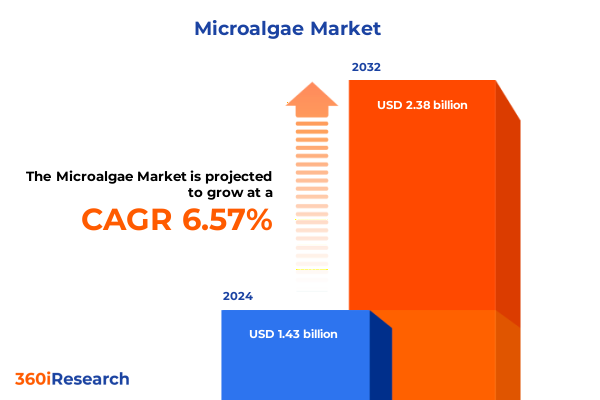

The Microalgae Market size was estimated at USD 1.51 billion in 2025 and expected to reach USD 1.61 billion in 2026, at a CAGR of 6.68% to reach USD 2.38 billion by 2032.

Unveiling the Pivotal Role of Microalgae in Driving Sustainable Innovation across Diverse Industries and Applications Worldwide

The microalgae sector has emerged as a transformative force within the broader bioeconomy, offering a versatile array of applications that span nutritious food ingredients, sustainable biofuels, high-value cosmetics, and advanced biopharmaceuticals. Fueled by rapid technological progress in cultivation and processing, microalgae now deliver concentrated sources of proteins, lipids, antioxidants, and pigments that meet rising demands for natural and environmentally responsible products. Moreover, the inherent ability of microalgae to sequester carbon dioxide and purify wastewater positions it as a key enabler of circular economy strategies and climate mitigation initiatives.

Against this backdrop, stakeholders across research institutions, start-ups, and established enterprises are converging to harness microalgae’s intrinsic advantages. Investments in scalable photobioreactor designs and innovative downstream extraction techniques are accelerating cost efficiencies, while regulatory frameworks are adapting to facilitate market entry of novel algal ingredients. As a result, microalgae is transitioning from niche applications toward mainstream adoption, compelling industry leaders to reassess supply chains, engage in cross-sector collaborations, and integrate algae-based solutions into sustainability agendas. This report opens with a concise introduction that contextualizes these developments, highlighting the dynamic interplay between scientific innovation, policy shifts, and consumer preferences that underpin the current growth trajectory.

Exploring the Transformative Technological, Regulatory, and Consumer Shifts Reshaping the Global Microalgae Industry Landscape in Recent Years

Recent years have witnessed pivotal inflection points that are reshaping the microalgae landscape from a fragmented research field into a cohesive industrial arena. On the technological front, breakthroughs in genetic modification and automated cultivation systems are enabling higher biomass yields and targeted biosynthesis of specialty compounds. The integration of digital monitoring platforms and artificial intelligence-driven optimization now allows real-time control over light exposure, nutrient delivery, and harvesting cycles, reducing operational expenditures and enhancing product consistency.

Regulatory frameworks have concurrently evolved to accommodate algae-derived ingredients, with food safety authorities establishing clearer pathways for novel food approvals and environmental agencies defining standardized metrics for carbon credits and bioremediation projects. This regulatory clarity is attracting greater private capital, catalyzing a wave of partnerships between biotech innovators and established players seeking to diversify their portfolios. Equally significant are shifting consumer preferences, as health-conscious and eco-aware end users increasingly favor sustainably sourced proteins, natural pigments, and functional ingredients. This convergence of technological maturation, policy support, and consumer advocacy is propelling microalgae into its next phase of commercial viability.

Assessing the Far-reaching Cumulative Impacts of 2025 United States Tariff Policies on Microalgae Supply Chains, Costs, and Trade Dynamics

In 2025, a series of tariff adjustments by United States authorities targeting imported biomass and specialty extracts have introduced new cost variables into the microalgae value chain. These measures, aimed at bolstering domestic cultivation capabilities and protecting nascent producers, have elevated input costs for companies relying on overseas feedstock and processing services. As a result, organizations are reevaluating sourcing strategies and exploring regional partnerships to mitigate exposure to import duties.

Consequently, the tariff regime has spurred accelerated investments in local production facilities, with a focus on closed photobioreactor systems that offer greater yield control and compliance with stringent quality standards. At the same time, buyers are negotiating long-term off-take agreements to stabilize supply and secure preferential pricing. While the introduction of tariffs has presented near-term cost headwinds, it has also acted as a catalyst for infrastructure development and supply chain resilience, reinforcing the United States’ position as a competitive hub for microalgae innovation and commercialization.

Uncovering In-depth Segmentation Insights to Reveal How Products, Organisms, Cultivation Methods, Applications, and Distribution Channels Drive Market Differentiation

A granular understanding of market segmentation reveals the strategic imperatives that drive differentiated value propositions across the microalgae ecosystem. In terms of product format, extract offerings deliver concentrated active compounds optimized for high-value applications, whereas algal oils serve as lipid-rich feedstocks for biofuel and nutraceutical applications. Powdered formulations, in turn, provide a versatile matrix for incorporation into food and cosmetic products, underscoring the importance of aligning extraction and drying techniques with end-use specifications.

Delving deeper into organism selection, chlorella stands out for its robust protein profile and rapid growth rates, while diatoms, with their siliceous cell walls, unlock opportunities in biomaterials and filtration technologies. Dunaliella salina’s exceptional carotenoid yield positions it as a premium source of natural colorants and antioxidants. Similarly, Haematococcus pluvialis commands attention for its high astaxanthin content, and spirulina remains a mainstay ingredient in health supplements due to its balanced nutrient composition. Each strain imparts unique characteristics, mandating tailored cultivation and downstream processing strategies.

Cultivation methodologies themselves delineate competitive dynamics, where closed photobioreactors offer superior control over contamination and environmental parameters, fermenters enable high-density heterotrophic growth, and open pond systems capitalize on low-capital expenditure models in favorable climates. Application segments further drive differentiation: animal feed formulators prize algal protein’s amino acid profile; biofuel developers leverage lipid yields for renewable energy; bioremediation projects harness algal uptake of pollutants; cosmetics and personal care brands seek natural pigments and bioactives; food and beverage innovators integrate algae into functional formulations; and pharmaceutical and nutraceutical developers rely on algae for potent, standardized extracts.

Lastly, distribution channels shape go-to-market strategies, as established distributors utilize direct sales, retail partnerships, and wholesale networks to reach industrial and consumer clients, while digital platforms such as company websites and e-commerce marketplaces offer agile, direct-to-customer engagement. This multilayered segmentation matrix underscores the need for companies to craft specialized approaches that align product characteristics, cultivation frameworks, application demands, and distribution pathways.

This comprehensive research report categorizes the Microalgae market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Product Type

- Cultivation

- Application

- Distribution Channel

Revealing the Distinct Regional Dynamics and Growth Enablers Shaping the Microalgae Market Across the Americas, EMEA, and Asia-Pacific Regions

Geographic nuances profoundly influence the trajectories of microalgae developments across major regions. In the Americas, advanced research hubs in the United States and Canada lead the way in proprietary strain development and pilot-scale photobioreactor technologies, while Latin American nations benefit from abundant sunlight and expansive land availability, fostering large-scale open pond cultivation for commodity-grade biomass.

Europe, the Middle East, and Africa present a mosaic of opportunities: European Union member states emphasize strict sustainability certifications and robust funding programs to integrate microalgae into circular bioeconomy initiatives, whereas Middle Eastern countries leverage saline environments and desalination byproducts to cultivate salt-tolerant strains like Dunaliella salina. In Africa, emerging ventures are exploring low-cost pond systems to boost rural livelihoods and address nutritional deficits through local protein production.

The Asia-Pacific region exhibits a dynamic blend of government incentives, private-sector alliances, and rapidly expanding consumer markets. China’s industrial infrastructure and cost advantages underpin large-scale biomass production, India’s pharmaceutical and nutraceutical sectors drive demand for high-purity extracts, and Japan and South Korea focus on advanced bioreactor integrations and functional food applications. These regional distinctions highlight how local resources, policy landscapes, and market demands converge to shape diverse growth pathways within the global microalgae ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Microalgae market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Competitive Strategies, Innovation Pathways, and Partnerships Driving Leading Companies to Excel in the Global Microalgae Ecosystem

Leading organizations in the microalgae sector are exemplifying a blend of strategic initiatives that span innovation, collaboration, and market expansion. Many have forged research partnerships with academic institutions to unlock novel metabolic pathways and accelerate strain optimization. Simultaneously, joint ventures between specialty chemical manufacturers and algae producers are facilitating access to downstream processing capabilities and established distribution networks, enabling faster commercialization of high-value ingredients.

On the innovation front, proprietary photobioreactor designs and enzyme-assisted extraction techniques have given certain companies a competitive edge by improving yield and reducing processing costs. Some players have diversified their portfolios by integrating multiple organism types and product formats, thereby hedging risks associated with single-stream revenue models. Moreover, aggressive patenting strategies and supply agreements with end-use industries, such as functional foods and cosmetics, have anchored long-term partnerships and secured early mover advantages. These collective strategies underscore the importance of convergence across R&D, production, and commercialization efforts to achieve leadership in this rapidly evolving domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microalgae market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AlgaeCytes Limited

- AlgaEnergy

- Algatech Ltd.

- Algiecel ApS

- Allmicroalgae Natural Products S.A.

- Aralab

- Archer Daniels Midland Company

- BASF SE

- Brevel Ltd.

- Cargill, Incorporated

- Cellana Inc.

- Checkerspot, Inc.

- Cyanotech Corporation

- DIC Corporation

- Far East Microalgae Industries, Co., Ltd.

- Kuehnle AgroSystems Inc.

- Phycom BV

- Plankton Australia Pty Limited

- Seagrass Tech Private Limited

- Solabia Nutrition

- Solazyme, Inc.

- Sun Chlorella Corporation

- Taiwan Chlorella Manufacturing Company

- Taiwan Wilson Enterprise Inc.

- Valensa International

- Vedan Biotechnology Corporation

Proposing Actionable Recommendations to Enable Industry Leaders to Harness Microalgae Innovations, Optimize Value Networks, and Achieve Sustainable Advantages

To harness the momentum within the microalgae industry, leaders should prioritize strategic investments in scalable cultivation infrastructure, particularly closed photobioreactor systems that deliver consistent quality and mitigate contamination risks. By aligning capital deployment with pilot-tested process optimizations, organizations can swiftly translate laboratory successes into commercial viability.

Next, fostering interdisciplinary collaborations between biotechnologists, chemical engineers, and end-user application specialists can accelerate the development of tailored algal extracts with differentiated value propositions. Such partnerships not only streamline product innovation cycles but also facilitate entry into emerging application domains.

In parallel, companies must deepen engagement with policy makers and standard-setting bodies to shape favorable regulatory frameworks and sustainability certification criteria. Proactive participation in industry consortia and stakeholder forums will ensure alignment of technical specifications and open pathways for broader market acceptance.

Leveraging digital platforms to establish direct connections with end users can amplify market reach and gather real-time feedback, informing iterative product enhancements. Finally, integrating robust traceability solutions and sustainability metrics across the supply chain will bolster brand credibility and resonate with increasingly discerning consumers focused on environmental and social responsibility.

Detailing a Robust Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Rigorous Validation Processes to Ensure Insights Integrity

This report’s findings are grounded in a rigorous research methodology that combines both primary and secondary research streams. The secondary phase entailed exhaustive analysis of scientific journals, patent filings, regulatory documents, and company disclosures to map prevailing technologies, competitive landscapes, and application trends. Concurrently, the primary research phase comprised in-depth interviews with senior executives, technical experts, and end users across producer, distributor, and customer segments to validate insights and uncover emerging challenges.

Data triangulation techniques were employed to reconcile quantitative observations with qualitative inputs, ensuring data integrity and minimizing bias. Supplementary workshops and peer reviews provided critical cross-checks, while an iterative process of validation ensured that the final insights reflect both industry realities and forward-looking perspectives. This comprehensive approach underpins the credibility of the analysis and equips stakeholders with a robust foundation for informed decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microalgae market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microalgae Market, by Product

- Microalgae Market, by Product Type

- Microalgae Market, by Cultivation

- Microalgae Market, by Application

- Microalgae Market, by Distribution Channel

- Microalgae Market, by Region

- Microalgae Market, by Group

- Microalgae Market, by Country

- United States Microalgae Market

- China Microalgae Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Reflections on Microalgae’s Strategic Importance, Evolving Market Dynamics, and the Path Forward for Stakeholders Across Sectors

In summary, microalgae has transitioned from a niche research focus to a multifaceted industrial domain with profound implications for sustainability, health, and technology. The convergence of advancing cultivation platforms, evolving regulatory landscapes, and diverse application demands has created a complex yet opportunity-rich environment for innovators and investors alike. As tariff policies reshape supply dynamics and segmentation insights reveal nuanced differentiation strategies, regional variations further underscore the need for tailored approaches.

Stakeholders who proactively invest in scalable infrastructure, foster cross-sector collaborations, and engage in policy dialogues will be best positioned to capture the next wave of growth. By weaving together technical excellence, market sophistication, and sustainability commitments, industry participants can unlock the full spectrum of microalgae’s potential. These concluding reflections highlight the urgency of strategic action and the promise of algae-derived solutions in addressing global challenges across nutrition, energy, and environmental stewardship.

Driving Future Growth Through Partnership Opportunities and Tailored Insights by Engaging with Ketan Rohom for Comprehensive Microalgae Market Intelligence

To unlock the full potential of microalgae for your organization’s strategic agenda, contact Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to secure your copy of the comprehensive microalgae market intelligence report. Engaging directly with Ketan Rohom will grant you tailored insights into cutting-edge cultivation strategies, regulatory landscapes, and application pipelines designed to accelerate your growth and competitive positioning. Elevate your decision-making with data-driven recommendations, rigorous segmentation analysis, and actionable roadmaps that align with your unique business objectives. Don’t miss this opportunity to partner with an expert resource and steer your microalgae initiatives toward sustained success and innovation.

- How big is the Microalgae Market?

- What is the Microalgae Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?