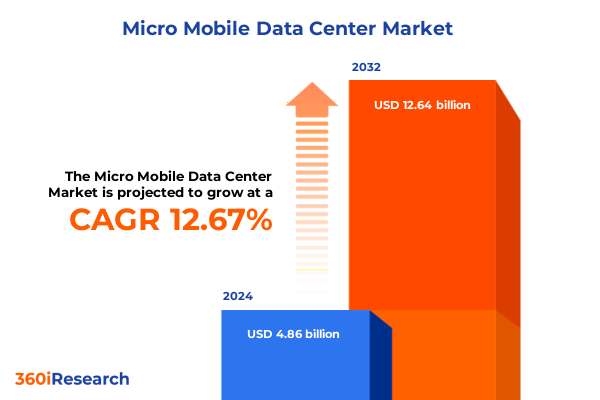

The Micro Mobile Data Center Market size was estimated at USD 5.43 billion in 2025 and expected to reach USD 6.07 billion in 2026, at a CAGR of 12.82% to reach USD 12.64 billion by 2032.

Introduction to micro mobile data centers framed as pragmatic distributed infrastructure that accelerates deployment timelines and strengthens resilience in complex environments

Micro mobile data centers are rapidly evolving from niche tactical deployments into strategic distributed infrastructure that directly supports latency-sensitive applications, resilience planning, and rapid capacity scaling. These compact, transportable systems combine compute, power, cooling, and networking in pre-integrated enclosures that can be deployed at the edge, inside campuses, or as portable disaster-recovery nodes. As compute workloads diversify - from real-time AI inference at the edge to localized colocation services and mission-critical telecom functions - decision-makers are treating micro mobile data centers as a practical way to decentralize capacity while retaining enterprise-grade control.

This introduction frames the technology in operational, financial, and strategic terms so leaders can quickly understand where micro mobile data centers deliver the highest value. Operationally, they reduce installation timelines and simplify site preparation by bringing pretested modules to the field. Financially, they enable phased capital deployment that aligns more closely to user demand and reduces the risk of stranded capacity. Strategically, they broaden the options for resilience, enabling distributed redundancy across dense metropolitan footprints, industrial campuses, and temporary event sites. Taken together, these attributes position micro mobile data centers as a pragmatic element of a modern infrastructure portfolio, particularly for organizations that need predictable deployment outcomes and lower execution risk.

Transformative shifts reshaping micro mobile data center design, procurement, energy strategy, and site selection as edge and resilience priorities converge

The landscape for micro mobile data centers is being reshaped by a set of interlocking shifts that touch technology design, procurement behavior, energy strategy, and site selection. Advances in liquid cooling, higher-density power architectures, and standardized modular enclosures are enabling more compute in smaller footprints, which directly changes how transportable systems are specified and integrated. Meanwhile, end users are demanding solutions that are easier to commission, monitor, and maintain remotely, which elevates integrated telemetry, remote management, and plug-and-play electrical and network interfaces as essential features rather than optional extras.

Procurement patterns are also shifting from single-vendor turnkey purchases to more flexible supplier ecosystems where enclosure makers, OEMs, systems integrators, and local contractors share responsibilities. This trend is driven by the desire to reduce supply chain concentration, accelerate lead times, and enable faster local assembly or customization. Energy considerations are increasingly pivotal: operators prioritize power-efficiency gains and low-water cooling solutions, and they evaluate how a modular deployment interacts with on-site generation or demand-response programs. Regulatory and site-permitting dynamics push design choices as well, particularly in urban and constrained sites where noise, emissions, and physical footprint matter. Collectively, these transformations are narrowing the gap between fixed hyperscale facilities and distributed micro deployments, making the latter a credible option for a wider range of use cases.

Assessment of the cumulative influence of United States tariff actions in 2025 on procurement, supply chain design, and operational deployment strategies for modular systems

The United States’ tariff environment in 2025 is an active and influential variable for suppliers, integrators, and end users of micro mobile data centers because tariffs alter unit economics, sourcing patterns, and inventory decisions across components such as servers, power systems, cooling assemblies, and enclosure materials. Recent actions under the Section 301 review clarified and in some cases increased duties on targeted product groups, with certain increases taking effect at the start of 2025; those policy decisions directly affect critical upstream inputs like semiconductor-related components and specific materials. Organizations that source components globally or rely on assembly in tariff-impacted jurisdictions have seen procurement teams reorganize to evaluate alternative suppliers, apply for product exclusions when available, and consider local assembly or nearshoring as practical mitigations. These strategic responses are reshaping supply chain playbooks because they alter lead times, contractual terms, and capital conversion expectations.

In parallel, industry observers and data center operators are reporting tangible cost and timing pressure as tariffs influence the price of racks, server platforms, and power distribution equipment. Several hardware vendors and systems providers have signaled or implemented price adjustments to reflect higher import duties, while operators are using inventory staging and extended procurement windows to shield short-term projects from immediate rate shocks. The net effect is a growing premium on components and subsystems that are not yet manufactured at scale domestically or that rely on complex supply chains. This dynamic has particular relevance for micro mobile data centers because their economic model often depends on standardization and tight supply chains for repeatable, rapid deployment.

Finally, the tariff regime itself is subject to legal and political pressures that create uncertainty for planning horizons. Recent court activity and media attention have highlighted the potential for judicial review and legislative responses, creating a scenario where tariffs may be contested, modified, or partially rolled back depending on outcomes in litigation or policy shifts. This legal uncertainty has a very practical operational implication: organizations must plan for multiple scenarios, including persistent duties, partial relief via exclusions, and the possibility of retroactive claims or refunds. In turn, that compels more conservative contracting, incremental procurement, and contractual clauses that explicitly allocate tariff risk between buyers and suppliers.

Key segmentation insights connecting form factor, power capacity, cooling type, and end-user priorities into actionable design envelopes and procurement strategies

A segmentation-driven view clarifies which design choices and commercial strategies best align with specific operational objectives for micro mobile data centers. When the product architecture is thought through by form factor - whether containerized designs that include both 20‑foot and 40‑foot variants, modular alternatives that break down into pre‑engineered and prefabricated elements, or compact rack-based systems - the trade-offs become clear: containerized units deliver transportability and scale, modular approaches enable site-specific customization with reduced on-site assembly risk, and rack systems offer the smallest footprint for latency-sensitive nodes. Design teams should therefore consider how each form factor affects transport logistics, site permitting, and integration timelines.

Power capacity segmentation further defines the operational envelope: systems specified for the lowest tier of capacity are optimized for constrained deployments with strict site constraints, mid-range power offerings cater to hybrid edge-colocation use cases, and the above‑100 kW class aligns with denser compute clusters and telecom aggregation nodes. Understanding these capacity tiers informs not only power distribution and UPS choices but also cooling and generator strategies. Cooling type is another crucial axis: air-cooled architectures minimize fluid handling and simplify deployment but may limit achievable rack densities, while liquid‑cooled systems, including cold‑plate and immersion variants, unlock significantly higher thermal headroom at the expense of increased mechanical systems complexity and skilled maintenance requirements.

End-user segmentation highlights different procurement motivations and lifecycle expectations. Healthcare and pharmaceuticals prioritize compliance, redundancy, and environmental controls; IT and cloud customers, spanning colocation, enterprise, and hyperscale segments, emphasize density, telemetry, and operational economics; military and defense buyers value ruggedization, rapid deployability, and secure logistics; and telecom operators focus on tight integration with network gear and long-term site serviceability. Mapping form factor, power capacity, cooling type, and end-user priorities together produces actionable design envelopes that connect technical requirements to procurement strategy, vendor selection, and lifecycle support models.

This comprehensive research report categorizes the Micro Mobile Data Center market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form Factor

- Power Capacity

- Cooling Type

- End User

Regional deployment dynamics and procurement implications across the Americas, Europe Middle East & Africa, and Asia-Pacific markets shaping design and supply strategies

Regional dynamics materially influence deployment decisions for micro mobile data centers because regulatory regimes, labor cost structures, and local supply chains vary across geographies. In the Americas, deployment emphasis centers on rapid scalability in metropolitan markets and hyperscale-adjacent campuses, combined with a heavy focus on compliance with local electrical codes and utility interconnection practices. Available domestic manufacturing capacity and proximity to major cloud and colocation customers also shape procurement choices, so many teams prioritize modular designs that can be assembled locally to mitigate import exposure and accelerate commissioning.

Europe, the Middle East & Africa features a diverse set of regulatory frameworks and site constraints that affect design choices. Noise, emissions, and building codes in European urban centers drive a preference for compact, low-noise enclosures and non‑water‑intensive cooling strategies, while emerging markets in the region may prioritize ruggedized transportable modules that simplify logistics. Regulatory emphasis on energy efficiency and sustainability in Europe also raises the bar for thermal efficiency and lifecycle reporting, so solution providers that offer clear energy metrics and carbon accounting gain a competitive advantage.

Asia‑Pacific presents a spectrum of use cases ranging from dense urban edge deployments in developed markets to rapidly deployable telecom and industrial modules in developing economies. Supply chain density in several Asia‑Pacific markets lowers component lead times, but geopolitical considerations, regional trade policies, and site permitting complexity create heterogeneity in procurement risk. As a result, many global teams adopt a hybrid sourcing strategy that blends locally sourced enclosures with standardized preintegrated subsystems to balance speed, compliance, and cost.

This comprehensive research report examines key regions that drive the evolution of the Micro Mobile Data Center market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key companies insights emphasizing preintegration quality, resilient supply chain partnerships, and service oriented delivery models that de-risk deployments

The competitive landscape for suppliers and systems integrators in the micro mobile data center space centers on three capabilities: the quality and repeatability of preintegration, the strength of supply chain partnerships, and the depth of service and lifecycle support offerings. Leading equipment makers differentiate on enclosure engineering and modular interfaces that reduce field labor and commissioning time, while systems integrators compete on integration playbooks that bundle power electronics, telemetry, and site commissioning into reproducible delivery packages. These distinctions matter because buyers value predictable, low-risk delivery pathways that minimize the number of on-site unknowns.

Service and support models are a second axis of differentiation. Customers increasingly require remote monitoring, fast spare parts logistics, and clear field maintenance playbooks that reduce mean time to repair. Provider business models that combine extended warranties, field‑service networks, and certified partner programs tend to win large enterprise and public sector contracts because they lower the operational burden on the buyer. Finally, partnerships that enable local fabrication or final assembly near deployment regions provide a tactical advantage in tariff‑sensitive environments and markets with long lead times for imported enclosures. In short, successful companies are those that combine engineered repeatability, resilient supply chains, and a service‑oriented delivery model.

This comprehensive research report delivers an in-depth overview of the principal market players in the Micro Mobile Data Center market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Altron a.s

- Canovate Group

- Cisco Systems Inc.

- Dell Technologies Inc.

- Delta Electronics

- Eaton Corporation PLC

- Fujitsu Limited

- Hanley Energy Limited

- Hewlett Packard Enterprise Company

- Hitachi, Ltd.

- Huawei Technologies Co., Ltd.

- International Business Machines Corporation

- Panduit Corporation

- Rittal GmbH & Co. KG

- Schneider Electric SE

- Shenzhen Kstar Science&Technology Co.,Ltd.

- Sicon Chat Union Electric Co.,Ltd.

- STULZ GmbH

- Vertiv Group Corporation

- Zella DC

Actionable recommendations for industry leaders to strengthen supplier resilience, validate high-density cooling pilots, and standardize operations to de-risk deployment

Industry leaders should adopt a sequence of pragmatic, measurable actions to capture near-term value while preserving strategic optionality. First, prioritize supplier resilience by qualifying alternate sources for critical subsystems and creating conditional contracts that include tariff‑pass-through clauses and price-review triggers. This reduces exposure to sudden duty increases and provides contractual pathways to renegotiate as policy clarity emerges. Second, accelerate validation of liquid cooling and compact high‑density designs through small pilots that emphasize maintainability and spare‑parts logistics, thereby proving thermal performance in the target operating environment before wide rollout. These pilots should include clear performance acceptance criteria and a transition plan for scaling production-ready units.

Third, invest in a modular procurement playbook that treats enclosures, power subsystems, cooling, and IT payloads as composable elements. This approach simplifies vendor management and enables localized assembly options that can reduce tariff exposure and compress lead times. Fourth, build a robust telemetry and remote‑operations standard across deployments so that operators maintain a consistent operational baseline independent of physical location; standardization reduces training overhead and increases the pool of qualified field technicians. Finally, incorporate scenario-based contracting into procurement cycles to explicitly allocate tariff, lead-time, and quality risk between buyers and sellers, and to provide clear escalation paths and remedies. Collectively, these measures reduce execution risk and enable organizations to capitalize on the performance and resilience benefits of micro mobile data centers.

Research methodology explaining the combined use of interviews, technical validation, policy review, and scenario analysis to produce practitioner focused recommendations

The research methodology behind this executive summary synthesizes multiple inputs to form a coherent, practitioner-oriented analysis. Primary inputs included structured interviews with technical decision-makers across enterprise, telecom, and public-sector organizations to gather real-world deployment constraints and priorities. These qualitative interviews were complemented by technical reviews of product specifications, vendor integration guides, and installation manuals to validate claims about mechanical interfaces, power distribution, and cooling approaches.

Secondary sources included trade policy announcements, industry reporting on tariff developments, and operator statements that illuminated procurement responses to changes in import duties and supply chain patterns. The analysis then applied scenario-based modeling to stress-test common procurement responses such as inventory staging, nearshoring, and conditional supply agreements. Throughout, the methodology emphasized traceability: each recommendation is linked to observed constraints, technical validation steps, or explicit operator preferences so readers can recreate the decision logic and adapt it to their own environments. Where appropriate, the methodology highlights uncertainty and recommends specific validation steps for each major recommendation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Micro Mobile Data Center market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Micro Mobile Data Center Market, by Form Factor

- Micro Mobile Data Center Market, by Power Capacity

- Micro Mobile Data Center Market, by Cooling Type

- Micro Mobile Data Center Market, by End User

- Micro Mobile Data Center Market, by Region

- Micro Mobile Data Center Market, by Group

- Micro Mobile Data Center Market, by Country

- United States Micro Mobile Data Center Market

- China Micro Mobile Data Center Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Conclusion synthesizing how micro mobile data centers deliver speed, resilience, and practical edge capacity when procured with targeted mitigation for supply risk

Micro mobile data centers occupy an increasingly pragmatic space within modern infrastructure strategies because they combine predictable deployment outcomes with the flexibility needed for edge, resilience, and temporary capacity use cases. The confluence of technological advances in cooling and power architectures, evolving procurement behavior toward modular and composable supply chains, and shifting policy dynamics has expanded the viable use cases for these systems. At the same time, tariff volatility and supply chain complexity create near-term execution risk that requires deliberate mitigation actions in procurement and vendor contracting.

For decision-makers, the imperative is clear: treat micro mobile data centers as a distinct class of asset with its own procurement playbook, lifecycle support expectations, and regulatory touchpoints. When specified and procured with attention to segmentation, regional dynamics, and tariff risk, these systems deliver a compelling combination of speed to deployment, operational resilience, and targeted cost control. Conversely, treating them as generic IT purchases risks schedule slippage, cost escalation, and suboptimal operational outcomes. Organizations that combine disciplined pilots, scenario-driven procurement clauses, and service-focused supplier relationships will be best positioned to realize the promise of distributed, transportable compute capacity.

Arrange a tailored executive briefing with Ketan Rohom, Associate Director Sales & Marketing, to translate micro mobile data center research into procurement and deployment actions

If your organization is evaluating a purchase, pilot, or strategic partnership related to micro mobile data centers, the next step is a direct, outcomes-focused conversation with Ketan Rohom, Associate Director, Sales & Marketing. He can help align the report’s findings with your procurement timelines, procurement constraints, and technical integration needs, translating high-level insights into procurement-ready checklists and vendor selection frameworks. Reach out to arrange a tailored briefing that highlights the specific sections most relevant to your use case, including modular and rack form factors, liquid cooling implementation considerations, and tariff-sensitive sourcing strategies.

A tailored briefing will enable your team to accelerate decision cycles by converting research insights into an executable implementation roadmap, clarifying where to prioritize vendor validation, pilot scope, and total cost of ownership analysis based on your deployment geography and end-user profile. This briefing is designed to be pragmatic: it maps recommended procurement levers to near-term mitigation tactics such as strategic inventory layering, local assembly partnerships, and conditional supplier agreements that hedge exposure to import duties and lead-time risk.

To proceed, request a customized executive briefing that sequences recommended actions over 30-, 90-, and 180-day windows so leadership can prioritize capital allocation and supplier negotiations. The briefing also includes a focused Q&A with subject-matter experts to validate technical assumptions and refine implementation plans for micro mobile data centers, giving your team an operational blueprint to move from insight to deployment.

- How big is the Micro Mobile Data Center Market?

- What is the Micro Mobile Data Center Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?