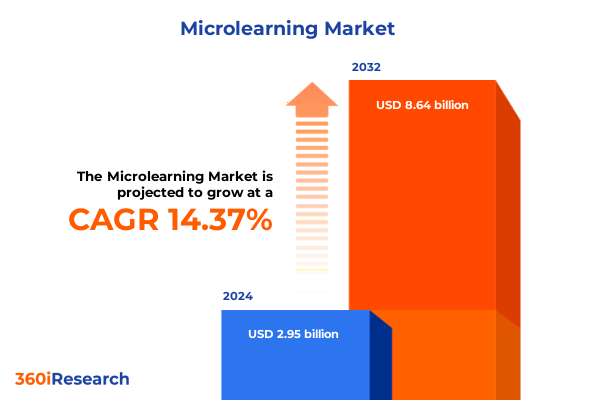

The Microlearning Market size was estimated at USD 3.38 billion in 2025 and expected to reach USD 3.83 billion in 2026, at a CAGR of 14.35% to reach USD 8.64 billion by 2032.

Set the stage for understanding how agile bite-sized digital learning modules are reshaping organizational capability building in today’s fast-paced world

An effective executive summary begins by framing the critical importance of microlearning as the preferred vehicle for delivering targeted knowledge in the digital age, poised to revolutionize how organizations upskill workforces and drive performance. In the face of shorter attention spans, dispersed teams, and the constant need for just-in-time learning, microlearning emerges as a compelling paradigm, enabling learners to absorb focused content in concise, engaging bursts.

Transitioning from the macroscopic view of traditional training programs, this section sets the stage for a deep-dive into microlearning’s characteristics: its agility, scalability, and alignment with modern learner preferences. By elucidating how bite-sized modules empower employees to seamlessly integrate learning into daily workflows, the introduction underscores the technology’s capacity to enhance retention, accelerate upskilling, and foster continuous development.

Building momentum, the introduction highlights the broader context of digital transformation within enterprises. It contrasts the historic cycle of lengthy training sessions with the present demand for adaptive, personalized learning journeys. This foundation not only establishes the relevance of subsequent analysis but also galvanizes decision-makers to explore the forthcoming insights, fully appreciating the pivotal role microlearning plays in shaping organizational resilience and competitiveness.

Explore the pivotal technological and pedagogical evolutions that have accelerated microlearning into a data-driven, learner-centric powerhouse

The microlearning landscape has experienced pivotal inflection points, driven by seismic shifts in technology adoption and learner expectations. Initially grounded in simple quiz-based formats, the sector has rapidly evolved to incorporate immersive simulations and gamification, signaling a move from passive reception of content to active, experience-driven learning journeys.

Simultaneously, the proliferation of cloud-based platforms has democratized access, enabling organizations of all sizes to deploy and iterate on microlearning offerings without heavy infrastructure investment. This shift has been complemented by the rise of mobile-first strategies, as smartphones and tablets become primary touchpoints for learners, foregrounding convenience and on-the-go access.

Moreover, the integration of data analytics and artificial intelligence has transformed how content is curated, delivered, and optimized, ushering in an era of hyper-personalization. Learner engagement metrics and performance analytics now fuel continuous content refinement, ensuring that each module aligns precisely with individual skill gaps and organizational KPIs. Collectively, these transformative shifts underscore a vibrant ecosystem in which microlearning not only adapts to emerging technologies but also sets new benchmarks for responsive, learner-centric design.

Understand how recent US trade policy revisions are reshaping cost and sourcing strategies for microlearning solution providers

In recent months, fluctuations in United States tariff policies have introduced new variables affecting the supply chain dynamics and cost structures for microlearning technology providers. By imposing increased duties on hardware components critical for interactive video production and virtual reality setups, the policy adjustments have reverberated across content creation budgets and delivery timelines.

As a result, vendors are recalibrating sourcing strategies, pivoting toward domestic manufacturing partnerships or alternative offshore suppliers to mitigate duty escalations. This strategic realignment has not only reshaped pricing negotiations but has also driven innovation in low-footprint hardware solutions, encouraging the development of software-centric experiences that rely less on specialized peripherals.

In parallel, the uncertainty around tariff stability has elevated risk management to the forefront of vendor and procurement discussions. Organizations are now building in contingency buffers, diversifying supplier bases, and exploring open-source content authoring tools to insulate themselves from sudden cost shocks. Consequently, the landscape reflects a hybrid approach that balances cost efficiency with agility, ensuring that essential microlearning deployments remain both sustainable and scalable amid a shifting trade environment.

Gain deep segmentation intelligence revealing how distinct content formats, deployment models, industry focuses, end-user profiles, and device preferences shape microlearning dynamics

Diving into the nuanced composition of the microlearning domain reveals distinct contours based on content typology and delivery preferences. The market’s core spans gamification modules designed to incentivize learner engagement, rapid-fire micro lectures that distill key concepts, interactive quizzes ranging from multiple choice scenarios to true-false assessments, and immersive simulations that replicate real-world scenarios.

Video content anchors much of the consumption experience, with a clear delineation between standard recorded segments and interactive formats that pause for knowledge checks or branching scenarios. Virtual reality experiences occupy a specialized niche, targeting high-stakes training contexts that demand spatial learning and procedural memory reinforcement.

Deployment modalities further color the market’s segmentation, with cloud-based platforms offering instantaneous scalability and on-premises solutions catering to stringent data sovereignty requirements. Horizontal adoption cuts across industry verticals, including financial services, healthcare, telecommunications, and retail ecosystems, each leveraging microlearning to address sector-specific compliance, technical, or customer service competencies.

Finally, end-user demographics span the corporate learning environment, academic institutions seeking to supplement traditional curricula, public sector bodies focused on workforce readiness, and healthcare professionals requiring precision-driven certifications. Across devices, desktop interfaces deliver robust development environments, while mobile applications ensure that learning persists in the flow of work.

This comprehensive research report categorizes the Microlearning market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Content Type

- Deployment Mode

- Industry Vertical

- End User

- Device Type

Discover how regional economic dynamics and cultural factors in the Americas, EMEA, and Asia-Pacific propel diverse microlearning adoption patterns and innovation pathways

A regional analysis uncovers distinct trajectories across major global markets. In the Americas, mature enterprise ecosystems are accelerating adoption, driven by digital transformation mandates and employee experience initiatives. North American incumbents lead in integrating sophisticated analytics and AI-driven personalization, while Latin American organizations are rapidly adopting mobile-first microlearning to overcome infrastructure constraints.

Across Europe, the Middle East, and Africa, diverse regulatory frameworks and language considerations add complexity, spurring demand for localized content and compliance-oriented modules. Western European entities prioritize data privacy and accessibility standards, whereas Gulf region investors channel funding into VR-enabled safety training within industrial sectors.

Meanwhile, the Asia-Pacific region exhibits the fastest uptake, supported by burgeoning e-commerce ecosystems, high smartphone penetration, and government initiatives promoting digital literacy. South and Southeast Asian markets emphasize affordability and scalability of cloud-based solutions, while advanced economies like Japan and Australia explore AI-enhanced adaptive learning to upskill aging workforces. Each region’s unique macroeconomic and cultural drivers contribute to a rich mosaic of microlearning innovation and investment.

This comprehensive research report examines key regions that drive the evolution of the Microlearning market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unpack the competitive terrain where full-service incumbents and specialized innovators converge through strategic alliances and platform enhancements

A competitive overview highlights both established players and innovative disruptors shaping the microlearning field. Leading platform developers are distinguished by comprehensive suites that encompass content authoring, delivery, and analytics, facilitating end-to-end management of learning initiatives. These incumbents continue to refine AI-driven personalization engines and adaptive assessment frameworks to deepen learner engagement.

At the same time, agile challengers are carving out niches through specialized offerings, such as simulation-based compliance training and interactive video authoring tools. Their lean development cycles and targeted go-to-market strategies enable rapid iteration and tailored customer experiences, often at price points accessible to small and mid-sized enterprises.

Strategic partnerships among content creators, technology integrators, and service providers are proliferating, underscoring a collaborative ethos that leverages complementary strengths. Alliances between cloud infrastructure firms and creative studios yield seamless scalability for high-production-value modules. Concurrently, integrations with workforce management systems are streamlining data flows, empowering human resources functions to measure the impact of learning interventions more holistically.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microlearning market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 7taps Inc.

- Arist Inc.

- Axonify Inc.

- Blue Ocean Brain LLC

- Centrical Ltd.

- Docebo Inc.

- EdApp Pty Ltd

- eduMe Ltd.

- Gnowbe Pte. Ltd.

- Grovo Learning, Inc.

- iSpring Solutions Inc.

- Kahoot! ASA

- MobieTrain NV

- OpenLearning Limited

- Qstream Inc.

- RapL Inc.

- Spekit Inc.

- TalentCards by Epignosis LLC

- Thinkific Labs Inc.

- Whatfix Private Limited

Implement strategic microlearning initiatives by emphasizing interactive modalities, analytics-driven refinement, and supply chain flexibility to drive sustainable performance gains

Industry leaders should act swiftly to embed microlearning as a core pillar of talent and performance strategies. Prioritizing the adoption of interactive video tools and scenario-based simulations can heighten learner motivation and accelerate skill acquisition. Equally important is the integration of robust analytics dashboards that surface real-time engagement metrics and competency gaps, feeding a continuous improvement loop for content authorship.

To mitigate geopolitical and tariff-related uncertainties, organizations are advised to diversify their technology supply chains and explore modular, software-centric solutions that reduce reliance on specialized hardware. Engaging with multiple content vendors and pursuing open API ecosystems will ensure flexibility and resilience in the face of shifting trade landscapes.

Furthermore, leaders must champion change management initiatives that align stakeholders around the cultural shift toward decentralized, learner-driven education. By establishing clear governance frameworks and incentivizing knowledge sharing, organizations can foster a social learning environment that amplifies the impact of formal microlearning modules and embeds learning into everyday workflows.

Delve into a rigorous evidence-based approach combining executive interviews, custom surveys, and comprehensive secondary analysis to validate microlearning market insights

This research leverages a multi-faceted methodology encompassing primary and secondary sources to ensure a robust, evidence-based perspective. Primary interviews with senior learning and development professionals across industries inform real-world adoption patterns and investment rationales. Additionally, custom surveys and focus groups yield granular insights into learner preferences, content efficacy, and platform usability across device types.

Secondary research draws on technical whitepapers, regulatory filings, and academic publications to contextualize technological innovations and compliance mandates. Vendor literature and case studies underpin competitive analyses, while macroeconomic reports shed light on regional expansion drivers and tariff policy impacts.

Data synthesis involves triangulation of findings across sources, followed by thematic coding to identify recurring trends, challenges, and best practices. Quantitative metrics are corroborated through cross-validation with multiple datasets, ensuring consistency. The final deliverable is subjected to internal peer review and validation by subject matter experts to uphold methodological rigor and analytical integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microlearning market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microlearning Market, by Content Type

- Microlearning Market, by Deployment Mode

- Microlearning Market, by Industry Vertical

- Microlearning Market, by End User

- Microlearning Market, by Device Type

- Microlearning Market, by Region

- Microlearning Market, by Group

- Microlearning Market, by Country

- United States Microlearning Market

- China Microlearning Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesize strategic insights across technology trends, geopolitical impacts, and segmentation nuances to reveal future pathways for effective microlearning deployment

The evolving microlearning sector stands at the confluence of technological advancement, learner-centric design, and strategic imperatives shaped by geopolitical dynamics. As organizations grapple with accelerated digital transformation and workforce expectations for on-demand learning, microlearning emerges as a versatile solution that bridges skill gaps efficiently and measurably.

Through a detailed examination of transformative trends, tariff-induced cost considerations, and granular segmentation insights, this report illuminates the strategic options available to stakeholders across regions and industries. By understanding both the macro drivers and micro-level nuances-from interactive video formats to cloud versus on-premises trade-offs-leaders can craft learning ecosystems that are resilient, scalable, and aligned with business goals.

Looking ahead, the synergy of AI-powered personalization, immersive experiences, and collaborative partnerships promises to unlock new frontiers in skill development. With a holistic grasp of the market landscape and actionable recommendations in hand, organizations are poised to harness microlearning’s full potential, accelerating innovation and sustaining competitive advantage.

Unlock personalized strategic advantage by engaging with Ketan Rohom to transform market insights into impactful microlearning initiatives

Extend your insights into actionable guidance by partnering with Ketan Rohom, Associate Director, Sales & Marketing

As you conclude your exploration of the microlearning landscape, consider deepening your strategic advantage by engaging directly with Ketan Rohom. With his unique blend of industry acumen and sales proficiency, he can guide you through the nuances of this rapidly evolving domain, ensuring you select the insights and deliverables most aligned with your organization’s objectives. Ketan’s consultative approach emphasizes listening to your pain points, aligning our research depth with your decision-making timelines, and translating complex data into clear, executable strategies that drive tangible outcomes.

By connecting with Ketan, you gain a partner who not only understands the intricate forces shaping microlearning adoption but also anticipates emerging trends and competitive pressures. He will work with you to customize report add-ons, facilitate executive briefings, and coordinate ongoing intelligence updates, ensuring that your leadership remains informed and agile. Furthermore, Ketan’s collaborative ethos extends beyond the initial transaction; he remains an accessible advisor for periodic check-ins, bespoke presentations, and deeper dives into niche subtopics as your needs evolve.

Secure your competitive edge now by reaching out to Ketan Rohom. Together, you can convert insights into action, transform challenges into opportunities, and cement your position as a forward-thinking leader in the microlearning ecosystem.

- How big is the Microlearning Market?

- What is the Microlearning Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?