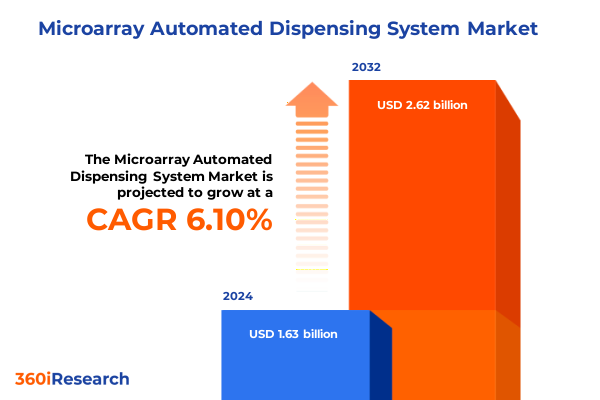

The Microarray Automated Dispensing System Market size was estimated at USD 1.71 billion in 2025 and expected to reach USD 1.82 billion in 2026, at a CAGR of 6.27% to reach USD 2.62 billion by 2032.

Exploring the Frontier of Precision and Efficiency in Automated Microarray Dispensing Technologies Revolutionizing Life Science Research and Diagnostics Workflows

Microarray automated dispensing systems have emerged as foundational enablers of precision, reproducibility, and throughput in modern life science and diagnostic laboratories. By leveraging the convergence of robotics, optics, and microfluidics, these platforms facilitate the miniaturization of assays and the parallelization of experiments, enabling researchers to screen thousands of targets with unprecedented accuracy. Over the past decade, developments in acoustic droplet ejection, piezoelectric actuators, and solenoid valve–driven dispensers have transformed manual pipetting workflows into high-speed automated processes that significantly reduce error rates and operational costs.

Driven by increasing demand for high-resolution genomic, proteomic, and drug discovery applications, the latest generation of microarray dispensing solutions integrates advanced software controls, user-friendly interfaces, and real-time quality monitoring. These enhancements not only accelerate assay development but also open new possibilities for personalized medicine, biomarker validation, and large-scale screening campaigns. As the field continues to evolve, laboratories are prioritizing systems that offer both modular scalability and rapid method development, ensuring that scientists can respond swiftly to emergent research needs and regulatory requirements.

Unveiling the Strategic Transformations Driving the Integration of Automated Microarray Dispensing Systems Across Research and Industrial Bioanalysis

The landscape of automated microarray dispensing has been reshaped by several transformative shifts that underscore the maturation of life science research and industrial biomanufacturing. First, the integration of acoustic droplet ejection technology has elevated dispensing resolution to the nanoliter scale, minimizing reagent consumption while expanding the range of compatible assay formats. Simultaneously, innovations in microfluidic chip design have streamlined fluid handling pathways, enabling high-density array spotting with exceptional uniformity and reduced cross-contamination risk.

In parallel, the adoption of piezoelectric dispensing modules has enhanced control over droplet volume and placement, facilitating applications that demand sub-picoliter precision. As throughput requirements have intensified, developers have introduced parallelized solenoid valve arrays, allowing multiple channels to operate concurrently without sacrificing accuracy. These technological strides are complemented by advancements in software-driven closed-loop feedback systems, which continuously monitor dispensing parameters and adjust in real time to ensure consistent performance across thousands of microarray spots. Collectively, these shifts are driving a new era of efficiency, flexibility, and reliability in high-throughput screening, molecular diagnostics, and biomarker discovery workflows.

Assessing the Combined Effect of Section 232 and Section 301 Tariff Measures on Imports of Automated Microarray Dispensing Equipment in 2025

In mid-2025, the cumulative impact of U.S. trade measures on laboratory equipment has reached a new apex. A baseline World Trade Organization Most-Favored-Nation tariff of up to 7% has been supplemented by a 10% reciprocal tariff on most imports, which is scheduled to remain in effect through July 9, 2025. On China-origin goods, an additional 20% surcharge-imposed as a fentanyl-related penalty-and a 25% levy under Section 301 have combined to produce an effective duty rate of 55% at the U.S. border for non-steel items. For equipment whose essential component is steel or aluminum, a 50% Section 232 tariff displaces the 10% reciprocal layer and stacks with the China-only duties, elevating total duties to as high as 70% for certain imports.

Despite aggressive protection measures, the Office of the U.S. Trade Representative has maintained duty-free status for 178 tariff subheadings encompassing consumables, spectrometer parts, and centrifuge rotors through August 31, 2025. Companies that secure valid exclusions for microarray dispensing instruments can mitigate cost pressures by filing exemption numbers on import documentation, but must diligently monitor the renewal deadlines. Concurrently, the impending lapse of the reciprocal-tariff pause highlights the importance of front-loading orders supported by robust customs compliance strategies and dynamic supplier sourcing plans.

Actionable Insights on Market Dynamics Across End User, Technology, Application, and Throughput Segmentation for Automated Microarray Dispensing

Analyzing the microarray dispensing market through the lens of end users reveals a diverse ecosystem ranging from academic research institutes pioneering fundamental science to biotechnology firms driving novel therapeutic platforms. Contract research organizations, both clinical and preclinical, leverage these systems to accelerate study throughput and uphold stringent regulatory compliance, while large pharmaceutical companies integrate dispensing automation into lead optimization and target identification pipelines to enhance R&D productivity.

From a technology standpoint, acoustic droplet ejection stands out for its noncontact precision, making it ideal for sensitive assays and composite array fabrication. Microfluidic systems offer unparalleled fluidic miniaturization and integration potential, whereas piezoelectric dispensers balance speed with micron-scale accuracy. Solenoid valve–based platforms further cater to high-throughput requirements by supporting multiplexed reagent handling with rapid cycle times.

Applications span diagnostics, where array-based cancer and infectious disease panels demand consistent spot morphology, to genomics, where comparative genomic hybridization, gene expression profiling, and single nucleotide polymorphism genotyping depend on precise reagent deposition. In proteomics, functional protein analysis and protein array screening rely on uniform spot volumes to ensure quantitative repeatability. Finally, throughput segmentation underscores the need for flexible hardware configurations capable of alternating between high-throughput screening for large compound libraries and low-throughput custom assays without extensive revalidation.

This comprehensive research report categorizes the Microarray Automated Dispensing System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Throughput

- End User

- Application

Regional Trends and Opportunities in Automated Microarray Dispensing Across the Americas, Europe Middle East and Africa, and Asia-Pacific Regions

Regional analysis illuminates how geographic nuances shape technology adoption and competitive strategies. In the Americas, established research ecosystems in North America are underpinned by supportive funding environments and mature regulatory frameworks, fostering early uptake of high-precision dispensing solutions. Latin American markets are gradually emerging as strategic growth zones, driven by expanding biotech hubs and increasing public-private partnerships in molecular diagnostics.

Across Europe, the Middle East, and Africa, heterogeneous regulatory landscapes and variable research infrastructure investments have created pockets of concentrated demand. Western Europe remains a hotbed for platform innovation and integration into comprehensive laboratory automation suites, while emerging markets in the Middle East and Africa prioritize cost-effective, modular solutions that can adapt to diverse application requirements.

In Asia-Pacific, rapid expansion of genomics and proteomics initiatives has catalyzed significant interest in scalable, high-throughput dispensing systems. Government-backed precision medicine programs and collaborations between domestic OEMs and global technology providers are accelerating deployments. Together, these regional dynamics underscore the importance of tailored market entry strategies and localized service offerings to capture growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Microarray Automated Dispensing System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Innovations, Strategic Collaborations, and Competitive Positioning of Major Players Driving Advancement in Automated Microarray Dispensing

Leading solution providers continue to differentiate through focused innovation and strategic partnerships. Industry stalwarts have invested heavily in expanding acoustic and microfluidic module portfolios, while select players have forged alliances with software developers to deliver integrated data analytics and quality-control platforms. Recent collaborations between dispensing OEMs and consumables manufacturers have yielded high-performance tip arrays designed to minimize carryover and maximize spot integrity across a broad range of reagents.

Competitive positioning is further influenced by the ability to offer comprehensive service frameworks, including on-site method development, remote diagnostics, and rapid response spare parts availability. Companies that maintain agile production footprints across multiple regions can navigate tariff fluctuations and currency shifts more effectively, providing customers with cost-efficient procurement pathways. As the market becomes increasingly crowded, differentiation through unique technology offerings and end-to-end solution ecosystems will be critical to sustaining leadership positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microarray Automated Dispensing System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Arrayit Corporation

- Aurora Biomed Inc.

- Beckman Coulter Life Sciences, Inc.

- Bio-Rad Laboratories, Inc.

- BioDot, Inc.

- Eppendorf AG

- Hamilton Company

- Illumina, Inc.

- M2-Automation GmbH

- Molecular Devices, LLC

- PerkinElmer, Inc.

- QIAGEN N.V.

- Revvity, Inc.

- SCIENION GmbH

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

Strategic Initiatives and Tactical Guidance to Enhance Flexibility and Supply Chain Resilience in Automated Microarray Dispensing

To maintain a competitive advantage, industry leaders are advised to embrace platform flexibility by investing in modular systems that support multiple dispensing technologies within a unified framework. Establishing diversified supplier networks across Asia, Europe, and North America can mitigate exposure to sudden tariff escalations and logistical disruptions. Furthermore, leveraging artificial intelligence and machine learning algorithms for predictive maintenance and process optimization can reduce downtime and enhance throughput consistency over time.

Organizations should also prioritize proactive engagement with regulatory and customs authorities to secure and extend duty-exempt status for critical HTS codes. Collaborative partnerships with academic and clinical institutions can foster co-development of novel assay formats, providing early insights into emerging market needs. By adopting a holistic strategy that balances technological innovation, supply chain resilience, and stakeholder collaboration, companies can navigate market complexities and drive sustainable growth.

Detailing a Research Methodology Centered on Primary and Secondary Data, Expert Consultations, and Robust Validation Protocols

The research process combined primary interviews with laboratory directors, procurement officers, and R&D heads across key end-user segments, alongside secondary analysis of policy documents, trade publications, and peer-reviewed literature. Multiple rounds of expert consultations-spanning manufacturing engineers, application scientists, and customs compliance specialists-ensured a balanced perspective on technology capabilities and regulatory environments.

Quantitative data was triangulated using public customs filings, company financial statements, and equipment installation records to validate trends and regional penetration rates. Rigorous validation protocols, including data cross-checks and consistency reviews, underpinned every analytical step to maintain the highest standards of accuracy and reliability. This multi-layered methodology provides stakeholders with a clear, actionable understanding of the evolving landscape for automated microarray dispensing systems.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microarray Automated Dispensing System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microarray Automated Dispensing System Market, by Technology

- Microarray Automated Dispensing System Market, by Throughput

- Microarray Automated Dispensing System Market, by End User

- Microarray Automated Dispensing System Market, by Application

- Microarray Automated Dispensing System Market, by Region

- Microarray Automated Dispensing System Market, by Group

- Microarray Automated Dispensing System Market, by Country

- United States Microarray Automated Dispensing System Market

- China Microarray Automated Dispensing System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Strategic Imperatives to Propel Technological Adoption and Excellence in Automated Microarray Dispensing Platforms

This executive summary has highlighted how rapid advancements in acoustic, piezoelectric, and microfluidic dispensing modules are reshaping experimental workflows by enabling higher precision and throughput. We have examined the profound impact of layered U.S. tariffs, revealing how Section 232 and Section 301 duties create significant cost pressures that require agile supply chain and compliance strategies.

Through segmentation analysis, end-user needs-from academic discovery to large-scale pharmaceutical development-have been mapped alongside technology and application requirements. Regional insights have emphasized the necessity of localized market approaches, while a review of competitive dynamics underscored the role of innovation partnerships and service excellence in driving differentiation.

As research organizations and commercial enterprises increasingly rely on automated microarray dispensing systems, adopting the strategic recommendations outlined here will be essential for optimizing performance, managing cost volatility, and capitalizing on emerging opportunities across diagnostics, genomics, and drug discovery domains.

Engage with Ketan Rohom to Access Expert Insights and Secure Your Comprehensive Automated Microarray Dispensing Market Research Report Today

Engage directly with Ketan Rohom for a personalized walkthrough of how our in-depth research can inform your strategic decisions and give you a competitive edge in adopting cutting-edge microarray dispensing solutions. Whether you’re evaluating new platform integrations, navigating evolving trade policies, or exploring partnerships for innovation acceleration, his expertise can help you unlock actionable insights tailored to your organization’s needs.

Reach out today to arrange a one-on-one consultation and discover how you can secure immediate access to the industry’s most comprehensive market research report on automated microarray dispensing systems. Partnering with a knowledgeable guide ensures you translate data into growth strategies and maintain a leadership position as the technology landscape continues to evolve.

- How big is the Microarray Automated Dispensing System Market?

- What is the Microarray Automated Dispensing System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?