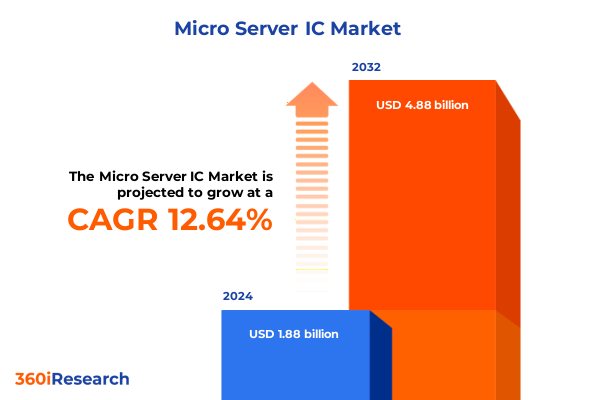

The Micro Server IC Market size was estimated at USD 2.04 billion in 2025 and expected to reach USD 2.21 billion in 2026, at a CAGR of 11.16% to reach USD 4.28 billion by 2032.

Discover the Foundational Dynamics of the Micro Server IC Market and Their Role in Shaping the Future of Distributed Computing Infrastructures

Micro server integrated circuits represent a paradigm shift in the architecture of distributed computing, combining reduced power consumption with high-density integration to enable efficient data handling across diverse environments. At its core, these compact ICs optimize processing throughput for workloads that demand lower per-thread performance but benefit from massive parallelism. This modular approach delivers substantial cost efficiencies and enhanced thermal characteristics, making micro server ICs increasingly attractive for emerging computing scenarios where traditional server designs prove either overpowered or prohibitively energy intensive.

The proliferation of microservices, containerized applications, and edge analytics has catalyzed demand for specialized silicon that balances compute capability with power efficiency. This market segment bridges the gap between low-cost consumer processors and high-performance server CPUs, offering a mid-tier solution that addresses the evolving needs of data centers, telecom infrastructures, and enterprise deployments. Researchers and technology developers are channeling significant efforts into refining fabrication processes, power management techniques, and system-on-chip configurations, laying the groundwork for next generation capabilities in modular and scalable architectures.

Transitioning from conventional scale-up strategies, micro server ICs champion a scale-out philosophy that aligns with modern software development methodologies. This introduction sets the stage for a comprehensive exploration of transformative market dynamics, regulatory influences, segmentation nuances, regional variations, and competitive profiles that define the rapidly evolving micro server IC landscape.

Explore the Key Technological and Operational Shifts Reshaping Micro Server IC Architectures and Powering Next Generation Data Processing Paradigms

Recent advances in semiconductor materials and design methodologies have triggered transformative shifts in micro server IC architectures. Developers are embracing heterogeneous integration, marrying high-efficiency Arm cores with specialized accelerators on system-on-chip platforms. This trend enables workload-specific optimization, reducing idle power draw while delivering tailored performance for data analytics, machine learning inference, and network packet processing. Meanwhile, open-source instruction sets like Risc-V are gaining traction, offering customizable core designs and fostering an ecosystem of collaborative innovation that challenges proprietary X86 dominance.

Concurrently, thermal management breakthroughs, including advanced packaging solutions such as chiplets and multi-chip modules, are facilitating higher aggregate performance within constrained form factors. By interposing discrete dies through high-bandwidth interconnects, designers can mix and match logic blocks optimized for different process nodes, leveraging mature Greater 22 nm lines for control functions alongside cutting-edge 7 nm or 10 nm geometries for compute-intensive tasks. These packaging evolutions not only reduce manufacturing risk but also enable rapid technology refresh cycles in response to shifting workload profiles.

Operational paradigms are also evolving, with edge computing infrastructures demanding resilient architectures capable of operating in harsh environmental conditions while sustaining minimal latency. The rise of telecom edge and industrial applications necessitates micro server ICs that balance ruggedized reliability with seamless connectivity. This section outlines how these technical and operational shifts are redefining performance benchmarks and unlocking new market possibilities for micro server ICs.

Analyze the Multifaceted Effects of 2025 U.S. Tariffs on Micro Server IC Supply Chains, Manufacturing Costs, and Global Competitive Positioning

The imposition of U.S. tariffs in 2025 has introduced significant headwinds across micro server IC supply chains, influencing component availability, cost structures, and global competitive positioning. Manufacturers with fabrication facilities outside North America have encountered elevated import duties on raw wafers, masking dysfunctionalities in cost forecasting and pressuring margin optimization efforts. This cumulative impact extends from silicon foundries to assembly partners, where fluctuating input prices compel design teams to reassess technology node selections and negotiate alternative supply arrangements.

Higher duties on intermediate goods have amplified the importance of near-shoring strategies. Some vendors are evaluating the feasibility of relocating key assembly operations to regions with favorable trade agreements, seeking to mitigate the tariff burden and restore predictable cost trajectories. However, transitioning complex production lines incurs lead time penalties and requires rigorous qualification cycles to ensure yield parity. In parallel, tariff pressures have sparked discussions around diversification of supply sources, prompting enterprises to engage with multiple foundry partners, thereby enhancing resilience against geopolitical disruptions.

Despite these challenges, certain stakeholders view the tariff environment as an impetus to strengthen domestic ecosystems. Increased investment in localized R&D centers and the pursuit of government incentives for semiconductor manufacturing underscore a strategic pivot toward greater self-reliance. This section delves into how 2025 U.S. tariffs have cumulatively reshaped the micro server IC value chain, driving both short-term cost management tactics and long-term strategic realignments within the industry.

Reveal Key Insights on Architecture Choices, End User Demand, Node Technologies, Packaging Innovations and Distribution Strategies

Reveal Key Insights on Architecture Choices, End User Demand, Node Technologies, Packaging Innovations and Distribution Strategies

Architecturally, Arm-based micro server ICs continue to dominate scenarios where power efficiency and modularity are paramount, while Risc-V options gain appeal for bespoke use cases requiring open extensibility. X86 platforms maintain relevance within enterprise segments that demand legacy software compatibility. Observing end user demand, cloud computing environments are bifurcating into hybrid deployments that balance on-premises control with public cloud elasticity, private cloud installations that emphasize security, and purely public offerings aimed at cost-sensitive workloads. Edge computing applications address varied contexts such as industrial automation sites, retail locations for real-time analytics, and telecom edge nodes optimized for low-latency network management.

In the enterprise server domain, large conglomerates deploy micro server clusters to offload batch processing tasks, while small and midsize businesses embrace compact systems to achieve enterprise-grade efficiency without prohibitive capital investment. Hyperscale data center operators differentiate between tier 1 platforms that push the leading edge of performance and tier 2 facilities that favor cost-effective configurations for predictable workloads. Within telecom, continual 5G rollouts coexist alongside 4G infrastructure, prompting micro server IC developers to craft solutions that seamlessly bridge these generational networks.

Technology node selection remains a critical lever, with mature 22 nm and Greater 22 nm lines serving volume-focused cost centers, while 14 nm, 10 nm, and 7 nm nodes underpin performance-oriented product tiers. Packaging innovations leverage chiplet-based architectures featuring discrete dies or embedded die integration, multi-chip modules that are interposer-based or substrate-based, and system-on-chip designs that emerge as either chiplet-based mosaics or monolithic configurations. Distribution strategies combine direct sales-encompassing corporate partnerships and online platforms-with channel partners such as system integrators and value-added resellers, complemented by broadline and specialized distributors and select OEM alliances.

This comprehensive research report categorizes the Micro Server IC market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Architecture

- Technology Node

- Packaging Type

- End User

- Distribution Channel

Examine Distinct Regional Dynamics Across the Americas, Europe Middle East and Africa, and Asia Pacific Unveiling Unique Adoption Drivers and Market Influencers

Examine Distinct Regional Dynamics Across the Americas, Europe Middle East and Africa, and Asia Pacific Unveiling Unique Adoption Drivers and Market Influencers

In the Americas, innovation centers in the United States and Canada lead micro server IC adoption, propelled by governmental support for semiconductor research and a robust ecosystem of hyperscale data centers. The presence of major cloud providers and edge service integrators accelerates validation cycles, creating a feedback loop that refines product roadmaps and design requirements. Meanwhile, Latin American markets demonstrate nascent interest in cost-effective micro server deployments, particularly within telecommunications and decentralized cloud segments seeking to enhance regional data sovereignty and reduce latency.

Across Europe, the Middle East and Africa, regulatory mandates on data privacy, sustainability, and energy efficiency shape micro server IC specifications. European Union directives incentivize low-power computing platforms, while the Middle East’s push toward smart city infrastructure generates demand for compact, ruggedized modules. In Africa, infrastructure investments are gradually rising, with public sector initiatives laying the groundwork for edge-enabled applications in healthcare, agriculture, and education.

In Asia Pacific, contrasting growth trajectories emerge between mature markets like Japan and South Korea, where high-performance micro server clusters augment existing telecom networks, and fast-growing economies in Southeast Asia and India, where affordability drives adoption of basic micro server architectures. The region’s vast manufacturing capacity also positions it as a key hub for both chip fabrication and packaging, reinforcing the global supply chain and fostering collaborations with international technology partners.

This comprehensive research report examines key regions that drive the evolution of the Micro Server IC market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assess the Strategic Initiatives, Technology Portfolios and Collaborative Opportunities of Leading Companies Shaping the Competitive Micro Server IC Ecosystem

Assess the Strategic Initiatives, Technology Portfolios and Collaborative Opportunities of Leading Companies Shaping the Competitive Micro Server IC Ecosystem

Industry incumbents are differentiating through vertical integration strategies, combining in-house design capabilities with proprietary packaging expertise. Market leaders maintain extensive IP portfolios spanning core architectures, interconnect fabrics, and power management modules. Partnerships between established foundries and fabless design houses accelerate time-to-market for specialized offerings, while alliances with cloud service providers enable real-world validation and co-innovation. Collaborative testbeds also emerge, where consortia of hardware vendors, software developers, and hyperscale operators refine performance metrics under realistic workload conditions.

Emerging players are carving niches by focusing on specific end use segments such as telecom edge or industrial computing. These innovators leverage open instruction sets and modular packaging approaches to deliver customizable solutions with rapid iteration cycles. Joint ventures between semiconductor firms and system integrators facilitate turnkey platforms that integrate compute, networking, and storage in compact footprints. Furthermore, strategic investments in AI-driven design tools and advanced simulation environments grant certain companies a competitive edge in optimizing thermal behavior, silicon yield, and reliability metrics.

Competitive differentiation increasingly stems from comprehensive service ecosystems that bundle firmware support, security certifications, and sustainability initiatives alongside silicon deliveries. This holistic value proposition underscores a shift from component-centric transactions to solution-oriented engagements, where success depends on the ability to address total cost of ownership, operational continuity and future-proofing requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Micro Server IC market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Micro Devices, Inc.

- Alibaba Group Holding Limited

- Ampere Computing LLC

- Broadcom Inc.

- Cisco Systems, Inc.

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- Infinera Corporation

- Intel Corporation

- Loongson Technology Corporation Limited

- Marvell Technology, Inc.

- NVIDIA Corporation

- Oracle Corporation

- Qualcomm Incorporated

Provide Actionable Recommendations Guiding Industry Leaders to Navigate Market Challenges, Optimize Investments and Capitalize on Micro Server IC Opportunities

Provide Actionable Recommendations Guiding Industry Leaders to Navigate Market Challenges, Optimize Investments and Capitalize on Micro Server IC Opportunities

Industry leaders should prioritize investments in modular packaging technologies, as chiplets and multi-chip modules offer the flexibility to tailor compute-performance ratios across diverse workload scenarios. Embracing open-standard architectures such as Risc-V can reduce licensing costs while fostering a developer community that drives rapid innovation. Concurrently, organizations must reevaluate supply chain resilience strategies by establishing multi-regional manufacturing and assembly footprints, thereby mitigating exposure to tariff shocks and geopolitical uncertainties.

To align with escalating edge computing demands, stakeholders should collaborate with telecom operators and systems integrators to develop pre-validated platforms optimized for industrial, retail, and network edge environments. Such partnerships can expedite deployment cycles and enhance product-market fit. Moreover, data center customers are advised to explore hybrid cloud configurations that leverage micro server clusters for batch processing and distributed analytics, freeing up high-performance cores for latency-sensitive transactions.

Finally, companies should institute cross-functional innovation councils that bring together architects, product managers, and market analysts to continuously monitor performance metrics and emergent use cases. By fostering a culture of agile development and iterative validation, organizations can stay ahead of competitive pressures while delivering tailored solutions that meet evolving customer requirements.

Detail Rigorous Research Methodologies Analytical Frameworks and Data Collection Processes Underlying the Comprehensive Evaluation of the Micro Server IC Market

Detail Rigorous Research Methodologies Analytical Frameworks and Data Collection Processes Underlying the Comprehensive Evaluation of the Micro Server IC Market

The analysis underpinning this report is built upon a mixed-methods research design combining in-depth primary interviews with semiconductor executives, system architects, and supply chain experts, alongside extensive secondary literature reviews. Quantitative data is sourced from proprietary tracking of production yields, pricing indices, and trade volume records. Qualitative insights are derived through structured dialogues with industry stakeholders, ensuring the capture of nuanced perspectives on adoption barriers, regulatory impacts, and technology roadmaps.

Analytical frameworks encompass SWOT assessments, Porter’s Five Forces evaluations specific to micro server IC value chains, and scenario modeling of tariff-induced cost fluctuations. Segmentation analyses draw upon categorical breakdowns by architecture, end user, technology node, packaging type, and distribution channel. Regional comparisons leverage geopolitical risk indices and infrastructure maturity metrics. This multi-layered approach ensures a holistic understanding of market dynamics, competitive landscapes, and strategic inflection points.

Validation steps include cross-verification of findings through third-party patent analytics, revenue benchmarking against public financial disclosures, and pilot consultations with technology buyers. This methodology yields a robust, objective, and actionable body of intelligence designed to inform decision-making and strategic planning across the micro server IC ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Micro Server IC market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Micro Server IC Market, by Architecture

- Micro Server IC Market, by Technology Node

- Micro Server IC Market, by Packaging Type

- Micro Server IC Market, by End User

- Micro Server IC Market, by Distribution Channel

- Micro Server IC Market, by Region

- Micro Server IC Market, by Group

- Micro Server IC Market, by Country

- United States Micro Server IC Market

- China Micro Server IC Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Synthesize Core Findings Strategic Insights and Industry Implications to Drive Informed Decision Making Within the Expanding Micro Server IC Landscape

Synthesize Core Findings Strategic Insights and Industry Implications to Drive Informed Decision Making Within the Expanding Micro Server IC Landscape

The micro server IC market is characterized by rapid architectural evolution, regulatory influences, and shifting end user expectations. Key findings highlight the ascent of heterogeneous integration, the disruptive potential of open instruction sets, and the strategic imperatives imposed by recent tariff regimes. Regional disparities underscore the importance of localized innovation hubs and tailored deployment models, while competitive analysis reveals a growing divide between full-stack integrators and nimble specialized entrants.

Strategically, embracing modular packaging, diversifying supply chains, and forging ecosystem partnerships emerge as critical success factors. Stakeholders that align R&D investment with emerging workload patterns-whether in cloud computing, edge analytics, or hyperscale operations-are positioned to capture first-mover advantages. Meanwhile, the infusion of advanced simulation tools and AI-driven design workflows promises to accelerate iteration cycles and enhance reliability.

This confluence of technological, geopolitical, and economic forces demands a proactive stance. Organizations that leverage comprehensive, data-driven insights to refine product roadmaps, optimize cost structures, and anticipate regulatory shifts will unlock new value and fortify competitive positions. The strategic implications outlined here serve as a roadmap for decision makers navigating the complexities of this dynamic market ecosystem.

Connect with Ketan Rohom for Tailored Market Intelligence and Expert Guidance to Secure Your Competitive Edge in the Dynamic Micro Server IC Arena

Engaging with Ketan Rohom provides unparalleled access to bespoke market intelligence and strategic guidance, empowering stakeholders to make well-informed decisions in the competitive micro server IC arena. As Associate Director of Sales & Marketing, Ketan brings deep expertise in interpreting complex data, identifying emerging trends, and tailoring insights to align with specific business priorities. Prospective clients benefit from one-on-one consultations, where customized briefings and in-depth analyses are delivered to address unique challenges and objectives. By collaborating directly with Ketan, technology leaders, product managers, and investment professionals gain clarity on strategic imperatives and actionable pathways for growth.

Prospective stakeholders are invited to initiate a dialogue that delves into advanced benchmarking, comparative technology assessments, and risk analysis tailored to their market positioning. This personalized approach ensures that decision-makers receive not only the empirical evidence necessary to justify capital allocation but also the contextual understanding required to outpace competitors. Whether the focus is on supply chain resilience, architectural differentiation, or go-to-market optimization, Ketan’s guidance equips organizations with the foresight needed to capitalize on opportunities and mitigate emerging risks. Reach out today to secure your competitive advantage and drive sustained success in the dynamic micro server IC landscape.

- How big is the Micro Server IC Market?

- What is the Micro Server IC Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?