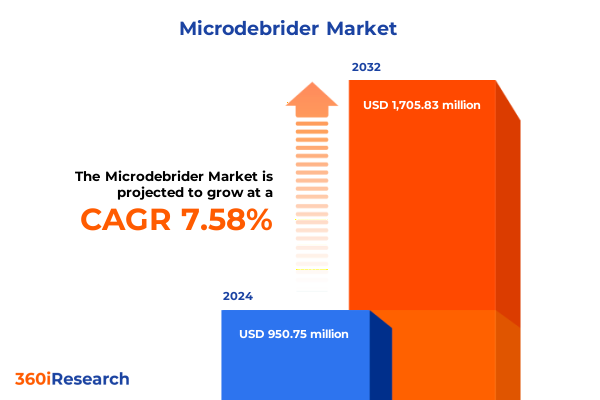

The Microdebrider Market size was estimated at USD 1.02 billion in 2025 and expected to reach USD 1.09 billion in 2026, at a CAGR of 7.56% to reach USD 1.70 billion by 2032.

Innovative Minimally Invasive Surgical Device Transforming Tissue Debridement Across Multiple Clinical Specialties with Precision and Efficiency

Microdebriders have emerged as a cornerstone of modern surgical practice, offering unparalleled precision and efficiency in tissue debridement across a wide spectrum of clinical disciplines. Originally developed for endoscopic sinus surgery, these powered instruments have been refined over the past two decades to address complex anatomical challenges with minimal collateral damage. At their core, microdebriders combine high‐speed rotary cutting with integrated suction to simultaneously excise and evacuate tissue, thereby reducing operative time and improving intraoperative visualization.

The proliferation of chronic ear, nose, and throat pathologies has catalyzed the adoption of microdebrider‐assisted procedures. According to the Centers for Disease Control and Prevention, approximately 29.4 million U.S. adults experience chronic sinusitis, underscoring the imperative for effective, minimally invasive therapies. Advances in device ergonomics and blade technology have further elevated the clinician’s ability to perform delicate resections, leading to enhanced patient outcomes and lower postoperative complication rates. In parallel, surgeons in orthopedics, gynecology, and sports medicine have begun integrating microdebriders into arthroscopic, hysteroscopic, and soft‐tissue procedures, leveraging their cutting control and suction efficiency to remove pathological tissues with greater safety than conventional instruments.

Moreover, the drive toward outpatient and ambulatory surgical settings has accelerated demand for microdebriders that are compact, user‐friendly, and capable of rapid turnover. Health systems increasingly prioritize devices that support same‐day discharge and lower overall procedure costs, while maintaining high standards of patient safety. Consequently, manufacturers are responding with next‐generation platforms that offer modular console architectures, single‐use disposable handpieces, and intuitive user interfaces. As the clinical landscape continues to evolve toward value‐based care, microdebriders stand at the intersection of technological innovation and procedural excellence, poised to redefine tissue management in operating theaters worldwide.

Cutting Edge Technological Innovations Driving a Paradigm Shift in Microdebrider Applications and Surgical Workflows Worldwide

The microdebrider market is undergoing a profound transformation driven by the convergence of digitalization, advanced imaging, and robotic assistance within the operating room. Modern consoles now integrate high‐resolution endoscopic cameras and real‐time visualization software, enabling surgeons to navigate intricate anatomical landscapes with pinpoint accuracy. The advent of robotic‐guided microdebrider systems has further refined this capability by incorporating motion control algorithms and haptic feedback, which can proactively compensate for tremors and optimize cutting trajectories. Recent literature highlights how artificial intelligence modules embedded within surgical platforms are enhancing intraoperative decision‐making by autonomously recognizing tissue boundaries and suggesting optimized resection paths.

Simultaneously, technological refinements in device mechanics have led to the development of both electric and pneumatic microdebriders, each offering unique performance profiles tailored to specific clinical needs. Innovations in ergonomic design have resulted in handpieces that minimize surgeon fatigue and improve handling during extended procedures. Equipment manufacturers are also exploring cordless, battery‐powered handheld devices that extend portability to ambulatory care units and field settings. These compact instruments, which complement traditional console‐driven models, enable clinicians to execute minimally invasive debridement outside conventional operating theaters, thus expanding the potential application of microdebriders beyond hospital walls and into outpatient clinics.

Beyond hardware, the integration of cloud‐based data analytics is allowing providers to benchmark procedural metrics, track device utilization rates, and identify opportunities for operational efficiency. This digital ecosystem fosters a continuous improvement cycle, where feedback loops inform product development and training programs. As healthcare systems increasingly lean on data‐driven protocols, the microdebrider industry’s ability to deliver smart, connected solutions will be a defining factor in achieving better clinical outcomes and cost containment.

Navigating Complex Economic Policies and Tariff Regimes Shaping the Cost Structure and Supply Chain Resilience of Medical Device Manufacturers

Economic policies and international trade dynamics in 2025 have introduced new cost pressures and supply chain complexities for medical device manufacturers, including those producing microdebriders. In March 2025, the U.S. government imposed 25% tariffs on steel‐ and aluminum‐containing products-mechanical components integral to surgical console frames and handpiece casings-under Section 301 measures targeting Chinese, Mexican, and Canadian imports. Concurrently, critical electronic subsystems, such as semiconductor chips and circuit boards, saw duties escalate from 25% to 50%, reflecting broader national security and domestic manufacturing priorities. These layered levies have had the immediate effect of raising production costs, prompting device producers to reassess procurement strategies and explore alternative suppliers in lower‐tariff jurisdictions.

Industry trade associations, including the Advanced Medical Technology Association, have actively lobbied for carve‐outs to shield essential medical apparatus from the full brunt of these tariffs. Despite exemptions granted for certain classes of diagnostic imaging equipment, microdebrider consoles and their high‐precision electronic control units have largely remained subject to elevated duties. Manufacturers must now navigate a landscape where duty mitigation takes precedence alongside quality assurance, as the substitution of critical components is constrained by stringent regulatory pathways.

As a result, many firms are reevaluating global footprint designs, with a growing emphasis on near‐shoring and dual‐sourcing models to buffer against tariff volatility. While these strategies can prolong lead times and require significant capital investment, they offer a hedge against ongoing policy fluctuations and potential trade confrontations. Moreover, the tariff‐induced cost headwinds have accelerated structured price negotiations and longer‐term supply agreements with healthcare providers, ensuring budget predictability amid an otherwise uncertain economic environment.

Unveiling Segmentation Dynamics That Illuminate Diverse Application Areas Product Types Usage Patterns Distribution Strategies and End User Behaviors Driving Market Variations

The segmentation of the microdebrider market provides critical insights into demand drivers and procurement behaviors across diverse clinical and commercial channels. Application segmentation reveals that ear, nose, and throat procedures remain the primary use case, yet there is accelerating uptake in gynecological tissue resection and soft‐tissue management within orthopedics, particularly in arthroscopic sports medicine contexts. This cross‐specialty diffusion underscores how platform versatility can unlock new revenue streams for OEMs.

Within product type segmentation, the delineation between console‐driven microdebriders-offered in multi‐console configurations that support multiple simultaneous handpieces, as well as more cost‐conscious single‐console systems-and standalone portable handpieces has become increasingly pronounced. Hospitals and larger surgical centers gravitate toward multi‐console platforms for high‐volume environments, while single‐console and handheld solutions are favored in outpatient centers and specialty clinics that demand agility and rapid turnover.

End user segmentation further refines the market landscape by differentiating procurement patterns across ambulatory surgical centers, clinics, and hospital settings. Among ambulatory centers, multi‐specialty facilities leverage economies of scale to invest in advanced microdebrider consoles, whereas single‐specialty centers prioritize streamlined handpieces tailored to their core procedural focus. In hospital systems, private institutions often deploy cutting‐edge technologies to elevate clinical branding and patient experience, while public hospitals must balance innovation with rigorous budget constraints, frequently resulting in hybrid portfolios of upgraded consoles and legacy handpiece models.

Finally, distribution channel segmentation highlights the dual pathways of direct sales and authorized distributors. OEM direct sales teams maintain deep clinical relationships and offer customization, commissioning, and training services, whereas distributor networks provide broad geographic reach and localized inventory management. The strategic interplay between these channels influences time-to-market, pricing structures, and post-sales support, shaping competitive positioning in mature and emerging regions alike.

This comprehensive research report categorizes the Microdebrider market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

- Distribution Channel

Comparative Regional Market Perspectives Highlighting Growth Drivers Regulatory Environments Infrastructure Readiness and Adoption Trends Across Key Geographies

Regional dynamics play a pivotal role in shaping the strategic priorities of microdebrider manufacturers and their distribution partners. In the Americas, mature healthcare infrastructures and high procedure volumes have fostered robust demand for advanced console platforms and integrated navigation‐enabled systems. The prevalence of private ambulatory surgical centers in North America has spurred manufacturers to develop turnkey solutions that combine device, software, and service bundles designed to streamline adoption and maximize utilization rates. Conversely, Latin American markets are characterized by a growing network of dual‐use public-private facilities, where budget allocations for specialized surgical equipment are increasingly available, yet procurement cycles remain complex and subject to public sector oversight.

Across Europe, Middle East & Africa, regulatory heterogeneity and variable reimbursement frameworks have created a patchwork of market entry requirements and pricing models. Western Europe shows steady uptake of both multi-console platforms and premium handheld devices, supported by national health services that incentivize minimally invasive techniques. Meanwhile, certain Gulf Cooperation Council nations are aggressively investing in healthcare infrastructure modernization, establishing centers of clinical excellence that drive early adoption of robotic-assisted microdebrider innovations. In sub-Saharan Africa, access challenges persist, steering demand toward cost-effective handheld instruments and distribution partnerships that emphasize bundled procurement and training support.

Asia-Pacific stands out for its rapid growth trajectory, fueled by expanding surgical capacity, rising healthcare expenditure, and a burgeoning middle-class population with increasing access to private healthcare services. China and India, in particular, are witnessing significant capital investments in both hospital expansion and ambulatory surgery centers, prompting global and regional device manufacturers to forge joint ventures and local manufacturing alliances. Meanwhile, Pacific island markets and Southeast Asia require adaptable distribution strategies that balance advanced device offerings with modular platforms to accommodate diverse surgical environments.

This comprehensive research report examines key regions that drive the evolution of the Microdebrider market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Their Strategic Innovations Collaborations and Portfolio Strengths in the Evolving Microdebrider Landscape

Medtronic has maintained a leading position in the microdebrider console segment with its Straightshot M4 and M5 handpieces, which operate on the Integrated Power Console system. These devices combine high-speed rotary motors-up to 30,000 rpm on the M5-with an extensive lineup of over 125 application-specific blades and burs. The company’s focus on ergonomic design and navigation-enabled blades has solidified its console-centric strategy, appealing to high‐volume ENT and multispecialty surgical suites.

Arthrex has distinguished itself by targeting sports medicine and orthopedic niches through its PowerPick microfracture instrument system paired with the Synergy resection platform. The recent FDA clearance for pediatric applications of the NanoScope™ operative arthroscopy system underscores the company’s commitment to expanding its product pipeline into new patient demographics and procedural areas, such as laparoscopy and pediatric orthopedics.

Emerging players are innovating around disposable handpiece models with pre-loaded sterile blade cassettes, aiming to reduce cross‐contamination risks and streamline operating room logistics. Rival device makers are also investing in strategic partnerships with imaging and navigation software firms to deliver fully integrated surgical suites that offer value-added analytics and procedural benchmarking tools. As competition intensifies, the ability to bundle device platforms with consumables, service contracts, and digital support ecosystems will be a critical differentiator for both established OEMs and new market entrants.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microdebrider market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arthrex Inc.

- B. Braun SE

- Bess Medizintechnik GmbH

- CONMED Corporation

- Gyrus ACMI Inc.

- Innomed Inc.

- Integra LifeSciences Holdings Corporation

- Karl Storz SE & Co. KG

- Medtronic plc

- Misonix Inc.

- Olympus Corporation

- Richard Wolf GmbH

- Smith & Nephew plc

- Stryker Corporation

- Söring GmbH

Actionable Strategic Initiatives for Market Entrants and Incumbents to Enhance Competitiveness Supply Resilience and Technological Leadership

Industry leaders should prioritize product diversification that aligns with distinct end-user requirements and regional preferences. By offering a balanced portfolio of multi-console systems and portable handheld devices, manufacturers can capture the full spectrum of procedure volumes and facility types. Simultaneously, investing in robust supply chain analytics and dual-sourcing strategies will mitigate the financial impact of fluctuating tariff regimes and ensure continuity of component supply.

To maximize market penetration, firms should customize engagement models for ambulatory surgical centers, clinics, and hospitals, leveraging data-driven value propositions that demonstrate return on investment in reduced operative times and improved patient throughput. Strategic partnerships with key distributor networks in EMEA, combined with direct sales teams in the Americas, can accelerate time-to-market and enhance after-sales support. Additionally, local manufacturing alliances in Asia-Pacific will bolster price competitiveness and foster stronger regulatory alignment.

Technological differentiation remains paramount. Companies should continue to integrate AI-powered image recognition, haptic feedback, and navigation capabilities into their microdebrider platforms. Creating open-architecture software ecosystems that facilitate third-party application development can further embed devices within broader digital health frameworks. Finally, tailored training programs-both virtual and on‐site-will improve clinician proficiency and drive device utilization rates, ensuring that investments in advanced microdebrider technologies translate into measurable clinical and operational gains.

Robust Mixed Method Research Framework Integrating Primary Interviews Secondary Data and Rigorous Categorization Ensuring Comprehensive Insights

This research employed a mixed-method approach, beginning with an exhaustive secondary data review of peer-reviewed journals, regulatory filings, and policy documents to frame the industry’s technological trajectory and trade policy evolution. Published literature on device design innovations and clinical outcomes informed the analysis of product segmentation and application trends.

Primary research comprised in-depth interviews with key stakeholders, including surgical opinion leaders, procurement officers, and distribution executives across major healthcare markets. These qualitative insights were synthesized via thematic coding to identify adoption barriers, purchasing drivers, and unmet clinical needs. Furthermore, a comprehensive survey of supply chain managers furnished quantitative data on component sourcing, lead times, and tariff mitigation strategies.

Finally, data triangulation was conducted using bottom-up modeling to align stakeholder perspectives with macro-level trade statistics and healthcare infrastructure metrics. This rigorous methodology ensures that the resulting market insights reflect both granular operational realities and overarching strategic dynamics, providing stakeholders with a robust foundation for informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microdebrider market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microdebrider Market, by Product Type

- Microdebrider Market, by Application

- Microdebrider Market, by End User

- Microdebrider Market, by Distribution Channel

- Microdebrider Market, by Region

- Microdebrider Market, by Group

- Microdebrider Market, by Country

- United States Microdebrider Market

- China Microdebrider Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Conclusive Reflections Emphasizing Technological Evolution Strategic Adaptation Future Outlook and Emerging Healthcare Ecosystem Trends Impacting Microdebrider Adoption

The evolution of microdebrider technology underscores a broader shift toward precision, connectivity, and patient-centric surgical care. As device platforms incorporate AI, robotics, and next-generation imaging, the clinical applications of microdebriders will expand beyond traditional ENT and orthopedic uses to novel domains such as neurosurgery and gynecologic oncology.

Strategic adaptation to external pressures-especially complex tariff landscapes and regulatory heterogeneity-will be a defining success factor. Organizations that establish agile supply chain models and localized production capabilities will be better positioned to sustain competitive pricing and uninterrupted product availability. Regional market expansion, particularly in Asia-Pacific and parts of EMEA, offers sustained growth opportunities, provided that manufacturers align with local healthcare priorities and reimbursement schemes.

Looking forward, the integration of microdebrider platforms within holistic digital surgery suites will redefine procedural standardization, training methodologies, and outcome benchmarking. OEMs that embrace open innovation, foster collaborative ecosystems with software developers, and deliver end-to-end solutions will differentiate themselves in a crowded landscape. Ultimately, the microdebrider market will reward companies that harmonize technological leadership with resilient operational strategies and deep clinical partnerships.

Engage Today with Associate Director Ketan Rohom to Unlock Tailored Strategic Insights and Secure Access to the Comprehensive Microdebrider Market Research Report

To delve deeper into the comprehensive analysis of the microdebrider market and equip your organization with actionable intelligence, engage directly with Associate Director Ketan Rohom. Ketan’s expertise in sales and marketing transformations ensures you receive tailored strategic insights that align with your growth objectives and address your unique challenges. By partnering with him, you gain access not only to the full market research report but also to customized data interpretation sessions, enabling you to translate findings into concrete business actions.

Reach out today to secure your copy of the report and embark on a journey toward strengthened market positioning, enhanced supply chain resilience, and informed innovation roadmaps. Ketan will guide you through our bespoke offerings, discuss implementation support, and ensure that your investment drives measurable returns and competitive differentiation. Start the conversation now to unlock the strategic advantages afforded by this authoritative research deliverable

- How big is the Microdebrider Market?

- What is the Microdebrider Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?