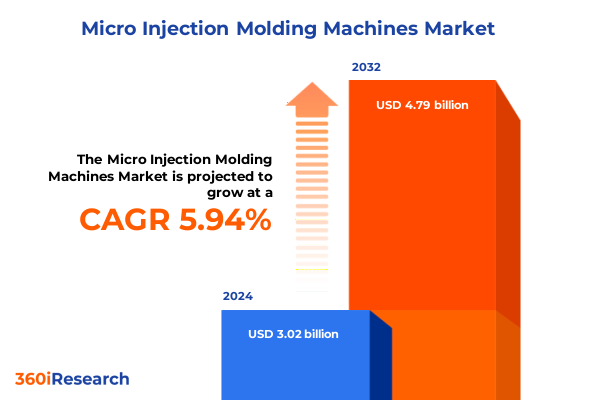

The Micro Injection Molding Machines Market size was estimated at USD 3.02 billion in 2024 and expected to reach USD 3.19 billion in 2025, at a CAGR of 5.94% to reach USD 4.79 billion by 2032.

A concise strategic framing of how micro injection molding has become indispensable for precision miniaturization across regulated and high‑performance industries

The micro injection molding domain has evolved from a niche prototype technique into a critical manufacturing capability for industries that demand extreme precision, functional miniaturization, and reproducible quality at scale. Engineers and product leaders now turn to micro injection processes to manufacture components that weigh fractions of a gram yet perform mission‑critical functions inside medical devices, optical systems, and microelectromechanical assemblies. As a result, machine builders, mold designers, material specialists, and contract manufacturers are aligning around a shared objective: convert micron‑level accuracy into repeatable production economics while preserving regulatory and biomedical compliance where applicable.

This convergence of precision engineering and scalable manufacturing is driven by three interlocking forces. First, product architectures increasingly embed sensing, connectivity, and fluidics at scales that demand specialized injection systems and mold engineering. Second, material science advances - particularly in elastomers and specialty thermoplastics - are expanding the palette of usable polymers for microscopic geometries. Third, factory automation and process control have matured to the point where consistent production of micro parts no longer depends solely on operator skill but can be sustained through deterministic machine performance and in‑line quality feedback. Together these dynamics make micro injection molding a strategic enabler for companies seeking to shrink form factors, consolidate assemblies, and reduce part counts without compromising function.

How Industry 4.0 integration and advanced materials convergence are driving reproducible micro part manufacturing and elevating supplier qualification standards

The landscape for micro injection molding is being reshaped by technological and materials breakthroughs that are transforming both what can be produced and how production is organized. Additive advances in mold fabrication, tighter cavity pressure control, and closed‑loop process monitoring are converting once‑specialized setups into reproducible manufacturing cells. In parallel, increased adoption of low‑viscosity elastomers and engineering biopolymers allow designers to create thinner walls, finer features, and multi‑material assemblies that were previously impractical.

Industry 4.0 practices are accelerating this change by embedding sensors, edge analytics, and predictive maintenance into molding cells. Manufacturers are leveraging real‑time data to reduce scrap, stabilize cycle variability, and automate corrective adjustments that keep micron tolerances within specification. This integration of digital process control with advanced materials is enabling manufacturers to shift from bespoke prototyping runs to validated production with full traceability and digital records suitable for regulated sectors. These developments are altering customer expectations as procurement teams increasingly evaluate suppliers on their ability to deliver validated micro parts with demonstrable process control and material provenance, rather than on price alone.

An analysis of how late 2024 and early 2025 tariff modifications have altered procurement planning and prompted strategic sourcing shifts across precision manufacturing supply chains

Policy decisions and tariff adjustments implemented in recent review cycles have introduced a new degree of import cost uncertainty that affects capital equipment sourcing, tooling imports, and components for micro molding systems. Regulatory changes announced by trade authorities in late 2024 and implemented across 2024–2025 adjusted Section 301 tariff schedules and reclassified several strategic product groups, creating immediate cost implications for certain imported machinery and semiconductor‑related inputs. These policy shifts have compelled purchasing teams to re‑examine supplier portfolios, accelerate domestic sourcing where feasible, and to model multi‑scenario procurement strategies that account for phased tariff increases and potential exclusions processes. The U.S. Trade Representative finalized modifications to Section 301 actions that took effect in late 2024 and included staged increases with additional measures becoming effective on January 1, 2025, affecting a range of strategic sectors and HTS classifications.

In practice, the tariff environment has pushed three parallel adjustments among manufacturing stakeholders. Equipment buyers are prioritizing vendors with regional manufacturing footprints or documented eligibility for tariff exclusions. Moldmakers and tool suppliers are accelerating local capacity upgrades to reduce cross‑border tool shipments and lead‑time risk. Finally, product teams are increasingly exploring design changes that reduce reliance on tariff‑sensitive imported subassemblies and critical semiconductor‑grade inputs. These operational reactions are not merely short‑term mitigations; they are reshaping sourcing playbooks and capital allocation decisions across engineering and procurement functions.

Technical segmentation insights showing how machine selection, material choices, and cell architecture jointly determine manufacturability and supplier suitability for micro injection projects

Segmentation insight demonstrates that micro injection molding is not a single monolithic market but a matrix of technical choices and application demands that drive machine selection, material strategy, and factory configuration. Clamping force ranges guide whether a buyer opts for ultra‑compact, low‑tonnage platforms for delicate micro cavities or moves to higher clamping capacities when multi‑cavity tooling and overmolding require added mechanical stability. Machine type decisions hinge on throughput requirements and process sensitivity: all‑electric platforms deliver precision and energy efficiency for repeatable microscale shots while hydraulic or hybrid systems remain attractive where force density or legacy tooling compatibility is paramount.

Material choices define product performance and regulatory pathways. Elastomers and liquid silicone rubber address sealing, biocompatibility, and sterilization needs in medical and wearable products, whereas thermoplastics such as polycarbonate and polypropylene balance structural performance, optical properties, and cost for connectors, housings and micro gears. Biopolymers are emerging where sustainability criteria intersect with non‑implantable applications, offering design teams the ability to meet brand and regulatory expectations for circularity while requiring upfront process development to manage variability. Orientation and automation levels determine how cells are laid out and what ancillary equipment is required; vertical machines can reduce floor footprint in certain mold designs while fully automatic cells embed part handling, inspection and secondary operations to support high mix, low volume production. Shot‑size and cavitation strategy further refine supplier selection: machines and molds that can reliably meter and inject micro‑gram shot weights with consistent repeatability are essential when tolerances are tight and scrap is costly.

Finally, application and user type overlay this technical matrix with commercial behavior. Medical and electronics customers demand validated processes and traceability, making contract manufacturers and specialized in‑house molders the preferred partners for scale‑up. Automotive and consumer segments prize integration with assembly lines and cost efficiency, which often drives different tradeoffs in machine selection and mold design. Understanding this interplay of clamping force, machine type, material portfolio, orientation, automation level, shot size, cavitation strategy, application, and user type is foundational to configuring equipment purchases and supplier evaluations that meet both technical and commercial objectives.

This comprehensive research report categorizes the Micro Injection Molding Machines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Clamping Force

- Machine Type

- Process Material

- Orientation

- Automation Level

- Shot Size

- Mold Cavitation

- Application

- User Type

Assessment of how Americas nearshoring, EMEA regulatory pressures, and Asia‑Pacific manufacturing density are reshaping supply chain design for micro molding stakeholders

Regional dynamics continue to exert a strong influence on capital allocation, supplier selection, and time‑to‑market strategies for manufacturers of micro components. In the Americas, a combination of nearshoring momentum and investments in automation has encouraged manufacturers to expand local capacity for high‑precision molding, particularly for medical devices and automotive subsystems where proximity to OEMs shortens validation cycles and improves intellectual property control. This shift is reflected in rising interest in local toolmaking and greater willingness to accept slightly higher unit production costs in exchange for lead‑time reduction and supply assurance. Several industry observers have documented a measurable increase in onshore and nearshore manufacturing initiatives that prioritize resilient regional supply chains.

Europe, the Middle East and Africa present a different calculus. Regulatory pressure around recyclability, extended producer responsibility, and single‑use plastics has pushed manufacturers to emphasize recyclable thermoplastics, takeback programs, and documented material provenance. At the same time, European OEMs continue to invest in automation and advanced process control to maintain competitiveness while meeting sustainability mandates. Asia‑Pacific remains the global hub for volume tooling, component ecosystems, and specialized machine builders, and will continue to be a critical partner for companies seeking cost competitive tooling and access to a dense supplier network. However, buyers increasingly blend Asia‑Pacific sourcing with regional production nodes to balance cost and speed and to mitigate geopolitical and tariff risks.

This comprehensive research report examines key regions that drive the evolution of the Micro Injection Molding Machines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How equipment makers, molders, and contract manufacturers are evolving into integrated solution providers to deliver validated micro manufacturing outcomes

Competitive dynamics in micro injection molding are shifting from purely equipment sales to outcome‑based partnerships that combine machine performance with services, process validation, and material expertise. Machine manufacturers are extending warranties and embedding service agreements that include predictive maintenance and digital twins to reduce buyer risk and demonstrate lifecycle value. Mold houses and tool designers are integrating upfront simulation and sensorized cavity monitoring into their offerings so that customers receive production‑ready tools with proven process windows rather than basic cavities requiring extended tuning.

Contract manufacturers and specialized medical molders are differentiating through cleanroom capabilities, traceable material sourcing, and multi‑disciplinary teams that combine mold design, materials science, and regulatory support. Strategic collaborations between equipment builders, resin suppliers, and precision molders accelerate time‑to‑validation for new device launches and help manage the material transition to low‑viscosity elastomers and biopolymer blends. As a result, buyers are increasingly evaluating vendors on their ability to deliver demonstrable process reproducibility, supply continuity, and end‑to‑end validation services rather than on simple equipment price alone.

This comprehensive research report delivers an in-depth overview of the principal market players in the Micro Injection Molding Machines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALVIN Group

- ANN TONG INDUSTRIAL CO., LTD

- ARBURG GmbH + Co KG

- Biplas Medical Ltd

- BOY Machines, Inc.

- Dalal Plastics Pvt Ltd.

- ELECTRONICA PLASTIC MACHINES PVT LTD

- ENGEL Holding GmbH

- FANUC Corporation

- Guangdong Yizumi Holdings Co., Ltd.

- Hansemold GmbH

- Jiangsu Victor Machinery CO.,Ltd.

- KraussMaffei Technologies GmbH

- Makuta, Inc. by SANSYU Group

- Matrix Tool Inc.

- MicroMolder by Shopbotix LLC

- Milacron, LLC

- MTD Micro Molding

- Ningbo Moiron Machinery Co.,Ltd.

- Ningbo Shuangsheng Plastic Machinery Co., Ltd.

- Nissha Co. Ltd.

- Otto Männer GmbH by Barnes Group Inc.

- Polymermedics Ltd

- QNES Global Co.

- Rambaldi Group

- Rapidwerks, Inc.

- Regloplas AG

- SeaskyMedical

- Seiko Epson Corporation

- Shibaura Machine CO., LTD

- SMC Ltd

- Sodick Co., Ltd.

- Sovrin Plastics Ltd.

- Sumitomo Corporation

- The Japan Steel Works, LTD.

- Tung Yu Hydraulic Machinery Co., Ltd.

- Welltec Machinery Limited

- Westfall Technik, LLC

- Wittmann Battenfeld GmbH

Practical prioritized actions for executives to secure supply continuity, accelerate qualification, and reduce production risk for micro component programs

Industry leaders should prioritize a few immediate, actionable moves to convert uncertainty into competitive advantage. First, invest in process control instrumentation and data infrastructure that capture cavity pressure, melt temperature, and cycle‑level KPIs to shorten qualification cycles and reduce scrap during scale‑up. Second, build supplier scorecards that include tariff‑sensitivity, regional footprint, and documented lead‑time performance so procurement can execute rapid reallocation of orders if policy or logistics conditions change.

Third, create a staged material transition plan that pilots biopolymers and LSR in non‑critical applications while preserving validated thermoplastics for regulated components; this approach balances sustainability objectives with risk control. Fourth, structure commercial agreements with equipment and service providers that include performance SLAs, spare parts availability clauses, and access to remote diagnostics; such terms materially reduce downtime risk associated with complex micro tooling. Finally, accelerate cross‑functional capability building by combining design, process engineering, and quality teams early in product development to ensure that micro geometries are manufacturable and that validation timelines are realistic. Executing these steps will help leaders convert policy, materials, and technology disruption into defensible operational improvements and faster product launches.

Research methodology that integrates primary factory observations, supplier interviews, and tariff scenario modeling to produce operationally actionable insights

This research synthesizes primary interviews, hands‑on process observations, and a structured secondary intelligence program to ensure that recommendations are grounded in operational reality. Primary inputs include in‑depth interviews with machine builders, contract manufacturers, mold shops, and material producers, combined with on‑floor visits to production cells to observe process control implementations and automation architectures. Secondary research draws on trade publications, regulatory notices, and policy briefings to map tariff changes and regional manufacturing initiatives.

Analytical methods applied to the collected data include qualitative segmentation mapping, supplier capability scoring, and scenario modeling for tariff sensitivity. Process validation case studies were reviewed to identify best practices for shot control, cavity monitoring, and material handling of low‑viscosity elastomers. Wherever possible, triangulation across supplier interviews, machine specifications, and material data sheets was used to validate claims about reproducibility and production readiness. This multi‑method approach ensures that the insights and recommendations are operationally actionable and aligned to the needs of both engineering and commercial teams.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Micro Injection Molding Machines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Micro Injection Molding Machines Market, by Clamping Force

- Micro Injection Molding Machines Market, by Machine Type

- Micro Injection Molding Machines Market, by Process Material

- Micro Injection Molding Machines Market, by Orientation

- Micro Injection Molding Machines Market, by Automation Level

- Micro Injection Molding Machines Market, by Shot Size

- Micro Injection Molding Machines Market, by Mold Cavitation

- Micro Injection Molding Machines Market, by Application

- Micro Injection Molding Machines Market, by User Type

- Micro Injection Molding Machines Market, by Region

- Micro Injection Molding Machines Market, by Group

- Micro Injection Molding Machines Market, by Country

- United States Micro Injection Molding Machines Market

- China Micro Injection Molding Machines Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 3021 ]

Concluding synthesis emphasizing the strategic importance of process integration, material strategy, and regional supply resilience in micro injection molding

Micro injection molding has transitioned from a specialized prototyping capability into a strategic production discipline that enables miniaturization, functional consolidation, and new product architectures across medical, electronics, automotive, and consumer applications. The interplay of advanced materials, tighter process control, and regional sourcing decisions means that success depends less on single equipment attributes and more on an integrated supplier ecosystem that delivers validated reproducibility, supply resilience, and regulatory compliance.

Looking ahead, leaders who invest in digitized process control, diversify regional sourcing with attention to tariff exposure, and pilot material transitions under a controlled validation framework will be better positioned to convert technological and policy disruption into durable competitive advantages. The capability to manufacture micro parts at scale with predictable quality will increasingly become a deciding factor in product design choices and supplier selection.

Request a tailored enterprise license and interactive data access from Ketan Rohom to unlock actionable insights and commercialize precision micro injection molding initiatives

To obtain a full, enterprise-grade market research report that includes detailed segmentation matrices, supplier landscapes, trade-impact modeling, and custom regional annexes, contact Ketan Rohom to request a proposal, secure immediate access options, and discuss an enterprise license tailored to your strategic priorities. The report is designed to support capital planning, procurement strategies, product launch roadmaps, and M&A diligence for stakeholders focused on micro injection molding across medical, electronics, automotive, and precision consumer goods segments.

Ketan will assist you in selecting the right data package, clarifying the scope of custom analyses (including tariff-sensitivity scenarios and material transition case studies), and arranging a demo of the interactive data workbook. Engage today to translate the strategic insights in this research into operational decisions, supplier evaluations, and investment priorities that reduce lead times, limit exposure to policy volatility, and accelerate time-to-market for next-generation micro components.

- How big is the Micro Injection Molding Machines Market?

- What is the Micro Injection Molding Machines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?