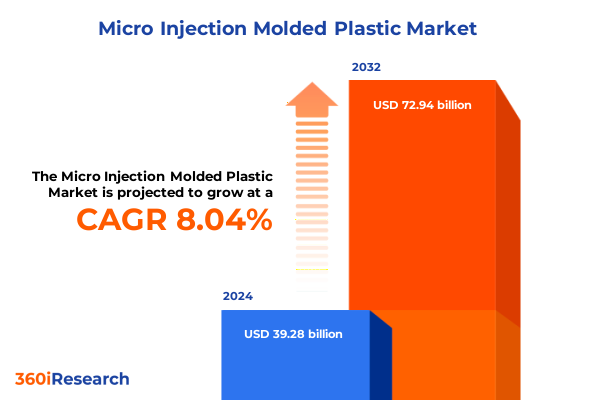

The Micro Injection Molded Plastic Market size was estimated at USD 1.61 billion in 2025 and expected to reach USD 1.79 billion in 2026, at a CAGR of 11.53% to reach USD 3.46 billion by 2032.

Unlocking the Growing Potential of Micro Injection Molded Plastics Through Innovation, Precision Engineering, and Strategic Market Dynamics

Micro injection molded plastics have become indispensable for producing miniature components with microscopic precision across critical sectors such as medical devices, advanced electronics, and wearable technologies. The convergence of ultra-precise tooling materials and next-generation process controls now enables manufacturers to replicate complex microstructures with micron-level tolerances. This capability is crucial for fabricating microfluidic lab-on-a-chip devices, high-density electrical connectors, and intricately detailed sensor assemblies, ensuring consistent performance and reliability in applications where even the smallest deviation can compromise functionality.

The pursuit of sustainability and operational efficiency has further reshaped equipment choices, with electric and hybrid micro molding machines now reducing energy consumption by over half compared to traditional hydraulic presses. Concurrently, the integration of recycled and bio-based resins aligns production workflows with circular economy principles, satisfying stringent environmental regulations while appealing to eco-conscious end users. These advances not only lower energy and material costs but also reinforce brand reputations for environmental stewardship in increasingly competitive markets.

Navigating the Transformative Shifts Redefining Micro Injection Molded Plastics From Material Innovation to Advanced Automation Integration

The micro injection molding landscape is witnessing a surge in smart process optimization powered by artificial intelligence, enabling machines to autonomously refine injection speed, pressure, and cooling profiles through data-driven algorithms to minimize cycle times and scrap yields. Concurrently, the adoption of advanced mold architectures, including conformal cooling channels fabricated via 3D printing, has introduced unprecedented thermal management control, accelerating production while preserving dimensional fidelity in complex microstructures. These breakthroughs underscore the transformative potential of embedding digital intelligence within every stage of mold design and process execution.

The integration of digital twin frameworks into micro injection molding operations now enables virtual replication of the mold and machine interplay, providing a continuous simulation environment that predicts warpage, tracks tool wear to schedule maintenance, and adjusts process settings in real time before deviations manifest. Simultaneously, the proliferation of connected sensors and Industry 4.0 platforms has ushered in predictive maintenance regimes and remote monitoring capabilities, empowering operators to detect anomalies, optimize throughput, and maintain stringent quality standards across distributed production facilities.

Assessing the Cumulative Impact of 2025 United States Tariff Policies on Micro Injection Molded Plastic Supply Chains and Cost Structures

The imposition of 25 percent levies on steel and aluminum imports under Section 232, effective March 12, 2025, eliminated prior exemptions for multiple trading partners and directly increased the cost base for mold fabrication. Simultaneously, the enforcement of Section 301 tariffs, also set at 25 percent on many Chinese-manufactured injection molds, intensified pressures on producers reliant on offshore tooling, prompting a recalibration of procurement strategies and cost-plus pricing models to safeguard margins.

In early 2025, the U.S. government further invoked the International Emergency Economic Powers Act to impose a 10 percent tariff on imports from China, alongside 25 percent duties on goods from Canada and Mexico, creating layered trade barriers that affected a broad range of plastic products and raw materials. This policy shift, which took effect in March, spurred both temporary delays as stakeholders sought exemptions and a strategic redirection of sourcing to more tariff-friendly jurisdictions. Meanwhile, China’s anti-dumping duties of up to 74.9 percent on POM copolymers, announced in January and finalized in May 2025, introduced additional complexity for exporters targeting global supply chains, underlining the global nature of tariff-induced dislocations.

Revealing Critical Segmentation Insights that Illuminate Application, Material, Industry, Equipment and Process Dynamics in Micro Injection Molding

The analysis of market segmentation reveals the diverse application environments and evolving material preferences that define the competitive micro injection molding arena. Across end-use applications, components for automotive powertrain systems, electrical safety devices, and advanced driver-assistance sensors demand micro-scale precision, while consumer electronics segments-spanning wearables, personal care gadgets, and household appliance interfaces-require high-performance polymers processed with exacting surface‐finish standards. Within the electronics domain, connector housings and sensor modules leverage ultra-fine gate designs to achieve integral part geometries, whereas industrial automation equipment calls for robust material choices that balance thermal stability with cycle efficiency. In the medical field, sub-millimeter implantable devices, dental surgical guides, and diagnostic microchips rely on biocompatible resins molded under rigorously controlled cleanroom conditions. Packaging applications utilize microcaps and precision containers to meet the stringent demands of pharmaceuticals, and telecommunications hardware features micro-molded handsets and network switching components engineered for high-frequency signal integrity.

From a materials perspective, micro injection molding operations encompass engineering resins such as ABS, nylon, polycarbonate, polyethylene, polypropylene, and POM, each selected based on stiffness, chemical resistance, or electrical isolation requirements. Variations in machine architectures-from all-electric systems preferred for methylene chloride‐sensitive medical components to hybrid presses balancing speed and energy consumption-illustrate the link between equipment choice and process optimization goals. Likewise, specialized molding approaches including insert molding for overmolded sensor assemblies, two-shot molding for multi-color user interfaces, and thin-wall techniques for lightweight housings underscore the technical breadth embodied by modern micro molding processes. At the tooling level, the adoption of multi-cavity and family molds enhances production efficiency for high-volume micro parts, while single-cavity and stack mold designs support rapid prototyping and low-volume validation runs. This multidimensional segmentation framework illuminates the technical and commercial contours that manufacturers must navigate to align product capabilities with evolving customer requirements.

This comprehensive research report categorizes the Micro Injection Molded Plastic market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Material Type

- End User Industry

- Machine Type

- Molding Process

- Mold Type

Unpacking Key Regional Dynamics and Growth Drivers Across the Americas Europe Middle East Africa and Asia Pacific in Micro Injection Molding

Regional dynamics in micro injection molded plastics exhibit distinct drivers and constraints that shape adoption and investment patterns. In the Americas, technological leadership in medical device manufacturing and consumer electronics supports demand for micro components, while nearshoring trends accelerate facility expansion in North America to mitigate tariff exposure and optimize time-to-market for high-value applications. European, Middle East, and African markets benefit from stringent environmental and safety regulations that reinforce uptake of bio-based and recycled resins, with Germany and the Nordics spearheading initiatives for energy-efficient electric molding press utilization. At the same time, compliance requirements around circular economy mandates in EMEA have accelerated the integration of closed-loop material recovery practices across production networks.

In the Asia-Pacific region, established micro molding hubs in Japan, South Korea, and Taiwan continue to drive innovation in ultra-high precision tooling and advanced polymer formulations, while emerging manufacturing centers in Southeast Asia leverage low labor costs and favorable trade agreements to attract capacity investments. China’s evolving trade policies and domestic subsidy programs for advanced manufacturing equipment have propelled local machine tool advancements, though recent anti-dumping measures underscore the geopolitical complexities that companies must navigate. Moreover, the Asia-Pacific Economic Cooperation (APEC) dialogues on systemic trade challenges highlight the need for agile supply chain strategies and regional collaboration to maintain resilient access to both raw materials and micro molding technology expertise.

This comprehensive research report examines key regions that drive the evolution of the Micro Injection Molded Plastic market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Players Driving Innovation Operational Excellence and Strategic Growth in Micro Injection Molded Plastics

The competitive landscape of micro injection molded plastics features a blend of global machinery manufacturers, specialized mold makers, and resin suppliers, each contributing to the ecosystem of innovation and service excellence. Industry-leading equipment suppliers such as Arburg and Engel consistently introduce all-electric and hybrid micro molding platforms with advanced servo-driven injection units and closed-loop sensors that deliver sub-micron accuracy. Complementing these offerings, regional mold tool experts in Germany and Japan harness ultra-precision micro machining and laser texturing to fabricate inserts capable of replicating features measured in microns. Resin producers continue to diversify formulations, with key players expanding bio-based PEEK and reinforced polycarbonate grades tailored for micro applications in medical and electronics sectors.

Additionally, rapid adaptation to smart factory requirements has positioned select contract manufacturers at the forefront of Industry 4.0 adoption, deploying real-time monitoring systems and robotic part handling solutions that minimize manual intervention in cleanroom environments. Collaboration between mold tool vendors and automation integrators has yielded turnkey micro molding cells capable of unattended operation, reflecting a strategic shift toward modular, scale-up architectures that enable fast response to emerging demand. This confluence of advanced machinery, specialized tooling expertise, and material innovation underscores the synergistic partnerships that define leadership in the micro injection molding domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Micro Injection Molded Plastic market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accu‑Mold LLC

- BMP Medical Ltd

- Isometric Micro Molding Inc

- Knightsbridge Plastics Inc

- Makuta Micro Molding Inc

- Microdyne Plastics Inc

- Microsystems UK Ltd

- Mikrotech LLC

- MTD Micro Molding Inc

- Paragon Medical Inc

- Polymermedics Ltd

- Precimold Inc

- Rapidwerks Inc

- SeaskyMedical Co Ltd

- SMC Ltd

- Sovrin Plastics Ltd

- Stack Plastics Inc

- Stamm AG

- Starlim Spritzguss GmbH

- Yomura Technologies Co Ltd

Crafting Actionable Strategic Recommendations for Industry Leaders to Enhance Competitiveness and Drive Sustainable Growth in Micro Injection Molding

To thrive amid rapid technological change and evolving trade environments, micro injection molding industry leaders should pursue a multifaceted approach that balances innovation, supply chain resilience, and customer alignment. First, investing in material science partnerships can accelerate the qualification of high-performance and sustainable polymers, enabling the development of next-generation micro components with enhanced mechanical, thermal, and biocompatibility profiles. Second, expanding nearshore and regional manufacturing footprints will mitigate the risks of tariff fluctuations while reducing lead times for time-critical applications in medical and telecommunications sectors.

Furthermore, integrating digital twin and AI-driven analytics into core production workflows will optimize cycle times, lower scrap rates, and facilitate proactive maintenance scheduling, thereby maximizing equipment utilization. At the same time, cultivating strategic alliances with automation and IoT specialists can streamline the deployment of robotics and sensor networks, fostering scalable, lights-out production cells. Finally, fostering a culture of continuous improvement through cross-functional training and data-centric decision-making will empower organizations to respond swiftly to customer demands and maintain competitive differentiation.

Detailing a Robust Research Methodology Centered on Triangulation Data Integrity and Comprehensive Analysis for Micro Injection Molded Plastics

This comprehensive research entailed a rigorous methodology combining exhaustive secondary research, structured primary interviews, and robust data validation to ensure integrity and accuracy. The initial phase involved collating industry filings, patent registries, and technical white papers to map the technological and regulatory contours of micro injection molding. Subsequently, in-depth interviews with equipment manufacturers, mold tool engineers, and resin suppliers validated technological trends and procurement practices, providing real-world perspectives on capacity expansion and process optimization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Micro Injection Molded Plastic market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Micro Injection Molded Plastic Market, by Application

- Micro Injection Molded Plastic Market, by Material Type

- Micro Injection Molded Plastic Market, by End User Industry

- Micro Injection Molded Plastic Market, by Machine Type

- Micro Injection Molded Plastic Market, by Molding Process

- Micro Injection Molded Plastic Market, by Mold Type

- Micro Injection Molded Plastic Market, by Region

- Micro Injection Molded Plastic Market, by Group

- Micro Injection Molded Plastic Market, by Country

- United States Micro Injection Molded Plastic Market

- China Micro Injection Molded Plastic Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Concluding Synthesis Emphasizing Strategic Imperatives Opportunities and Resilience in the Competitive Micro Injection Molded Plastics Environment

The confluence of precision engineering, material innovation, and digital transformation in micro injection molded plastics has created a dynamic environment ripe with opportunity and complexity. Leaders who leverage advanced molding technologies, navigate evolving tariff frameworks with strategic sourcing, and embed data-driven quality controls will be best positioned to deliver differentiated micro components that meet the exacting demands of medical, electronics, and aerospace applications. As regional market dynamics continue to evolve, the ability to pivot manufacturing strategies and embrace sustainability mandates will determine long-term resilience. Ultimately, the companies that harmonize technical excellence with agile supply chain management will set the benchmark for performance and growth in the rapidly advancing micro injection molding landscape.

Engage with Associate Director Ketan Rohom to Access In-Depth Micro Injection Molded Plastics Market Intelligence and Drive Strategic Decision Making

To explore the unparalleled depth and actionable insights offered in this comprehensive research report on Micro Injection Molded Plastics, connect with Ketan Rohom, Associate Director of Sales & Marketing. Engage directly to discuss how this report’s advanced analyses of material innovations, supply chain dynamics, and competitive benchmarks can equip your organization with the strategic intelligence needed to outpace rivals. Whether your focus is on optimizing production efficiency, navigating complex tariff landscapes, or refining product development roadmaps, Ketan will tailor recommendations to your unique objectives. Initiate a conversation today to unlock tailored guidance, schedule a personalized briefing, and secure your access to the data-driven frameworks that will drive your next wave of growth.

- How big is the Micro Injection Molded Plastic Market?

- What is the Micro Injection Molded Plastic Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?