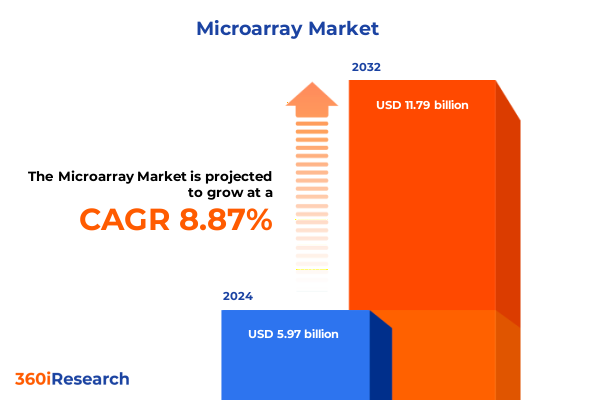

The Microarray Market size was estimated at USD 6.40 billion in 2025 and expected to reach USD 6.87 billion in 2026, at a CAGR of 9.10% to reach USD 11.79 billion by 2032.

Setting the Stage for Microarray Innovation by Unveiling Foundational Concepts Emerging Technologies and Strategic Importance in Modern Bioscience

Microarray technology has emerged as a foundational instrument in modern biological research, enabling comprehensive profiling of genes, proteins, and tissue characteristics with unprecedented throughput. By facilitating simultaneous analysis of thousands of biomolecular targets, microarrays have accelerated discoveries from basic genomic mapping to clinical diagnostics. This evolution has been driven by improvements in surface chemistries, miniaturization techniques, and automation platforms that collectively raise the bar for data quality and reproducibility. Consequently, multidisciplinary teams in academia, industry, and healthcare settings are harnessing microarray platforms to decode complex biological systems and to translate molecular signatures into actionable insights.

Amid rapid growth in fields such as personalized medicine and precision agriculture, microarray systems now play a pivotal role in biomarker discovery, drug candidate screening, and pathogen detection. This broad applicability underscores the strategic importance of monitoring technological advances, cost dynamics, and regulatory developments that influence adoption. As emerging methods integrate machine learning algorithms and single-cell resolution capabilities, stakeholders must align their research strategies with these innovations.

This executive summary synthesizes critical developments shaping the microarray ecosystem. It outlines paradigm-shifting trends, examines the implications of recent policy changes in the United States, and highlights segmentation and regional factors that guide investment priorities. Finally, key company activities, evidence-based recommendations, and methodological rigor underpinning this analysis are presented to inform decision makers seeking to capitalize on the next wave of microarray breakthroughs.

Exploring Revolutionary Shifts Reshaping the Microarray Landscape through Technological Advances Emerging Applications and Collaborative Research Paradigms

The microarray landscape is undergoing revolutionary transformations driven by convergence of engineering, informatics, and life sciences. First, advancements in substrate materials and nanofabrication have transitioned microarrays from conventional glass slides to silicon-based platforms, improving signal uniformity and enabling higher probe densities. This shift supports applications requiring fine-scale molecular discrimination, such as single-cell transcriptomics and multiplexed proteomics.

Simultaneously, the integration of machine learning-powered image analysis and cloud-based data management has ushered in a new era of digital microarrays. Automated spot recognition, artifact correction, and predictive analytics expedite data interpretation, allowing researchers to move from raw fluorescence intensities to biological hypothesis testing with greater confidence. As a result, end users can detect subtle expression changes and complex biomarker panels that were previously obscured by noise.

Moreover, the democratization of microarray workflows through low-cost consumable offerings and compact benchtop instrumentation has expanded accessibility beyond specialized core facilities. This expansion is fueling collaborative networks between academic laboratories and industry partners, each contributing unique expertise to co-development initiatives. Likewise, regulatory agencies are adapting guidelines to accommodate these novel platforms, paving the way for accelerated clinical validation and adoption in diagnostics.

Taken together, these transformative shifts underscore the dynamic interplay between technology refinement and evolving research demands, marking a decisive step forward in leveraging microarrays as a cornerstone of molecular science.

Assessing the Far-Reaching Effects of New United States Tariffs on Microarray Supply Chains Research Workflows and Strategic Planning

In early 2025, the United States government implemented a set of tariffs targeting key microarray consumables and instruments, particularly imported silicon chips, high-precision robotics, and specialized reagents. These duties have exerted upward pressure on input costs, prompting laboratory managers and procurement teams to reassess vendor agreements and supply chain resilience. As tariffs are cumulative in nature, each increment has compounded price sensitivity across consumable arrays, labware, and service agreements.

Consequently, many organizations have pursued multi-source procurement strategies to mitigate exposure to elevated American duties. For example, alliances with regional or domestic suppliers have gained traction, reducing reliance on high-tariff imports. At the same time, strategic stockpiling of reagents and spare parts has emerged as a short-term buffer against acute cost fluctuations, albeit at the expense of working capital.

This environment has also catalyzed innovation in reagent formulations that can be produced locally under less onerous tariff codes. Such developments offer a pathway to maintaining experimental continuity while supporting domestic manufacturing. Furthermore, research institutions are exploring cross-border partnerships in regions not subject to these levies, thereby preserving access to state-of-the-art instrumentation.

Overall, the cumulative impact of 2025 United States tariffs is redefining procurement and operational models within the microarray segment, accelerating trends toward supply chain diversification and domestic capacity building.

Uncovering Critical Segmentation Insights Revealing How Product Technology Application and End User Dynamics Shape Microarray Market Evolution

A nuanced understanding of market segmentation reveals the intricate layers shaping the microarray sector. Within the spectrum of product types, consumable arrays-encompassing glass slides and silicon chips-remain the most widely adopted component, while labware and reagents facilitate streamlined workflows from sample preparation to hybridization reactions. Beyond these, specialized instruments ranging from scanning systems to liquid handlers and affiliated services support the end-to-end microarray lifecycle. Complementing this, technology type segmentation underscores the prominence of DNA-based platforms, where cDNA arrays and oligonucleotide arrays enable high-resolution gene expression profiling, and protein and tissue microarrays extend capabilities into proteomic mapping and spatial histology. Application areas further diversify market dynamics, as diagnostic use cases leverage array panels for biomarker screening, drug discovery stages employ arrays for target identification and validation, genomics research exploits broad expression datasets, and personalized medicine initiatives refine patient stratification via tailored molecular signatures. End user segmentation illuminates the ecosystem’s breadth, with academic and research institutes driving foundational science, contract research organizations offering outsourced expertise, hospitals and diagnostic centers applying clinical assays, and pharmaceutical and biotechnology firms integrating microarrays into pipeline development. The interplay of these segmentation dimensions underscores how product design, technological innovation, application focus, and end-user requirements collectively shape the future trajectory of microarray advancements.

This comprehensive research report categorizes the Microarray market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology Type

- Application

- End User

Illuminating Regional Dynamics Highlighting How Americas EMEA and Asia-Pacific Drive Distinct Opportunities and Challenges in Microarray Adoption

Regional dimensions play a pivotal role in dictating how microarray solutions are adopted and developed across global markets. In the Americas, strong government funding for genomics research and significant investment by pharmaceutical enterprises have established North America as a breeding ground for novel array platforms and clinical assay validation. The United States remains a central hub for technology innovation, with leading institutions leveraging arrays in large-scale biomarker discovery projects and precision oncology trials. Meanwhile, Latin American research centers are increasingly collaborating with North American counterparts to address region-specific health challenges and to build local manufacturing capabilities.

Europe, the Middle East, and Africa present a mosaic of opportunities influenced by regional regulation, varied research infrastructures, and collaborative networks. Europe’s robust regulatory framework and supportive funding programs foster cross-border consortia for translational research, while Middle Eastern initiatives aim to establish regional genome centers focusing on disease prevalence unique to the area. In Africa, partnerships between international organizations and local institutes are driving capacity building for infectious disease surveillance using microarray panels, thereby strengthening public health responses.

Asia-Pacific has emerged as a critical frontier for microarray adoption, spurred by expansive life sciences investment in countries such as China, Japan, and India. Domestic manufacturers are rapidly scaling production of consumables and instruments, often benefiting from government incentives for biotechnology innovation. In parallel, research institutions throughout the region are integrating array technologies into national precision medicine programs, thereby accelerating clinical translation and driving substantial market growth potential.

This comprehensive research report examines key regions that drive the evolution of the Microarray market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Players Demonstrating Strategic Partnerships Investment Priorities and Technological Differentiation in Microarray Space

Leading stakeholders in the microarray arena are pursuing diverse strategies to solidify their positions and spur innovation. A number of established players have concentrated on expanding their consumable arrays portfolio by developing next-generation substrates that enhance sensitivity and reproducibility. These companies have augmented their offerings through strategic partnerships with reagent developers, combining proprietary chemistries with advanced detection methods to deliver end-to-end solutions compatible with both gene and protein analysis.

Simultaneously, select instrument manufacturers have accelerated investments in automation platforms that integrate liquid handling, hybridization, and high-resolution scanning. By offering modular systems, these firms enable laboratories to tailor workflows-and scale throughput-without overhauling existing infrastructure. Service providers have complemented this trend by extending customized assay development, data analysis pipelines, and training modules to ensure that end users maximize the value of their microarray investments.

Emerging entrants are carving out niches with specialized offerings, such as single-cell microarray kits and high-plex immunoassays, designed to address unmet needs in oncology and immunology research. Several of these innovators are forging alliances with academic consortia to co-develop validated assay panels for translational studies, thereby accelerating time to market and establishing credibility among key opinion leaders.

Taken together, these company-driven initiatives underscore a competitive landscape characterized by collaborative ecosystems, differentiation through technology integration, and a relentless focus on enhancing user experience and data fidelity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microarray market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Applied Micro Arrays, Inc.

- Arrayit Corporation

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- CapitalBio Technology Co., Ltd.

- CD Genomics, Inc.

- Creative Biolabs, Inc.

- Danaher Corporation

- F. Hoffmann-La Roche AG

- GE HealthCare Technologies Inc.

- Illumina, Inc.

- JPT Peptide Technologies GmbH

- Merck KGaA

- Microarrays Inc.

- Oxford Gene Technology IP Limited

- PerkinElmer, Inc.

- QIAGEN N.V.

- RayBiotech, Inc.

- Revvity, Inc.

- Thermo Fisher Scientific Inc.

Guiding Strategic Decision Makers with Actionable Recommendations to Leverage Microarray Innovations Enhance Collaboration and Accelerate Research Outcomes

To leverage the full potential of microarray technologies, decision makers should prioritize strategic initiatives that align with emerging scientific and operational imperatives. First, establishing collaborative frameworks with both established instrument suppliers and emerging niche providers can facilitate access to the latest consumable and automation innovations. Co-development partnerships and consortium-based projects will be instrumental in adapting array designs to specialized research challenges.

Second, integrating advanced data analytics tools, including artificial intelligence and machine learning models, should be considered essential for extracting deeper insights from high-content array datasets. Investments in cloud-based platforms and interoperable software will streamline data processing workflows and support reproducible results across distributed research teams.

Third, diversifying procurement strategies to encompass a balanced mix of local manufacturing sources and international suppliers can mitigate supply chain risks amplified by tariff regimes. Cultivating relationships with regional producers of reagents and labware may also yield cost efficiencies without sacrificing quality.

Finally, cultivating internal expertise through targeted training programs and knowledge-sharing forums will enable laboratories to fully harness the capabilities of next-generation microarray platforms. By developing specialized skill sets in assay optimization and data interpretation, organizations can accelerate the translation of experimental findings into tangible applications.

Detailing Rigorous Methodology Employed to Ensure Data Integrity Comprehensive Analysis and Robust Insights in Microarray Market Evaluation

The insights presented in this summary are underpinned by a rigorous methodological framework designed to ensure accuracy and relevance. Primary research involved in-depth interviews with leading scientists, procurement managers, and clinical laboratory directors to capture firsthand perspectives on technology adoption, operational challenges, and strategic priorities. These qualitative inputs were systematically triangulated with secondary data sources, including peer-reviewed publications, regulatory filings, patent databases, and industry white papers, to validate emerging trends and technological breakthroughs.

Quantitative analysis incorporated vendor performance metrics, patent activity tracking, and published adoption rates to map the competitive landscape and identify areas of rapid evolution. Geographic and end-user segmentation was informed by cross-referencing regional research funding allocations, clinical trial registries, and industry event proceedings. In each segment, data was normalized against standardized definitions for product types, technology categories, applications, and end users to maintain comparability.

Furthermore, an expert advisory panel comprising microarray specialists and data scientists reviewed interim findings to ensure methodological soundness and to highlight areas requiring deeper investigation. All data sources and analytical assumptions were documented in detail, enabling stakeholders to trace the genesis of key insights and to assess the robustness of conclusions drawn.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microarray market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microarray Market, by Product Type

- Microarray Market, by Technology Type

- Microarray Market, by Application

- Microarray Market, by End User

- Microarray Market, by Region

- Microarray Market, by Group

- Microarray Market, by Country

- United States Microarray Market

- China Microarray Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Drawing Conclusive Perspectives on the Microarray Landscape by Synthesizing Trends Insights and Strategic Imperatives for Future Growth

The microarray domain continues to evolve at a remarkable pace, sculpted by technological refinements, shifting policy landscapes, and strategic maneuvers by industry leaders. Through careful examination of transformative innovations-from substrate enhancements and digital analytics integration to single-cell resolution capabilities-it is evident that microarrays are moving beyond traditional gene expression studies into broader proteomic and spatial profiling arenas.

Moreover, the introduction of tariffs in the United States has underscored the importance of adaptive supply chain strategies and regional capacity expansions, highlighting a parallel imperative to foster domestic manufacturing and strengthen global collaboration. Segmentation insights emphasize the interconnected roles of product design, technology type, application focus, and end-user requirements in steering market dynamics. At the same time, regional analyses demonstrate distinct drivers across the Americas, EMEA, and Asia-Pacific, each presenting unique opportunities for growth and partnership.

Key company initiatives-spanning strategic alliances, automation investments, and specialized assay development-further illustrate the competitive intensity and innovation ethos permeating the microarray segment. Building on these observations, actionable recommendations point toward a future in which collaborative frameworks, advanced analytics adoption, supply chain diversification, and skill development are critical success factors.

Collectively, these insights coalesce into a strategic roadmap that empowers stakeholders to navigate the complex microarray landscape and to harness its full potential for advancing scientific discovery and applied diagnostics.

Transform Your Strategic Vision and Research Outcomes by Securing Customized Microarray Market Intelligence Today

I hope this executive summary has provided a comprehensive perspective on the transformative potential and strategic considerations surrounding microarray applications across industries and research domains. If these insights resonate with your organizational goals and you are ready to delve deeper into tailored analysis and detailed data, I encourage you to reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through the full breadth of our market research offering and discuss how a customized report can empower your decision making. Connect today to secure the in-depth intelligence necessary to achieve your next breakthrough in microarray-driven innovation

- How big is the Microarray Market?

- What is the Microarray Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?