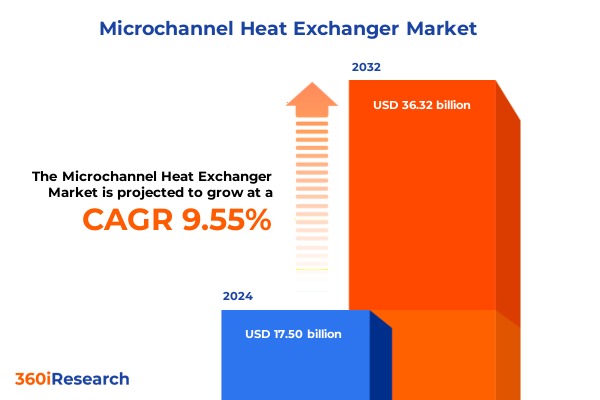

The Microchannel Heat Exchanger Market size was estimated at USD 19.01 billion in 2025 and expected to reach USD 20.66 billion in 2026, at a CAGR of 9.68% to reach USD 36.32 billion by 2032.

Setting the stage for the strategic significance and technological evolution of microchannel heat exchangers in the modern thermal management landscape

As thermal management challenges intensify across industries, microchannel heat exchangers have emerged as a pivotal technology driving efficiency and sustainability in modern systems. With their compact form factor, superior heat transfer coefficients, and reduced refrigerant charge, these devices provide a critical advantage in applications ranging from air conditioning to power electronics cooling. The escalating demand for high-performance, space-saving solutions is reshaping engineering priorities, compelling design teams to integrate advanced microchannel architectures in next-generation platforms. In this context, stakeholders from equipment OEMs to end users must appreciate the strategic relevance of microchannel technology as it transitions from niche specialty deployments to mainstream adoption.

Moreover, the intersection of regulatory pressures on greenhouse gas emissions and the push toward electrification is accelerating innovation in thermal management. Energy efficiency standards in commercial refrigeration, electrified powertrains in vehicles, and the exponential growth of data center capacities underscore the need for heat exchangers that deliver higher performance per unit volume. This report sets out to capture these intersecting imperatives, offering a foundational overview of the technology’s evolution, market drivers, and competitive dynamics. By framing the current landscape, the introduction lays the groundwork for deep dives into transformational trends, tariff impacts, and strategic segmentation insights that follow.

Exploring the convergence of manufacturing breakthroughs and sustainability drivers reshaping microchannel heat exchanger innovation and deployment

In recent years, the microchannel heat exchanger landscape has undergone transformative shifts driven by a convergence of technological breakthroughs and market imperatives. Additive manufacturing techniques have enabled the creation of highly optimized channel geometries that enhance fluid mixing and thermal performance, while computational fluid dynamics tools now allow engineers to simulate and refine designs with unprecedented accuracy. These advancements have propelled microchannel solutions from laboratory prototypes to commercially viable products, expanding the scope of applications in sectors such as data center cooling and automotive thermal management.

Simultaneously, sustainability imperatives have fostered material innovations that reduce resource consumption and environmental impact. The migration from traditional copper and stainless steel toward advanced aluminum alloys and composite surfaces has improved thermal conductivity while lowering weight and production costs. In parallel, the integration of microchannel heat exchangers with refrigerants of low global warming potential has become a critical differentiator in regions with stringent environmental regulations. Consequently, manufacturers are forming cross-sector partnerships, leveraging digital twin platforms to accelerate time to market, and establishing modular supply chains to scale production. These shifts underscore a broader industry transformation that elevates microchannel heat exchangers as a cornerstone of eco-efficient thermal solutions.

Unpacking the multifaceted repercussions of recent United States tariff adjustments on microchannel heat exchanger supply chains and market strategies

The United States government’s 2025 tariff adjustments have introduced a new layer of complexity to the microchannel heat exchanger market, particularly affecting cross-border supply chains for aluminum-based components. With levies imposed on imports from select regions, manufacturers have faced increased input costs that ripple through procurement processes and pricing strategies. Responding to this fiscal environment, several domestic producers have accelerated investments in local extrusion and brazing facilities to mitigate exposure to incremental duties and safeguard production continuity.

Consequently, global suppliers have reevaluated their market entry tactics, opting to establish joint ventures or toll-manufacturing arrangements within the United States to maintain competitiveness. Although these measures have partially offset tariff burdens, they have also prompted suppliers to reexamine sourcing strategies for core materials. In parallel, downstream integrators in data centers and refrigeration equipment have sought alternative cooling configurations or reoptimized system designs to preserve margins. Taken together, the cumulative impact of these tariff measures underscores the importance of supply chain agility and strategic localization in preserving market resilience amid shifting trade policies.

Revealing nuanced demand dynamics through detailed segmentation of applications, industries, materials, and design configurations

A granular assessment of market segmentation reveals differentiated demand patterns across application domains, end use industries, and material choices that inform tailored product strategies. Within the application spectrum, air conditioning and refrigeration segment performance hinges on sub-segments serving both commercial installations and residential systems, where space constraints and efficiency mandates vary significantly. Automotive applications diverge between passenger vehicles and commercial vehicles, each presenting unique heat flux and packaging requirements. Similarly, data center cooling spans both chiller-based and direct expansion systems, dictating distinct exchanger configurations to optimize rack-level thermal management.

Further segmentation by end use industry highlights the heterogeneous needs of automotive, chemical, data center, food and beverage, oil and gas, and pharmaceutical operators. In pharmaceutical environments, stringent sterility and hygienic design standards elevate the importance of material selection and cleanability. Conversely, in oil and gas process streams, corrosion resistance and high-temperature tolerance are paramount. Material segmentation across aluminum, copper, and stainless steel underscores cost-performance trade-offs tied to thermal conductivity, manufacturability, and corrosion resilience. Flow arrangement insights differentiate counter flow, cross flow, and parallel flow architectures, each offering discrete pressure drop and thermal gradient profiles. Channel shape variations-ranging from circular and rectangular to trapezoidal and triangular geometries-further refine heat transfer efficiency. Cooling capacity delineations below 50 kilowatts, between 50 and 100 kilowatts, and above 100 kilowatts map to diverse end use requirements, while sales channels bifurcate between original equipment manufacturers and aftermarket suppliers to delineate distribution pathways.

This comprehensive research report categorizes the Microchannel Heat Exchanger market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Flow Arrangement

- Channel Shape

- Cooling Capacity

- Application

- Sales Channel

Examining diverse regional regulatory influences and infrastructural imperatives driving varied adoption patterns for microchannel heat exchangers

Regional market dynamics for microchannel heat exchangers reflect divergent regulatory landscapes, infrastructure demands, and growth trajectories. In the Americas, stringent environmental regulations and rising adoption of electric vehicles are fueling demand for high-efficiency thermal management solutions. Furthermore, expanding data center footprints across North America underscore the need for scalable, compact exchanger technologies that can support ultra-high heat flux densities. Supply chain localization efforts are particularly pronounced in this region as manufacturers seek to mitigate tariff exposure and reduce lead times.

In Europe, Middle East, and Africa, regulatory alignment around circular economy principles and greenhouse gas reduction targets is accelerating the uptake of environmentally benign refrigerants and lightweight materials. Data center development remains robust, especially in Northern Europe, while the Middle East’s industrial diversification strategies are amplifying opportunities in oil and gas and chemical process cooling. Asia-Pacific continues to lead in manufacturing capacity, with a proliferation of low-cost production hubs in Southeast Asia and China. However, increasing labor costs and evolving environmental regulations are prompting OEMs to explore regional balancing models, leveraging localized expertise in advanced brazing and assembly to optimize cost and compliance.

This comprehensive research report examines key regions that drive the evolution of the Microchannel Heat Exchanger market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing how leading heat exchanger manufacturers are evolving from component suppliers to providers of integrated digital and service-oriented thermal solutions

The competitive landscape in microchannel heat exchangers is characterized by a mix of global conglomerates and specialized innovators. Leading manufacturers have differentiated through an integrated approach spanning proprietary channel geometries, patented surface enhancements, and advanced brazing techniques. Strategic alliances between materials suppliers and end equipment producers are forging end-to-end solution frameworks that deliver turnkey thermal systems rather than standalone exchanger cores.

Innovation pipelines are increasingly focused on the convergence of digital monitoring and predictive maintenance capabilities. By embedding sensors and leveraging the Industrial Internet of Things, companies are offering real-time performance analytics to optimize energy consumption and preemptively schedule maintenance. Moreover, select tier-one players are expanding into service offerings that encompass unit refurbishment, refrigerant recapture, and system retrofits, thereby creating recurring revenue streams beyond initial device sales. These strategic maneuvers underscore the shift from component manufacturing to holistic lifecycle management in the competitive arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microchannel Heat Exchanger market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval AB

- Amber

- API Heat Transfer

- Carrier Global Corporation

- Climetal S.L.

- Danfoss A/S

- Dantherm Cooling, Inc.

- EVAPCO, Inc.

- Filson FIlter

- Heatric by Parker Hannifin Corporation

- Johnson Controls International PLC

- Kaltra GmbH

- Mikros Technologies

- Modine Manufacturing Company

- Nanjing Metalli Industrial Co., Limited

- Norsk Hydro ASA

- Rolls-Royce PLC

- Sanhua International, Inc.

- Shanghai Shenglin M&E Technology Co., Ltd.

- Sierra S.p.A.

- Thermokey S.p.A.

- VPE Thermal LLC

- WELCON Inc.

- Zhejiang Dunan Artificial Environment Co., Ltd.

- Zhejiang Kangsheng Co. Ltd

Implementing holistic supply chain integration and digital service models alongside material and refrigerant innovation for sustained competitive strength

Industry leaders must adopt a multifaceted strategy to navigate the complex interplay of technological, regulatory, and commercial pressures. First, establishing vertically integrated supply chains that encompass raw material processing, extrusion, brazing, and assembly can shield organizations from tariff fluctuations while enhancing quality control. Complementing this, forging collaborative R&D partnerships with universities and technology startups will accelerate breakthroughs in channel design and additive manufacturing processes.

Second, embracing digitalization through the incorporation of sensors, cloud-based analytics, and predictive maintenance platforms will shift value propositions toward service-based models, unlocking recurring revenue potential. Third, prioritizing material and refrigerant innovations-particularly those aligned with low global warming potential standards-will address regulatory compliance while meeting sustainability goals. Additionally, equipping sales and marketing teams with targeted regional insights can optimize market entry strategies by aligning product portfolios with local demand drivers. Taken together, these actions will equip industry leaders to achieve operational resilience, foster innovation, and secure competitive advantage.

Outlining a comprehensive research framework integrating secondary intelligence with targeted primary engagement and robust data triangulation

This research combines rigorous secondary data analysis with comprehensive primary insights to ensure robust and reliable findings. Initially, an extensive review of trade publications, regulatory filings, and patent databases established a foundational understanding of market drivers, technological developments, and policy landscapes. Key performance benchmarks and historical trends were corroborated through industry white papers, technical journals, and equipment vendor specifications.

Subsequently, primary research consisted of structured interviews with thermal management experts, procurement officers, and senior engineers across end use industries. These engagements provided qualitative perspectives on emerging challenges, adoption hurdles, and strategic priorities. Quantitative validation was achieved through a proprietary survey instrument deployed to a representative sample of OEMs and end users, yielding data on design preferences, performance expectations, and procurement criteria. Finally, data triangulation techniques integrated secondary and primary inputs, allowing for cross-verification of thematic insights and ensuring the analysis reflects both market realities and forward-looking considerations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microchannel Heat Exchanger market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microchannel Heat Exchanger Market, by Type

- Microchannel Heat Exchanger Market, by Material

- Microchannel Heat Exchanger Market, by Flow Arrangement

- Microchannel Heat Exchanger Market, by Channel Shape

- Microchannel Heat Exchanger Market, by Cooling Capacity

- Microchannel Heat Exchanger Market, by Application

- Microchannel Heat Exchanger Market, by Sales Channel

- Microchannel Heat Exchanger Market, by Region

- Microchannel Heat Exchanger Market, by Group

- Microchannel Heat Exchanger Market, by Country

- United States Microchannel Heat Exchanger Market

- China Microchannel Heat Exchanger Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Summing up the intersection of innovation, sustainability, and strategic agility defining the future landscape of microchannel heat exchangers

In summary, microchannel heat exchangers stand at the nexus of technological innovation and sustainability imperatives, poised to redefine thermal management across a broad spectrum of industries. The interplay of advanced manufacturing methods, evolving regulatory frameworks, and shifting end user requirements has created a dynamic environment in which agility and strategic foresight are paramount. While tariff adjustments present near-term challenges, they simultaneously catalyze supply chain localization and vertical integration strategies that strengthen market resilience.

Looking ahead, the most successful organizations will be those that seamlessly blend design innovation with digital services, aligning product roadmaps with the overarching decarbonization objectives of their customers. By leveraging nuanced segmentation insights and regional intelligence, companies can tailor offerings to specific operational contexts, from high-density data centers to demanding industrial process streams. Ultimately, the convergence of material science advances, smart analytics, and collaborative partnerships will determine competitive positioning in the evolving microchannel heat exchanger ecosystem.

Secure unparalleled competitive intelligence and market mastery by contacting Ketan Rohom to acquire the definitive microchannel heat exchanger market report

For organizations seeking to leverage comprehensive insights into the global microchannel heat exchanger market and its nuanced dynamics, the time to act is now. Engage with Ketan Rohom, Associate Director of Sales & Marketing, to secure your access to an in-depth report that distills critical data, strategic analyses, and actionable intelligence. His expertise will ensure you obtain the tailored guidance necessary to navigate emerging shifts, regulatory challenges, and innovation trajectories. Don’t miss the opportunity to empower your decision-making with precise, field-tested knowledge. Reach out today to request your copy of the definitive market research report and position your organization at the forefront of thermal management excellence.

- How big is the Microchannel Heat Exchanger Market?

- What is the Microchannel Heat Exchanger Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?