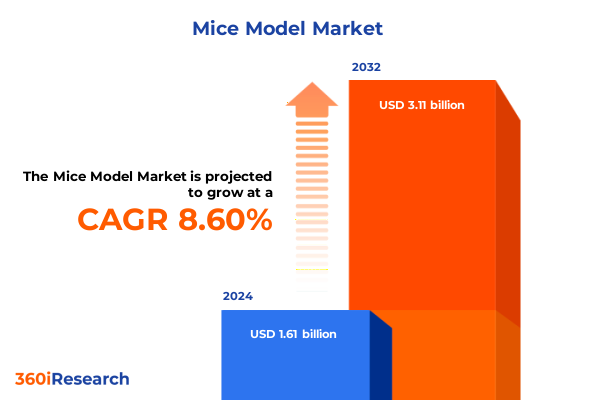

The Mice Model Market size was estimated at USD 1.74 billion in 2025 and expected to reach USD 1.88 billion in 2026, at a CAGR of 8.66% to reach USD 3.11 billion by 2032.

Exploring the Evolution of Preclinical Mice Models Unveiling Their Integral Role in Translational Research, Biomedical Breakthroughs, and Drug Development

Mice models have emerged as indispensable tools in preclinical research, bridging the gap between molecular discoveries and clinical applications. Over the past several decades, the use of laboratory mice has expanded beyond basic biological inquiry to encompass a multitude of therapeutic areas, including oncology, immunology, and neurodegenerative disease research. This evolution reflects the scientific community’s commitment to refining experimental platforms that can reliably predict human responses, thus accelerating drug development and de-risking clinical trials.

In recent years, advancements in genetic engineering have revolutionized the creation of more precise and representative mice models. Innovations such as conditional knockouts, humanized systems, and transgenic constructs have provided researchers with the ability to mimic complex human pathologies with unprecedented accuracy. These breakthroughs have not only enhanced our understanding of disease mechanisms but have also unlocked new avenues for targeted therapies, biomarkers, and personalized medicine.

As the scientific landscape continues to evolve, the strategic integration of cutting-edge technologies-ranging from CRISPR gene editing to advanced imaging techniques-has further cemented the role of mice models at the forefront of translational research. This report delivers a concise yet thorough introduction to the field, highlighting key drivers, emerging trends, and critical considerations that decision-makers must understand to navigate an increasingly dynamic preclinical environment.

Charting Paradigm Shifts in Mice Model Research Driven by Genetic Engineering, CRISPR Advances, Therapeutic Target Emergence and Advanced Screening Technologies

The mice model landscape is undergoing a transformative period marked by the seamless convergence of genetic engineering, precision technologies, and evolving therapeutic demands. Driven by breakthroughs in CRISPR advances, researchers have gained the capacity to introduce targeted genetic modifications with surgical precision, enabling the study of disease pathways that were once out of reach. Concurrently, therapeutic target emergence within areas such as neurodegeneration and metabolic disorders has redirected research focus, prompting the development of new model variants that more faithfully recapitulate human physiology.

Moreover, advanced screening technologies have streamlined high-throughput compound libraries and phenotypic assays, accelerating early‐stage discovery and toxicology workflows. These methodological enhancements are reshaping experimental design, reducing cycle times, and minimizing the risk of translational failures. In parallel, bioinformatics platforms and machine learning algorithms have begun to offer predictive insights into model performance and experimental outcomes, enabling a data-driven approach to selecting and validating mouse strains.

As a result, stakeholders across academia, contract research organizations, and the biopharmaceutical industry are witnessing a paradigm shift toward customizable, application-driven model design. This trend not only enhances experimental fidelity but also supports strategic diversification, as organizations seek to align their preclinical pipelines with rapidly evolving regulatory expectations and market demands.

Evaluating the Compound Effects of 2025 United States Tariffs on Mice Model Research Costs, Supply Chain Resilience, and Industry Competitiveness

In 2025, newly imposed United States tariffs have introduced a complex array of challenges for laboratories relying on imported mice models and specialized reagents. These levies have elevated the cost structure of key inputs, creating pressure to reassess traditional sourcing strategies and evaluate domestic alternatives. As tariffs are cumulative, procurement teams have confronted rising expenses across direct and indirect channels, from breeding stock and consumables to technical services.

In response, many organizations have prioritized supply chain resilience by diversifying vendor portfolios and exploring regional breeding facilities that fall outside the scope of high‐tariff classifications. Some research centers have also accelerated investments in local breeding capabilities, aiming to mitigate the impact of import restrictions. Meanwhile, manufacturers of genetically engineered lines have adapted their distribution networks, forging agreements with U.S. counterparts to maintain continuity of supply.

Despite these adjustments, the ripple effects of 2025 tariffs extend beyond cost implications. Laboratories have adjusted experimental timelines and increased buffer inventories to account for longer lead times, which has in turn influenced study design and budgeting. Collectively, these shifts underscore the critical importance of strategic procurement planning and collaborative supplier relationships in navigating an increasingly protectionist trade environment.

Unlocking Critical Segmentation Insights Across Diverse Mice Model Types, Research Applications, and End-User Profiles in Biomedical Studies

A deep analysis based on Genetically Engineered Mice Models, Inbred Mice Models, and Outbred Mice Models reveals nuanced opportunities and challenges across the mice model market. Within the genetically engineered segment, conditional knockout models have surged in prominence as investigators seek temporal and spatial control of gene expression. At the same time, humanized mice models have become critical in immuno-oncology studies, offering a translational bridge for assessing novel checkpoint inhibitors and cell therapies. Knockout and transgenic variants remain foundational, supporting fundamental research and target validation across a wide spectrum of disease areas.

When examining application areas such as behavioral studies, drug discovery and toxicology, and genetic disease research, specialized model selection becomes pivotal. Researchers focusing on infectious diseases and immunology require models with robust immune system reconstitution, while neurology and neurodegenerative investigations depend on lines that accurately reflect human central nervous system physiology. Metabolic disorder studies, cardiovascular disease research, and oncology investigations each drive demand for bespoke model features, from diet-induced obesity phenotypes to tumor xenograft compatibility.

End users including academic and research institutions expect versatile, cost-effective solutions, whereas contract research organizations prioritize throughput and regulatory compliance. Hospitals and diagnostic centers increasingly leverage mice models for companion diagnostics and preclinical validation, and pharmaceutical and biotechnology companies demand scalable supply and rigorous quality standards. By synthesizing insights across model types, applications, and end users, stakeholders can identify high-value segments, optimize resource allocation, and accelerate pathway selection.

This comprehensive research report categorizes the Mice Model market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Model Type

- Application

- End User

Examining Distinct Regional Dynamics and Growth Drivers Shaping the Americas, Europe Middle East and Africa and Asia-Pacific Mice Model Markets

Regional dynamics shape the trajectory of the mice model market, with the Americas, Europe Middle East and Africa, and Asia-Pacific each exhibiting distinct demand drivers and regulatory frameworks. In the Americas, robust research funding, a concentration of pharmaceutical headquarters, and a mature service provider ecosystem have created an environment conducive to rapid adoption of advanced model technologies. The presence of leading academic centers and well-established biomanufacturing clusters further cements the region’s status as a global innovation hub.

Europe Middle East and Africa presents a heterogeneous landscape characterized by divergent regulatory regimes and funding priorities. Western European nations benefit from coordinated research initiatives and public-private partnerships that foster cross-border collaborations, while emerging markets in the Middle East and Africa demonstrate growing investment in life sciences infrastructure and talent development. As harmonization efforts intensify, stakeholders in the region are aligning model validation standards and ethical guidelines to support multinational studies.

In the Asia-Pacific, accelerating R&D expenditure, expanding CRO networks, and government incentives have driven significant market growth. Countries such as China, Japan, and South Korea lead in the development of genetically engineered models, supported by cutting-edge genome editing facilities. Simultaneously, rising disease prevalence and increasing pharmaceutical outsourcing have boosted demand for both standard and bespoke mouse strains, highlighting the strategic importance of regional supply chain partnerships and localized technical support.

This comprehensive research report examines key regions that drive the evolution of the Mice Model market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Innovators and Strategic Partnerships Driving Advancement in Mice Model Development, Supply Solutions, and Collaborative Research Excellence

Leading companies in the mice model landscape are distinguished by their commitment to innovation, quality assurance, and strategic alliances. Some pioneers have integrated advanced genetic engineering platforms with in-house breeding facilities to expedite model development cycles and ensure traceability. Other key players have established global distribution networks, enabling researchers to access specialized strains with predictable lead times and comprehensive data packages while maintaining rigorous compliance with ethical and regulatory mandates.

Partnerships between commercial suppliers and academic centers have further fueled novel model creation, facilitating the translation of cutting-edge discoveries into commercially viable offerings. In addition, collaborations with technology vendors have introduced automation and digital tracking systems that enhance colony management, health monitoring, and data analytics. These initiatives have collectively elevated operational efficiencies, reduced variability, and improved user experience across the research continuum.

As market maturity deepens, stakeholders are pursuing strategic mergers, targeted acquisitions, and licensing agreements to broaden their portfolios and geographic reach. By capitalizing on complementary capabilities-ranging from immuno-profiling services to cryopreservation expertise-these companies are well positioned to address the evolving needs of biopharmaceutical innovators, academic researchers, and diagnostic developers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mice Model market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Applied StemCell, Inc.

- Aragen Life Sciences Ltd.

- Biocytogen Boston Corporation

- Charles River Laboratories International, Inc.

- Creative Biolabs

- Crown Bioscience by JSR Life Sciences, LLC

- Cyagen US Inc. by PolyGene AG

- Envigo by Inotiv, Inc.

- GenOway

- Harbour BioMed

- inGenious Targeting Laboratory, Inc.

- Janvier Labs

- Marshall BioResources

- MD Biosciences

- Mirimus, Inc.

- Ozgene Pty Ltd.

- PhoenixBio Co., Ltd.

- Shanghai Model Organisms Center, Inc.

- Taconic Biosciences, Inc.

- The Jackson Laboratory

- TransCure bioServices

- Translational Drug Development, LLC

- Urosphere SAS

- XenOPAT SL by Bellvitge Biomedical Research Institute

Strategic Recommendations for Industry Leaders to Enhance Mice Model Research Efficiency, Regulatory Compliance, and Collaborative Innovation

Industry leaders aiming to maintain a competitive edge should first invest in supplier diversification and redundancy to mitigate the impact of trade disruptions and regulatory changes. Establishing relationships with multiple breeding and genetic engineering providers across different regions will enhance supply chain resilience and safeguard research continuity. Concurrently, organizations should integrate advanced genome editing capabilities in-house or through tight collaborations to reduce dependence on external model design services and accelerate time-to-study.

It is also critical to engage proactively with regulatory agencies and standards bodies to influence evolving guidelines on animal welfare, model validation, and data transparency. By participating in working groups and consortia, companies can anticipate regulatory shifts, align processes with best practices, and avoid costly compliance delays. Moreover, fostering interdisciplinary partnerships-linking life sciences with informatics, imaging, and bioengineering-will unlock new applications and drive cost efficiencies throughout the R&D pipeline.

Finally, adopting digital platforms for colony management, experimental tracking, and data analytics will enhance operational visibility and decision-making. Investing in workforce development and training will ensure that scientific teams can leverage these technologies effectively, fostering a culture of continuous improvement and innovation.

Comprehensive Methodological Framework Employing Mixed Qualitative and Quantitative Approaches for Mice Model Market Analysis

This analysis employs a mixed methodological framework combining rigorous secondary research with targeted primary validation. Secondary research involved systematic review of scientific literature, patent filings, regulatory updates, and industry white papers to map historical trends and technological advancements. Publicly available data from academic institutions, government agencies, and professional associations provided foundational context on research funding, model usage patterns, and ethical guidelines.

Primary research comprised in-depth interviews with key opinion leaders, veterinary scientists, procurement managers, and executive decision-makers from academic, CRO, pharmaceutical, and biotech organizations. These discussions yielded qualitative insights into procurement challenges, model selection criteria, and anticipated technology adoption. Quantitative surveys supplemented these findings, capturing statistical data on purchasing behaviors, pricing pressures, and regional sourcing trends.

All data were triangulated to ensure reliability, with cross-referencing across independent sources and validation through expert review panels. This robust approach provided both breadth and depth, enabling the synthesis of actionable insights and the identification of emerging market inflection points.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mice Model market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mice Model Market, by Model Type

- Mice Model Market, by Application

- Mice Model Market, by End User

- Mice Model Market, by Region

- Mice Model Market, by Group

- Mice Model Market, by Country

- United States Mice Model Market

- China Mice Model Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 795 ]

Synthesis of Key Findings and Forward-Looking Perspectives on the Evolution and Strategic Imperatives of Mice Model Research

In synthesizing the landscape of preclinical mice models, several overarching themes emerge. First, the convergence of genetic engineering and technological innovation has redefined the boundaries of model fidelity, supporting more predictive research pathways. Second, external factors such as trade policies and regulatory shifts have underscored the necessity of strategic supply chain management and region-specific sourcing solutions. Third, granular segmentation by model type, application area, and end-user has illuminated pockets of high demand that warrant targeted investment.

Regional dynamics further amplify the complexity of market engagement, with each geography presenting unique drivers, funding ecosystems, and regulatory landscapes. Leading companies are responding by forging strategic partnerships and expanding service offerings to deliver end-to-end solutions-from custom model design through to data analytics and regulatory support. As the market matures, digital integration and data transparency will become essential differentiators, enabling organizations to optimize operations and accelerate translational timelines.

Ultimately, the trajectory of mice model research will be shaped by a blend of scientific innovation, strategic collaboration, and operational agility. Stakeholders who embrace these principles will be well positioned to capitalize on the evolving demands of drug discovery, translational science, and precision medicine.

Engage With Associate Director Ketan Rohom to Access In-Depth Mice Model Market Intelligence for Informed Strategic Decision-Making

To explore this market in depth and to secure a comprehensive report tailored to your strategic priorities, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, to arrange your purchase and gain immediate access to actionable insights, detailed analyses, and expert guidance.

- How big is the Mice Model Market?

- What is the Mice Model Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?