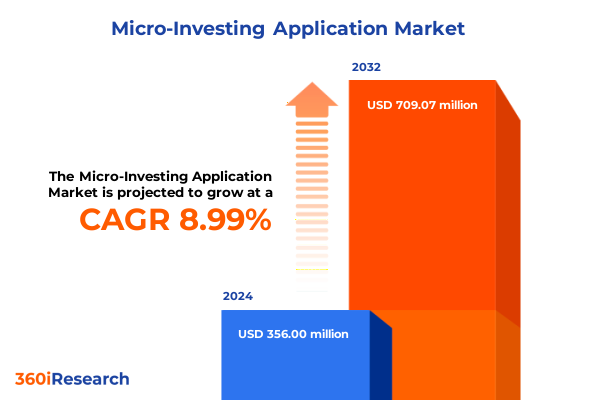

The Micro-Investing Application Market size was estimated at USD 389.11 million in 2025 and expected to reach USD 425.30 million in 2026, at a CAGR of 8.95% to reach USD 709.07 million by 2032.

Exploring how micro-investing platforms are redefining financial accessibility and empowering individuals to build wealth through fractional investing

Micro-investing has rapidly evolved from a niche offering into a mainstream pathway for individuals seeking to participate in financial markets without the traditional barriers of high capital requirements. By enabling investors to acquire fractional shares and diversified portfolios through intuitive digital interfaces, these applications are democratizing an asset class once reserved for affluent participants. The convergence of user-friendly mobile design, seamless onboarding processes, and real-time analytics has created unprecedented accessibility, allowing users to start investing with minimal amounts while receiving insights that were once the exclusive domain of professional advisors.

Consequently, the micro-investing sector has emerged as a vibrant ecosystem where technology and finance intersect to empower a new generation of investors. App developers continually innovate with customizable round-up features, automated recurring investments, and integrated educational content, fostering a habit of long-term saving and wealth accumulation. In turn, this has ignited a broader cultural shift, as financial wellness becomes an integral part of everyday life. As the industry matures, platforms that blend advanced data capabilities with emotional engagement will define the future of democratized investing.

Identifying the technological and behavioral transformations reshaping micro-investing dynamics and driving mass adoption across diverse investor cohorts

Over the past few years, the micro-investing landscape has been shaped by profound technological innovations that reimagined how users interact with financial markets. Advances in artificial intelligence and machine learning now enable hyper-personalized portfolio recommendations based on real-time spending habits and risk preferences. Similarly, the proliferation of open banking APIs has facilitated seamless integration with users’ existing financial infrastructure, creating an interconnected experience that merges daily transactions with investment opportunities. These transformative shifts have not only improved operational efficiency but also deepened user engagement, driving retention and fostering a sense of ownership over financial outcomes.

Meanwhile, behavioral shifts are reinforcing technology-driven progress. Growing financial literacy initiatives and gamification mechanics have encouraged novices to explore investing with confidence, while regulatory developments have balanced innovation with investor protection. As a result, community-focused features, such as social feed sharing and collaborative goal setting, have bridged the gap between individual ambitions and collective wisdom. Taken together, these developments signal a new era in micro-investing where technology, regulation, and user psychology converge to deliver both accessibility and meaningful financial growth.

Analyzing the layered economic consequences of the 2025 United States tariffs on consumer costs, corporate operations, and broader market stability

Recent analyses underscore that the cumulative effect of all 2025 U.S. tariffs has driven consumer price levels up by roughly 2.3 percent in the short term, translating to an average per household loss of $3,800 in purchasing power. This price inflation compounds existing global economic uncertainties, as broader trade tensions continue to challenge central bank independence and fiscal stability across major economies.

Sector-level studies reveal that manufacturing and mining industries face some of the highest effective average tariff rates, ranging between 18 and 22 percent under current proposals. Substantial proportions of firms within these sectors have already undertaken strategic adjustments: more than half of manufacturing CFOs report supply chain diversification efforts in anticipation of tariff escalation, while others accelerate capital investments to hedge against cost increases.

Despite these headwinds, financial markets have shown a degree of resilience, buoyed by robust corporate earnings in select industries. However, companies such as Stellantis and Philips have publicly acknowledged significant tariff-related cost hits-€1.5 billion and up to €200 million respectively-while Procter & Gamble’s margin pressures illustrate the cascading effect of input price rises. Analysts caution that import-dependent sectors like automotive and apparel could experience job reductions and dampened consumer spending if tariffs remain elevated, suggesting potential long-term distortions in market stability.

Uncovering deep segmentation perspectives that reveal how demographic and behavioral profiles influence micro-investment preferences and portfolio strategies

An in-depth segmentation framework reveals how demographic cohorts shape micro-investing behavior in distinctive ways. Baby Boomers often prioritize retirement-focused strategies and show steady engagement with advisor-assisted channels, whereas Millennials and Gen Z demonstrate a preference for self-directed platforms that offer social sharing capabilities and gamified experiences. Gen X occupies an intermediary space, balancing risk-adjusted portfolios with a desire for both automated and hybrid advisory solutions, illustrating the nuanced interplay between life stage and technology adoption.

Investor type further diversifies the landscape. Individual investors leveraging advisor-assisted or self-directed options contrast with institutional entities-such as financial institutions and retirement funds-that emphasize scale and compliance. Simultaneously, robo advisors, whether fully automated or hybrid, have carved out a unique niche by blending algorithmic precision with human oversight. This multi-layered segmentation underscores the importance of tailored user journeys aligned with each investor’s familiarity, capital base, and regulatory requirements.

Equally influential are strategic and account type considerations. Active strategies in bonds and stocks attract those seeking targeted alpha, while passive vehicles, including ETFs and index funds, appeal to cost-sensitive investors seeking broad market exposure. Thematic approaches-ranging from sustainable investing to technology-centric portfolios-cater to values-driven segments. Retirement accounts like 401(k)s, Roth IRAs, and Traditional IRAs coexist with taxable brokerage options, creating varied tax treatments and liquidity profiles that platforms must accommodate to optimize value delivery.

Finally, transaction patterns reveal behavioral nuances that inform platform design. One-time investors often rely on single transactions for milestone-based goals, whereas recurring investors exhibit higher lifetime engagement through daily, weekly, or monthly contributions. Recognizing these distinctions enables providers to create frictionless pathways for both opportunistic and disciplined investment styles.

This comprehensive research report categorizes the Micro-Investing Application market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Investor Type

- Transaction Frequency

- Account Type

- Investment Strategy

Examining regional micro-investing trends that highlight distinctive growth drivers, regulatory influences, and consumer behaviors in global markets

The micro-investing landscape in the Americas is characterized by mature fintech ecosystems and well-established regulatory frameworks, enabling rapid adoption of fractional share offerings. Users in North America particularly gravitate toward platforms that emphasize seamless integration with existing banking services, robust mobile experiences, and comprehensive customer support. Latin American markets, meanwhile, are experiencing accelerated growth as underserved populations leverage low barrier-to-entry models to access global equity and fixed-income instruments, often bypassing legacy institutional hurdles.

Across Europe, the Middle East, and Africa, regulatory diversity shapes market dynamics. The European Union’s harmonized digital finance regulations foster cross-border service provision, incentivizing platforms to develop multilingual, multi-currency interfaces. In contrast, markets in the Middle East and Africa balance burgeoning digital infrastructure with evolving compliance requirements, prompting local innovators to prioritize scalable solutions that address both connectivity challenges and emerging investor education needs.

Asia-Pacific presents a mosaic of market maturity levels. Developed economies like Australia and Japan benefit from sophisticated digital banking adoption and strong regulatory oversight, encouraging partnerships between traditional financial institutions and disruptive startups. Emerging markets in Southeast Asia and South Asia are propelled by expanding internet penetration and mobile-first populations, creating fertile ground for micro-investing applications that offer automated savings tools, micro-loans integration, and localized content in regional languages.

This comprehensive research report examines key regions that drive the evolution of the Micro-Investing Application market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading industry players innovating in micro-investing with advanced technologies, strategic partnerships, and competitive differentiation strategies

Leading micro-investing platforms have differentiated themselves through a combination of technological innovation and strategic alliances. Some have deployed advanced recommendation engines that dynamically adjust portfolios according to real-time market movements and individual spending patterns, while others have forged partnerships with traditional banks to streamline funding flows and expand service offerings. These collaborations have accelerated product roadmaps, delivering integrated checking and investing solutions that enhance user convenience and foster ecosystem stickiness.

In parallel, a wave of emerging entrants is challenging incumbents by focusing on niche propositions such as thematic baskets, carbon offset trackers, and crypto-enabled portfolios. These agile players leverage open-source data feeds and plugin architectures to bring novel features to market rapidly, compelling established firms to iterate on user experience and diversify asset coverage. As the competitive landscape continues to evolve, the platforms that invest in seamless interoperability, robust security protocols, and high-touch customer engagement will maintain a decisive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Micro-Investing Application market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acorns Grow Incorporated

- Betterment Holdings, Inc.

- Block, Inc.

- Charles Schwab Corporation

- eToro Group Ltd

- Fundrise, LLC

- Groww Private Limited

- M1 Holdings Inc.

- Moneybox Limited

- Nutmeg Saving and Investment Limited

- Plum Fintech Ltd

- Public Holdings, Inc.

- Raiz Invest Limited

- Revolut Ltd

- Robinhood Markets, Inc.

- SoFi Technologies, Inc.

- Stash Financial, Inc.

- StashAway Pte. Ltd

- Stockpile, Inc.

- Wealthsimple Inc.

Offering strategic guidance for industry leaders to enhance platform capabilities, optimize user engagement, and navigate evolving regulatory landscapes

To stay ahead, industry leaders should prioritize user experience enhancements rooted in data science and behavioral psychology. Simplified onboarding flows with progressive disclosure of complex concepts can reduce drop-off rates, while integrated educational modules that adapt to each investor’s learning curve can boost retention. Moreover, the adoption of machine learning-powered chatbots and real-time support channels will not only elevate satisfaction but also provide actionable insights that drive portfolio optimization and long-term loyalty.

Strategically, platforms must align product roadmaps with regulatory expectations and macroeconomic shifts. Establishing transparent fee structures, robust compliance frameworks, and flexible API ecosystems will facilitate collaboration with banks, asset managers, and fintech innovators. Additionally, embracing emerging themes-such as environmental, social, and governance (ESG) investing-through dedicated thematic portfolios will resonate with values-driven segments. By combining agile governance with strategic partnerships and continuous product iteration, industry participants can navigate uncertainty while capturing new growth vectors.

Detailing the rigorous research framework combining quantitative analytics, expert interviews, and real-world data to ensure robust micro-investing insights

This research integrates a multistage quantitative approach to ensure statistical rigor and depth of insight. Primary data was sourced from proprietary surveys and platform usage analytics, capturing behavioral signals from millions of anonymized user interactions. Advanced econometric modeling and machine learning algorithms were then applied to identify key drivers of engagement and performance across demographic and regional segments. All datasets underwent normalization and validation against external benchmarks to guarantee accuracy and minimize bias.

Complementing the quantitative analysis, extensive qualitative methods enriched our findings with real-world context. In-depth interviews were conducted with industry executives, portfolio managers, and regulatory experts, providing nuanced perspectives on adoption barriers and future trends. Additionally, secondary research drew on reputable economic briefs, policy papers, and academic publications to triangulate insights. This blended framework of data, expert opinion, and literature review produced a robust, actionable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Micro-Investing Application market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Micro-Investing Application Market, by Investor Type

- Micro-Investing Application Market, by Transaction Frequency

- Micro-Investing Application Market, by Account Type

- Micro-Investing Application Market, by Investment Strategy

- Micro-Investing Application Market, by Region

- Micro-Investing Application Market, by Group

- Micro-Investing Application Market, by Country

- United States Micro-Investing Application Market

- China Micro-Investing Application Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Distilling the strategic implications of micro-investing trends and charting the path forward for stakeholders seeking sustained competitive advantage

The confluence of technological innovation, evolving investor behavior, and shifting regulatory environments is reshaping the micro-investing frontier. Platforms that harness advanced analytics to deliver personalized experiences while maintaining transparent governance will define success. As tariffs, market volatility, and geopolitical dynamics introduce new uncertainties, adaptable strategies and continuous learning will be essential to sustain competitive differentiation.

Ultimately, the micro-investing opportunity lies in creating ecosystems that foster financial inclusion, empower diverse investor types, and anticipate emerging needs. By applying the segmentation, regional, and strategic insights detailed in this report, stakeholders can confidently chart a course toward scalable growth and meaningful impact. The future belongs to those who blend human expertise with technological agility to unlock the transformative power of fractional investing.

Encouraging immediate engagement with Ketan Rohom for access to comprehensive research empowering data-driven decisions in micro-investing markets

To unlock the full strategic value of our comprehensive research and gain a competitive edge in the evolving micro-investing landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His deep understanding of data-driven insights and market dynamics will guide your team through tailored solutions and actionable intelligence. Engage now to schedule a personalized consultation, explore bespoke research packages, and empower your decision-makers with the clarity needed to seize emerging opportunities. Connect with Ketan Rohom today and transform insight into impact for sustained growth in micro-investing markets

- How big is the Micro-Investing Application Market?

- What is the Micro-Investing Application Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?