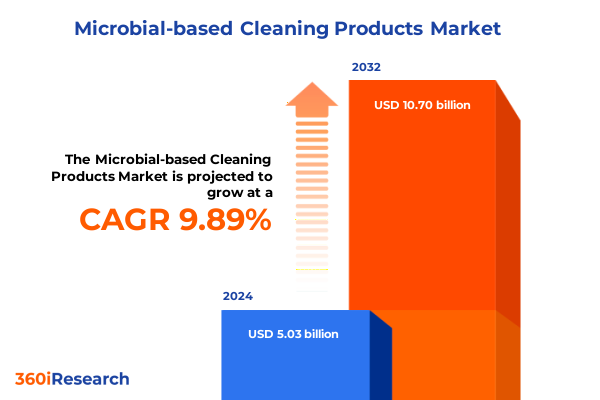

The Microbial-based Cleaning Products Market size was estimated at USD 5.49 billion in 2025 and expected to reach USD 6.01 billion in 2026, at a CAGR of 9.98% to reach USD 10.70 billion by 2032.

Exploring the Unprecedented Rise of Microbial-Based Cleaning Solutions as Sustainable, High-Performance Alternatives Revolutionizing Sanitation Practices Worldwide

In an era defined by heightened environmental consciousness and growing scrutiny of traditional chemical agents, microbial-based cleaning products have emerged as a pivotal innovation in sanitation and hygiene. Leveraging naturally occurring microorganisms and enzyme-driven processes, these formulations offer a dual advantage of effectively degrading organic soils and biofilms while minimizing ecological impact. As stakeholders across industries seek alternatives to harsh chemical disinfectants and detergents, microbial solutions have gained traction for their ability to deliver sustainable performance without compromising on efficacy. Moreover, the evolution of formulation science has expanded the applicability of these products across diverse use cases, from routine household cleaning to specialized industrial hygiene.

The rising global emphasis on circular economy principles and reduction of volatile organic compounds (VOCs) has further propelled interest in biologically based sanitation technologies. Against a backdrop of stringent regulatory frameworks aimed at curbing chemical pollution and antimicrobial resistance, end users are increasingly drawn to solutions that align with public health and environmental goals. Concurrently, advances in biotechnology have enabled manufacturers to enhance stability, shelf life, and targeted activity of microbial strains, paving the way for next-generation product portfolios.

This executive summary offers a strategic lens on the microbial-based cleaning market, mapping its key drivers, disruptive shifts, and emerging opportunities. Through an in-depth examination of recent regulatory changes, supply chain dynamics, and competitive landscapes, the following sections deliver critical insights designed to inform executive decision-making and shape actionable growth strategies.

Identifying Key Technological, Regulatory, and Consumer-Driven Shifts Reshaping the Microbial Cleaning Solutions Ecosystem Worldwide

The microbial cleaning sector is undergoing transformative shifts driven by technological breakthroughs, regulatory realignments, and evolving consumer values. On the technological front, advances in strain engineering and bioencapsulation have enabled the development of formulations with improved stability and efficacy. Manufacturers are integrating symbiotic enzyme-microbe complexes that accelerate the breakdown of complex organic compounds, while novel delivery mechanisms such as time-release microcapsules ensure sustained activity on treated surfaces. These innovations not only elevate cleaning performance but also reduce dosing frequency, enhancing user convenience.

Regulatory landscapes are concurrently reshaping market dynamics, as governments worldwide tighten restrictions on high-toxicity chemicals and prioritize green procurement policies. In markets such as the European Union, where stringent biocide regulations and REACH directives limit conventional disinfectants, microbial alternatives benefit from expedited approvals and favorable labeling. Meanwhile, in North America, anticipated revisions to Clean Air Act standards are expected to place greater emphasis on VOC-free and low-residue sanitation products, reinforcing the competitive positioning of microbial-based offerings.

Consumer-driven forces are equally pivotal, as end users increasingly demand transparency, eco-certifications, and demonstrable health benefits. The growing push for traceable ingredient sourcing and verifiable environmental claims has prompted leading players to invest in third-party certifications and digital traceability platforms. Additionally, the proliferation of online reviews, social media advocacy, and sustainability ratings has intensified competition, compelling brands to differentiate through innovative microsolutions and educational outreach initiatives.

Assessing the Comprehensive Influence of New United States 2025 Trade Tariffs on Cost Structures and Supply Chain Strategies in Microbial Cleaning Solutions

The imposition of new U.S. tariffs in 2025 on imported specialty chemicals and enzyme precursors has had a cumulative impact on the microbial cleaning products industry, influencing cost structures and supply chain configurations. Raw materials critical to formulating enzyme-microbe complexes, including select biopolymers and carrier substrates sourced from international suppliers, now incur additional duties that increase baseline input costs. To counteract margin compression, manufacturers have reevaluated procurement strategies, seeking out domestic bio-based feedstocks and negotiating multi-year contracts to stabilize pricing.

Furthermore, the tariffs have prompted a strategic reassessment of distribution networks. Companies are exploring nearshoring initiatives to establish localized blending and packaging facilities, thereby reducing cross-border logistics expenses and mitigating exposure to future trade policy uncertainties. This shift towards regional supply hubs also complements growing demand for rapid order fulfillment and reduced carbon footprints. As a result, some enterprises have forged partnerships with state-backed innovation clusters to access grant funding supporting onshore enzyme production and biomanufacturing.

Despite these challenges, resilient pricing mechanisms and value-based propositions have allowed microbial cleaning manufacturers to navigate the tariff environment without sacrificing product quality. By leveraging a premium positioning strategy and articulating total cost of ownership savings tied to reduced chemical usage and lower environmental remediation costs, leading brands have maintained price integrity. Looking ahead, ongoing tariff reforms will likely drive further diversification of enzyme sourcing and underscore the importance of vertical integration in sustaining competitive advantage.

Deriving Actionable Insights from Product, Application, End User, and Sales Channel Segmentation to Unlock Market Potential

A nuanced understanding of market segmentation reveals critical pathways to capturing value across distinct product formats, usage scenarios, customer profiles, and distribution channels. Within the product dimension, liquid solutions continue to dominate due to their user-friendly dosing capabilities and compatibility with automated dispensing systems. At the same time, pods or tablets have gained favor among eco-conscious consumers by minimizing packaging waste and ensuring precise formulation ratios, while concentrated powder form products offer cost-effective shipping and extended shelf stability. Complementary sprays and mists facilitate targeted application in high-touch areas, and single-use wipes cater to convenience-driven segments seeking rapid sanitation.

Application-based segmentation uncovers further growth vectors, as microbial hard surface cleaners address the critical need for biofilm disruption in commercial kitchens and healthcare settings. Laundry detergent lines enriched with live cultures are becoming a mainstream option for consumers keen on fabric care innovation and odor neutralization without harsh chemicals. Likewise, specialized odor eliminators harness enzymatic biodegradation to target volatile compounds at their source, appealing to industries and households coping with pet care, waste management, and hospitality scenarios.

End-user segmentation highlights commercial environments such as corporate offices embracing green janitorial standards, educational institutions prioritizing safe classrooms, healthcare facilities demanding robust infection control, and hospitality venues seeking differentiated guest experiences. Industrial operations, including food processing and manufacturing plants, rely on microbial formulas for heavy-duty equipment cleaning and hygiene compliance, while residential homeowners increasingly adopt subscription-based microbe-infused cleaners for everyday maintenance.

From a distribution standpoint, offline retail channels remain essential for mass-market penetration, with convenience stores supporting on-the-go purchases, specialty stores delivering expert guidance, and supermarkets & hypermarkets ensuring broad product visibility. Meanwhile, online retail platforms have emerged as powerful enablers of direct-to-consumer engagement, driving subscription renewals through personalized offers and leveraging data analytics to refine product assortments based on purchasing behaviors.

This comprehensive research report categorizes the Microbial-based Cleaning Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Microbial Composition

- Application Area

- End User

- Sales Channel

Uncovering Regional Dynamics Driving Growth and Adoption of Microbial Cleaning Products Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics significantly shape market maturation, with distinct drivers and barriers across major geographies. In the Americas, the United States leads adoption through federal and state-level green procurement mandates, incentivizing facility managers to integrate microbial cleaners into janitorial contracts and public infrastructure maintenance. Canada echoes this sentiment with its own environmental certification programs, while Latin American markets are gradually embracing sustainable hygiene solutions as awareness campaigns bolster demand. Transitioning into Europe, Middle East & Africa, regulatory rigor in Western Europe-driven by the EU’s circular economy agenda-propels microbial formulations ahead of synthetic alternatives, and strong certification ecosystems validate product claims. In the Middle East, post-pandemic sanitation investments and heightened focus on food safety are fueling interest in biologically driven cleaning methods, whereas Africa represents an emergent frontier characterized by nascent infrastructure upgrades and cost-sensitive procurement models.

Within the Asia-Pacific region, rapid urbanization and public health awareness in China are transforming demand for non-chemical disinfectants across commercial and residential contexts. Japan’s stringent labeling requirements and deep-rooted consumer trust in biotech innovations create a robust environment for novel microbial brands, while Australia’s progressive environmental standards and premium consumer segment drive uptake of certified green cleaners. In South and Southeast Asia, rising middle-class populations and expanding e-commerce ecosystems present significant opportunities, although price competitiveness and supply chain scalability remain critical to achieving widespread market penetration.

This comprehensive research report examines key regions that drive the evolution of the Microbial-based Cleaning Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Landscapes and Strategic Imperatives of Leading Innovators in Microbial-Based Cleaning Solutions Sector Globally

The competitive landscape of microbial-based cleaning solutions is evolving as established chemical conglomerates and agile biotech startups vie for market leadership. Legacy players with extensive distribution networks have introduced proprietary probiotic and enzyme blends, leveraging brand recognition and scale economies to secure contracts in high-volume accounts. Conversely, specialized innovators are differentiating through cutting-edge strain development, harnessing genomics and metagenomics to tailor microbe consortia for niche applications such as food processing sanitation and pharmaceutical cleanrooms. Strategic partnerships between chemical formulators and life science research hubs are accelerating product pipelines, enabling co-development of formulations that integrate next-generation microbial strains with digital monitoring technologies.

Mergers and acquisitions are also reshaping market hierarchies, as larger firms acquire niche specialists to augment their green portfolios and enhance technical expertise. Joint ventures with packaging technology providers are delivering sustainable delivery systems, such as refillable pouches and biodegradable dispensing units, thereby strengthening value propositions. Meanwhile, venture-backed challengers are carving out footholds in online retail by offering flexible subscription models, data-driven refill reminders, and immersive digital experiences that educate users on microbe-driven cleaning mechanisms. Across these various strategies, differentiation increasingly hinges on a combination of technical validation, certification credentials, and the ability to demonstrate total environmental and health impact reductions relative to legacy chemistries.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microbial-based Cleaning Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AB Electrolux

- Acuro Organics Limited

- Advanced Enzyme Technologies Limited

- American Biosystems, Inc.

- American Cleaning Technologies, Inc.

- BBA Ecotech S.r.l.

- Betco Corporation

- Bionetix International by Cortec Corporation

- CoverTec Products LLC

- Croda International Plc

- Culleoka Company LLC

- Diversey Inc. by Solenis International LLC

- Earth Alive Clean Technologies Inc.

- Ecolab Inc.

- Evonik Industries AG

- Faultless Brands

- Faultless Brands

- Genesis Biosciences Ltd.

- Graymills Corporation

- HeiQ PLC

- Henkel AG & Co. KGaA

- Infinita Biotech Private Limited

- Ingenious Probiotics

- Insinc Products Limited

- Jelmar, LLC

- Novonesis Group

- NuGenTec LLC

- Nyco Products Company

- Praras Biosciences Pvt. Ltd.

- Probiotic Group

- Pure Ingenious Ltd.

- Reckitt Benckiser Group plc

- S.C. Johnson & Son Inc.

- SCD Probiotics LLC

- The Clorox Company

- The Procter & Gamble Company

- Univar Solutions Inc.

- Wilh. Wilhelmsen Holding ASA

- WorldWare Enterprises Ltd.

- Z BioScience, Inc.

Empowering Industry Leaders with Strategic Recommendations to Scale and Differentiate Microbial Cleaning Product Portfolios

To capitalize on the accelerating momentum of microbial cleaning technologies, industry leaders should adopt a multifaceted strategy that aligns R&D innovation, supply chain optimization, and market engagement. Prioritizing investment in next-generation strain engineering and encapsulation techniques can yield breakthrough formulations with extended stability and targeted efficacy. Concurrently, diversifying raw material sourcing to include domestic bioprocessing facilities or regional fermentation hubs will enhance resilience against trade disruptions and tariff pressures.

Engagement strategies must focus on educating procurement professionals and end users through robust digital content, interactive training programs, and certification partnerships. Demonstration pilots in high-value verticals such as hospitality and healthcare can serve as proof points for efficacy, driving broader acceptance. In parallel, the development of software-enabled dispensing systems and IoT-based usage analytics will enable service providers to differentiate through real-time performance monitoring and predictive maintenance insights.

Sustainability certifications, third-party validations, and transparent life cycle assessments should be integrated into branding narratives to reinforce credibility. Expanding direct-to-consumer channels with subscription-based offerings and dynamic pricing models will deepen customer relationships and generate recurring revenue streams. Finally, alliances with waste management and recycling organizations can foster circular packaging initiatives, further strengthening appeal to environmentally conscious stakeholders.

Outlining Rigorous Qualitative and Quantitative Methodologies Underpinning the Comprehensive Market Analysis of Microbial Cleaners

This research integrates both qualitative and quantitative methodologies to ensure a robust and comprehensive analysis of the microbial cleaning products market. Primary data was gathered through in-depth interviews with C-level executives, R&D scientists, procurement managers, and distribution partners, providing firsthand perspectives on product performance, regulatory challenges, and customer preferences. To validate these insights, targeted surveys were conducted across end-user segments, including corporate facility teams, hospitality operators, healthcare professionals, and residential consumers, supplying granular adoption metrics and attitudinal data.

Secondary research encompassed a thorough review of regulatory databases, patent filings, technical white papers, and environmental certification standards to map evolving compliance frameworks and innovation trajectories. Competitive profiling was informed by annual reports, investor presentations, and supply chain disclosures, enabling an accurate depiction of market share dynamics and strategic initiatives. Data triangulation techniques were employed to reconcile variances across sources, ensuring analytical rigor and reducing potential bias. Segmentation matrices were developed to categorize product formats, applications, end-user clusters, and sales channels, which were cross-referenced against regional performance indicators to highlight growth pockets and risk factors.

Limitations of this study include the rapidly evolving nature of biotechnology regulations and potential shifts in trade policies. However, by establishing a dynamic update protocol through continuous monitoring of regulatory bulletins and industry consortium announcements, the research framework remains adaptable to emerging developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microbial-based Cleaning Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microbial-based Cleaning Products Market, by Product Type

- Microbial-based Cleaning Products Market, by Microbial Composition

- Microbial-based Cleaning Products Market, by Application Area

- Microbial-based Cleaning Products Market, by End User

- Microbial-based Cleaning Products Market, by Sales Channel

- Microbial-based Cleaning Products Market, by Region

- Microbial-based Cleaning Products Market, by Group

- Microbial-based Cleaning Products Market, by Country

- United States Microbial-based Cleaning Products Market

- China Microbial-based Cleaning Products Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Synthesizing Critical Insights on the Future Trajectory of Microbial Cleaning Products and Strategic Imperatives for Market Success

In synthesizing the insights from technological advancements, regulatory upheavals, segmentation dynamics, tariff impacts, regional nuances, and competitive strategies, a clear narrative emerges: microbial-based cleaning products are poised to redefine hygiene standards across industries. The convergence of sustainability imperatives, public health priorities, and biotechnology breakthroughs has fostered an environment where biologically driven formulations can outcompete traditional chemistries on both performance and ecological criteria. Leading organizations that embrace innovation, develop resilient supply chains, and articulate compelling environmental value propositions will secure a premium positioning in increasingly discerning markets.

Moreover, the strategic recommendations outlined earlier-ranging from R&D investment to digital engagement and certification alignment-provide a cohesive roadmap for scaling operations and accelerating adoption. Regional differentiation remains crucial, as regulatory stringency, consumer behavior, and infrastructure maturity vary across the Americas, EMEA, and Asia-Pacific. Companies that tailor go-to-market and product strategies to align with local context will unlock incremental growth and fortify their competitive moat.

Ultimately, ongoing vigilance in monitoring policy changes, scientific breakthroughs, and end-user feedback loops will be pivotal to sustaining market leadership. As the microbial cleaning ecosystem matures, those who proactively adapt to shifting landscapes and invest in differentiated capabilities will emerge as the architects of a cleaner, safer, and more sustainable future.

Connect with Ketan Rohom to Access the Full Market Research Report and Gain a Competitive Edge in Microbial Cleaning Markets

To explore the full depth of insights, data, and strategic analyses presented in our comprehensive market research report on microbial-based cleaning products, connect with Ketan Rohom, Associate Director, Sales & Marketing. Engaging with Ketan will unlock a tailored walkthrough of granular findings, advanced segmentation models, and region-specific strategies designed to empower your organization’s decision-making. Through this collaboration, you can access exclusive appendices containing detailed company profiles, proprietary benchmarking frameworks, and step-by-step implementation roadmaps that translate high-level recommendations into actionable initiatives.

By partnering with Ketan, you gain direct entry to expert consultation sessions that align research outcomes with your unique business objectives, facilitating prioritized road mapping for product development, regulatory navigation, and go-to-market planning. Whether you require custom data extractions, scenario planning exercises, or validation of internal strategies against market realities, this engagement ensures you are equipped with the intelligence needed to outperform competitors. Reach out today to secure a briefing and download a complimentary executive snapshot that highlights the transformative opportunities awaiting in the microbial cleaning landscape.

- How big is the Microbial-based Cleaning Products Market?

- What is the Microbial-based Cleaning Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?