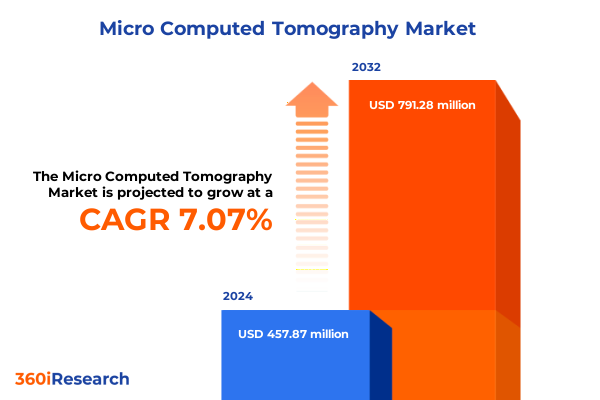

The Micro Computed Tomography Market size was estimated at USD 457.87 million in 2024 and expected to reach USD 489.10 million in 2025, at a CAGR of 7.07% to reach USD 791.28 million by 2032.

Exploring the transformative potential of micro computed tomography to revolutionize high-resolution 3D imaging across scientific and industrial domains

Micro computed tomography has emerged as a cornerstone technology for obtaining high-resolution, three-dimensional representations of internal structures without the need for destructive sample preparation. By harnessing advanced X-ray imaging coupled with precision motion control, this modality delivers submicron spatial resolution that surpasses traditional imaging techniques. In research settings, it underpins breakthroughs in materials science, paleontology, life sciences, and beyond by revealing intricate microarchitectures previously obscured within opaque specimens.

Beyond academic inquiry, industry stakeholders have rapidly embraced micro CT to ensure quality and reliability across manufacturing processes. Whether validating additive manufacturing components for aerospace or inspecting semiconductor packaging for electronic devices, the ability to visualize density variations and structural defects in situ enhances both safety and performance. As regulatory standards tighten and competitive pressures intensify, the value proposition of non-invasive 3D metrology becomes ever more compelling, positioning micro computed tomography at the intersection of innovation and practicality.

In recent years, converging trends in hardware miniaturization, detector sensitivity, and computational power have further accelerated adoption. These developments have democratized access to micro CT solutions, empowering small-scale laboratories and large-scale industrial facilities alike to leverage volumetric insights. As the technology matures, its potential to disrupt conventional workflows continues to expand, heralding a new era of precision imaging for scientists and engineers worldwide.

Unveiling the pivotal shifts reshaping micro computed tomography from hardware advances to software intelligence and integrated workflow optimization

The micro computed tomography landscape has undergone profound transformation as breakthrough innovations redefined the boundaries of performance and accessibility. Initially driven by improvements in X-ray source stability and motion mechanics, recent iterations have integrated advanced detector arrays with enhanced sensitivity to capture finer details at faster scan speeds. This evolution has enabled researchers and industrial users to achieve unprecedented throughput without sacrificing resolution, effectively balancing speed and accuracy in routine workflows.

Parallel to hardware advances, software intelligence has emerged as a pivotal force reshaping user experiences. Machine learning algorithms now automate segmentation, defect detection, and quantitative analysis, reducing manual intervention and operator bias. Such capabilities not only accelerate decision-making but also unlock new use cases across fields as diverse as pharmaceutical development, geological exploration, and heritage preservation. Integration with cloud-based platforms further facilitates collaborative analysis, breaking down data silos and fostering cross-disciplinary insight sharing.

Moreover, the convergence of micro CT with complementary technologies-such as additive manufacturing and in situ mechanical testing-has catalyzed novel applications. By capturing tomographic sequences under varying environmental conditions, stakeholders can observe microstructural evolution in real time, guiding materials design and process optimization. As these integrative workflows become more prevalent, micro computed tomography’s role evolves from a standalone imaging tool to a central component of holistic research and production ecosystems.

Analyzing the multifaceted repercussions of 2025 United States tariff implementations on micro computed tomography supply chains and market accessibility

In 2025, the implementation of revised United States tariffs on imported instrumentation and critical components introduced a complex array of challenges for micro computed tomography suppliers and end users. With duties applied to select X-ray tubes, precision motion stages, and advanced detector assemblies, manufacturers faced immediate cost pressures that reverberated throughout global supply chains. Delays in component sourcing and higher landed costs strained procurement budgets, prompting many to reevaluate existing supplier relationships.

End users, particularly in research institutions and industrial quality control labs, experienced cascading effects as equipment lead times extended and capital expenditure approvals became more rigorous. To mitigate tariff-induced cost escalation, several organizations explored alternative procurement strategies, including regional assembly partnerships and nearshoring of key system integrations. Such efforts aimed to preserve pricing stability while maintaining access to the latest generation of scanning solutions.

Simultaneously, the tariff landscape accelerated domestic innovation by incentivizing local research into alternative detector materials and in-house manufacturing of mechanical subsystems. Although initial R&D investments were substantial, they laid the foundation for long-term supply resilience. Ultimately, the 2025 tariff adjustments underscored the critical importance of flexible sourcing strategies, collaborative vendor ecosystems, and adaptive business models to sustain growth in a progressively protectionist environment.

Decoding segmentation insights to reveal opportunities across offerings detector types scanning targets technologies applications end users driving innovation

A deep dive into micro computed tomography’s market segmentation reveals a landscape rich with differentiated value propositions and tailored growth opportunities across multiple dimensions. When considering offerings, systems continue to dominate due to their turnkey capabilities, encompassing both rugged floor-standing configurations suited for high-throughput industrial inspections and more compact tabletop models ideal for academic laboratories with space constraints. Complementary services-ranging from maintenance contracts to application-specific training-and specialized software packages further enhance system utility, creating integrated solutions that align with organizational priorities.

Delineating by detector type, legacy charge-coupled device assemblies still find use in niche applications where dynamic range takes precedence, while state-of-the-art flat panel detectors deliver superior spatial resolution and rapid readout speeds, enabling time-sensitive preclinical imaging studies. Scanning target segmentation underscores this duality: ex vivo investigations leverage higher power sources and stable setups for maximal clarity, whereas in vivo protocols prioritize low-dose sensitivity and biocompatible chambers to visualize living specimens with minimal perturbation.

Technological paradigms in micro CT oscillate between cone beam designs that offer wide field-of-view imaging for larger samples and parallel beam approaches that yield the highest geometric fidelity for ultra-fine structures. Application diversity spans rigorous electronics inspection workflows-encompassing printed circuit board analysis, semiconductor packaging evaluation, and solder joint integrity testing-to heavy industrial realms such as additive manufacturing part validation, aerospace and automotive component assessment, and metal powder characterization. In parallel, the realm of preclinical imaging thrives on detailed bone morphology studies and small animal investigations that inform translational research.

End-user segmentation further nuances the competitive dynamic. Academic and research institutions drive methodological innovation and remain early adopters of cutting-edge capabilities, while contract research organizations capitalize on turnkey platforms to deliver bespoke projects. Government and defense entities apply micro CT to critical materials qualification, and industrial quality control departments deploy routine inspections to uphold reliability standards. Meanwhile, pharmaceutical and biotechnology companies increasingly rely on volumetric analysis for formulation development and biologic delivery assessments. Together, these segments chart a multifaceted roadmap for market participants striving to align product strategies with evolving customer needs.

This comprehensive research report categorizes the Micro Computed Tomography market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Detector Type

- Scanning Target

- Technology

- Resolution

- Application

- End User

Unearthing regional dynamics shaping micro computed tomography adoption across Americas Europe Middle East Africa and Asia-Pacific markets

Regional dynamics exert a profound influence on the trajectory of micro computed tomography adoption and its associated service ecosystems. In the Americas, well-established research institutions, pharmaceutical giants, and advanced manufacturing hubs contribute to a mature environment for high-precision imaging. Strong government and private sector investments in R&D have sustained demand for both turnkey systems and bespoke analytical services, fostering vibrant public-private partnerships that accelerate technology transfers and knowledge dissemination.

Across the Europe, Middle East, and Africa region, the interplay of stringent regulatory frameworks and a diverse industrial base creates unique market contours. Automotive and aerospace manufacturers leverage micro CT to validate complex geometries and composite materials, while research consortia in Western Europe collaborate on cross-border initiatives to standardize imaging protocols. Emerging markets in the Middle East and Africa are rapidly scaling infrastructure, presenting untapped potential for localized service offerings and strategic vendor alliances.

In Asia-Pacific, rapid economic expansion, aggressive investment in semiconductor foundries, and a burgeoning footprint of academic centers have catalyzed the fastest growth rates globally. Domestic equipment providers and integrators have capitalized on regional supply chain strengths to deliver cost-competitive solutions, even as multinational players deepen their footprint through joint ventures and localized R&D labs. This vibrant amalgam of public policy support, manufacturing capabilities, and research fervor positions the Asia-Pacific region as an essential nexus for the next frontier of micro CT innovation.

This comprehensive research report examines key regions that drive the evolution of the Micro Computed Tomography market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing strategic initiatives and competitive positioning among leading micro CT solution providers driving innovation and market leadership

Leading organizations in the micro computed tomography arena continuously refine their strategic playbooks to maintain competitive differentiation. Several pioneering suppliers have prioritized the integration of artificial intelligence algorithms for automated defect recognition and quantitative analysis, embedding machine learning models directly into acquisition software to shorten time-to-insight. Others have deployed modular architectures that allow customers to upgrade X-ray sources, detectors, or motion platforms independently, thus extending equipment lifecycles and preserving capital efficiency.

Collaborations between imaging specialists and academic research teams have produced novel contrast agents and sample preparation protocols, enabling deeper exploration into soft-tissue structures and composite materials. Strategic partnerships with cloud service providers have also unlocked remote processing pipelines, facilitating high-performance computing for volumetric reconstructions and opening new recurrent revenue streams through subscription-based analytics offerings.

On the manufacturing front, select vendors have embraced localized assembly and component sourcing initiatives to mitigate geopolitical risk and tariff exposure. Investments in regional service centers-complete with application laboratories and customer training facilities-have further strengthened after-sales support and fostered communities of practice. As consolidation activity reshapes the competitive landscape, nimble mid-sized players remain poised to challenge incumbents by focusing on niche applications and rapid innovation cycles.

This comprehensive research report delivers an in-depth overview of the principal market players in the Micro Computed Tomography market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3DHISTECH Ltd.

- Bruker Corporation

- Canon Medical Systems Corporation

- Carl Zeiss AG

- Comet Yxlon GmbH

- Deben UK Limited

- Hamamatsu Photonics K.K.

- Matsusada Precision Inc.

- Measurlabs

- NEOSCAN BVBA

- Nikon Corporation

- North Star Imaging Inc.

- ProCon X‑Ray GmbH

- Revvity, Inc.

- Rigaku Corporation

- RX Solutions

- Sanying Precision Instruments Co.,Ltd

- SCANCO Medical AG

- Shimadzu Corporation

- Tescan Group A.S.

- Waygate Technologies by Baker Hughes Company

Charting actionable strategies for industry leaders to harness micro CT capabilities optimize operations and capitalize on emerging opportunities

To thrive amid intensifying competition and evolving regulatory constraints, industry leaders should first prioritize the deployment of advanced AI-driven analytics directly within acquisition workflows. By automating routine inspection tasks and predictive maintenance alerts, organizations can reallocate skilled personnel toward higher-value research and development initiatives. Next, forging closer alliances with domestic and regional suppliers will reduce exposure to tariff volatility while enhancing supply chain resilience and delivery predictability.

Equally important is the expansion of modular service offerings that bundle equipment upgrades with remote training, software patches, and application consulting. This approach not only cultivates deeper customer loyalty but also generates recurring revenue streams that buffer against cyclical hardware sales fluctuations. In parallel, firms should explore the development of tailored financing and leasing models to lower the barrier to entry for high-resolution systems, enabling adoption among small laboratories and emerging market users.

Finally, proactive engagement with industry standards bodies and regulatory agencies will ensure that new modalities-such as in situ environmental chambers and high-throughput screening platforms-are seamlessly integrated into certification frameworks. By championing interoperability and open data formats, market participants can foster collaborative ecosystems that accelerate the translation of micro CT innovations into tangible product improvements and scientific breakthroughs.

Illustrating rigorous research methodology and analytical frameworks employed to ensure comprehensive and reliable insights in the micro CT study

The research methodology underpinning this analysis combined rigorous primary and secondary intelligence gathering to ensure a holistic understanding of micro computed tomography dynamics. Primary insights were derived from in-depth interviews with device manufacturers, academic researchers, industrial end users, and service providers, complemented by structured surveys that quantified adoption patterns and technology preferences. These firsthand perspectives were invaluable in contextualizing quantitative data points and highlighting evolving pain points within procurement and operational workflows.

Secondary research incorporated extensive reviews of peer-reviewed journals, patent filings, regulatory filings, and publicly available financial disclosures. Conference proceedings and technical white papers provided additional granularity on emerging technological breakthroughs, while proprietary patent analytics tools revealed innovation hotspots and competitive trajectories. Triangulating these varied data sources facilitated robust validation of key observations and mitigated the risk of single-source bias.

Analytical frameworks-such as SWOT evaluations, Porter’s Five Forces, and value chain assessments-were applied to structure findings and illuminate strategic inflection points. All data underwent a multi-stage quality assurance process, including expert peer review and cross-validation against external industry benchmarks, ensuring that the insights presented herein rest on a foundation of accuracy, consistency, and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Micro Computed Tomography market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Micro Computed Tomography Market, by Offering

- Micro Computed Tomography Market, by Detector Type

- Micro Computed Tomography Market, by Scanning Target

- Micro Computed Tomography Market, by Technology

- Micro Computed Tomography Market, by Resolution

- Micro Computed Tomography Market, by Application

- Micro Computed Tomography Market, by End User

- Micro Computed Tomography Market, by Region

- Micro Computed Tomography Market, by Group

- Micro Computed Tomography Market, by Country

- United States Micro Computed Tomography Market

- China Micro Computed Tomography Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Summarizing critical insights and future imperatives to guide decisionmakers leveraging micro computed tomography innovations across diverse sectors

Micro computed tomography stands at a pivotal juncture, propelled by a confluence of hardware miniaturization, software intelligence, and integrative workflow innovations. While the 2025 U.S. tariff adjustments introduced short-term supply chain challenges, they simultaneously catalyzed domestic R&D and strategic partnership models that promise enhanced resilience. Segmentation analysis underscores the necessity for tailored solutions across offerings, detector types, scanning targets, technologies, applications, and end-user profiles, with each dimension revealing distinct value drivers and growth levers.

Regional variances further highlight the strategic imperative of localizing service infrastructures and aligning product portfolios with market-specific demands. Key players are differentiating through AI-embedded analytics, modular upgrade paths, and collaborative research ventures, thereby reshaping competitive paradigms. Actionable recommendations emphasize the integration of advanced analytics, diversification of supplier ecosystems, and the creation of flexible financing structures to lower adoption barriers and sustain revenue growth.

By adhering to the robust research methodology outlined, decision makers can have confidence in the insights presented and use them to inform investment roadmaps, product development strategies, and go-to-market plans. In doing so, stakeholders across academia, industry, and government can harness the full potential of micro computed tomography to drive tomorrow’s scientific discoveries and industrial advancements.

Engage with Ketan Rohom to access unparalleled market intelligence and secure competitive advantage by acquiring the detailed micro computed tomography report

Engage directly with Ketan Rohom to secure your organization’s strategic edge by tapping into unparalleled market intelligence tailored for micro computed tomography leaders. His deep expertise in guiding executive decision makers through complex technology landscapes ensures you receive bespoke support in leveraging the comprehensive report’s insights. Reach out to refine your go-to-market strategies, optimize your investment roadmap, and unlock new avenues for growth and innovation within your enterprise. Don’t let opportunity pass by-partner with Ketan Rohom and transform insight into action today.

- How big is the Micro Computed Tomography Market?

- What is the Micro Computed Tomography Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?