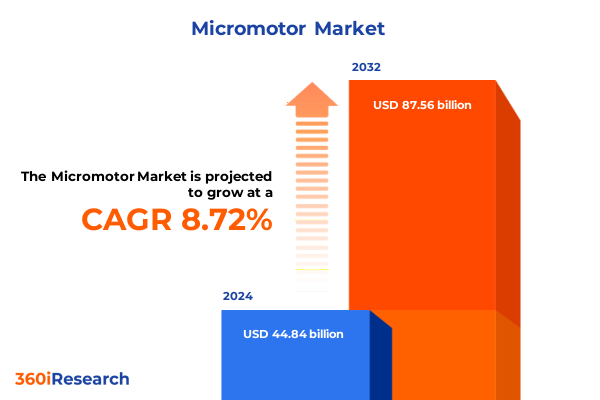

The Micromotor Market size was estimated at USD 48.60 billion in 2025 and expected to reach USD 52.70 billion in 2026, at a CAGR of 8.77% to reach USD 87.56 billion by 2032.

Exploring the Dynamic Evolution and Future Trajectory of the Global Micromotor Market Amid Accelerating Technological Demands

The global micromotor domain has witnessed an unprecedented pace of innovation as digital transformation and electrification converge to redefine performance benchmarks. Rapid miniaturization, driven by advancements in materials science and precision manufacturing techniques, has enabled micromotors to permeate an ever-wider array of applications. Simultaneously, the proliferation of the Internet of Things (IoT) and smart devices has generated demand for motors that deliver higher efficiency, enhanced controllability, and extended operational lifespans under compact form factors.

Moreover, evolving consumer expectations around product durability and power consumption have spurred original equipment manufacturers to prioritize next-generation brushless and piezoelectric architectures. These developments are further accelerated by the push toward autonomous systems in robotics, aerospace platforms, and medical technologies. As a result, the micromotor market is transitioning from a focus on basic mobility to integrated solutions that marry mechanical precision with digital intelligence. Consequently, stakeholders across the value chain-ranging from component suppliers to end-users-are aligning their innovation roadmaps to harness this confluence of trends.

Unveiling the Critical Technological and Market Disruptions Redefining Micromotor Performance and Industry Applications Worldwide

Over the past few years, the industry landscape has been reshaped by several paradigm shifts that extend beyond incremental improvements. First, the integration of advanced control algorithms and embedded sensing has transformed micromotors into intelligent actuators, enabling real-time feedback loops that optimize performance under variable loads. In parallel, additive manufacturing has opened new pathways for complex geometries and lightweight assemblies, challenging traditional machining processes and fostering greater design flexibility.

Concurrently, breakthroughs in magnetic materials and thin-film deposition have unlocked higher torque densities while reducing acoustic noise, making micromotors viable for precision applications in medical devices and optical instruments. To complement these hardware advances, software-defined architectures now enable seamless connectivity across industrial automation platforms and consumer electronics ecosystems. This synergy of hardware and software innovations is catalyzing new use cases, from haptic feedback modules in wearable electronics to adaptive control in unmanned aerial vehicles. Altogether, these transformative shifts are propelling the micromotor market toward a future defined by adaptive intelligence and unparalleled miniaturization.

Assessing the Far Reaching Consequences of United States 2025 Tariff Policies on Micromotor Supply Chains and Competitive Dynamics

In 2025, new tariff policies enacted by the United States government have introduced an additional layer of complexity to the micromotor supply chain. These measures, which target select categories of electromechanical components, have increased landed costs on imports from key manufacturing hubs. As a result, original equipment manufacturers are reassessing supplier networks, with many expediting plans to diversify sourcing or shift assembly operations closer to end-market regions.

Consequently, the cumulative impact of these tariffs extends beyond immediate pricing pressures. Increased duties have prompted renegotiations of long-term contracts and spurred investments in domestic production capabilities, particularly in regions where labor and infrastructure incentives can offset added import costs. Moreover, this policy landscape has heightened stakeholder focus on trade compliance and cross-border logistics optimization. As organizations adapt to these regulatory headwinds, a broader realignment of global value chains is emerging-one that prioritizes resilience and agility to navigate potential future trade uncertainties.

Delving into Segmentation Driven Nuances Illuminating Tailored Micromotor Opportunities Across Diverse Performance and Application Criteria

A nuanced segmentation framework reveals the multifaceted nature of demand and performance expectations within the micromotor market. When distinguishing by type, the contrast between brushed micromotors and brushless micromotors highlights divergent performance profiles: the former offers cost-effective simplicity for lower-precision tasks, while the latter delivers higher efficiency and extended lifecycle suitability for advanced robotics and aerospace applications. This differentiation is further refined when considering product types such as electrostatic, magnetic, piezoelectric, and thermal micromotors, each encompassing unique mechanisms that dictate torque generation, speed control, and energy consumption characteristics.

Power consumption categories-high, medium, and low-underscore the importance of aligning motor selection with end-use constraints, from battery-dependent wearable devices to heavy-duty automated machinery. Control mechanisms, whether closed-loop for precision feedback or open-loop for streamlined simplicity, shape system architecture decisions and inform the level of integration with digital control platforms. Functionality distinctions between linear micromotion and rotary micromotion delineate the spectrum of motion requirements across verticals. In addition, application segments ranging from aerospace and defense to medical devices, optics, and industrial automation reveal the breadth of performance and reliability standards. Finally, buy-cycle variations across distributors and resellers, online retail, and original equipment manufacturers dictate how products reach market and influence customization capabilities, lead times, and post-sales support offerings.

This comprehensive research report categorizes the Micromotor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product Type

- Power Consumption

- Control Mechanism

- Functionality

- Application

- Sales Channel

Mapping Regional Variations Shaping Micromotor Demand Patterns and Strategic Priorities Across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics play a critical role in shaping strategic imperatives for micromotor stakeholders. In the Americas, demand is particularly robust in automotive electrification and medical device applications, where stringent regulatory standards and consumer expectations for safety drive adoption of advanced brushless architectures and embedded sensing capabilities. This region’s mature manufacturing base and established supply chain ecosystems facilitate iterative innovation and enable rapid prototyping of custom solutions for specialized use cases.

Across Europe, the Middle East, and Africa, emphasis on aerospace, defense, and industrial automation underscores the need for ultra-reliable micromotors with high torque density and fault-tolerant control designs. Collaborative research initiatives between industry and leading academic institutions further accelerate the development of next-generation materials and miniaturization techniques. Meanwhile, in Asia-Pacific, a robust electronics manufacturing infrastructure and competitive cost structures have positioned the region as a global production center. Consumer electronics giants and robotics manufacturers are driving large-scale deployments, while emerging local champions develop niche capabilities in thermal and piezoelectric motor technologies to serve specialized application segments.

This comprehensive research report examines key regions that drive the evolution of the Micromotor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies Investments and Partnerships Fueling Leading Micromotor Manufacturers in a Rapidly Evolving Global Landscape

The competitive landscape of the micromotor market is characterized by a mix of established multinationals and agile niche players. Leading entities have pursued aggressive acquisition strategies to augment their technological portfolios and broaden global footprints, while simultaneously investing in new production facilities to localize manufacturing closer to key end markets. For instance, major firms have expanded their R&D centers to focus on low-noise magnetic motor designs and advanced piezoelectric actuator integration for optical instrumentation.

At the same time, smaller specialized manufacturers are capitalizing on emerging applications in robotics and medical devices by offering highly customized solutions with rapid turnaround times. Strategic partnerships between suppliers and tier-one original equipment manufacturers are becoming increasingly prevalent, facilitating co-development of proprietary control software and sensor fusion capabilities. Furthermore, environmental sustainability has emerged as a competitive differentiator, with top players setting targets for reduced carbon footprint in manufacturing and increased utilization of recyclable materials in motor components.

This comprehensive research report delivers an in-depth overview of the principal market players in the Micromotor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allied Motion, Inc

- ARC Systems Inc.

- Bühler Motor GmbH

- Changzhou Fulling Motor Co., Ltd

- Citizen Micro Co. Ltd.

- Constar Micromotor Co., Ltd.

- Dr. Fritz Faulhaber GmbH & Co. KG

- ebm‑papst Group

- Impulse Drives And Motors

- Johnson Electric Holdings Limited

- Lunar Motors Pvt. Ltd.

- Mabuchi Motor Co. Ltd.

- Maxon Group

- Mitsuba Corp.

- Moog Inc.

- Nidec Corporation

- Pelonis Technologies, Inc.

- PiezoMotor

- Precision Microdrives

- Valeo

- Zhejiang Zhengke Electromotor Co., Ltd

Formulating Strategic Roadmaps for Industry Leaders to Navigate Technological Shifts Regulatory Challenges and Evolving Customer Demands in Micromotors

To maintain a leadership position in this complex environment, industry players should enact a series of strategic initiatives. First, diversifying the supplier ecosystem and exploring nearshoring opportunities will mitigate tariff-related cost volatility and enhance supply chain resilience. Simultaneously, directing R&D investments toward advanced brushless and piezoelectric micromotor architectures will align product pipelines with the growing demand for efficiency and precision in robotics and medical sectors.

Moreover, establishing cross-functional teams that integrate data analytics, digital twin modelling, and embedded software expertise will accelerate time to market and support adaptive performance tuning under real-world conditions. Forging deeper alliances with OEMs across high-growth verticals will enable joint innovation roadmaps and secure long-term contracts that underpin sustainable revenue streams. Lastly, leveraging free trade agreements and deploying localized production cells in strategic regions will optimize total landed cost and shorten lead times, thereby delivering a competitive advantage in a rapidly shifting regulatory landscape.

Outlining Rigorous and Transparent Research Methodology Underpinning Comprehensive Insights into Micromotor Market Dynamics and Stakeholder Perspectives

This research is grounded in a rigorous methodology that combines comprehensive secondary research with targeted primary engagements. Initially, public domain sources such as academic journals, patent filings, and industry white papers were analyzed to map historical developments and emerging technological breakthroughs. Subsequently, over fifty in-depth interviews were conducted with senior executives, R&D leaders, and supply chain managers across major micromotor producers and end-user organizations to validate findings and uncover nuanced market sentiments.

Data triangulation techniques were employed to cross-verify insights from multiple perspectives, while qualitative analyses of case studies provided context around strategic pivots and innovation initiatives. The study’s segmentation framework was iteratively refined through feedback loops with subject-matter experts, ensuring alignment with real-world use cases and performance criteria. Throughout the process, data integrity was maintained via stringent validation protocols, and all primary participants were assured of confidentiality to facilitate candid disclosures.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Micromotor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Micromotor Market, by Type

- Micromotor Market, by Product Type

- Micromotor Market, by Power Consumption

- Micromotor Market, by Control Mechanism

- Micromotor Market, by Functionality

- Micromotor Market, by Application

- Micromotor Market, by Sales Channel

- Micromotor Market, by Region

- Micromotor Market, by Group

- Micromotor Market, by Country

- United States Micromotor Market

- China Micromotor Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings on Technological Trends Tariff Impacts and Strategic Imperatives Shaping the Next Decade of Micromotor Innovation

Bringing together these diverse insights paints a coherent narrative of a market in the throes of transformation. Technological innovations are elevating micromotor capabilities beyond mere actuation, embedding intelligence and connectivity at the core of device ecosystems. At the same time, geopolitical factors such as evolving tariff regimes and supply chain realignments are reshaping cost structures and strategic priorities.

The multilayered segmentation analysis clarifies how performance requirements and purchase channels vary across end-use applications, while regional insights reveal distinct market drivers from the Americas to Asia-Pacific. Competitive dynamics underscore the importance of agile adaptation, strategic partnerships, and sustainability commitments. Finally, the actionable recommendations offer a strategic blueprint for navigating complexity and capturing emergent opportunities. Together, these findings provide a roadmap for industry stakeholders aiming to thrive in the next decade of micromotor innovation.

Engaging with Expert Analysis and Premium Insights to Propel Strategic Decisions and Unlock Growth Potential in the Micromotor Market with Personalized Support

To harness the full value of this comprehensive analysis and gain tailored insights that align with your strategic priorities, engage directly with Ketan Rohom, Associate Director of Sales & Marketing at our firm. Through a personalized briefing, you will explore how transformative trends, tariff pressures, and segmentation dynamics converge in your specific area of interest. By collaborating closely, your organization will secure priority access to detailed dashboards, proprietary qualitative findings, and customized modelling that illuminate hidden growth corridors and competitive opportunities within the micromotor ecosystem.

Connecting with Ketan will allow you to align your product development roadmaps and investment plans with the nuanced realities of supply chain shifts and end-market demands. From developing next-generation brushless micromotors for robotics to optimizing low-power solutions for medical devices, this engagement ensures that your strategic decisions are informed by both cutting-edge data and actionable recommendations. Don’t miss the opportunity to leverage this authoritative research to outpace emerging competitors and capitalize on market inflections.

Schedule a confidential consultation today to secure your copy of the full report, complete with executive summaries, granular segmentation analysis, regional breakdowns, and competitor deep dives. Propel your organization toward sustainable leadership in the evolving global micromotor market by initiating the conversation with Ketan Rohom-your gateway to informed decision-making and accelerated growth.

- How big is the Micromotor Market?

- What is the Micromotor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?