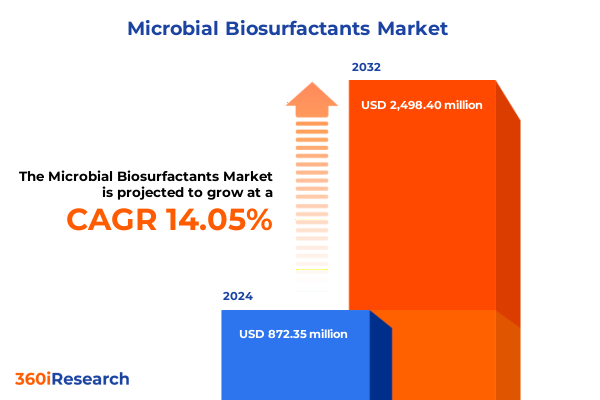

The Microbial Biosurfactants Market size was estimated at USD 986.45 million in 2025 and expected to reach USD 1,120.89 million in 2026, at a CAGR of 14.19% to reach USD 2,498.39 million by 2032.

Unveiling the Undeniable Versatility of Microbial Biosurfactants as Sustainable Emulsifiers, Cleaners, and Bioactive Agents in Evolving Global Markets

Microbial biosurfactants represent a groundbreaking class of surface-active compounds synthesized by microorganisms such as bacteria, fungi, and yeast that deliver unparalleled performance across an array of industrial applications. These biomolecules exhibit exceptional emulsification properties, enabling the stabilization of oil-in-water and water-in-oil systems, while simultaneously offering compelling advantages in terms of biodegradability and low toxicity. As corporations and regulatory bodies intensify their focus on sustainable chemistries, microbial biosurfactants have rapidly transitioned from niche laboratory curiosities to commercial mainstays.

Initially embraced by the oil and gas sector for enhanced oil recovery and bioremediation efforts, these compounds have since gained traction in personal care, agriculture, food and beverage, and industrial cleaning segments. Consequently, companies are now allocating research and development resources toward optimizing microbial strains and fermentation processes, bolstered by advances in bioprocess engineering and downstream purification techniques. Moreover, the intrinsic functionality of glycolipids, lipopeptides, phospholipids, and polymeric variants continues to expand, yielding tailored solutions for specific application requirements.

Furthermore, evolving regulations across key geographies have elevated the imperative for non-petrochemical surfactants, reinforcing the market’s trajectory toward green alternatives. In tandem, consumer demand for bio-based and ethically sourced ingredients has driven brand owners to integrate biosurfactants into sustainable product portfolios. As a result, the stage is set for a sustained period of strategic innovation and cross-sector collaboration, positioning microbial biosurfactants at the forefront of the clean-chemistry movement.

How Technological Innovations, Sustainability Imperatives, and Regulatory Changes Are Reshaping the Microbial Biosurfactants Market Landscape

Underpinning the rapid maturation of the microbial biosurfactants market are a series of transformative shifts driven by technology breakthroughs, sustainability mandates, and tightening regulatory frameworks. Technological progress in fermentation design-ranging from high-throughput strain screening to continuous bioreactor operation-has significantly reduced production timelines and improved yields. Concurrently, innovations in downstream processing, including membrane separations and green extraction solvents, have enhanced purity profiles and minimized environmental footprints.

Moreover, global sustainability imperatives have catalyzed investments in renewable feedstocks and circular-economy models. Manufacturers are increasingly exploring agricultural and industrial byproducts as low-cost carbon sources, thereby reducing reliance on refined sugars and minimizing waste streams. In parallel, digitalization initiatives, such as real-time process monitoring and predictive analytics, provide unprecedented control over fermentation kinetics and ensure consistent product quality.

However, regulatory developments present both challenges and opportunities. Stringent safety assessments under frameworks like the European Union’s REACH legislation and the U.S. Environmental Protection Agency’s biocidal product regulations have elevated entry barriers for novel biosurfactant chemistries. At the same time, these standards have validated the high safety margins of established microbial surfactants, accelerating their adoption in sensitive sectors such as food and pharmaceuticals. As a result, market participants must navigate a dynamic landscape where scientific innovation and compliance converge to define competitive advantage.

Evaluating the Impact of 2025 United States Tariffs on Supply Chains, Pricing Structures, and Competitive Positioning in the Biosurfactants Industry

The imposition of United States tariffs in early 2025 has introduced considerable pressure on global supply chains, reshaping cost structures, sourcing strategies, and competitive dynamics within the biosurfactants sector. By increasing duties on imported biosurfactant precursors and finished products, domestic manufacturers have gained a relative pricing edge, prompting downstream formulators to reevaluate procurement channels. Consequently, firms reliant on international suppliers have accelerated efforts to secure alternative feedstock origins or to vertically integrate production capabilities.

Furthermore, the tariff framework has triggered a chain reaction across pricing mechanisms. Many market participants have been compelled to adjust contract terms, with pass-through of incremental costs becoming a central negotiation point. In response, a subset of end-users has increasingly migrated toward formulations that leverage locally sourced microbial surfactants, thereby reducing exposure to import duties. However, this strategic pivot has underscored challenges in achieving consistent quality and scale, highlighting the need for enhanced partnerships between raw material suppliers and contract production organizations.

In addition, competitive positioning has undergone a recalibration. International biosurfactant producers are exploring joint ventures and technology licensing agreements to establish domestic footholds and mitigate tariff impacts. Conversely, leading domestic players are channeling investments into expanding fermentation capacity and bolstering R&D for next-generation compounds. Collectively, these developments reinforce the notion that tariff regimes can serve as a catalyst for supply chain resilience and regional self-sufficiency, shaping market structures well beyond pricing alone.

Unlocking Critical Insights from Type, Source, Distribution Channel, and Application Segmentation in the Biosurfactants Market

A comprehensive examination of the microbial biosurfactants market necessitates an understanding of how product categories, production sources, distribution frameworks, and application areas interrelate to influence strategic direction. From a product perspective, glycolipids command attention for their low critical micelle concentration and broad emulsifying efficacy, while lipopeptides such as surfactin deliver potent antimicrobial activity that appeals to pharmaceutical and personal care formulators. Meanwhile, phospholipid-based biosurfactants offer exceptional biocompatibility for food-grade uses, and polymeric variants provide high-viscosity stabilization in specialized industrial settings.

Turning to sources, bacterial strains dominate due to robust growth kinetics and genetic tractability, whereas fungal and yeast systems-particularly sophorolipid producers-offer cost advantages and distinct functional profiles. Transitioning into distribution modalities, the market is served by traditional offline channels encompassing chemical distributors, formulation houses, and direct sales, alongside burgeoning online platforms that facilitate rapid sampling, e-commerce ordering, and small-batch deliveries suited to R&D operations.

Applications underscore the versatility of microbial biosurfactants across sectors. In agriculture, these agents support eco-friendly pest control and soil remediation, while in food and beverage they enhance texture, foam control, and shelf stability. Industrial cleaning processes benefit from robust oil removal and low-foaming characteristics, and in oil and gas operations, formulations optimize enhanced oil recovery and pipeline maintenance. Beyond these uses, personal care and cosmetics companies integrate biosurfactants into shampoos, creams, and body washes for milder skin interactions, whereas pharmaceutical developers leverage them as drug delivery vehicles. Finally, environmental remediation efforts rely on biosurfactants to accelerate waste treatment and bioremediation of hydrocarbon spills. By integrating these segmentation dimensions, stakeholders can tailor R&D roadmaps and go-to-market tactics to specific value-chain junctures.

This comprehensive research report categorizes the Microbial Biosurfactants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Source

- Form

- Distribution Channel

- Application

Delivering Strategic Regional Perspectives on the Biosurfactants Market Across Americas, EMEA, and Asia-Pacific Growth Hubs

Regional dynamics exert a profound influence on the evolution of the microbial biosurfactants market, with each geography driven by distinct regulatory frameworks, resource availability, and end-user requirements. In the Americas, the United States and Brazil emerge as focal points, thanks to well-established biotechnology ecosystems and substantial demand from oil and gas, industrial cleaning, and agriculture sectors. Moreover, supportive incentives for bio-based innovations at federal and state levels have spurred pilot projects and commercial-scale plants, fostering a vibrant domestic supply chain.

Turning to Europe, Middle East & Africa, regulatory rigor under the European Chemicals Agency and national agencies has heightened emphasis on safety and environmental performance, shaping procurement policies in cleaning and personal care markets. Simultaneously, renewable feedstock mandates in several European countries have catalyzed bio-refinery integrations, while Middle East nations explore biosurfactant applications in enhanced oil recovery as part of initiatives to diversify energy portfolios. African markets, though nascent, present opportunities for decentralized production tailored to local waste treatment and agro-industrial needs.

In the Asia-Pacific region, rapid industrialization and rising consumer awareness of green products have driven adoption across personal care, food and beverage, and agriculture applications. China and India, in particular, are witnessing capacity expansions backed by government subsidies and tax incentives. Additionally, partnerships between multinational biosurfactant producers and regional specialty chemical companies are facilitating knowledge transfer and market access. Collectively, these regional variations underscore the necessity for adaptive strategies that align product offerings with localized priorities and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Microbial Biosurfactants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Initiatives, Portfolio Diversification, and Collaborative Ventures of Leading Biosurfactants Manufacturers in the Global Arena

The competitive landscape in the microbial biosurfactants domain is characterized by dynamic maneuvering among global chemical conglomerates, specialty biotech firms, and nimble start-ups. Market leaders have pursued portfolio diversification strategies, integrating glycolipid and lipopeptide technologies into broader surfactant lines to cater to cross-industry demand. Concurrently, acquisitions of smaller innovators have accelerated time-to-market for next-generation chemistries, while joint ventures between established players and research institutes have fueled proprietary strain development and process optimization.

Furthermore, alliances aimed at enhancing downstream capabilities have become increasingly prevalent. Collaborative projects with contract research organizations and engineering partners enable scale-up validation and cost reduction, mitigating technical risk for end-users. In parallel, select firms have invested in dedicated carbon source supply chains, forging partnerships with agricultural cooperatives to secure stable, traceable feedstocks for fermentation.

Moreover, forward-looking companies are exploring digital platforms to streamline customer engagement, offering online configurators for custom biosurfactant blends and virtual process simulations. These initiatives not only increase operational efficiency but also reinforce brand visibility in specialized market segments. As competitive pressure intensifies, a clear trend emerges: those organizations that combine robust R&D pipelines with strategic partnerships and agile commercialization frameworks are best positioned to capture the expanding opportunities in microbial biosurfactants.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microbial Biosurfactants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGAE Technologies, LLC

- Allied Carbon Solutions Co., Ltd.

- AmphiStar BV

- BASF SE

- Biosurfactants LLC

- Biosynth Ltd.

- BIOTENSIDON s.r.o.

- Croda International PLC

- Dispersa Inc.

- Evonik Industries AG

- Geocon Products

- Givaudan SA

- GlycoSurf, Inc.

- Holiferm

- Jeneil Biotech Inc.

- Kaneka Corporation

- Locus Performance Ingredients

- Merck KGaA

- Saraya Co. Ltd.

- Sasol Limited

- Shaanxi Deguan Biotechnology Co., Ltd.

- Sihauli Chemicals Private Limited

- Stepan Company

- Syensqo

- The Dow Chemical Company

- Unilever PLC

- Wheatoleo

Empowering Industry Leaders with Tactical Recommendations to Capitalize on Emerging Opportunities and Mitigate Risks in the Biosurfactants Sector

To thrive in a market defined by rapid innovation and shifting regulatory demands, industry leaders must adopt a proactive approach that balances short-term agility with long-term strategic vision. First, prioritizing investment in advanced strain engineering and process intensification can yield cost advantages and enhance performance metrics, enabling companies to differentiate their offerings. Furthermore, fostering partnerships with academic institutions and specialized contract research organizations can accelerate technology validation and de-risk scale-up phases.

In addition, supply chain resilience must remain at the forefront of risk mitigation efforts. By diversifying feedstock sourcing across multiple geographies and cultivating relationships with secure agricultural or industrial byproduct suppliers, organizations can hedge against tariff volatility and raw material shortages. Moreover, pursuing incremental improvements in downstream purification-through techniques such as membrane filtration and green solvent integration-can further lower operational costs and reduce environmental impact.

Finally, leaders should engage end-users through educational initiatives that highlight the functional superiority and sustainability benefits of microbial biosurfactants. Digital tools such as interactive formulation libraries and virtual workshops can streamline adoption curves and foster collaborative innovation. By aligning R&D roadmaps, marketing communications, and supply chain strategies around evolving customer requirements, forward-thinking companies will be well positioned to transform emerging trends into sustainable competitive advantage.

Detailing a Robust Research Methodology Combining Primary Interviews, Secondary Analysis, and Qualitative Techniques for Rigorous Biosurfactants Market Insight

This study employs a rigorous, multi-tiered research methodology designed to capture comprehensive insights into the microbial biosurfactants landscape. The primary research phase involved in-depth interviews with senior executives, technical directors, and application specialists across chemical manufacturers, formulation houses, and end-user companies. These qualitative discussions provided firsthand perspectives on market drivers, technology adoption challenges, and strategic priorities.

Parallel secondary research encompassed an exhaustive review of peer-reviewed journals, patent filings, public company disclosures, regulatory databases, and industry publications. Insights gleaned from these sources were meticulously triangulated with primary data to validate findings and ensure accuracy. Additionally, qualitative tools-such as SWOT analyses, PESTLE frameworks, and supply chain mapping-were applied to contextualize market dynamics and identify inflection points.

Finally, a series of validation workshops brought together subject matter experts to challenge preliminary conclusions and refine strategic recommendations. This iterative process ensured that the final deliverables reflect a balanced synthesis of expert judgment and empirical evidence, providing stakeholders with dependable intelligence to guide investment, innovation, and operational decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microbial Biosurfactants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microbial Biosurfactants Market, by Type

- Microbial Biosurfactants Market, by Source

- Microbial Biosurfactants Market, by Form

- Microbial Biosurfactants Market, by Distribution Channel

- Microbial Biosurfactants Market, by Application

- Microbial Biosurfactants Market, by Region

- Microbial Biosurfactants Market, by Group

- Microbial Biosurfactants Market, by Country

- United States Microbial Biosurfactants Market

- China Microbial Biosurfactants Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Summarizing Key Takeaways, Emerging Trends, and Strategic Imperatives Shaping the Future Trajectory of the Microbial Biosurfactants Market

In summary, microbial biosurfactants are poised to redefine surfactant portfolios across industries, driven by their superior ecological profiles and functional versatility. Emerging process technologies and circular feedstock strategies are unlocking new cost-performance frontiers, while regulatory endorsements reinforce the transition away from petrochemical alternatives. At the same time, tariff shifts in key markets have highlighted the importance of supply chain resilience and regional production capabilities.

Looking ahead, segmentation dynamics-spanning product types such as glycolipids and lipopeptides, production sources including bacterial and fungal systems, distribution channels that bridge traditional and digital platforms, and diverse applications from agriculture to pharmaceuticals-will continue to shape strategic roadmaps. Regional disparities in regulatory rigour, resource endowments, and consumer preferences underscore the need for localized approaches that align R&D investments and go-to-market tactics with specific market contexts.

Collectively, these insights point to a future in which collaboration, innovation, and adaptive strategies will determine market leadership. Companies that invest in technology acceleration, feedstock diversification, and customer education will not only navigate immediate challenges but also establish the foundation for long-term, sustainable growth in the dynamic microbial biosurfactants sector.

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to Secure In-Depth Microbial Biosurfactants Market Research Insights and Propel Strategic Growth

To unlock unparalleled strategic advantages in an increasingly competitive biosurfactants market, reach out to Ketan Rohom, Associate Director of Sales & Marketing, and leverage his deep industry expertise. By engaging with Ketan, you will gain access to an in-depth market research report that delivers actionable insights, rigorous analysis, and tailored recommendations. This comprehensive resource offers the clarity needed to navigate supply chain complexities, align product development with sustainable trends, and refine go-to-market strategies.

Don’t miss the opportunity to empower your organization with data-driven intelligence that can shape investment decisions, drive innovation pipelines, and foster high-impact partnerships. Connect with Ketan Rohom today to secure your copy of the microbial biosurfactants market research report and propel your strategic growth agenda into new frontiers

- How big is the Microbial Biosurfactants Market?

- What is the Microbial Biosurfactants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?