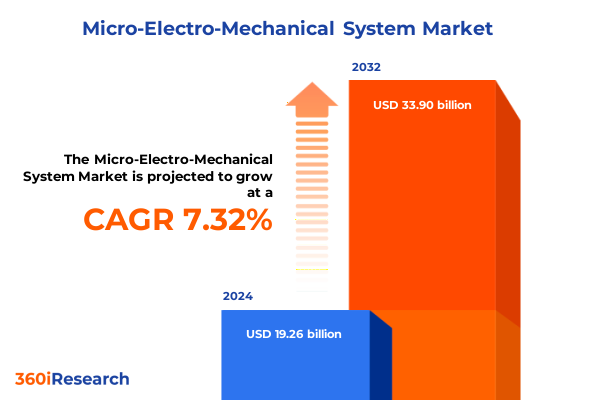

The Micro-Electro-Mechanical System Market size was estimated at USD 20.58 billion in 2025 and expected to reach USD 22.03 billion in 2026, at a CAGR of 7.38% to reach USD 33.90 billion by 2032.

Understanding the Strategic Importance of MEMS Technology and Its Expanding Role in Modern Industrial, Consumer and Healthcare Applications

Micro-electro-mechanical systems (MEMS) have emerged as a foundational technology underpinning a vast array of contemporary applications. By integrating miniaturized mechanical elements with electronic circuitry, MEMS devices enable unparalleled performance in environments where size, weight, and power are critical constraints. Over the past decade, advancements in microfabrication and materials science have driven MEMS from laboratory curiosities into high-volume commercial products, establishing these systems as essential building blocks for everything from consumer electronics to aerospace instrumentation. As industries strive for greater automation, connectivity, and efficiency, MEMS technology continues to evolve at the intersection of engineering disciplines, delivering increasingly sophisticated sensing and actuation capabilities that reshape traditional product design practices.

Innovation in MEMS has been propelled by the convergence of multiple technological trends. The integration of artificial intelligence algorithms with on-chip sensor data processing is enabling real-time decision making at the device level, reducing latency and off-chip data loads in critical applications such as predictive maintenance and autonomous navigation. At the same time, the proliferation of 5G networks has created demand for RF MEMS filters and switches that can operate efficiently at higher frequencies with minimal power consumption, reinforcing the role of MEMS as a key enabler for next-generation wireless infrastructure.

Meanwhile, the medical and healthcare sectors have witnessed a renaissance in lab-on-a-chip platforms, implantable sensors, and wearable diagnostic devices, all of which rely on MEMS for fluid handling, pressure sensing, and biochemical detection at scales previously unattainable. These trends underscore MEMS’s unique ability to miniaturize complex functions into small form factors, unlocking new use cases in patient monitoring, telemedicine, and personalized medicine. Collectively, these developments establish the strategic importance of MEMS as a transformative technology driving innovation across diverse markets.

Transformative Technological and Market Shifts Revolutionizing the MEMS Landscape Through Integration of AI, IoT, Advanced Materials, and Novel Fabrication Techniques

The MEMS industry is undergoing transformative shifts driven by converging technological, market, and geopolitical trends. Foremost among these is the deepening integration of MEMS devices with Internet of Things (IoT) ecosystems and edge-AI architectures. By embedding data processing and simple machine learning routines directly on MEMS sensor chips, device makers are reducing system latency and power consumption while enhancing data security-an advancement that is rapidly gaining traction in industrial automation and automotive safety systems.

Parallel to this, there has been a marked proliferation of MEMS applications within the 5G and beyond-5G communications infrastructure. RF MEMS resonators, filters, and switches are being adopted to meet stringent requirements for low insertion loss and high frequency agility, enabling network operators to deploy more efficient, higher-bandwidth links. These components offer distinct advantages over traditional technologies, including greater linearity and tunability, positioning MEMS as a critical enabler for next-generation wireless networks.

Advances in materials science also represent a major inflection point. Researchers are exploring novel piezoelectric and polymer-based materials to extend the functional range of MEMS actuators and sensors. Such materials can deliver enhanced sensitivity, broader operating temperature windows, and improved biocompatibility-attributes that are accelerating MEMS adoption in biomedical devices, micro-fluidic platforms, and haptic feedback systems. Moreover, the maturation of additive manufacturing and micro-3D printing techniques is opening avenues for complex, multi-material MEMS architectures that were previously impractical, heralding new device topologies and performance capabilities.

Evaluating the Cumulative Effects of United States 2025 Trade Tariffs on MEMS Supply Chains and Component Costs Across Domestic and Global Production Networks

The cumulative impact of the United States’ 2025 tariff measures on MEMS supply chains and component costs has been profound. Beginning with the reinstatement of broad-scope duties on semiconductor imports, U.S. policymakers have layered additional tariffs-up to 54% on certain Chinese-origin goods-on top of existing national security levies. These actions have driven MEMS producers to reevaluate sourcing strategies, accelerating initiatives to diversify manufacturing footprints outside of China and mitigate duty exposure.

Concurrently, the elimination of the de minimis exemption for imports from China and Hong Kong has reshaped e-commerce and small-component logistics. Shipments below the previous $800 threshold now face standard customs duties, increasing landed costs for prototype materials and low-volume spare parts. MEMS developers relying on cross-border rapid prototyping services have encountered material delays and cost surges, prompting a shift toward domestic fabrication services or near-shoring in Southeast Asia to maintain project timelines and budget compliance.

Moreover, the tariff environment has had cascading effects on small and mid-sized MEMS manufacturers that lack the scale or capital buffers of larger industry players. Facing input cost increases of 10–25% on metals and specialized substrates, many are now adopting leaner production models and exploring strategic partnerships with domestic foundries to reduce reliance on imported components. While larger firms have been able to negotiate margin cushions, these pressures underscore the strategic imperative for agile supply-chain management and localized capacity investments in the evolving U.S. trade landscape.

Uncovering Critical Insights Across MEMS Market Segmentation by Device Types, Fabrication Materials, End Users and Distribution Channels

Insight into the MEMS market’s segmentation reveals the diversity of device types, materials, end-use applications, and distribution paths that shape strategic planning. When examined by device type, microactuators and microsensors form the core categories. Within microactuators, electrostatic and piezoelectric actuation technologies underpin applications ranging from precision haptics to inkjet printing heads. Meanwhile, microsensors encompass inertial, optical, and pressure-sensing functionalities that enable motion tracking, environmental monitoring, and microfluidic diagnostics. This device-centric view highlights the necessity for portfolio planning that addresses both actuator dynamics and sensing accuracy.

Considering fabrication materials, MEMS products leverage ceramics, metals, polymers, and silicon substrates. Polymer-based MEMS, including parylene, PDMS, polyimide, and SU-8, have opened new frontiers in flexible electronics, biocompatible implants, and microfluidic lab-on-a-chip devices due to their mechanical compliance and chemical inertness. Ceramic and metal MEMS remain indispensable for high-temperature and harsh-environment sensing, while silicon continues to be the dominant substrate for its mature fabrication ecosystem and electrical performance.

End-use segmentation illustrates six principal vertical markets: aerospace and defense; automotive; consumer electronics; healthcare; industrial; and IT and telecommunications. In automotive, MEMS are critical for both commercial vehicles and passenger cars, supporting advanced driver-assistance systems and powertrain management. Consumer electronics deployments span smartphones, tablets, and wearables, where inertial and pressure sensors deliver user interface and health-tracking capabilities. Distribution channels range from direct sales, often for high-mix customized solutions, to established global distributor networks that service broad component demand.

This comprehensive research report categorizes the Micro-Electro-Mechanical System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Fabrication Material

- End User

- Distribution Channel

Assessing Regional Dynamics and Growth Drivers Shaping MEMS Markets Across the Americas, Europe, Middle East and Africa, and Asia-Pacific Regions

Regional dynamics in the MEMS market are defined by distinct innovation ecosystems, manufacturing infrastructures, and regulatory environments. In the Americas, a robust semiconductor R&D base and government incentives for onshore fabrications have bolstered domestic MEMS capacity. This environment supports high-value applications in aerospace, defense, and specialized medical devices. North American MEMS clusters benefit from proximity to key end-use OEMs and a deep talent pool in microelectronics and microfabrication engineering.

Europe, Middle East, and Africa (EMEA) present a heterogeneous landscape characterized by strong automotive and industrial automation demand in Western Europe, complemented by emerging consumer electronics and healthcare opportunities in the Middle East. The region’s emphasis on Industry 4.0 and regulatory standards for automotive safety has accelerated the qualification cycles for inertial and pressure sensor technologies. Additionally, EMEA governments are increasingly funding collaborative research initiatives to advance piezoelectric and microfluidic MEMS capabilities.

Asia-Pacific stands out as both the largest production hub and fastest-growing market segment, driven by extensive consumer-electronics manufacturing in China, South Korea, and Taiwan, as well as rapidly expanding 5G infrastructure across Southeast Asia. These factors have positioned the region at the forefront of MEMS adoption, with local foundries scaling capacity to serve global OEM demand and domestic 5G network roll-outs. The region’s dynamic ecosystem continues to attract investment in next-generation MEMS technologies.

This comprehensive research report examines key regions that drive the evolution of the Micro-Electro-Mechanical System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading MEMS Industry Players and Their Strategic Initiatives That Define Competitive Positioning and Technology Leadership in the Ecosystem

A review of leading MEMS providers reveals diverse strategic approaches to innovation, capacity expansion, and market positioning. Bosch has sustained its leadership by leveraging integrated 200 mm and 300 mm fabs to supply high-volume automotive and consumer electronics segments, while concurrently advancing haptic actuator research. Broadcom continues to strengthen its inertial sensor portfolio through targeted acquisitions and deep integration of sensor fusion software, catering to both mobile and industrial IoT platforms.

STMicroelectronics has differentiated itself through multi-fab investments in Europe and strategic partnerships with research institutions, focusing on advanced piezoelectric materials for actuator and RF applications. Similarly, TDK’s acquisition of InvenSense has expanded its footprint in mass-market inertial sensors and optimized its distribution reach across Asia-Pacific. Niche specialists are also emerging, such as Rogue Valley Microdevices in the U.S., which offers low-volume, high-mix runs on 300 mm wafers with ISO-13485 certification for medical MEMS.

Competitive moats are increasingly shaped by bundled firmware and algorithm solutions that accelerate time-to-market for OEMs. Companies investing in edge-AI sensor fusion and adaptive calibration routines are raising switching costs and setting new performance benchmarks. Collectively, these strategies underscore the importance of integrated supply-chain control, IP portfolio depth, and software-hardware co-design in sustaining MEMS leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Micro-Electro-Mechanical System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACEINNA, Inc.

- Analog Devices, Inc.

- Angst+Pfister Sensors & Power AG

- ASC GmbH

- DJB Instruments (UK) Ltd.

- EMCORE Corporation

- FormFactor, Inc.

- Genesys Aerosystems by Moog Inc.

- Hamamatsu Photonics K.K.

- Honeywell International Inc.

- Inertial Labs, Inc.

- Infineon Technologies AG

- KIONIX, Inc., by ROHM Co., Ltd.

- Knowles Electronics by Dover Corporation

- Merit Medical Systems, Inc.

- NXP Semiconductors N.V.

- Panasonic Corporation

- Qorvo Inc.

- Quartet Mechanics, Inc.

- Robert Bosch GmbH

- Safran S.A.

- Seiko Epson Corporation

- STMicroelectronics International N.V.

- TDK Corporation

- TE Connectivity Ltd.

Delivering Actionable Strategies for MEMS Industry Leaders to Navigate Disruption, Optimize Supply Chains and Capitalize on Emerging Technology Opportunities

Industry leaders must adopt multifaceted strategies to navigate the evolving MEMS landscape. First, expanding domestic and near-shore fabrication capacity will be critical for mitigating tariff risks and supply-chain disruptions. By investing in flexible manufacturing lines with rapid changeover capability, companies can respond to shifting trade policies and customer requirements with greater agility.

Second, integrating AI-driven data analytics directly onto MEMS devices can unlock new value in predictive maintenance, condition monitoring, and adaptive control. Firms should prioritize development partnerships that marry sensor hardware with edge-AI frameworks, enabling differentiated offerings in automation, automotive safety, and smart infrastructure.

Third, deepening collaboration with materials science research institutions will accelerate the commercialization of next-generation polymer and piezoelectric MEMS. Joint development agreements and shared pilot lines can reduce time to market for novel device architectures, while ensuring performance validation under real-world environmental stresses.

Lastly, companies should enhance their software and services portfolios by embedding firmware, calibration tools, and analytics dashboards into core MEMS solutions. This bundling approach not only raises customer switching costs but also generates recurring revenue streams and strengthens long-term relationships with OEMs across diverse end-use industries.

Explaining the Rigorous Research Methodology Employed to Generate Robust MEMS Market Analysis Through Data Triangulation and Primary Expert Engagement

The research methodology for this executive summary rests on a rigorous, multi-pronged approach designed to ensure both depth and accuracy. Our process began with extensive secondary research, drawing upon peer-reviewed journals, patent databases, and reputable industry publications to map out technological trajectories and competitive landscapes in MEMS design and fabrication.

Complementing this groundwork, we conducted primary interviews with over twenty subject-matter experts, including senior R&D engineers, supply-chain managers, and end-use OEM executives. These discussions provided first-hand insights into material performance challenges, tariff mitigation tactics, and emerging application requirements, enriching our understanding of real-world deployment dynamics.

Data triangulation played a central role in validating findings. We cross-referenced public company filings, customs duty notices, and trade-association reports to accurately capture the impact of U.S. tariff policies and regional production shifts. Lastly, analytical modeling tools were employed to synthesize qualitative insights and highlight strategic imperatives, ensuring that recommendations are grounded in empirically robust evidence and reflective of current industry conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Micro-Electro-Mechanical System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Micro-Electro-Mechanical System Market, by Device Type

- Micro-Electro-Mechanical System Market, by Fabrication Material

- Micro-Electro-Mechanical System Market, by End User

- Micro-Electro-Mechanical System Market, by Distribution Channel

- Micro-Electro-Mechanical System Market, by Region

- Micro-Electro-Mechanical System Market, by Group

- Micro-Electro-Mechanical System Market, by Country

- United States Micro-Electro-Mechanical System Market

- China Micro-Electro-Mechanical System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Summarizing Key Findings and Strategic Imperatives from the MEMS Industry Analysis to Guide Decision Makers in a Rapidly Evolving Technological Ecosystem

In conclusion, MEMS technology stands at a transformative inflection point, driven by advances in AI integration, next-generation materials, and evolving trade policies. The integration of edge-AI capabilities into MEMS devices is enabling more intelligent and autonomous system architectures, while material innovations are expanding the frontiers of performance and application diversity. However, U.S. tariff measures in 2025 have underscored the need for agile supply-chain strategies and localized manufacturing investments to preserve competitiveness and manage cost exposure.

Segmentation analysis reveals opportunities across device types-from electrostatic actuators to pressure and optical sensors-as well as in polymer-based flexible MEMS. Regional insights highlight distinct growth drivers, from aerospace applications in the Americas to industrial automation in EMEA and consumer-electronics scale in the Asia-Pacific. Leading companies continue to differentiate through integrated fab networks, software-hardware co-design, and strategic M&A, setting the stage for sustained innovation.

By synthesizing these findings, this executive summary offers decision makers a clear view of the strategic landscape. Stakeholders should prioritize resilient supply-chain architectures, pursue collaborative materials research, and embed analytics and AI within MEMS solutions. These imperatives will ensure that organizations not only navigate current disruptions but also capture the full potential of MEMS technologies in an increasingly connected and automated world.

Secure Your Comprehensive MEMS Market Research Report by Connecting with Ketan Rohom, Associate Director of Sales and Marketing, to Unlock In-Depth Industry Insights

To access the full depth of our micro-electro-mechanical systems market intelligence, reach out today. Ketan Rohom, Associate Director of Sales and Marketing, is available to guide your acquisition and ensure you receive the comprehensive insights needed to drive informed decisions. Connect directly with him to secure your copy of the detailed report and unlock tailored analysis on technology trends, supply-chain impacts, and strategic opportunities across the MEMS landscape.

- How big is the Micro-Electro-Mechanical System Market?

- What is the Micro-Electro-Mechanical System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?