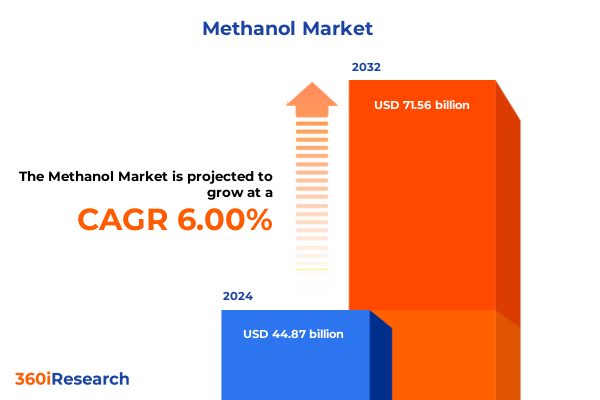

The Methanol Market size was estimated at USD 47.44 billion in 2025 and expected to reach USD 50.20 billion in 2026, at a CAGR of 6.04% to reach USD 71.56 billion by 2032.

Framing the strategic context for methanol stakeholders with concise orientation to technological evolution, regulatory pressure, and shifting end-use demand dynamics

The methanol value chain is undergoing a pivotal moment driven by converging energy, environmental, and industrial dynamics. Historically a commodity feedstock for chemical synthesis and fuel applications, methanol is increasingly viewed through the lens of decarbonization and circularity, prompting innovators and incumbents alike to reassess feedstock strategies, production technologies, and downstream offtake. Investors are tracking shifts in feedstock availability and carbon management options, while producers contend with evolving regulatory regimes and customer preferences that favor lower carbon intensity products.

Transitioning from conventional fossil-derived routes to renewable and waste-based pathways introduces complexity and opportunity. Advances in biomass conversion, bio-methanol integration, and scalable electrification of synthesis processes are expanding the feasible supply landscape. Simultaneously, demand-side developments such as the marine bunker fuel transition, increased uptake as a hydrogen carrier, and incorporation into advanced materials are reshaping commercial priorities. These dynamics require a clear strategic framing: companies must balance near-term operational realities with medium- and long-term objectives for carbon intensity reduction and product differentiation.

In this context, the industry’s imperative is to align asset deployment, feedstock contracting, and customer engagement to capture value amid policy shifts and competition for low-carbon credentials. Leaders who combine technical agility with disciplined commercial planning will be best positioned to translate the sector’s technical potential into resilient growth trajectories.

How feedstock diversification, stricter carbon regulation, and shifting industrial and maritime demand are jointly reshaping production models and commercial partnerships

The landscape for methanol production and use is being transformed by several interlocking forces that collectively reconfigure supply chains and commercial models. First, feedstock diversification is accelerating as operators pursue biomass-derived routes and electrified synthesis to reduce carbon intensity. This shift changes upstream procurement profiles and creates new interfaces with agricultural and forestry value chains, increasing the importance of logistics and feedstock quality management.

Second, policy and regulatory frameworks are raising the bar for lifecycle emissions transparency, driving interest in blue and green methanol classifications. Compliance mechanisms and voluntary corporate procurement commitments are incentivizing producers to invest in carbon capture, utilization, and storage, as well as in renewable hydrogen and biogenic feedstock integration. This, in turn, affects capital allocation and project economics, as firms weigh retrofit options against greenfield investments.

Third, demand-side transformations are materializing across transport and industrial sectors. Marine shipping’s decarbonization pathways are elevating methanol as a viable bunker alternative, while chemical manufacturers are signaling preferences for low-carbon intermediates. Coupled with technological progress in biomass gasification and bio-methanol production, these trends are catalyzing strategic partnerships between feedstock suppliers, technology licensors, and offtakers. Taken together, these shifts imply a market environment where agility, verification of carbon intensity, and vertically coordinated supply arrangements will be decisive competitive differentiators.

Assessing the aggregate effects of 2025 United States tariff actions on sourcing patterns, regional investment decisions, and supply chain resilience strategies

The introduction of United States tariff measures in 2025 introduced a material policy variable that has reverberated through import strategies, pricing dynamics, and trade flows. Tariff adjustments have prompted importers and multinational producers to reassess sourcing footprints and to accelerate localization of certain production elements. In practice, the tariff environment increased the relative competitiveness of domestically-sourced feedstock and incentivized supply chain reconfiguration to mitigate exposure to additional trade costs.

Consequently, some international suppliers pursued strategic responses such as establishing regional processing hubs, negotiating long-term offtake contracts with tariff-protected pricing clauses, and investing in downstream value capture to preserve margins. Domestic producers faced a dual challenge of managing feedstock procurement costs while scaling capacity to meet redirected demand. Meanwhile, buyers with global procurement mandates adapted by diversifying supplier panels and enhancing contractual flexibility, including destination-based pricing and pass-through mechanisms for duty-related expenses.

Importantly, tariffs also influenced investment timing for projects that depend on imported catalysts, compressors, or electrochemical equipment by increasing the total landed cost of capital goods. This led to more rigorous cost-benefit evaluations and, in some cases, staged procurement strategies that balance near-term operational needs against longer-term decarbonization goals. Overall, the tariff landscape emphasized the need for strategic supply chain design that accounts for trade policy volatility, enabling firms to preserve competitiveness while pursuing low-carbon pathways.

Deep segmentation insight across feedstock choices, production routes, purity grades, carbon-intensity classes, application end-uses, industry buyers, and distribution channels

A nuanced segmentation view reveals where strategic focus should be applied across feedstock, production technique, product specification, carbon intensity, application, end-use, and distribution pathways. Based on feedstock source, industry participants must differentiate strategies for biomass, coal, and natural gas, recognizing that biomass pathways require robust links to agricultural residue and wood waste supply chains to secure consistent feedstock quality and sustainability credentials. This has implications for procurement, logistics, and stakeholder verification frameworks.

Based on production method, operators should evaluate the trade-offs between bio-methanol, conventional methanol, and biomass gasification pathways, as each route presents distinct capital profiles, integration opportunities with carbon management systems, and regulatory alignment for low-carbon product labeling. Based on purity level, producers and buyers need to align quality assurance processes to the requirements of fuel grade, industrial grade, and pharmaceutical grade products, recognizing that higher-purity streams command more stringent process controls and certification regimes.

Based on carbon intensity, portfolio differentiation across gray methanol, blue methanol, and green methanol will be a central commercial lever; commitments to capture emissions or integrate renewable hydrogen fundamentally alter production economics and market positioning. Based on application, suppliers should segment efforts across biodiesel synthesis, chemical production, fuel additive, marine fuel, and solvents while also recognizing the downstream specificity within chemical production that includes acetic acid production, formaldehyde production, and MTBE production. Finally, based on end-user industry and distribution channel considerations, companies must align offerings to the needs of automotive, construction, electronics, energy and power generation, paints and coatings, pharmaceuticals, and plastics and polymers sectors while planning both offline and online sales strategies and optimizing between direct sales and distributor networks.

This comprehensive research report categorizes the Methanol market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Feedstock Source

- Production Method

- Purity Level

- Carbon Intensity

- Application

- End-User Industry

- Distribution Channel

Regional strategic imperatives shaped by divergent policy frameworks, infrastructure endowments, and application demand across the Americas, Europe Middle East & Africa, and Asia-Pacific

Regional dynamics will continue to determine strategic priorities for capacity deployment, commercial partnerships, and regulatory engagement. In the Americas, policy initiatives and industrial decarbonization programs are driving investments in low-carbon production and in applications such as marine fuel and chemical feedstocks, creating opportunities for integrated projects that combine renewable hydrogen and biomass feedstocks. North American energy infrastructure and capital markets also support project financing models that favor modular and scalable deployments.

In Europe, the Middle East & Africa, regulatory stringency on lifecycle emissions and strong maritime decarbonization commitments are accelerating demand for verified low-carbon methanol. Industrial clusters with deep chemical value chains provide natural offtake corridors for green and blue methanol, while energy-rich Middle Eastern producers are exploring conversion pathways that leverage both natural gas resources and renewable hydrogen to produce lower-carbon methanol variants.

In Asia-Pacific, demand fundamentals are shaped by large chemical manufacturing bases, extensive marine shipping fleets, and significant coal-to-methanol legacy capacity. Rapid urbanization and industrial expansion make the region a central battleground for technology deployment and feedstock transition. Across all regions, cross-border trade patterns, logistics constraints, and regulatory harmonization around carbon accounting will be decisive in shaping which geographies become supply or demand hubs for low-carbon methanol solutions.

This comprehensive research report examines key regions that drive the evolution of the Methanol market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How competitive advantage is shifting toward vertically integrated players, technology partners, and offtakers that deliver verified low-carbon methanol solutions

Competitive dynamics are being redefined by technology licensors, feedstock integrators, engineering firms, and downstream offtakers that are investing in low-carbon pathways and verification mechanisms. Leading firms are deploying a mix of retrofit and greenfield projects, pursuing partnerships with hydrogen producers, and establishing offtake agreements tied to carbon intensity metrics. These initiatives reflect an industry-wide shift from purely volume-driven competition to differentiated offerings based on sustainability attributes and supply chain transparency.

Strategic alliances and vertical integration are emerging as practical responses to feedstock availability constraints and capital intensity of new production routes. Companies that control feedstock aggregation, logistics, and pre-treatment gain negotiating leverage and the ability to guarantee sustainability credentials. At the same time, technology providers that can demonstrate scalable, reliable methanol synthesis with lower lifecycle emissions are securing advantage through licensing and consortium arrangements.

From a commercial standpoint, suppliers that invest in certification schemes and lifecycle analysis capabilities are better positioned to serve buyers seeking low-carbon inputs. In parallel, service providers offering finance, risk management, and advisory support play a growing role in de-risking projects and accelerating deployment. Overall, competitive success will favor organizations that combine technical execution with commercial frameworks that internalize carbon performance and partner ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Methanol market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atlantic Methanol Production Company, LLC

- BASF SE

- BP PLC

- Brunei Methanol Company Sdn Bhd

- Celanese Corporation

- Coogee Chemicals Pty Ltd

- Eastman Chemical Company

- Enerkem Inc.

- Eni S.p.A.

- Fanavaran Petrochemical Company

- Gujarat State Fertilizers & Chemicals Limited (GSFC)

- INEOS AG

- LyondellBasell Industries N.V.

- Merck KGaA

- Methanex Corporation

- Mitsubishi Gas Chemical Company, Inc.

- Mitsui & Co., Ltd

- Natgasoline LLC

- OCI Global

- Oman Methanol Company

- Petroliam Nasional Berhad

- Proman AG

- PT. Kaltim Methanol Industri

- Qatar Fuel Additives Company Limited

- Saudi Arabia's Basic Industries Corporation

- Sinopec

- SIPCHEM

- Topsoe A/S

- Yankuang Group

- Zagros Petrochemical Company

Practical strategic moves for industry executives to secure feedstock versatility, production flexibility, verified low-carbon credentials, and resilient distribution networks

Industry leaders should adopt a set of pragmatic, actionable measures to capture upside from evolving demand and to mitigate policy and supply-side risks. First, prioritize feedstock diversification strategies that secure access to agricultural residue and wood waste while maintaining optionality to deploy natural gas or coal-derived inputs during transitional phases. Such diversification reduces exposure to single-source supply shocks and supports staged decarbonization pathways.

Second, accelerate investments in production flexibility by retrofitting existing assets where feasible and planning new capacity that can utilize renewable hydrogen or biomass intermediates. Third, embed carbon accounting and third-party verification into commercial agreements to meet buyer expectations and to participate in low-carbon value chains. Fourth, design distribution and sales strategies that combine direct relationships with strategic offtakers and selective distributor partnerships to reach diverse end-user industries. Fifth, strengthen supply chain resilience by localizing critical equipment procurement where tariffs or trade frictions increase landed costs, and by structuring contracts to share policy and energy price volatility with partners.

Finally, align corporate R&D and M&A activity toward technologies and partnerships that accelerate green and blue methanol production, including collaborations with hydrogen producers, catalyst developers, and logistics providers. By pursuing these actions, companies can convert strategic intent into operational capability and secure leadership positions in a more carbon-constrained commercial environment.

Methodological approach combining lifecycle analysis, expert interviews, technical validation, and regional case studies to produce robust strategic insights and actionable conclusions

The research underpinning these insights combined a structured review of publicly available technical literature, policy documents, and industry white papers with targeted interviews and primary qualitative engagement across the methanol value chain. Technical verification drew on engineering assessments of production routes, lifecycle emissions methodologies, and supply chain logistics analyses to ensure robustness in the characterization of feedstock and technology trade-offs. Expert interviews included operators, technology licensors, offtakers, and logistics specialists to capture real-world constraints and commercial practices.

Case studies of representative projects across different geographies were used to illustrate pathways for integration of renewable hydrogen, biomass conversion, and carbon management. Where useful, secondary data informed comparisons of regional infrastructure endowments and policy environments, while lifecycle analysis frameworks provided consistent lenses for carbon-intensity classification. The synthesis prioritized triangulation across sources to validate findings and to identify convergent trends rather than relying on single data points.

Transparency and reproducibility guided the methodology: assumptions and evaluation criteria were documented to facilitate downstream review and to enable stakeholders to adapt the analytical approach to their organizational context. This methodological rigor supports the practical relevance of recommendations and helps ensure that strategic choices are grounded in a balanced assessment of technological feasibility, policy dynamics, and commercial viability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Methanol market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Methanol Market, by Feedstock Source

- Methanol Market, by Production Method

- Methanol Market, by Purity Level

- Methanol Market, by Carbon Intensity

- Methanol Market, by Application

- Methanol Market, by End-User Industry

- Methanol Market, by Distribution Channel

- Methanol Market, by Region

- Methanol Market, by Group

- Methanol Market, by Country

- United States Methanol Market

- China Methanol Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Concluding perspective emphasizing the necessity of integrated decarbonization, supply chain adaptability, and strategic partnerships to secure long-term competitive advantage

The synthesis leads to a clear strategic imperative: methanol stakeholders must integrate decarbonization objectives with pragmatic supply chain design and commercial differentiation to remain competitive. Technology pathways that reduce carbon intensity are technically attainable, but realizing commercial value requires alignment across feedstock procurement, production flexibility, certification, and offtake contracting. Companies that adopt a systems perspective-connecting feedstock sources to end-use demands and regulatory requirements-will unlock clearer routes to durable buyer relationships and premium positioning.

Moreover, the interplay of trade policy, regional infrastructure, and application-level demand underscores the importance of adaptive strategies that can respond to tariff changes, logistics disruptions, and shifts in offtaker preferences. Successful organizations will be those that build modular project plans, commit to transparent carbon accounting, and pursue partnerships that can scale both supply and demand for low-carbon methanol. Ultimately, the path to sectoral resilience depends on reconciling near-term operational constraints with sustained investment in technologies and partnerships that support a lower-carbon future.

Immediate procurement pathway to secure the comprehensive methanol research report, schedule a tailored briefing, and arrange custom licensing with senior sales leadership

For immediate access to the comprehensive methanol market research report, contact Ketan Rohom (Associate Director, Sales & Marketing) to arrange report purchase and licensing options. The research package includes a detailed breakdown of feedstock pathways, production technologies, carbon intensity classifications, application-level analyses, and regional strategic implications designed to support executive decision-making. A tailored briefing can be scheduled to walk through the report highlights, clarifying how findings align with corporate decarbonization targets, investment timelines, and supply chain resilience plans.

To expedite procurement, stakeholders may request an institutional license, a customized extract focused on specific feedstock or application segments, or an advisory session that translates report insights into actionable commercial plans. Early engagement yields the greatest value for strategy teams exploring partnerships, green methanol offtake agreements, or capital projects aiming to deploy low-carbon production capacity. Contacting the Associate Director enables negotiation of privileged access tiers and ensures that procurement aligns with organizational compliance and confidentiality requirements.

Partnering through a direct purchase also opens access to follow-up research addenda and workshop facilitation to operationalize the study’s findings. Reach out to arrange a walkthrough of the report contents, discuss bespoke enhancements, and secure rights for internal distribution and executive briefings. This step will fast-track your team’s preparedness for regulatory shifts, tariff impacts, and emergent demand channels in the methanol ecosystem.

- How big is the Methanol Market?

- What is the Methanol Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?