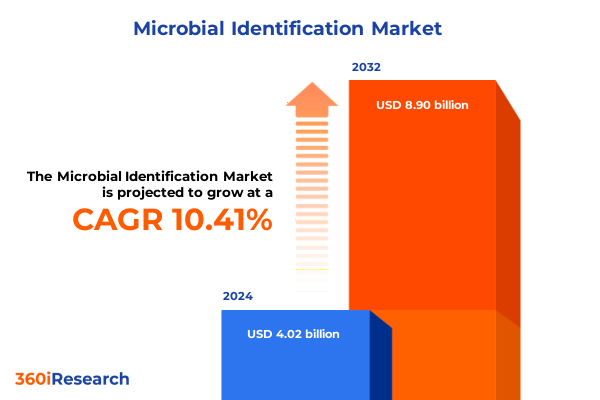

The Microbial Identification Market size was estimated at USD 4.39 billion in 2025 and expected to reach USD 4.79 billion in 2026, at a CAGR of 10.61% to reach USD 8.90 billion by 2032.

Laying The Groundwork For Comprehensive Microbial Profiling Through Innovative Identification Techniques And Emerging Analytical Frameworks

Microbial identification has transcended its traditional confines, evolving into a cornerstone of modern life sciences and clinical diagnostics. Fueled by escalating demands for rapid detection and precise characterization, the discipline now incorporates a spectrum of advanced methodologies aimed at uncovering the complex interplay among microorganisms, hosts, and environments. At its core, this shift underscores a commitment to accuracy and speed, enabling laboratories to address emergent health threats, food safety concerns, and biopharmaceutical quality control with enhanced confidence.

Over recent years, the convergence of high-resolution instrumentation, sophisticated informatics platforms, and refined consumable kits has laid the foundation for integrated workflows that streamline microbial profiling from sample preparation through data interpretation. Emerging approaches capitalize on the strengths of culture media and reagents optimized for target-specific enrichment, seamlessly dovetail with chromatography and sequencing systems, and leverage bioinformatics software to translate raw data into actionable insights. As a result, stakeholders are now better positioned to navigate regulatory complexities and deliver high-impact results that align with stringent quality standards and evolving customer expectations.

Catalyzing Evolution In Microbial Diagnostics Through Converging Technologies And Paradigm Shifts In Analytical Capabilities And Workflow Optimization

The landscape of microbial diagnostics is undergoing a profound transformation driven by synergistic advances in immunoassays, nucleic acid amplification, mass spectrometry, and sequencing technologies. Conventional methods, once regarded as the gold standard, now operate in concert with automated platforms that accelerate throughput and minimize human error. For instance, lateral flow assays and ELISA formats have benefited from enhanced sensitivity and multiplexing capabilities, bridging the gap between point-of-care convenience and laboratory-grade reliability.

Meanwhile, PCR-based systems have advanced beyond simple amplification to incorporate digital quantification and real-time analysis, enabling clinicians and researchers to monitor pathogen loads with unprecedented precision. MALDI-TOF mass spectrometry has similarly revolutionized species-level identification by offering rapid spectral fingerprinting, which, when paired with robust bioinformatics software, streamlines the translation of proteomic signatures into definitive results. The integration of next-generation sequencing further extends the diagnostic repertoire, delivering comprehensive community profiling and antimicrobial resistance detection. Collectively, these converging technologies redefine best practices, elevate performance benchmarks, and set the stage for next-generation diagnostic pathways.

Assessing The Comprehensive Consequences Of Tariff Adjustments On United States Microbial Analysis Supply Chains And Service Accessibility

Recent adjustments to United States tariffs have reshaped the procurement strategies of laboratories and service providers engaged in microbial identification. Tariff modifications on imported reagents, chromatographic columns, and instrumentation components have prompted a strategic reevaluation of supplier portfolios and sourcing corridors. Consequently, organizations have sought to build resilience by diversifying procurement across domestic manufacturing hubs and alternative international partners that mitigate exposure to fluctuating duties.

In response, leading distributors have adapted by augmenting their inventories, streamlining supply chain logistics, and offering bundled packages that buffer end users from sudden cost escalations. These measures have led to a recalibration of pricing structures, especially for high-value items such as MALDI-TOF systems and next-generation sequencing consumables. Simultaneously, service providers are emphasizing maintenance contracts and support services to ensure uninterrupted access amid evolving trade conditions. As a result, end users now benefit from predictable lead times and value-driven partnerships that support continuous operation and strategic planning.

Deciphering Key Insights Through Multifaceted Segmentation Across Products Technologies Applications End Users And Organismic Profiles

Insightful segmentation unveils the nuanced demands that shape procurement and utilization across the microbial identification spectrum. Within the realm of consumables, accessories and culture media cater to routine enrichment protocols while reagents and kits deliver targeted specificity for complex specimens. Instrumentation strategies, from chromatography and MALDI-TOF platforms to PCR and sequencing systems, address volume, throughput, and sensitivity requirements, each unlocking distinct investigative potential. Meanwhile, bioinformatics software and identification services provide interpretive power, and maintenance offerings safeguard continuous functionality.

Technological segmentation further illuminates market preferences, where conventional culturing coexists with immunoassays-such as ELISA and lateral flow formats-that balance rapid detection with ease of use. PCR-based diagnostics and mass spectrometry remain vital for quantitative accuracy, whereas sequencing approaches, encompassing both Sanger and next-generation modalities, unveil deeper genomic insights. Application-driven perspectives highlight academic research’s quest for exploratory analysis, clinical diagnosis’s imperative for infectious disease and sepsis detection, environmental testing’s focus on ecosystem health, food safety’s preventive measures, and pharmaceutical endeavors’ demand for rigorous contamination control.

End-user segmentation showcases the diverse ecosystems that rely on these solutions, from research institutions pioneering fundamental discoveries to environmental laboratories assessing water and soil risk. Food and beverage entities prioritize consumer safety and regulatory compliance, while hospitals and diagnostic labs demand rapid turnaround and clinical-grade precision. Pharmaceutical and biotech firms, with their tight process requirements, seek comprehensive identification to uphold quality and expedite product pipelines. Organism-specific insights draw attention to bacteria as the predominant focus, with fungi, parasites, and viruses each presenting unique detection challenges that influence method selection and workflow design.

This comprehensive research report categorizes the Microbial Identification market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Organism

- Technology

- End User

- Application

Highlighting Regional Dynamics And Strategic Considerations Within Americas Europe Middle East And Africa And Asia Pacific Microbial Identification Ecosystems

Regional dynamics play a pivotal role in shaping adoption rates, regulatory landscapes, and collaborative networks in microbial identification. In the Americas, a robust infrastructure of clinical laboratories and research institutions underscores a strong demand for high-throughput instrumentation and integrated software suites, enabling swift translation of discoveries into diagnostic applications. Transitioning north to south, supply chain optimization and domestic reagent production enhance resilience against international trade fluctuations.

Across Europe, the Middle East, and Africa, stringent regulatory frameworks reinforce the emphasis on standardized validation protocols and cross-border collaboration. European regulatory harmonization facilitates the deployment of MALDI-TOF and sequencing systems, while emerging economies in the Middle East and Africa pursue capacity building through public–private partnerships. In parallel, Asia Pacific’s vibrant life science hubs drive innovation in PCR automation and next-generation sequencing, supported by government-sponsored initiatives that accelerate digital health integration. Strategic alliances among manufacturers, contract research organizations, and academic centers in this region fuel a dynamic ecosystem that propels the next wave of microbial diagnostic advancements.

This comprehensive research report examines key regions that drive the evolution of the Microbial Identification market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Leading Industry Players And Their Strategic Initiatives Driving Innovation Collaboration And Competitive Differentiation In Microbial Identification

The competitive landscape in microbial identification is defined by a cadre of established and emerging players that continually refine their offerings to address evolving user requirements. Leading life science corporations have invested in expanding their reagent portfolios to include enriched culture media formulations and multiplex immunoassay kits, while simultaneously broadening their instrumentation range with advanced mass spectrometry and high-throughput sequencing systems. These organizations leverage global service networks to deliver training, calibration, and maintenance at scale, enhancing user confidence and uptime.

Adjacent technology firms have entered the fray by developing specialized bioinformatics platforms that integrate seamlessly with upstream data generation tools. Their cloud-enabled architectures facilitate remote collaboration and real-time insights, appealing to a spectrum of stakeholders from diagnostic labs to environmental monitoring agencies. Meanwhile, niche service providers specializing in microbial identification have cultivated reputations for bespoke method development and rapid turnaround times, complementing equipment manufacturers by addressing complex or non-standardized sample matrices. As competition intensifies, partnerships and strategic alliances emerge as key differentiators, enabling co-innovation and shared access to specialized expertise and geographical channels.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microbial Identification market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accelerate Diagnostics, Inc.

- Alifax S.r.l.

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- Biolog, Inc.

- bioMérieux SA

- Bruker Corporation

- CD Genomics.

- Charles River Laboratories International, Inc.

- Creative Diagnostics

- DH Life Sciences, LLC

- Eurofins Scientific (Ireland) Limited

- Genefluidics, Inc.

- Gradian Diagnostics

- Himedia Laboratories

- Liofilchem S.R.L.

- Merck KGaA

- Metabolon Inc.

- QIAGEN GmbH

- Shimadzu Corporation

- STERIS PLC

- Thermo Fisher Scientific Inc.

- Trivitron Healthcare

- VWR International, LLC. by Avantor, Inc.

- Wickham Micro Ltd.

- Zhuhai DL Biotech. Co.,LTD.

Proposing Strategic Imperatives For Industry Leadership Centered On Collaborative Innovation Regulatory Foresight And Operational Excellence In Microbial Diagnostics

To thrive in this dynamic environment, industry leaders must embrace a triad of strategic imperatives built around collaboration, regulatory foresight, and operational excellence. First, forging cross-sector partnerships among equipment manufacturers, software developers, and end users can catalyze co-development of tailored solutions that address unique sample types and throughput demands. These alliances also facilitate knowledge exchange, accelerating the refinement of protocols and validation frameworks.

Second, maintaining a proactive stance on regulatory evolution is essential. By engaging with standards bodies and contributing to guideline development, organizations can anticipate compliance requirements and influence the adoption of harmonized performance metrics. Early alignment with regulatory expectations not only streamlines product launches but also fortifies customer trust. Finally, optimizing internal processes through lean principles and data-driven quality management ensures consistent delivery of results. Investments in training programs, remote diagnostics for instrumentation, and modular workflow architectures can significantly reduce downtime, enhance reproducibility, and shorten time‐to‐result, thereby reinforcing competitive positioning.

Outlining A Robust Research Framework That Integrates Quantitative Methods Qualitative Insights And Rigorous Validation For Microbial Identification Studies

A robust research methodology forms the backbone of reliable microbial identification analysis. Quantitative approaches begin by collecting standardized data from key equipment segments, including mass spectrometers, PCR systems, and sequencing platforms, ensuring consistency through calibration checks and interlaboratory comparisons. Simultaneously, qualitative insights are gathered via expert interviews with clinical microbiologists, environmental scientists, and food safety specialists to contextualize technological performance in real-world applications.

Subsequent data validation employs cross-referencing between independent laboratories, reinforcing the accuracy of reported detection limits and turnaround times. Advanced statistical techniques assess variance across replicates and assay conditions, while thematic analysis of interview transcripts sheds light on emergent user preferences and pain points. This mixed-methods framework allows for a comprehensive understanding of both the technical capabilities and the operational realities that govern microbial identification workflows. By meticulously documenting protocols and validation criteria, the research ensures transparency and reproducibility for stakeholders who rely on these findings to inform procurement and process optimization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microbial Identification market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microbial Identification Market, by Product Type

- Microbial Identification Market, by Organism

- Microbial Identification Market, by Technology

- Microbial Identification Market, by End User

- Microbial Identification Market, by Application

- Microbial Identification Market, by Region

- Microbial Identification Market, by Group

- Microbial Identification Market, by Country

- United States Microbial Identification Market

- China Microbial Identification Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Synthesizing Critical Findings To Illuminate The Path Forward For Stakeholders Engaged In Microbial Profiling And Diagnostic Advancement

The collective insights from this analysis illuminate a dynamic field poised for transformative growth. The shift toward integrated diagnostic ecosystems, fueled by the convergence of mass spectrometry, nucleic acid amplification, and sequencing technologies, highlights the sector’s relentless pursuit of accuracy and efficiency. Segmentation analysis underscores the importance of tailoring solutions to specific product categories, technological modalities, application domains, end user contexts, and organism types.

Regional assessments reveal that geopolitical factors, regulatory environments, and collaborative ecosystems significantly influence adoption trajectories. Competitive mapping demonstrates that success hinges on the ability to synergize product innovation, service excellence, and strategic partnerships. Ultimately, organizations that align their strategies with evolving user needs, regulatory trends, and supply chain considerations will lead the next generation of microbial identification breakthroughs. In doing so, they will not only address critical public health challenges but also unlock new possibilities in life science research and industrial quality assurance.

Encouraging Engagement With Expert Associate Director To Secure Comprehensive Market Intelligence And Drive Strategic Decision Making In Microbial Identification

Engaging directly with Ketan Rohom, the Associate Director of Sales and Marketing, heralds an opportunity to align your organization’s objectives with the latest comprehensive analysis of microbial identification. Through a personalized consultation, you can explore deep insights into prevailing technological advances, regional dynamics, and segmentation nuances that underpin actionable strategies for competitive differentiation. This engagement ensures that decision makers receive tailored guidance on leveraging emerging diagnostic platforms and regulatory adaptations to optimize operational efficiency and scientific rigor.

By initiating this dialogue, you gain access to exclusive perspectives on end user needs, organism-specific demands, and supply chain considerations that drive procurement and implementation decisions. Ketan’s extensive experience in facilitating strategic alliances among manufacturers, service providers, and research institutions empowers your team to translate market intelligence into high-impact initiatives. Reserve your consultation today to secure a roadmap that directly addresses your priorities in microbial profiling and diagnostic excellence.

- How big is the Microbial Identification Market?

- What is the Microbial Identification Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?