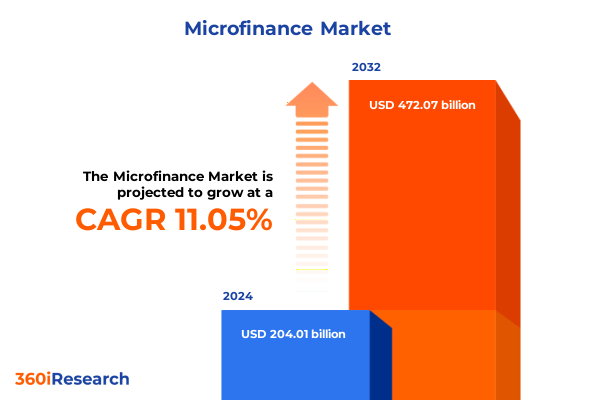

The Microfinance Market size was estimated at USD 225.01 billion in 2025 and expected to reach USD 248.16 billion in 2026, at a CAGR of 11.16% to reach USD 472.07 billion by 2032.

Unveiling the Evolution and Significance of Microfinance in Empowering Financial Inclusion and Driving Sustainable Development Across Diverse Communities Globally

Microfinance has evolved from a grassroots intervention into a cornerstone of financial inclusion, empowering millions across diverse socioeconomic landscapes. The discipline’s inception was rooted in the recognition that traditional banking institutions often overlook underserved communities with limited collateral or formal credit histories. Over time, practitioners and policymakers have collaborated to design mechanisms that extend credit and essential financial services to individuals and small enterprises, thereby fostering entrepreneurial activity and enhancing household resilience.

In recent years, stakeholders from multiple domains have converged to elevate microfinance beyond simple credit provision toward a comprehensive ecosystem of financial inclusion. This paradigm shift reflects an understanding that sustainable impact arises from the integration of insurance, savings, leasing, and investment solutions that collectively address the complex needs of vulnerable populations. As a result, microfinance now operates at the intersection of social empowerment, economic development, and technological innovation.

Looking ahead, industry participants must reconcile historic challenges-such as high operational costs and borrower education-with emerging opportunities in digital platforms, regulatory sandboxes, and collaborative models. In doing so, they will unlock pathways to greater financial stability and inclusive growth while preserving the sector’s core mission of democratizing access to capital.

Examining the Transformative Shifts Reshaping the Microfinance Landscape Through Technological Innovation Regulatory Evolution and Inclusive Service Models

The microfinance sector is undergoing a profound transformation driven by advancements in digital technology, evolving regulatory landscapes, and a renewed emphasis on client-centric service models. Fintech innovations, including mobile wallets, blockchain-based recordkeeping, and artificial intelligence–powered credit scoring, are streamlining operations and lowering transaction costs. These developments are enabling institutions to reach remote populations with greater speed and efficiency than ever before.

Concurrently, regulators are adopting more inclusive frameworks that balance consumer protection with financial innovation. Licensing reforms and the establishment of regulatory sandboxes have facilitated pilot programs for next-generation services, while collaborative partnerships between supervisory authorities and industry consortia are fostering knowledge sharing. Such structural evolutions are enhancing institutional resilience and reinforcing trust among clients.

Moreover, the industry is shifting toward integrated service delivery, where lending is supplemented by savings, insurance, and capacity-building initiatives. This holistic approach is increasingly recognized as essential to improving borrower outcomes and ensuring portfolio quality. Consequently, microfinance institutions are evolving from transactional lenders into comprehensive financial service providers that support sustainable livelihood strategies.

Analyzing the Cumulative Impact of United States Tariffs in 2025 on Microfinance Operations Supply Chains Borrowing Costs and Institutional Resilience

The imposition of United States tariffs in 2025 has exerted multifaceted effects on the global microfinance ecosystem, influencing supply chains, operational costs, and cross-border capital flows. Higher import levies on technology components have elevated the cost base for fintech platforms that power digital microcredit delivery, prompting institutions to adapt by renegotiating vendor contracts or investing in localized hardware manufacturing.

Simultaneously, tariffs on essential goods have impacted small-scale farmers and micro-enterprises reliant on imported inputs. These end users have experienced cost pressures that ripple back to microfinance portfolios in the form of higher default risks and demand for emergency liquidity support. In response, leading institutions have recalibrated credit scoring algorithms to account for commodity price volatility and have strengthened risk mitigation measures such as context-specific insurance schemes.

Despite these headwinds, the tariff environment has catalyzed innovation in risk management and supply chain financing. Microfinance practitioners are forging alliances with local suppliers, exploring alternative sourcing strategies, and expanding insurance coverage to protect against price shocks. As a result, the sector is demonstrating adaptability and developing new financial instruments to maintain service continuity under evolving trade conditions.

Deriving Key Segmentation Insights to Illuminate Service Offerings Institution Typologies Borrower Profiles and Customer Types That Shape Microfinance Dynamics

A nuanced understanding of market segmentation reveals how diverse service offerings, institutional structures, borrower characteristics, and customer categories collectively shape microfinance dynamics. When viewed through the lens of services, group and individual microcredit programs remain foundational, yet insurance, leasing, micro investment funds, and savings and checking accounts are gaining traction as complementary tools for bolstering household resilience and enabling enterprise scalability.

Institution type further influences market behavior, with commercial banks leveraging digital platforms to extend microloans, while cooperatives and credit unions draw on community networks to nurture trust. Dedicated microfinance institutions and non-governmental organizations often serve specialized segments, delivering tailored products focused on social impact and client empowerment.

Borrower profiles introduce additional complexity, as first-time borrowers navigate entry-level obligations and micro-enterprises seek working capital to sustain operations. Small-scale farmers require seasonal financing calibrated to cropping cycles, students demand flexible repayment schedules aligned with academic calendars, and women entrepreneurs often pursue services that integrate capacity building and marketlinkage support.

Customer type delineations underscore the divergence between individual borrowers, who prioritize personal credit access, and small enterprises, which require a broader suite of financial solutions. This categorical perspective enables institutions to refine product design, optimize delivery channels, and bolster portfolio performance by aligning services with distinct client journeys.

This comprehensive research report categorizes the Microfinance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Services

- Institution Types

- Borrower Profiles

- Customer Type

Uncovering Critical Regional Insights Across Americas Europe Middle East Africa and Asia Pacific to Understand Diverse Drivers and Opportunities in Microfinance

Regional dynamics play a critical role in defining the contours of microfinance markets. In the Americas, institutions harness digital banking channels and regulatory incentives to expand outreach in underserved urban and peri-urban areas. Collaborations with social enterprises have accelerated financial literacy initiatives, supporting communities that confront income inequality and cyclical vulnerabilities.

Across Europe, the Middle East, and Africa, a diverse mosaic of economic landscapes drives differentiated demand for microfinance services. Regulatory harmonization efforts in some jurisdictions are reducing barriers for cross-border capital inflows, while in others, localized product innovation-such as mobile credit in East Africa-is accelerating financial inclusion. Political will and development agency partnerships are further shaping the sector’s institutional framework.

In the Asia-Pacific region, rapid digital adoption and strong government backing for financial inclusion have enabled microfinance to penetrate remote and rural locations. Innovative e-kYC processes and biometric authentication have lowered onboarding costs, while strategic alliances between fintech startups and traditional banks are broadening the availability of credit, savings, and insurance products in markets characterized by high population density and heterogeneous client needs.

Together, these regional insights underscore the importance of contextualized strategies that respect local regulatory norms, demographic profiles, and technological ecosystems. Leaders must calibrate their approaches to align with the specific drivers of demand and operational realities in each geography.

This comprehensive research report examines key regions that drive the evolution of the Microfinance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Driving Innovation Partnerships and Competitive Strategies That Are Reshaping the Global Microfinance Ecosystem

Industry leaders are unlocking new frontiers in microfinance through strategic partnerships, innovative product development, and technology integration. Prominent commercial banks are collaborating with fintech platforms to deploy embedded credit solutions within e-commerce ecosystems, enhancing access for small-business owners. Meanwhile, leading microfinance institutions are adopting cloud-native core banking systems, streamlining loan origination, portfolio monitoring, and customer support.

Cooperatives and credit unions are differentiating themselves by deepening community engagement and leveraging member networks to offer peer-to-peer lending circles. Non-governmental organizations continue to pioneer social impact models that combine financial services with educational workshops, mentorship programs, and market linkage facilitation.

Across the board, institutions are prioritizing open architecture frameworks that allow third-party developers to build tailored extensions, from digital ledger analytics to real-time fraud monitoring. This modular approach is fostering a competitive marketplace for service enhancements and enabling providers to rapidly prototype and scale client-centric innovations across multiple regions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microfinance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Access Microfinance Holding AG

- Accion International

- Agricultural Bank of China Limited

- Al-Barakah Microfinance Bank

- Annapurna Finance (P) Ltd.

- ASA International India Microfinance Limited

- Banco do Nordeste do Brasil SA

- BancoSol

- Bandhan Bank Limited

- Belstar Microfinance Limited

- BlueOrchard Finance Ltd.

- BOPA Pte Ltd.

- BRAC

- BSS Microfinance Ltd.

- Cashpor Micro Credit

- CDC Small Business Finance Corp.

- Citigroup Inc.

- CreditAccess Grameen Limited

- Emirates Development Bank

- Equitas Small Finance Bank Ltd.

- Fusion Micro Finance Ltd.

- Gojo & Company, Inc.

- Grameen America Inc.

- IndusInd Bank Limited

- J.P.Morgan Chase & Co.

- Khushhali Microfinance Bank Limited

- Kiva Microfunds

- LiftFund Inc.

- Manappuram Finance Limited

- Microfinance Ireland

- Microlend Australia Ltd

- NRSP Microfinance Bank Limited

- Opportunity International

- Pacific Community Ventures Inc.

- Pro Mujer Inc.

- PT.Bank Rakyat Indonesia (Persero) Tbk.

- SATHAPANA Limited

- Satin Creditcare Network Limited

- SKS India

- Terra Motors Corporation

- The Enterprise Fund Limited

- Ujjivan Small Finance Bank Ltd.

Formulating Actionable Recommendations for Industry Leaders to Strengthen Risk Management Expand Digital Access and Foster Inclusive Growth in Microfinance

To navigate the evolving microfinance environment, industry stakeholders should intensify investments in digital infrastructure and user-centric design. Prioritizing mobile-first interfaces and API-driven integrations will enhance customer engagement and reduce transaction friction. In parallel, institutions must fortify risk management frameworks through advanced data analytics that incorporate macroeconomic indicators, borrower psychometrics, and real-time repayment behavior.

Operational resilience can be elevated by diversifying product offerings and broadening financial inclusion through blended solutions that marry credit, insurance, and savings. Collaboration with insurtech partners offers pathways to mitigate agricultural and disaster-related risks, while micro investment fund structures can unlock new capital pools for entrepreneurial ventures.

Cultivating a culture of continuous learning through field-based financial education and digital literacy campaigns will empower borrowers to manage liabilities responsibly. Simultaneously, strategic alliances with regulators and development agencies can foster an enabling policy environment that balances consumer protection with innovation incentives.

By executing these recommendations, organizations will strengthen their competitive positioning, drive sustainable impact, and uphold the mission of inclusive finance in the face of changing market dynamics.

Detailing a Robust Research Methodology Integrating Qualitative Engagements Quantitative Analysis and Cross Regional Comparative Assessments in Microfinance Studies

The research methodology underpinning this analysis synthesizes qualitative engagements with quantitative rigour to ensure robust, evidence-based insights. Primary data collection comprised structured interviews with senior executives from commercial banks, cooperatives, microfinance institutions, and regulatory bodies. These dialogues probed operational models, technological adoption, and strategic priorities across multiple regions.

Secondary research involved an extensive review of policy documents, academic publications, industry white papers, and digital innovation reports. This phase validated emerging trends in fintech, risk management, and service integration, while triangulating historical data to contextualize recent developments such as the impact of trade policies.

Quantitative analysis leveraged anonymized portfolio performance metrics, client satisfaction surveys, and transaction volumes to identify patterns and correlations. Advanced statistical techniques were applied to assess the efficacy of digital onboarding processes, loan repayment cycles, and cross-selling effectiveness. Cross-regional comparative assessments illuminated the interplay between regulatory frameworks, demographic profiles, and value chain dynamics.

Throughout the study, rigorous data governance protocols ensured confidentiality and integrity, while iterative peer reviews with subject-matter experts reinforced analytical validity. This integrated approach provides a comprehensive foundation for strategic decision-making and future research initiatives in the microfinance sphere.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microfinance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microfinance Market, by Services

- Microfinance Market, by Institution Types

- Microfinance Market, by Borrower Profiles

- Microfinance Market, by Customer Type

- Microfinance Market, by Region

- Microfinance Market, by Group

- Microfinance Market, by Country

- United States Microfinance Market

- China Microfinance Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Observations Emphasizing Strategic Imperatives Collaborative Innovation and Sustainable Impact for the Future of Microfinance Ecosystems

The microfinance sector stands at the confluence of technological innovation, regulatory evolution, and evolving client demands. As digital platforms democratize access and regulatory frameworks become more adaptive, institutions have an unprecedented opportunity to reshape the financial landscape in favor of underserved populations. By harnessing integrated service delivery models, stakeholders can address the multifaceted needs of diverse borrower segments while maintaining portfolio resilience.

Regional variations underscore the necessity of localized strategies that reflect specific economic, demographic, and policy environments. Nonetheless, common themes-such as the imperative for digital transformation, strengthened risk management, and collaborative partnerships-emerge as universal imperatives. By focusing on these strategic pillars, industry leaders can optimize operational efficiency and amplify social and economic impact.

Ultimately, the future of microfinance will be defined by the ability of institutions to balance innovation with inclusivity, ensuring that technological advancements augment rather than displace the human relationships at the heart of the sector. The insights presented herein offer a roadmap for navigating complexity and driving sustainable growth in an increasingly interconnected world.

Take the Next Step Engage with Associate Director Sales Marketing to Secure In Depth Microfinance Research Insights and Accelerate Strategic Decisions

We stand at a pivotal moment in microfinance research where informed, strategic decisions can enable organizations to capitalize on emerging trends and drive meaningful impact. To gain comprehensive visibility into market drivers, regulatory frameworks, and growth opportunities, we invite you to connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Through a direct conversation with Ketan, you will unlock detailed insights, customized data sets, and tailored advisory support designed to align with your strategic priorities.

Partnering with Ketan Rohom ensures that you receive expert guidance on how to leverage the research findings to optimize portfolio strategies, refine risk management processes, and accelerate digital transformation initiatives. By securing the full market research report, you will acquire a competitive edge in understanding service innovations, borrower behaviors, and regional dynamics. Reach out today to schedule a consultation with Ketan Rohom and take the next step toward empowering growth and fostering financial inclusion through data-driven decision making.

- How big is the Microfinance Market?

- What is the Microfinance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?