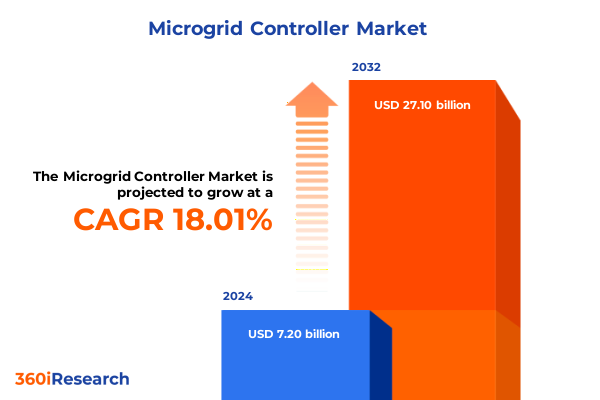

The Microgrid Controller Market size was estimated at USD 8.50 billion in 2025 and expected to reach USD 9.85 billion in 2026, at a CAGR of 18.00% to reach USD 27.10 billion by 2032.

Exploring the Evolutionary Trajectory of Microgrid Controllers Amidst Rising Energy Security, Decarbonization Goals, and Technological Advancements

The global imperative to bolster energy security while simultaneously advancing decarbonization initiatives has placed microgrid controllers at the forefront of modern power infrastructure innovation. In response to growing concerns over grid reliability and resilience, governments and private-sector consortiums are accelerating investment in technologies that can orchestrate diverse distributed energy resources with precision. This momentum is underscored by targeted funding, including an $8 million allocation through the DOE’s Community Microgrid Assistance Partnership program to catalyze controller development for rural and remote communities.

Amidst these policy-driven incentives, the definition and eligibility criteria for controller-related tax credits have been under review, reflecting the critical role controllers play in enabling clean energy integration. Recent guidance from the U.S. Department of the Treasury and IRS seeks to clarify what constitutes an eligible microgrid controller under the Inflation Reduction Act, laying out a framework for real-time monitoring, dynamic load management, and seamless resource orchestration in qualified projects. This evolving regulatory clarity is catalyzing innovation and investment, shaping the trajectory of controller capabilities and adoption rates worldwide.

Unveiling Decisive Technological and Regulatory Shifts Reshaping Competitive Dynamics and Investment Strategies in the Microgrid Controller Landscape

Recent regulatory reforms are redefining the playing field for microgrid controllers by unlocking novel market participation models. Foremost among these is FERC’s Order 2222, which mandates that regional transmission operators enable aggregated distributed energy resources-ranging from battery storage to solar PV and demand-response assets-to bid into wholesale electricity markets under unified rules. By dismantling legacy barriers related to minimum size requirements, locational constraints, and telemetry standards, the order paves the way for microgrids to function not only as islands of resilience but also as active market participants that can provide capacity, energy, and ancillary services in complex grid environments.

Concurrently, technological advancements in artificial intelligence, digital twins, and IoT connectivity are imbuing controllers with unprecedented levels of situational awareness and adaptive optimization. Leading deployments now utilize machine learning algorithms to forecast renewable generation, predict component maintenance needs, and autonomously reconfigure system topology in response to real-time grid events. At industry gatherings such as Distributech 2025, utilities and vendors alike highlighted the integration of cloud-native analytics, edge computing, and advanced cybersecurity frameworks-underscoring a strategic shift from reactive to proactive energy management practices.

Assessing the Intersection of U.S. Tariff Policies in 2025 and Their Compounding Effects on Microgrid Controller Supply Chains and Project Viability

In April 2025, the U.S. Department of Commerce imposed steep retaliatory duties targeting solar imports from Southeast Asia-ranging from hundreds to thousands of percent on products from Cambodia, Vietnam, Thailand, and Malaysia-alongside a 145 percent levy on Chinese-manufactured solar modules. These measures, aimed at curbing tariff circumvention, have introduced significant price escalations for photovoltaic components that serve as critical inputs to microgrid systems.

Earlier tariff initiatives enacted under the prior administration added a 30 percent surcharge to the cost of solar panels and inverters, compelling project developers to revisit financing models and renegotiate power purchase agreements. However, because microgrids encompass a broader suite of generation, storage, and integration services, the net impact on deployment pipelines has been less severe than in stand-alone solar installations-though short-term project delays and cost overruns have been widely reported.

Looking beyond immediate price effects, analysts at the Center for Strategic and International Studies warn that sustained tariff pressures could elevate costs for essential grid components such as inverters and transformers, potentially delaying planned grid upgrades and undermining clean energy innovation. Without strategic mitigation-such as diversifying supply chains or enhancing domestic manufacturing capacity-the cumulative impact of these trade measures may temper the pace of microgrid adoption and constrain long-term resilience objectives.

Deciphering Market Dynamics Through Power Rating Tiers, Control Architectures, Installation Modalities, Communication Protocols, and End-Use Profiles Driving Growth

Market dynamics for microgrid controllers are shaped by nuanced power-rating thresholds, where solutions must scale seamlessly from systems under 100 kW-often deployed in residential or remote off-grid scenarios-to mid-range deployments between 100 kW and 1 MW serving commercial and light industrial clients, and upwards of multi-megawatt configurations tailored to utility-scale applications. Each tier demands specialized hardware sizing, software licensing models, and lifecycle support strategies that balance capital expenditures against operational performance targets.

Control architecture choices similarly dictate value propositions, ranging from centralized command centers that optimize large-scale microgrid clusters to decentralized frameworks enabling peer-to-peer energy exchanges, and hierarchical schemes that blend local autonomy with enterprise-level oversight. These paradigms address distinct reliability, scalability, and interoperability requirements, driving divergent investment approaches and system design methodologies.

Installation modalities further diversify the landscape: grid-tied controllers focus on seamless utility integration and ancillary service participation, hybrid models marry renewable generation with energy storage to enhance dispatch flexibility, and islanded systems prioritize autonomy and black-start capabilities for critical loads in remote or emergency contexts. Underpinning all deployments, communication technologies span deterministic wired protocols-such as Ethernet, Modbus, and serial interfaces-to agile wireless networks leveraging cellular, LoRa, and WiFi transports, each offering trade-offs between latency, bandwidth, and geographic reach.

End-use profiles exert a pivotal influence on controller feature sets and service offerings. Commercial and industrial deployments in agriculture, data centers, healthcare, manufacturing, and retail sectors require deep analytics, stringent uptime guarantees, and integration with enterprise energy management platforms. Military and government installations emphasize cybersecurity hardening and mission-critical resilience. Remote and off-grid applications depend on simplified user interfaces and minimal maintenance overhead. Residential solutions prioritize cost-efficient plug-and-play designs, while utility-scale controllers orchestrate complex portfolios of distributed energy assets to optimize grid support and market participation.

This comprehensive research report categorizes the Microgrid Controller market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Power Rating

- Control Architecture

- Installation Type

- Communication Technology

- End Use

Comparative Regional Ecosystem Analysis of Microgrid Controllers Across the Americas, Europe Middle East & Africa, and Asia-Pacific Market Landscapes

In the Americas, microgrid controller adoption is buoyed by a convergence of federal incentives and strategic funding programs. The DOE’s Community Microgrid Assistance Partnership has allocated over $8 million to accelerate controller innovation in underserved and remote regions, while the expanded Investment Tax Credit under the IRA provides compelling financial offsets for qualifying hardware and integration costs. This dual policy thrust is catalyzing deployments across both commercial campuses and critical public infrastructure.

Across Europe, the Middle East & Africa, regulatory bodies are crafting frameworks to bolster mini-grid and microgrid projects as a means to address both energy access gaps and decarbonization mandates. Recent analyses from the IEA highlight that sub-Saharan Africa has seen mini-grid licenses double since the early 2020s, driven by supportive tariff regimes and streamlined permitting processes. Meanwhile, Gulf Cooperation Council nations are advancing demonstration projects that integrate renewables and storage to enhance grid resilience in extreme climates.

In the Asia-Pacific region, governmental strategies are placing microgrids at the heart of rural electrification and smart-city initiatives. China’s National Renewable Energy Microgrid Demonstration Program, Japan’s Sixth Strategic Energy Plan, and India’s rural solar microgrid subsidies collectively underscore a regional commitment to localized energy autonomy. Policy instruments ranging from grant funding to regulatory sandboxes are empowering rapid pilot rollouts, positioning the Asia-Pacific as a crucible for advanced controller technologies and innovative business models.

This comprehensive research report examines key regions that drive the evolution of the Microgrid Controller market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Microgrid Controller Innovators and Their Strategic Positioning Amidst Heightened Competition and Technological Convergence

A cadre of global technology leaders is staking early claims in the microgrid controller domain. Schneider Electric’s EcoStruxure platform has emerged as a benchmark for integrated hardware-software solutions, combining real-time analytics with IEC 62443-compliant cybersecurity measures to support enterprise-scale deployments. Siemens is likewise leveraging its industrial software portfolio to deliver digital grid solutions that emphasize cloud-native operations and open interoperability standards.

In parallel, traditional power equipment manufacturers are transforming their strategies. Honeywell International Inc. and GE Vernova are embedding AI-driven energy management modules into their inverters and switchgear, while Hitachi Energy and Eaton Corporation are deepening partnerships with utilities to pilot next-generation controller architectures. These companies are advancing through a combination of targeted acquisitions, R&D alliances with academic institutions, and collaboration with cloud hyperscalers to deliver scalable, secure, and future-proof controller offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microgrid Controller market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Caterpillar Inc.

- Cummins Inc.

- Eaton Corporation plc

- Emerson Electric Co.

- Enchanted Rock, Ltd.

- Encorp Inc.

- General Electric Company

- Go Electric Inc.

- Gridscape Solutions Inc.

- Heila Technologies, Inc.

- Hitachi, Ltd.

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Opus One Solutions Energy Inc.

- Power Analytics Corporation

- PowerSecure International, Inc.

- S&C Electric Company

- Scale Microgrid Solutions LLC

- Schneider Electric SE

- Schweitzer Engineering Laboratories, Inc.

- Siemens AG

- Spirae, LLC

- Toshiba Corporation

Strategic Blueprint for Industry Leaders to Capitalize on Emerging Microgrid Controller Opportunities, Enhance Resilience, and Mitigate Operational Risks

Industry leaders should prioritize the development of modular, software-defined controller architectures that can be tailored to distinct power-rating requirements and control paradigms. By adopting open APIs and supporting multiple communication stacks, vendors can accelerate integration with distributed energy resources and third-party analytics platforms, fostering an ecosystem that drives continuous innovation while mitigating vendor lock-in.

To navigate the evolving policy landscape and tariff environments, companies must cultivate diversified manufacturing and sourcing strategies. Establishing or strengthening domestic production capabilities for critical controller components will not only insulate supply chains from trade disruptions but also unlock additional tax incentives tied to local manufacturing thresholds. Concurrently, deepening collaboration with regulatory bodies can ensure emerging controller standards align with grid modernization goals and market participation rules.

Elucidating the Rigorous Mixed-Method Research Framework Underpinning Comprehensive Microgrid Controller Market Analysis and Insight Generation

This research draws on a mixed-method approach, combining extensive secondary analysis of policy documents, regulatory filings, and industry publications with primary interviews conducted among over 30 subject matter experts, including utility executives, project developers, controller OEM leaders, and academic researchers. Data triangulation techniques were applied to reconcile divergent perspectives and ensure the robustness of key findings.

Quantitative segmentation models were developed around five critical dimensions-power rating, control architecture, installation type, communication technology, and end use. These models were validated through a multi-stage Delphi process, securing consensus among industry stakeholders on definitional thresholds and performance metrics. The resulting framework underpins the strategic recommendations and regional insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microgrid Controller market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microgrid Controller Market, by Power Rating

- Microgrid Controller Market, by Control Architecture

- Microgrid Controller Market, by Installation Type

- Microgrid Controller Market, by Communication Technology

- Microgrid Controller Market, by End Use

- Microgrid Controller Market, by Region

- Microgrid Controller Market, by Group

- Microgrid Controller Market, by Country

- United States Microgrid Controller Market

- China Microgrid Controller Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Critical Insights on Technology, Policy, and Market Trends to Chart the Path Forward for Microgrid Controller Adoption and Evolution

The synthesis of technological, regulatory, and trade-policy analyses reveals a market at an inflection point. Microgrid controllers are transcending their traditional role as system orchestrators to become central enablers of grid flexibility, resource democratization, and clean-energy integration. The convergence of AI-driven operations, open interoperability standards, and supportive policy mechanisms sets the stage for accelerated controller adoption across diverse applications.

As stakeholders chart their strategic roadmaps, the imperative will be to balance innovation with resilience-developing controller solutions that not only optimize performance under ideal conditions but also maintain robust operations amid trade uncertainties, evolving tariff regimes, and emerging cybersecurity threats. Those who navigate these complexities with agility and foresight will shape the future contours of the global energy transition.

Engage with Ketan Rohom to Unlock Comprehensive Microgrid Controller Market Intelligence, Drive Strategic Decision-Making, and Foster Sustainable Growth

To gain access to the full suite of insights, detailed regional analyses, and tailored strategic recommendations outlined in this executive summary, we invite you to connect directly with Associate Director, Sales & Marketing, Ketan Rohom. With his extensive expertise in microgrid controller technologies and market dynamics, Ketan can provide personalized guidance on how this research can inform your investment decisions, technology roadmaps, and competitive positioning. Reach out through our professional inquiry portal to learn more about licensing options, customized data packages, and collaborative research opportunities that will empower your organization to stay ahead in the rapidly evolving microgrid controller landscape.

- How big is the Microgrid Controller Market?

- What is the Microgrid Controller Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?