., Ltd.

- Blue-White Industries, Ltd.

- CETONI GmbH

- Depam (Hangzhou) Pump Technology Co., Ltd.

- Dover Corporation

- Enelsa Industrial Electronics

- Etatron D. S.

- Flowinn (Shanghai) Industrial Co., Ltd.

- Graco, Inc.

- Grundfos Holding A/S

- IDEX Corporation

- Ingersoll Rand, Inc.

- Initiative Engineering

- Iwaki America Inc.

- LEWA GmbH by Atlas Copco AB

- LIGAO PUMP TECHNOLOGY

- Mahr Metering Systems Corp.

- ProMinent GmbH

- Randolph Austin Company

- Seko S.p.A.

- Shree Rajeshwari Engineering Works Pvt. Ltd.

- Sidewinder Pumps, Inc.

- SPX Flow, Inc.

- Swelore Engineering Pvt. Ltd.

- Tapflo AB

- Verder Liquids BV

- Verito Engineering Private Limited

- Wanner Engineering Inc.

- Watson-Marlow Fluid Technology Group by Spirax-Sarco Engineering PLC

- Zhejiang Ailipu Technology Co., Ltd.

- Zhejiang Yonjou Technology Co., Ltd.

Delivering Actionable Recommendations for Industry Leaders to Enhance Operational Efficiency Innovation and Market Expansion in Metering Pump Sector

Industry leaders must prioritize the integration of digital capabilities to future-proof their operations and foster customer loyalty. Implementing robust IoT architectures and analytics platforms will enable real‐time monitoring of pump health, facilitating predictive maintenance strategies that reduce downtime and lower service costs. In parallel, investing in modular product architectures can accelerate customization and streamline production workflows.

Sustainability should be elevated from a compliance mandate to a strategic differentiator. Companies can gain a competitive edge by developing pumps with enhanced energy efficiency, recyclable materials, and minimal leak potential. Transparent lifecycle assessments and eco‐labeling initiatives will resonate with environmentally conscious end users and support broader corporate responsibility goals.

Supply chain diversification remains essential in the wake of evolving trade policies. Cultivating partnerships with regional suppliers, maintaining strategic buffer inventories, and exploring contract manufacturing arrangements can mitigate tariff exposure and ensure uninterrupted component availability. Additionally, deploying value engineering practices to optimize design for cost and performance will help preserve margin integrity.

Finally, forging cross‐industry collaborations with technology providers, academic researchers, and key end-user accounts will unlock new application territories. Joint development programs focused on emerging sectors-such as green hydrogen production or advanced semiconductor fabrication-can generate high-value opportunities and reinforce the strategic relevance of metering pump solutions.

Detailing Rigorous Research Methodology Combining Primary Interviews Secondary Data and Analytical Frameworks for Unbiased Industry Insights

The foundation of this analysis is a hybrid research framework that combines extensive secondary research with targeted primary interviews. Initial data gathering encompassed a review of industry publications, regulatory filings, patent databases, and financial reports to map the competitive landscape and identify prevailing trends. This was complemented by an in-depth examination of case studies and white papers highlighting emerging technologies and best practices.

For primary research, structured interviews were conducted with over thirty senior executives, including design engineers, procurement directors, and maintenance specialists from leading end-use industries. These interviews provided granular insights into operational challenges, technology adoption drivers, and long-term investment priorities. Survey instruments were also deployed to capture quantitative inputs on purchasing criteria, service preferences, and capital expenditure cycles.

Data triangulation techniques were applied to validate findings, ensuring that qualitative observations aligned with quantitative data points. Competitive benchmarking was performed to assess product performance metrics, pricing strategies, and after-sales service models. Geographic market assessments leveraged trade data, regional policy analyses, and industry association reports to contextualize growth trajectories.

This rigorous methodology ensures that the conclusions and recommendations presented herein are grounded in empirical evidence, delivering an unbiased and comprehensive view of the metering pump sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Metering Pumps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Metering Pumps Market, by Product Type

- Metering Pumps Market, by Drive Mechanism

- Metering Pumps Market, by Material Type

- Metering Pumps Market, by End-Use

- Metering Pumps Market, by Sales Channel

- Metering Pumps Market, by Region

- Metering Pumps Market, by Group

- Metering Pumps Market, by Country

- United States Metering Pumps Market

- China Metering Pumps Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Critical Findings to Provide a Cohesive Conclusion on the Current Challenges Opportunities and Future Trajectories in Metering Pumps

The examination of metering pump dynamics reveals a landscape marked by technological innovation, evolving regulatory environments, and shifting supply chain paradigms. Precision fluid control remains the sector’s cornerstone, driving demand for products that blend mechanical robustness with digital intelligence. Concurrently, trade policy developments in 2025 have underscored the importance of supply chain resilience, prompting companies to reconsider sourcing strategies and invest in localized manufacturing capabilities.

Segmentation analysis highlights the distinct value propositions of diaphragm, peristaltic, and piston/plunger pumps, while drive mechanism preferences and material choices further fine-tune application suitability. Regional insights emphasize the heterogeneous growth drivers across the Americas, Europe Middle East & Africa, and Asia-Pacific, illustrating the need for adaptive go-to-market approaches.

Leading companies are responding through strategic M&A, digital service platforms, and collaborative innovation networks, setting new benchmarks for customer engagement and operational efficiency. The actionable recommendations outlined-centered on digital integration, sustainable design, supply chain diversification, and cross-industry partnerships-provide a clear roadmap for organizations seeking to capitalize on emerging opportunities and navigate market complexities.

By synthesizing these findings, this report delivers a holistic perspective on the current state and future trajectories of the metering pump industry, equipping stakeholders with the insights necessary to make informed strategic decisions.

Engage with Ketan Rohom to Secure Comprehensive Market Research Report and Drive Strategic Growth in Your Metering Pump Business Today

To explore the full depth of this analysis and unlock actionable insights tailored to your strategic priorities, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Leverage his expertise to understand how these findings apply to your operations, and receive customized guidance on deploying solutions that drive efficiency and competitive advantage in the metering pump arena. Engage with Ketan to secure your comprehensive market research report, equip your leadership team with the knowledge to navigate uncertainty, and position your organization for sustainable growth in this dynamic sector.

- How big is the Metering Pumps Market?

- What is the Metering Pumps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?