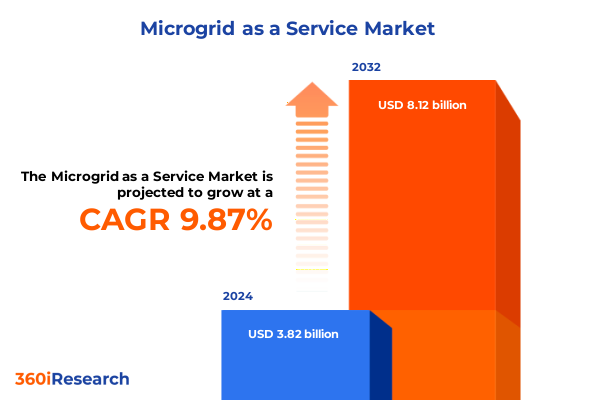

The Microgrid as a Service Market size was estimated at USD 4.16 billion in 2025 and expected to reach USD 4.54 billion in 2026, at a CAGR of 10.00% to reach USD 8.12 billion by 2032.

Emergence of Microgrid-as-a-Service as a Strategic Pillar Driving Resilient, Sustainable, and Cost-Efficient Energy Infrastructure in Critical Sectors Worldwide

The energy ecosystem is witnessing a profound transformation driven by the convergence of climate imperatives, technological innovation, and evolving customer expectations. Microgrid-as-a-service has emerged as a vital solution that delivers energy resilience and sustainability without imposing high upfront capital expenditure. By shifting the financing burden to skilled third-party providers, organizations across commercial, industrial, residential, and utility sectors can deploy tailored microgrid solutions that integrate local generation, storage, and grid interaction for enhanced reliability.

Fueled by aggressive decarbonization goals, many institutions are adopting microgrid-as-a-service to secure critical operations against grid outages and price volatility. This model not only caters to the growing demand for clean energy but also aligns with broader business initiatives around corporate social responsibility. Service providers offer turnkey solutions that encompass design, installation, financing, operations, and performance monitoring, enabling end users to focus on their core competencies while benefiting from guaranteed service-level agreements and predictable operational costs.

As technology advances in digital controls, energy storage, and renewable generation, microgrid-as-a-service stands at the intersection of innovation and practicality. It offers a path to modernize aging infrastructure, facilitate energy independence, and unlock new revenue streams through ancillary grid services. By providing a flexible, operator-managed model, this approach addresses the spectrum of emerging challenges in energy security and positions organizations to thrive in the dynamic energy landscape.

How Policy Reforms, Digital Innovation, and Corporate Sustainability Mandates Are Driving Rapid Transformation of Microgrid-as-a-Service Offerings

The microgrid-as-a-service landscape is undergoing rapid evolution driven by paradigm shifts across policy, technology, and market dynamics. Decentralization is reshaping traditional power architectures as stakeholders demand localized solutions that deliver continuous power amid grid disruptions. Concurrently, advancements in digital monitoring and analytics are empowering operators with real-time visibility into energy flows, enabling predictive maintenance and seamless integration of distributed energy resources.

Regulatory reforms, such as incentives for grid-support services and resilience credits, are creating new revenue streams for microgrid operators. Meanwhile, corporate procurement policies are increasingly favoring renewable energy through power purchase agreements that favor distributed generation. This convergence of legislative support and corporate sustainability mandates is catalyzing demand for microgrid-as-a-service, as organizations strive to meet net-zero targets while ensuring operational continuity.

Emerging trends such as vehicle-to-grid integration, hybrid energy storage architectures, and blockchain-enabled energy trading are redefining service offerings. These innovations not only enhance the economic viability of microgrids but also expand their functional footprint beyond mere backup systems. As service providers harness artificial intelligence and machine learning to optimize energy dispatch and asset health, the microgrid-as-a-service model is poised to become a cornerstone in the future decentralized utility ecosystem.

Analyzing the Multidimensional Consequences of New U.S. Trade Tariffs on Microgrid Component Costs, Supply Chains, and Project Financing in 2025

The United States’ tariff landscape in 2025 has significantly influenced the cost structure and deployment timelines for microgrid solutions that rely on solar PV modules and energy storage components. New import duties on crystalline silicon panels have increased utility-scale project costs by approximately thirty percent, placing pressure on project economics and contract negotiations. Higher equipment costs have led providers to renegotiate power purchase agreements, build larger risk contingencies, and rethink supply chain strategies to mitigate cost overruns.

The impact extends to energy storage as well, with tariffs on battery cell imports projected to drive battery system costs upward by as much as fifty percent. This escalation has forced some developers to delay project commissioning or seek alternative chemistries that can be manufactured domestically. The resulting uncertainty in component availability has prompted service providers to adjust lead times, increase inventory buffers, and explore strategic partnerships with domestic manufacturers to secure stable supply lines.

In addition to direct cost increases, these tariffs have introduced complexities in project financing and asset valuation. Lenders and investors are demanding more robust risk assessments to account for potential further changes in trade policy. Consequently, project bankability assessments now incorporate multi-scenario stress tests to model tariff fluctuations. This heightened scrutiny has extended the planning horizon for many microgrid-as-a-service deployments, as stakeholders navigate both rising costs and evolving regulatory frameworks.

Dissecting Microgrid-as-a-Service Market Dynamics Across Diverse End Users, Technology Platforms, and Deployment Capacities for Strategic Segmentation

The microgrid-as-a-service market exhibits nuanced behavior across various user bases, reflecting diverse reliability and sustainability requirements. End users span commercial operations such as educational facilities, retail outlets, hospitality venues, and hospitals; they require predictable energy performance and integration with existing energy management systems. Industrial sites, including data centers, healthcare campuses, manufacturing plants, and oil and gas installations, demand robust power quality and resilience to protect mission-critical processes. Residential adoption occurs primarily in single-family and multi-family dwellings seeking energy independence and cost stability, while utilities target distribution management, grid support services, and remote community electrification to balance loads and prevent outages.

Technology adoption within these projects hinges on modular and scalable solutions. Battery storage technologies, whether flow or lithium-ion chemistries, complement generation assets by smoothing output and providing instantaneous backup. Combined heat and power configurations, leveraging gas turbines or reciprocating engines, offer efficiency gains in facilities with thermal loads. Solar PV systems, whether fixed-tilt arrays or single-axis trackers, harness renewable energy, while wind turbines-both onshore and offshore-serve as complementary generation sources in suitable geographies.

Service offerings are tailored to client needs through engineering and design engagements that include feasibility studies and complex system integration. Financing models underwrite capital requirements, while fuel management optimizes dispatch strategies for hybrid systems. Operation and maintenance regimes, whether corrective, predictive, or preventive, maintain uptime and extend asset life, and performance monitoring, through advanced analytics and remote monitoring platforms, ensures service-level adherence.

Deployment strategies vary from grid-connected systems that interact dynamically with the main grid to hybrid solutions combining solar or wind with battery storage for enhanced resilience. Off-grid configurations address critical applications such as disaster relief operations and remote island communities. Power ratings range from small-scale installations under 100 kW for localized backup needs to mid-tier systems of 100 kW to 500 kW and 500 kW to 1 MW, as well as larger facilities above 1 MW segmented into 1 MW to 5 MW and beyond 5 MW capacities, aligning system scale with load requirements and financial objectives.

This comprehensive research report categorizes the Microgrid as a Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Service Offering

- Deployment

- Power Rating

- End User

Examining Divergent Regional Drivers and Adoption Patterns That Shape the Microgrid-as-a-Service Landscape Across the Americas, EMEA, and Asia-Pacific

Regional dynamics in the microgrid-as-a-service sector reveal distinct drivers and growth trajectories. In the Americas, regulatory frameworks and incentive structures for resilience and clean energy are fostering adoption among commercial and industrial customers. The push for disaster preparedness in hurricane-prone states and the integration of battery-backed distributed generation solutions are particularly vibrant, supported by progressive state policies and utility programs.

Within Europe, the Middle East, and Africa, regulatory impetus around decarbonization, coupled with the need to stabilize grids in emerging markets, has led to an uptick in hybrid microgrid deployments. Energy access initiatives in remote African communities leverage off-grid solutions powered by solar-battery hybrids, while European markets emphasize grid-connected systems that provide ancillary services to congested transmission networks.

In the Asia-Pacific region, rapid urbanization and industrial growth are fueling demand for resilient power architectures. Island nations are prioritizing microgrids to reduce diesel dependence, while major economies are exploring microgrid-as-a-service as a mechanism to meet aggressive renewable integration targets. The interplay of government subsidies, private sector investment, and urban energy planning is establishing the region as a hotspot for innovative microgrid models that balance cost, reliability, and environmental performance.

This comprehensive research report examines key regions that drive the evolution of the Microgrid as a Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How Leading and Emerging Providers Are Innovating Service Models, Financing Structures, and Technology Integrations to Outpace Competition in Microgrid-as-a-Service

Leading market participants are differentiating themselves through technology integration, strategic partnerships, and service excellence. Schneider Electric has leveraged its digital twin and IoT platforms to offer predictive analytics and remote operations that reduce downtime and optimize energy flows. Siemens integrates its expertise in grid automation and power electronics to deliver comprehensive microgrid control systems, frequently collaborating with utilities to provide grid-support services.

ABB differentiates through its modular power electronics and bi-directional converters, enabling rapid microgrid deployment and seamless transitions between grid-connected and islanded modes. Cummins and Caterpillar continue to innovate in hybridization, coupling their traditional generator offerings with battery storage and energy management systems. Ameresco and Engie focus on bespoke financing arrangements and long-term service agreements, allowing clients to deploy complex systems without capital burdens.

Up-and-coming entrants are challenging incumbents by specializing in niche applications such as data center microgrids or remote community solutions. These companies often emphasize local manufacturing partnerships and streamlined digital platforms to reduce engineering lead times and improve cost transparency. Collectively, the competitive landscape is accelerating innovation, compelling established and emerging players alike to refine their value propositions around service reliability, financing flexibility, and lifetime operational performance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microgrid as a Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- AES Corporation

- Black & Veatch Holding Company

- Bloom Energy Corporation

- Caterpillar Inc.

- Enel X North America S.r.l.

- Engie SA

- General Electric Company

- Hitachi ABB Power Grids Ltd

- Mitsubishi Electric Corporation

- Pareto Energy Ltd

- Rolls-Royce Power Systems AG

- S&C Electric Company

- Schneider Electric SE

- Siemens AG

- SolarCity Corporation by Tesla Inc

- Tech Mahindra Limited

- Teksan Generator Power Industries and Trade Co. Inc

Actionable Strategies for Service Providers to Innovate Technology Platforms, Secure Supply Chains, and Influence Policy Frameworks for Sustainable Growth

Industry leaders should prioritize the development of modular, standardized platforms that can be rapidly tailored to diverse customer requirements, thereby reducing engineering complexity and accelerating time to revenue. By adopting open architecture designs, service providers can integrate third-party technologies and accommodate future enhancements without extensive retrofitting.

Building robust strategic partnerships with domestic component manufacturers and research institutions will mitigate supply chain risks and spur joint innovation. Collaborative consortia can facilitate shared investment in pilot projects, generating best practices and reducing costs through economies of scale.

Companies must cultivate financing frameworks that balance customer risk with profitability, such as hybrid models combining performance-based fees with capacity payments. Transparent, outcome-oriented contracts will increase customer confidence and foster long-term relationships.

Investing in advanced digital platforms that incorporate artificial intelligence for real-time optimization of energy dispatch and predictive maintenance will enhance operational efficiency. These tools should be designed to interface seamlessly with existing enterprise resource planning and building management systems.

Finally, proactive engagement with regulators and industry associations will ensure that evolving policy environments reflect the mutual goals of resilience, decarbonization, and grid stability. By influencing tariff structures, incentive programs, and interconnection standards, service providers can shape conditions conducive to sustainable growth.

Detailed Methodology Leveraging Secondary Research, Expert Interviews, and Triangulated Data Analysis to Illuminate Microgrid-as-a-Service Market Dynamics

This study employs a multi-tiered research methodology combining extensive secondary research, primary interviews, and rigorous data triangulation. Initial insights were gathered from public filings, industry white papers, and regulatory documents to establish the market’s foundational landscape. Findings were cross-validated against proprietary datasets and expert commentary to ensure accuracy.

Primary interviews with key stakeholders-including microgrid operators, technology vendors, component manufacturers, financiers, and regulatory bodies-provided nuanced perspectives on market drivers, barriers, and emerging opportunities. These discussions illuminated real-world experiences in deployment, financing, and operations, informing the segmentation framework and thematic analysis.

Quantitative data underwent a layered validation process, with multiple analysts reviewing assumptions around technology adoption, service penetration, and regional growth dynamics. Competitive profiling involved examining corporate strategies, partnerships, and product roadmaps to identify leading-edge innovations.

Geographic coverage encompassed the Americas, Europe, Middle East & Africa, and Asia-Pacific, enabling comparative regional analyses. The segmentation approach aligned end users, technologies, services, deployment models, and power ratings to deliver actionable insights tailored to distinct stakeholder groups.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microgrid as a Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microgrid as a Service Market, by Technology

- Microgrid as a Service Market, by Service Offering

- Microgrid as a Service Market, by Deployment

- Microgrid as a Service Market, by Power Rating

- Microgrid as a Service Market, by End User

- Microgrid as a Service Market, by Region

- Microgrid as a Service Market, by Group

- Microgrid as a Service Market, by Country

- United States Microgrid as a Service Market

- China Microgrid as a Service Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3498 ]

Comprehensive Synthesis of Technological, Regional, and Strategic Factors Shaping the Future of Microgrid-as-a-Service Solutions in Evolving Energy Markets

As organizations confront the twin imperatives of resilience and decarbonization, microgrid-as-a-service has proven to be a flexible and financially viable solution. By outsourcing system design, financing, and operations to specialized providers, end users can achieve an optimal balance of reliability, cost control, and environmental impact.

Regional insights underscore the importance of customizing deployment strategies to local regulatory and infrastructure contexts, while the competitive landscape highlights the need for continuous innovation in technology integration and service delivery. The cumulative impact of U.S. tariffs in 2025 further underscores the value of strategic supply chain partnerships and domestic manufacturing alliances.

Leveraging the segmentation framework, stakeholders can identify high-value opportunities aligned with their operational profiles and strategic goals. Whether targeting commercial campuses, industrial installations, remote communities, or hybrid deployments, the microgrid-as-a-service model offers a pathway to secure, sustainable energy that adapts to evolving market and policy environments.

Ultimately, this comprehensive analysis equips decision-makers with the insights needed to navigate a complex landscape, minimize risk, and capitalize on the transformative potential of distributed energy solutions.

Unlock Strategic Growth with Expert Insights on Microgrid-as-a-Service by Connecting Directly with Ketan Rohom

To explore how microgrid-as-a-service can fortify your energy security and accelerate your path to sustainability, connect with Ketan Rohom, Associate Director of Sales & Marketing. Engage in a personalized consultation to learn how this market research report can guide your strategic investment and operational decisions. Reach out to him through LinkedIn to request a detailed proposal, schedule a briefing, or secure your copy of the full study today

- How big is the Microgrid as a Service Market?

- What is the Microgrid as a Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?