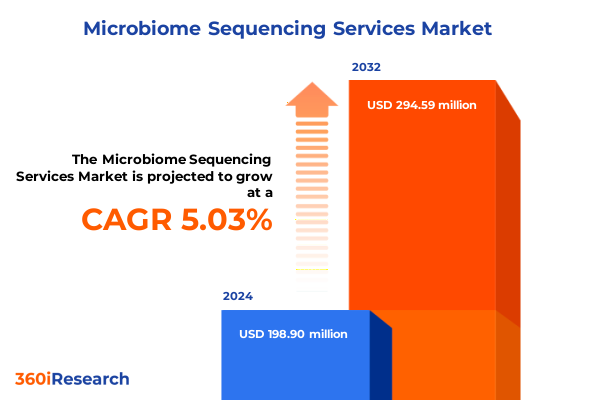

The Microbiome Sequencing Services Market size was estimated at USD 206.84 million in 2025 and expected to reach USD 220.76 million in 2026, at a CAGR of 5.18% to reach USD 294.59 million by 2032.

Harnessing Scientific Breakthroughs and Expanding Applications That Are Catalyzing the Rapid Advancement of Microbiome Sequencing Services Worldwide

The study of microbial communities has transcended niche academic interest to become a strategic imperative across health care, agriculture, environmental science, and pharmaceutical research. Innovative sequencing services now enable unprecedented resolution in characterizing bacterial, fungal, viral, and archaeal populations across human, animal, plant, and environmental habitats. Amid this expansion, decision makers are seeking clarity on how shifting technological capabilities, cost structures, and regulatory frameworks intersect to shape the evolving landscape.

At the heart of this dynamic environment lies a confluence of factors: rapidly declining sequencing costs, fueled by high-throughput and long-read platforms; the proliferation of specialized sample preparation protocols optimized for stool, oral swabs, skin scrapings, soil matrices, and water samples; and the integration of advanced bioinformatics pipelines powered by artificial intelligence to distill actionable insights from multi-terabyte datasets. As next-generation platforms push per-sample expenses ever lower, service providers are diversifying their offerings to include functional metatranscriptomics, shotgun metagenomics, and targeted amplicon approaches.

Consequently, stakeholders must navigate a complex mosaic of service modalities, instrument ecosystems, and end-user requirements in academic, clinical, agricultural, environmental, and industrial settings. This introduction establishes the foundational context for an in-depth executive summary that will articulate the key shifts, segmentation insights, regional differentiators, competitive dynamics, and strategic recommendations guiding market participants today.

Unveiling Transformational Technology Trends, Regulatory Shifts, and Analytical Innovations Reshaping the Microbiome Sequencing Services Landscape

In recent years, a series of technological breakthroughs have redefined what is possible in microbiome analysis. The introduction of high-throughput instruments with miniaturized reagents and reusable flow cells has dramatically increased sample throughput while compressing timelines. Meanwhile, long-read sequencing systems now deliver contiguous microbial assemblies that illuminate previously intractable genomic regions, facilitating strain-level discrimination and functional gene mapping. These advancements are complemented by emerging single-cell and spatial meta-omics techniques, bridging the gap between community profiling and localized cellular interactions.

Alongside instrumentation, the regulatory landscape has adapted to emerging clinical use cases. Authorities have begun establishing validation guidelines for microbial diagnostic assays, enabling service providers to pursue clinical laboratory improvement amendments (CLIA) certification and in vitro diagnostic (IVD) pathways. This shift from purely research-grade offerings to regulated diagnostic services, particularly in gastrointestinal and infectious disease panels, underscores the transformative trajectory of sequencing services.

Moreover, the convergence of multi-omics integration-combining metagenomics with metatranscriptomics, metabolomics, and proteomics-has accelerated discovery in drug development, sustainable agriculture, and environmental stewardship. As a result, strategic alliances between sequencing providers, pharma R&D groups, and agricultural conglomerates are proliferating, demonstrating how technological, regulatory, and collaborative shifts are reshaping the microbiome sequencing services landscape.

Analyzing the Multifaceted Effects of 2025 United States Trade Tariffs on Supply Chains Cost Structures and Service Pricing in Microbiome Sequencing

In April 2025, the United States implemented a universal 10 percent tariff on most imported goods, with country-specific adjustments resulting in a cumulative 145 percent tariff on laboratory goods from China, while non-USMCA imports from Canada and Mexico face 25 percent duties on non-compliant goods and 10 percent on energy and potash products. This new tariff framework has rendered critical sequencing reagents, electronic components, and precision instruments significantly more expensive for service providers, compelling procurement teams to reevaluate sourcing strategies and secure higher inventory levels.

Sequencing equipment manufacturers have responded by passing through a surcharge to end users. Illumina, for example, announced a 5 percent uplift on consumables, between 2 percent and 9 percent on instruments, and a 3.5 percent increase on most services for U.S. customers, citing approximately $85 million in tariff-related costs for fiscal year 2025. These price adjustments directly impact the cost basis of microbiome sequencing runs and have led some laboratories to renegotiate contracts or explore alternative platforms.

Analysts project that life science tools companies may encounter cost-of-goods-sold increases averaging 2 percent, with selected firms such as Agilent and Bruker experiencing up to a 3 percent to 4 percent rise in COGS in response to the tariff regime. As a result, the cumulative effect of these trade measures is driving providers to diversify their supplier base, consider domestic manufacturing partnerships, and invest in buffer inventories to insulate service levels from ongoing supply chain volatility.

Deriving Strategic Insights from Diverse Segmentation Criteria Spanning Sample Types Technologies Applications and End Users in Sequencing Services

A nuanced understanding of market segmentation reveals how service requirements and customer priorities vary. Laboratories analyzing human microbiomes commonly rely on fecal and oral specimens to probe gut and oral cavity ecosystems, respectively, while specialized protocols for skin swabs, soil cores, and water samples address environmental and agricultural research needs. Each sample matrix demands tailored extraction chemistries and quality control checks to ensure data fidelity.

Technological segmentation further underscores differentiation. Amplicon sequencing, anchored by 16S rRNA and internal transcribed spacer workflows, remains the workhorse for cost-effective taxonomic surveys. However, growing demand for functional insights has driven uptake of metatranscriptomic sequencing, which captures active gene expression profiles, and shotgun metagenomic sequencing, which delivers comprehensive community and strain-level resolution. Service providers are packaging these offerings into modular tiers, enabling clients to select from targeted or holistic profiling modalities.

Applications span agriculture and animal husbandry-where crop quality and livestock health monitoring leverage microbiome data-clinical diagnostics for gastrointestinal disorder and infectious disease detection, consumer genomics through at-home and clinic-based testing, environmental monitoring of soil health and water quality, and pharmaceutical R&D focused on drug discovery and microbiome therapeutic development. Across these domains, end users including academic and research institutes, clinical diagnostic laboratories, consumer genomics companies, contract research organizations, and pharmaceutical and biopharmaceutical firms drive demand, each with unique analytical specifications, turnaround expectations, and regulatory considerations.

This comprehensive research report categorizes the Microbiome Sequencing Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sample Type

- Technology

- Application

- End User

Examining Regional Dynamics and Strategic Drivers Influencing the Adoption and Deployment of Microbiome Sequencing Services Across Global Markets

Geographic markets exhibit distinct characteristics in the adoption and delivery of microbiome sequencing services. In the Americas, robust academic clusters and leading research institutions have historically propelled demand, supported by substantial public and private R&D investments. North American clinical laboratories have pioneered CLIA-certified microbiome assays, fostering a vibrant service ecosystem with rapid turnaround capabilities.

Europe, the Middle East, and Africa present a multifaceted landscape shaped by stringent data privacy regulations, regional harmonization under GDPR, and a strong emphasis on translational research. European consortia frequently collaborate across national borders on large-scale microbiome initiatives, leveraging shared biobanks and standardized protocols. Markets in the Middle East and Africa are emerging rapidly, with government-backed programs aimed at bolstering local sequencing capacity and reducing dependence on imports.

Asia-Pacific stands out for its competitive cost structures, large volume processing capabilities, and rapidly growing contract research sector. Nations such as China, Japan, South Korea, and Australia have prioritized microbiome projects in national science agendas, driving both domestic adoption and export-oriented service offerings. Price competition in the region has prompted global providers to establish local sequencing hubs to maintain market share and meet the demand for efficient, high-throughput workflows.

This comprehensive research report examines key regions that drive the evolution of the Microbiome Sequencing Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry-Leading Sequencing Service Providers and Their Strategic Initiatives Driving Competitive Differentiation and Market Leadership

Leading providers are executing targeted strategies to differentiate their service portfolios. Illumina has increased its pricing to reflect tariff impacts while concurrently expanding instrument applications into regulated clinical sequencing and emerging single-cell workflows. Its vast installed base enables a strong consumables business and positions it to capture recurring revenues from diverse end users.

Pacific Biosciences has enacted cost-saving measures in response to strained funding and trade pressures, including workforce reductions and operational streamlining to maintain its long-read sequencing platforms. These actions underscore the ongoing balance between capital efficiency and technology leadership in high-accuracy sequencing services.

Thermo Fisher Scientific’s multi-billion-dollar investment in domestic manufacturing and R&D underscores its commitment to supply chain resilience and innovation. By enhancing U.S. production capacity for reagents and instruments, the company seeks to reduce import exposure and deliver reliable service continuity across its global laboratory network. Other notable players such as QIAGEN, BGI, and Novogene are expanding their microbiome sequencing offerings through partnerships, platform enhancements, and regional laboratory launches, reflecting a strategic focus on both scale and specialized applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microbiome Sequencing Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Baseclear B.V.

- BGI Group

- Charles River Laboratories

- Clinical Microbiomics A/S

- CosmosID

- Diversigen Inc.

- Eurofins Scientific

- Microba Life Sciences

- Microbiome Insights Inc.

- Molecular Research LP

- Mérieux NutriSciences Corporation

- Novogene Co., Ltd.

- QIAGEN N.V.

- Second Genome

- Shanghai Realbio Technology Co., Ltd.

- Zymo Research Corporation

Formulating Actionable Strategies and Best Practices to Guide Industry Leadership in Navigating Challenges and Seizing Opportunities in Microbiome Sequencing

Organizations seeking to strengthen their position in microbiome sequencing should consider diversifying their supply chain by forging partnerships with domestic manufacturers and establishing buffer inventories for critical reagents and components. This approach mitigates the impact of future trade policy disruptions and ensures continuity in service delivery.

Investment in modular service architectures can enhance agility; by offering tiered sequencing packages-from targeted amplicon panels to comprehensive multi-omics profiling-providers can address the specific needs of agricultural researchers, clinical diagnostic laboratories, and pharmaceutical developers. Tailoring service level agreements and turnaround time commitments further cements client relationships and supports premium pricing strategies.

Finally, fostering cross-sector collaborations, such as co-development agreements with biotech firms on microbiome therapeutics or joint ventures with agricultural conglomerates, can accelerate market entry into high-growth applications. Complementing these partnerships with robust bioinformatics platforms that integrate artificial intelligence and machine learning will elevate analytical insights and position service providers as indispensable partners in regenerative agriculture, precision medicine, and environmental stewardship.

Detailing the Rigorous Multi-Source Research Methodology Employed to Ensure Comprehensive Analysis and Unbiased Validation of Microbiome Sequencing Insights

This analysis integrates primary and secondary research to ensure comprehensive coverage and validation of findings. Primary research included structured interviews with senior executives at sequencing service companies, laboratory directors, and end users across academia, clinical diagnostics, agriculture, and environmental sectors. These interviews yielded firsthand insights into service adoption drivers, operational challenges, and strategic priorities.

Secondary research drew from credible open-source publications, peer-reviewed literature, industry news outlets, and regulatory agency announcements. Quantitative data on tariff rates and pricing adjustments were extracted from government notices and closed-end communications from leading sequencing firms. Cost trend analyses were corroborated using data from WIPO’s Global Health initiatives and publicly available industry reports.

To maintain objectivity, data triangulation techniques were applied, cross-referencing information from multiple sources. Qualitative insights were synthesized through thematic analysis to identify recurring patterns in technological adoption, market segmentation, and regional dynamics. This rigorous methodology underpins the reliability of the strategic recommendations presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microbiome Sequencing Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microbiome Sequencing Services Market, by Sample Type

- Microbiome Sequencing Services Market, by Technology

- Microbiome Sequencing Services Market, by Application

- Microbiome Sequencing Services Market, by End User

- Microbiome Sequencing Services Market, by Region

- Microbiome Sequencing Services Market, by Group

- Microbiome Sequencing Services Market, by Country

- United States Microbiome Sequencing Services Market

- China Microbiome Sequencing Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings and Strategic Implications to Conclude the Executive Insights on the Evolution and Strategic Imperatives of Microbiome Sequencing

The evolving microbiome sequencing services market is defined by accelerating technological innovation, expanding application domains, and dynamic regulatory and trade landscapes. Rapid cost declines-driven by high-throughput platforms, miniaturized chemistries, and AI-enabled bioinformatics-are democratizing access and catalyzing new research and clinical use cases.

Segmentation insights reveal differentiated requirements across sample types, technology modalities, applications, and end users, underscoring the need for service providers to adopt modular, client-centric offerings. Regional analysis highlights North America’s leadership in clinical sequencing, EMEA’s collaborative research frameworks, and Asia-Pacific’s volume-driven cost competitiveness.

Key players are responding through strategic pricing adjustments, domestic manufacturing investments, and targeted partnerships. To thrive amid trade uncertainties and evolving customer expectations, industry leaders must enhance supply chain resilience, diversify service portfolios, and leverage cross-sector collaborations. These strategic imperatives will determine who emerges at the forefront of microbiome sequencing innovation and commercial success.

Driving Growth and Collaboration Through a Direct Invitation to Engage With Associate Director Sales and Marketing for Comprehensive Microbiome Research Access

For tailored guidance on unlocking the full potential of microbiome sequencing services for your organization, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He is ready to walk you through the comprehensive market research report, discuss customized insights aligned with your strategic objectives, and facilitate access to the data and analysis that will empower your next decision. Connect with Ketan to explore subscription options, enterprise licensing, or one-off purchases, and secure the competitive intelligence you need to drive innovation, optimize investments, and accelerate growth in the dynamic realm of microbiome sequencing services.

- How big is the Microbiome Sequencing Services Market?

- What is the Microbiome Sequencing Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?