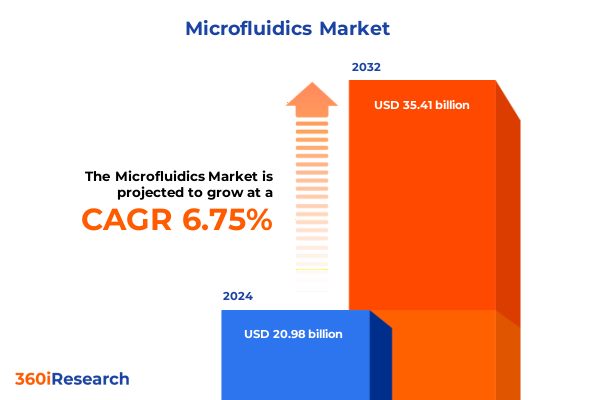

The Microfluidics Market size was estimated at USD 22.04 billion in 2025 and expected to reach USD 23.16 billion in 2026, at a CAGR of 7.00% to reach USD 35.41 billion by 2032.

Unveiling the Transformative Power and Expanding Potential of Microfluidics in Modern Scientific and Industrial Applications Driving Innovation Across Sectors

Microfluidics represents a paradigm shift in the precision manipulation of fluids at microscale volumes, enabling breakthroughs across healthcare, environmental monitoring, and high-throughput research. By miniaturizing processes traditionally confined to benchtop instruments, microfluidic systems drastically reduce reagent consumption and enhance analytical sensitivity. In this context, platforms capable of handling picoliter to microliter volumes empower researchers to accelerate time-to-result and drive innovation in areas such as organ-on-chip modeling and personalized diagnostics.

As microfluidic technologies continue to mature, integration with complementary disciplines-ranging from nanofabrication to data analytics-has become essential. The dynamic interplay of advanced manufacturing techniques, novel materials science, and automated workflows has fostered an ecosystem where complex fluidic assays can be conducted with higher throughput and reproducibility. This introductory section sets the stage for understanding how microfluidics is transforming research paradigms, enabling decentralized testing, and redefining the boundaries of laboratory automation.

Exploring the Transformative Technological and Market Shifts Redefining Microfluidic Systems for Enhanced Diagnostics Research and Precision Medicine

Over the past decade, microfluidics has undergone transformative shifts driven by technological convergence and evolving market requirements. First, the democratization of microfluidic platforms has lowered the barrier to entry, with benchtop systems becoming more accessible to academic labs and small-scale innovators. As a result, a broader array of end users can now implement lab-on-a-chip workflows without extensive engineering support.

Moreover, the integration of real-time data analytics and machine learning has redefined the capabilities of microfluidic systems. Digital microfluidics, for instance, now leverages algorithmic control to orchestrate droplet movement with unprecedented precision. This fusion of hardware and software not only streamlines assay development but also accelerates the path from prototyping to commercialization. Consequently, companies that marry fluidic automation with advanced analytics are setting a new standard for speed and accuracy in diagnostics and drug discovery.

Finally, the emergence of point-of-care and wearable microfluidic devices is reshaping healthcare delivery. Portable platforms able to perform multiplexed assays outside traditional laboratories are addressing urgent needs in infectious disease monitoring and remote patient management. These shifts underscore a broader trend: microfluidics is no longer confined to research benches, but is rapidly moving into real-world applications where speed, portability, and cost-effectiveness are paramount.

Analyzing the Far-Reaching Effects of 2025 United States Tariff Policies on Microfluidic Supply Chains, Cost Structures, and Research Development Dynamics

In 2025, the United States implemented targeted tariffs on imported silicon wafers, specialty polymer substrates, and precision-machined components commonly used in microfluidic chip fabrication. Although the policy aimed to bolster domestic manufacturing, it has introduced new cost pressures throughout the supply chain. Manufacturers reliant on Asian-sourced microfluidic chips and polymer reagents now face elevated input costs, which in turn necessitate price adjustments at the instrumentation and assay kit level.

These tariffs have also catalyzed a strategic pivot toward supply chain diversification. Recognizing the need for resilience, several system integrators have begun qualifying alternative suppliers in Europe and North America, while simultaneously exploring emerging materials such as biodegradable composites and glass-ceramic hybrids. This shift, however, requires extensive reengineering of device fabrication and validation protocols, potentially elongating product development timelines.

From a research and development perspective, increased material costs have prompted laboratories to optimize consumption through multiplexed assays and modular designs that maximize reuse of critical components. In aggregate, while the tariffs have introduced short-term challenges, they also serve as a catalyst for innovation-encouraging industry participants to adopt lean manufacturing principles, localize production where feasible, and invest in next-generation materials that mitigate exposure to geopolitical risk.

Deep Insights into Microfluidic Market Segmentation Spanning Offerings Materials Technologies and Diverse Application Domains Guiding Strategic Focus

A nuanced understanding of the microfluidic market emerges when examining its key segmentation dimensions. Based on offerings, the landscape encompasses core instrumentation alongside consumable kits and reagents, supported by increasingly sophisticated software control and analysis tools. Within instrumentation, modular microfluidic chips integrate with precision pumps to control fluid flow, while sensors and valves provide real-time monitoring and regulated actuation of microscale processes.

When viewed through the lens of materials, the market spans traditional substrates like glass and silicon, as well as advanced composites engineered for chemical resistance and optical clarity. Polymers remain a critical category, with elastomeric polydimethylsiloxane (PDMS) prized for prototyping, polystyrene favored for cell culture compatibility, and durable thermoplastics enabling robust disposable devices.

Technologically, digital microfluidics harnesses electrowetting to manipulate individual droplets, whereas droplet microfluidics leverages immiscible phase separation for high-throughput screening. Concurrently, specialized medical microfluidics focuses on biocompatible, integrated systems for clinical diagnostics, while paper-based microfluidics offers low-cost, portable assays for field applications.

Finally, applications range from early-stage academic and research use to critical sectors such as diagnostics-with targeted platforms for blood testing and rapid infectious disease detection-and environmental and industrial monitoring through chemical analysis and water quality assessment. The food and agriculture sphere benefits from microfluidic assays for food safety testing, nutrient analysis, and quality control, while pharmaceutical and biotechnology fields deploy these platforms for precise drug delivery studies and pharmacokinetic profiling.

This comprehensive research report categorizes the Microfluidics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offerings

- Material

- Technology

- Application

Uncovering Key Regional Dynamics Shaping the Adoption and Innovation of Microfluidic Technologies Across Americas EMEA and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping how microfluidic technologies are adopted and scaled. In the Americas, strong research funding and a supportive regulatory framework have spurred cutting-edge applications in personalized medicine and life sciences. The presence of established instrument manufacturers and leading academic institutions has fostered a robust innovation ecosystem, driving collaborations between device developers and pharmaceutical companies.

Meanwhile, Europe, the Middle East, and Africa (EMEA) exhibit a dual focus on environmental and industrial applications. Stricter water quality and emissions regulations have intensified the need for in-line monitoring solutions, prompting investment in chemical analysis and portable sensor platforms. European research consortia and government programs have further accelerated cross-border partnerships, harmonizing standards and facilitating broad adoption.

In the Asia-Pacific region, the rapid expansion of biopharmaceutical manufacturing and national initiatives for domestic technology capabilities have fueled demand for cost-effective microfluidic platforms. Countries such as China, Japan, and India are leveraging low-cost manufacturing infrastructures to produce both instrumentation and consumables at scale. At the same time, regulatory convergence and robust public-private collaborations are laying the groundwork for next-generation applications, particularly in point-of-care diagnostics and agricultural monitoring.

This comprehensive research report examines key regions that drive the evolution of the Microfluidics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Driving Competitive Advantage in the Global Microfluidics Industry Ecosystem

Major players in the microfluidics arena continue to shape industry trajectories through strategic investments and partnerships. Leading instrumentation providers have expanded product portfolios to include integrated lab-on-chip systems, while acquiring specialty component manufacturers to secure end-to-end control over device performance. Simultaneously, reagent suppliers have deepened collaborations with software developers, embedding data analytics and cloud connectivity into their assay kits to support seamless workflow automation.

Emerging challengers have carved out niches by offering high-precision pumps and valve systems engineered for ultra-low dead volume, catering to applications that demand exacting fluid control. Other innovators focus on digital microfluidic platforms that enable programmable assay design through user-friendly graphical interfaces. Such solutions are complemented by growing ecosystems of third-party developers creating assay protocols and custom modules, further enhancing platform versatility.

Through joint ventures and strategic alliances, industry leaders are also accelerating international expansion, leveraging local distribution networks to penetrate new markets. Investments in modular, plug-and-play systems have reduced time-to-deployment, enabling end users to rapidly integrate microfluidic capabilities into established workflows. This convergence of product innovation, software integration, and partnership ecosystems underscores the competitive dynamics propelling the microfluidics industry forward.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microfluidics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abaxis, Inc. by Zoetis Inc.

- AbCellera Biologics Inc.

- Achira Labs Pvt. Ltd.

- Agilent Technologies, Inc.

- ALLOYZMES Pte Ltd

- Ascent Bio-Nano Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- BioFluidica

- Biosurfit SA

- Cellix Ltd.

- Danaher Corporation

- Elvesys Group

- F. Hoffmann-La Roche Ltd.

- Fluigent S.A.

- Idex Corporation

- Illumina, Inc.

- Micronit B.V.

- Mission Bio, Inc.

- NanoCellect Biomedical

- Okomera

- OPKO Health, Inc.

- Parallel Fluidics, Inc.

- PerkinElmer Inc.

- QuidelOrtho Corporation

- Sphere Fluidics Limited

- Standard BioTools Inc.

- Syensqo

- Thermo Fisher Scientific, Inc.

- Unchained Labs

- World Precision Instruments

Actionable Strategies for Microfluidics Industry Leaders to Enhance Resilience Drive Innovation and Capitalize on Emerging Market Opportunities

To navigate the evolving microfluidics landscape, industry leaders must adopt proactive strategies that blend operational resilience with market agility. First, diversifying supply chains by qualifying multiple material and component vendors can mitigate the impact of geopolitical and tariff-driven disruptions. Establishing localized manufacturing hubs will further enhance responsiveness to regional demand fluctuations.

Second, investing in flexible, modular manufacturing platforms enables rapid iteration on device designs and scale-up of promising prototypes. By embracing lean manufacturing principles and digital twin simulations, companies can optimize production workflows and reduce time-to-market. At the same time, fostering partnerships with software and data-analytics providers will deliver next-generation solutions that integrate fluidic hardware with advanced machine learning algorithms for predictive insights.

Third, engaging early with regulatory bodies and participating in industry consortia will help standardize protocols and drive interoperability across platforms. This collaborative approach, combined with targeted talent development programs, ensures that organizations possess the expertise required to address complex assay requirements. Finally, embedding sustainability considerations-such as recyclable substrates and reduced energy consumption-into product roadmaps will align microfluidic innovations with broader environmental and social governance objectives.

Comprehensive Research Methodology Integrating Primary and Secondary Approaches Expert Interviews and Rigorous Data Validation Techniques for Credible Insights

The findings presented in this report derive from a meticulous combination of primary and secondary research methods. Primary data collection included structured interviews with a cross-section of stakeholders, encompassing device manufacturers, reagent suppliers, end-user laboratories, and regulatory experts. These interviews were complemented by on-site visits to leading research institutions and industry exhibitions to observe emerging prototypes and workflows in real-time.

Secondary research involved comprehensive reviews of scientific literature, patent filings, regulatory publications, and company collateral. Data triangulation techniques were employed to validate insights and reconcile disparate information sources, ensuring reliability and robustness of the analysis. Throughout the process, thematic coding of qualitative feedback and statistical analysis of quantitative inputs were conducted to uncover underlying trends and strategic imperatives.

Quality assurance protocols, including peer reviews and iterative validation workshops with domain experts, reinforced the credibility of the conclusions. This integrated methodology not only guarantees transparency and reproducibility but also provides a solid foundation for the strategic recommendations and actionable guidance outlined in preceding sections.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microfluidics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microfluidics Market, by Offerings

- Microfluidics Market, by Material

- Microfluidics Market, by Technology

- Microfluidics Market, by Application

- Microfluidics Market, by Region

- Microfluidics Market, by Group

- Microfluidics Market, by Country

- United States Microfluidics Market

- China Microfluidics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Perspectives on the Evolution of Microfluidics Highlighting Collaborative Innovation Future Directions and Impacts on Research and Industry Stakeholders

This executive summary has highlighted the transformative potential of microfluidics across multiple sectors, underscoring the convergence of advanced materials, precision engineering, and digital analytics. Collaborative innovation between instrumentation providers, reagent developers, and software partners is driving new applications-from point-of-care diagnostics to environmental monitoring and organ-on-chip systems.

As industry participants adapt to geopolitical shifts and evolving regulatory landscapes, a focus on supply chain resilience, modular design, and data-driven automation will be critical. Emerging regions in Asia-Pacific and EMEA are poised to influence global trends, while established markets in the Americas continue to lead in high-end research applications.

Looking ahead, sustained investment in next-generation materials and integrated platforms, coupled with a commitment to standardization and sustainability, will shape the future of microfluidics. Stakeholders who embrace these collaborative, interdisciplinary approaches will be best positioned to capitalize on the opportunities presented by this rapidly evolving field.

Engage with Associate Director Ketan Rohom to Secure Comprehensive Microfluidics Market Insights and Propel Strategic Decision Making

The executive summary you’ve just reviewed lays the groundwork for an in-depth understanding of the microfluidics landscape and the strategic opportunities it presents. To gain access to the full report-with detailed analysis, data-driven insights, and comprehensive strategic guidance-reach out directly to Associate Director Ketan Rohom. By securing this research, you’ll obtain the clarity needed to make informed decisions on partnerships, product development, and market expansion, ensuring your organization remains at the forefront of microfluidics innovation and competitive differentiation

- How big is the Microfluidics Market?

- What is the Microfluidics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?