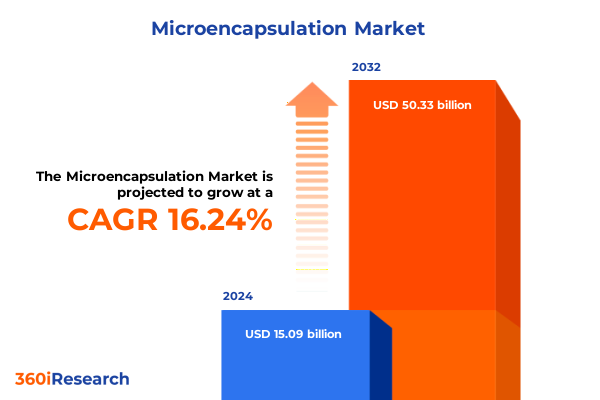

The Microencapsulation Market size was estimated at USD 17.47 billion in 2025 and expected to reach USD 20.23 billion in 2026, at a CAGR of 16.31% to reach USD 50.33 billion by 2032.

Discover How Advanced Microencapsulation Is Revolutionizing Product Performance Across Diverse Industries to Unlock Unprecedented Benefits and Efficiencies

Microencapsulation has emerged as a foundational technology across multiple industries, offering remarkable protection, controlled release, and targeted delivery of active ingredients. Whether safeguarding delicate enzymes in pharmaceuticals, preserving flavor integrity in food and beverage applications, or enhancing the stability of cosmetic actives, encapsulation techniques have become indispensable in product innovation. This introduction delves into how microencapsulation bridges the gap between consumer expectations for performance and the technical challenges faced by formulators.

Advances in encapsulation methodologies have unlocked new frontiers in functional applications. Modern processes no longer serve merely as protective shells; they enable precision engineering of release profiles and sensory attributes. As companies strive to differentiate their offerings in increasingly competitive landscapes, microencapsulation delivers both tangible and perceptual benefits. This section sets the stage for a comprehensive exploration of the shifts, drivers, and strategic imperatives redefining encapsulation markets.

Unveiling Transformative Shifts Redefining Microencapsulation Technologies and Market Dynamics to Drive Next Generation Formulation Innovations

The microencapsulation landscape is undergoing a profound transformation driven by technological breakthroughs and evolving consumer demands. Recent years have seen the integration of microfluidic systems and novel biopolymer matrices, which deliver tighter control over particle size distribution and release kinetics. At the same time, sustainability imperatives have pushed formulators to adopt eco-friendly wall materials and green solvent systems. As a result, encapsulation now aligns with broader corporate commitments to reduce environmental footprints and embrace circular economy principles.

Simultaneously, digitalization is reshaping how research and development teams approach formulation challenges. Advanced modeling tools and real-time process monitoring enable accelerated scale-up from bench to production scale. These transformative shifts are not confined to any single application; they span from agriculture, where encapsulated fertilizers and pesticides improve crop yields, to textiles, where microcapsules impart enhanced performance characteristics. This convergence of innovation axes sets the stage for dynamic market growth and new strategic collaborations.

Assessing the Cumulative Influence of 2025 United States Tariff Adjustments on Microencapsulation Supply Chains Raw Material Costs and Competitive Strategies

In early 2025, a series of adjustments to United States import duties on specialty chemicals and polymeric materials began to ripple through microencapsulation supply chains. These tariff changes have increased landed costs for certain encapsulation precursors, prompting formulators to reevaluate sourcing strategies. Raw material procurement teams are balancing the need to maintain quality specifications with the imperative to mitigate cost pressures, resulting in a discernible shift toward more vertically integrated value chains.

The cumulative impact of these tariff changes extends into product positioning and competitive戦略. Manufacturers reliant on imported wall system components have accelerated investments in domestic production capacities, while R&D groups are exploring alternative feedstocks less susceptible to trade fluctuations. Across downstream industries, from food and beverage to personal care, procurement cycles are increasingly influenced by tariff-driven cost volatility. As companies adapt to this new fiscal landscape, strategic partnerships and supply-side resilience will define competitive advantage in the coming quarters.

In-Depth Segmentation Insights Revealing Critical Technological Formulation and Application Perspectives Shaping Microencapsulation Market Tactics

An analysis of encapsulation technology modalities highlights distinct performance trade-offs. Coacervation processes offer excellent encapsulation efficiency for hydrophobic cores, whereas emulsion-based methods afford versatile core-shell architectures. Fluidized bed techniques excel at producing dry, free-flowing particles, while freeze-drying preserves sensitive biomolecules at low temperatures. Spray chilling and spray drying remain workhorses for cost-effective production of powder formats, each delivering specific advantages in thermal tolerance and particle morphology.

Wall material selection further influences product attributes. Carbohydrate matrices such as maltodextrin and starch derivatives provide low cost profiles and good solubility, whereas lipid-based walls enhance moisture barrier properties. Polymer systems deliver tunable release characteristics, and protein shells offer bioactive compatibility for nutraceutical applications. Core material choice-ranging from enzymes and probiotics to flavors, fragrances, and nutraceutical actives-dictates functional outcomes, while formulation state determines downstream handling. Liquid formats facilitate in-line process integration in beverages, whereas solid forms cater to encapsulation in dry mixes and tablets.

Capsule size is a critical lever for targeted delivery: macrocapsules serve controlled agricultural releases, microcapsules enable nuanced sensory experiences in cosmetics and functional drinks, and minicapsules offer precise dosing in pharmaceutical dosages. Application end-use scenarios span agriculture interventions boosting crop yield consistency, personal care products delivering sustained skin benefits, enhanced flavor delivery in bakery, confectionery, dairy, and functional beverages, and advanced drug formulations achieving site-specific release. Each segmentation layer provides a strategic lens through which companies can tailor their encapsulation platforms to optimize performance and market relevance.

This comprehensive research report categorizes the Microencapsulation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Wall Material

- Core Material

- Formulation

- Capsule Size

- Application

Granular Regional Insights Exposing Growth Drivers and Adoption Patterns Across Americas Europe Middle East Africa and Asia-Pacific Microencapsulation Sectors

Regional dynamics in the Americas are characterized by robust demand from food and beverage manufacturers seeking to extend shelf life and deliver consistent sensory quality in products ranging from functional beverages to dairy innovations. Regulatory clarity around food additives and GRAS-listed encapsulants has fostered rapid adoption, and strategic investments in North American production facilities are enhancing supply security.

Turning to Europe, the Middle East, and Africa, sustainability regulations and consumer awareness of clean label standards are driving a preference for natural wall materials such as plant-based carbohydrates and proteins. Collaborative public-private partnerships in the EMEA region are funding research on biodegradable encapsulation matrices. Concurrently, pharmaceutical hubs in Western Europe are leveraging encapsulation to improve bioavailability in complex drug candidates.

In the Asia-Pacific region, rapid growth in personal care and textiles applications is underpinned by rising disposable incomes and a strong appetite for premium, performance-driven goods. Local manufacturers are forging joint ventures to access advanced spray-drying and microfluidics capabilities, while government incentives for agricultural efficiency have spurred the adoption of encapsulated agrochemicals. Across these geographies, regional nuances in material preferences, regulatory regimes, and application focus are shaping differentiated market trajectories.

This comprehensive research report examines key regions that drive the evolution of the Microencapsulation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Company Highlights Illuminating Competitive Innovations Partnerships and Market Positioning in Microencapsulation Technologies Landscape

Leading industry participants have distinguished themselves through strategic investments in proprietary encapsulation platforms and selective M&A activity. Companies with vertically integrated polymer and emulsifier production capabilities have secured resilience against tariff-induced cost fluctuations. Meanwhile, specialized encapsulation firms continue to license innovative wall matrix technologies to global partners, expanding their intellectual property portfolios.

Collaboration between chemical suppliers and end-users has intensified, resulting in co-development agreements for tailor-made formulations. Some organizations have established dedicated application labs to provide hands-on support in optimizing encapsulation parameters for unique end-products. In parallel, partnerships with academic institutions are fueling breakthroughs in bioresponsive release systems and next-generation biopolymer shells. These concerted efforts are not only advancing technical performance but also forging stronger go-to-market alliances that span R&D, regulatory affairs, and customer training initiatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microencapsulation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Co.

- Ashland Inc.

- AVEKA Group

- Balchem Corporation

- BASF SE

- Bayer AG

- Cargill Incorporated

- Dow Inc.

- dsm-firmenich

- DuPont

- Encapsys, LLC

- Evonik Industries AG

- GAT Microencapsulation GmbH

- Givaudan SA

- International Flavors & Fragrances Inc. (IFF)

- Kerry Group plc

- Lycored

- Microtek Laboratories, Inc.

- Ronald T. Dodge Company

- Symrise AG

Actionable Recommendations for Industry Leaders to Leverage Emerging Technologies Supply Chain Strategies and Regulatory Engagement in Microencapsulation

Industry leaders should prioritize the development of sustainable encapsulation materials to align with evolving regulatory standards and consumer preferences for clean label solutions. Investing in pilot-scale facilities that incorporate green solvent recovery and low-energy drying methods will differentiate offerings and reduce environmental impact. In parallel, organizations must diversify supply chains by forging multi-regional sourcing agreements for critical core and wall materials, thereby mitigating the effects of tariff volatility.

Accelerating digital integration across process control and quality assurance will drive consistency and reduce time-to-market for new formulations. Engaging with regulatory bodies early in development cycles can streamline approvals for novel encapsulation chemistries. Finally, fostering cross-sector partnerships spanning agriculture, nutrition, and pharmaceuticals will open new application frontiers. By embedding these recommendations into strategic roadmaps, companies can secure competitive advantage while delivering tangible benefits to end-users.

Comprehensive Research Methodology Detailing Data Collection Triangulation Expert Validation and Analytical Framework for Microencapsulation Market Insights

The research methodology underpinning this analysis combines comprehensive secondary research, including peer-reviewed journals and industry whitepapers, with primary inputs from expert interviews across encapsulation technology providers, raw material suppliers, and end-use manufacturers. A rigorous data triangulation process was implemented to validate insights, ensuring that thematic trends are supported by multiple independent sources.

Quantitative and qualitative assessments were harmonized through an analytical framework that includes technology readiness evaluations, material compatibility matrices, and application performance benchmarks. An expert advisory panel provided continuous validation throughout the study, reviewing interim findings to refine hypotheses. This structured approach delivers robust, actionable insights rooted in real-world market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microencapsulation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microencapsulation Market, by Technology

- Microencapsulation Market, by Wall Material

- Microencapsulation Market, by Core Material

- Microencapsulation Market, by Formulation

- Microencapsulation Market, by Capsule Size

- Microencapsulation Market, by Application

- Microencapsulation Market, by Region

- Microencapsulation Market, by Group

- Microencapsulation Market, by Country

- United States Microencapsulation Market

- China Microencapsulation Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Concluding Reflections on Microencapsulation Innovations Market Dynamics and Strategic Imperatives Guiding Future Industry Success Trajectories

In summary, microencapsulation technology stands at a pivotal juncture, driven by sustainability imperatives, digital innovation, and shifting regulatory landscapes. Technological evolutions, from advanced coacervation techniques to microfluidics integration, are unlocking new performance thresholds, while tariff adjustments are prompting supply chain realignments. Segmentation analysis reveals nuanced opportunities across technology, material, and application vectors, and regional insights underscore the importance of localized strategies.

As companies navigate this multifaceted environment, strategic collaborations, supply chain resilience, and a commitment to green encapsulation will be the hallmarks of market leadership. The stage is set for industry players to harness these insights, transform challenges into competitive differentiators, and chart a course toward sustained innovation and growth in the dynamic world of microencapsulation.

Engage Directly with Associate Director Ketan Rohom to Access Detailed Microencapsulation Market Intelligence Tailored Solutions Report Purchase Options

For readers seeking a deeper competitive edge through unparalleled market insights, a personalized consultation with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, awaits. Engage with Ketan directly to explore tailored pathways for integrating microencapsulation intelligence into your strategic planning and to secure priority access to the full report.

By reaching out, you’ll gain priority notification of exclusive addenda covering emerging regulations and will receive customized briefing materials aligned with your organization’s objectives. Don’t miss the opportunity to transform data into decisive action-connect with Ketan Rohom today and embark on a journey toward innovation excellence.

- How big is the Microencapsulation Market?

- What is the Microencapsulation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?