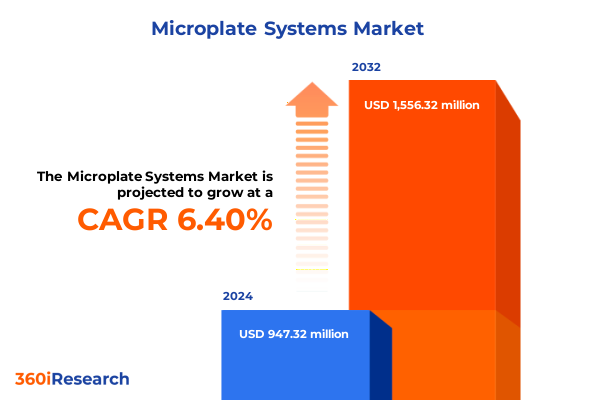

The Microplate Systems Market size was estimated at USD 998.43 million in 2025 and expected to reach USD 1,052.50 million in 2026, at a CAGR of 6.54% to reach USD 1,556.32 million by 2032.

Understanding the Critical Role and Expanding Applications of Microplate Systems in Accelerating Life Sciences and Pharmaceutical Innovations

The microplate system has emerged as a cornerstone technology in contemporary life sciences and pharmaceutical research, offering unprecedented throughput and reproducibility for a diverse array of assays. These platforms facilitate critical workflows ranging from high-throughput screening in drug discovery to intricate genomics and proteomics analyses and clinical diagnostics. By standardizing processes and integrating seamlessly with laboratory information management systems, microplate systems have transformed the landscape of experimental biology and biochemistry, enabling scientists to focus on data interpretation rather than manual execution.

A confluence of factors underpins the growing importance of these systems. The drive toward miniaturization has intensified as research organizations seek to reduce reagent consumption and operational costs, while the demand for robust, reproducible data has never been higher amid stringent regulatory scrutiny. Simultaneously, advancements in robotic automation allow for reduced human intervention, resulting in increased assay consistency and accelerated turnaround times. As laboratories worldwide modernize their infrastructure, microplate systems stand at the forefront of innovation, bridging the gap between complex experimental requirements and the imperative for operational efficiency.

Exploring the Transformative Technological and Operational Shifts Redefining the Microplate Systems Market Landscape and Competitive Dynamics

A series of transformative shifts is redefining the microplate systems landscape, driven by converging technological and operational trends. Digital integration has taken center stage, with systems now offering cloud connectivity, remote monitoring, and seamless data transfer to laboratory information management platforms. This connectivity enables real-time oversight of assay performance, predictive maintenance of equipment, and streamlined compliance with data integrity standards. Concurrently, machine learning algorithms are being incorporated to enhance assay optimization, improve signal-to-noise ratios, and deliver predictive insights that guide experimental design.

In parallel, the surge in demand for miniaturized assays and personalized medicine has spurred innovation in microplate design and materials. Ultra-low volume wells and advanced surface coatings are facilitating assays that require minimal sample volumes without sacrificing sensitivity. At the same time, the shift toward sustainability is gaining traction, with manufacturers exploring recyclable plate materials and energy-efficient instrumentation. The integration of modular robotics and open-architecture software further empowers laboratories to customize workflows, ensuring that microplate systems can adapt to evolving research paradigms and collaborative scientific endeavors.

Assessing the Cumulative Effects of United States Tariffs Implemented in 2025 on Supply Chains Costs and Competitiveness in Microplate Systems

The United States’ tariff measures introduced in 2025 have exerted a pronounced effect on the microplate systems supply chain, with cumulative repercussions for manufacturers, distributors, and end users. Import duties on laboratory automation equipment, including dispensers and readers, have elevated landed costs for key components sourced from traditional manufacturing hubs. This has compelled distributors to reevaluate sourcing strategies, leading some to diversify their supplier base toward domestic and alternative low-cost regions. As a result, procurement cycles have lengthened, with buyers navigating more complex logistics and inventory planning processes.

Despite these headwinds, the tariff environment has catalyzed strategic shifts within the industry. Domestic production lines have ramped up investment in high-precision fabrication to capture market share vacated by cost-constrained importers. Certain suppliers have absorbed a portion of the increased duties to maintain competitive pricing, while others have pursued vertical integration to control critical sub-assemblies. In the end-user segment, organizations are recalibrating budgets to accommodate higher capital expenditures and exploring extended service contracts to mitigate long-term operational risks. These dynamics underscore the imperative for agile supply chain strategies and continued innovation to navigate the evolving tariff landscape effectively.

Key Segmentation Insights Revealing How Varied Product Types Detection Technologies End Users Well Formats and Automation Levels Shape Market Opportunities

The microplate systems market can be dissected into distinct segments that reveal nuanced adoption patterns and technology preferences. Product type segmentation shows that plate dispensers are pivotal for automating reagent delivery in high-throughput assays, while plate readers remain indispensable for quantifying absorbance, fluorescence, and luminescence signals. Plate stackers enhance workflow efficiency by enabling continuous operation without manual intervention, and plate washers ensure the consistency and repeatability of assay conditions by removing residual reagents.

When evaluating detection technology, absorbance methods continue to anchor routine assays such as ELISA, offering cost-effective readouts and broad availability. Fluorescence detection is favored for its sensitivity and dynamic range in applications like nucleic acid quantification, whereas luminescence platforms deliver superior sensitivity for detecting low-abundance biomarkers. End-user segmentation highlights that academic and research institutes prioritize flexibility and cost control, often relying on manual or semi-automated solutions. Biotechnology companies and contract research organizations are investing heavily in fully automated systems to support large-scale screening campaigns, and pharmaceutical companies demand integrated platforms that ensure compliance with rigorous regulatory mandates.

Well format considerations further delineate market preferences: 96-well plates dominate in standard laboratory workflows due to their familiarity and ease of use; 384-well formats strike a balance between throughput and assay robustness; and 1536-well plates cater to ultra-high-throughput screening where reagent conservation and space optimization are critical. Finally, the spectrum of automation levels underscores diverging operational priorities. Manual systems remain prevalent in low-throughput or budget-constrained settings, semi-automated platforms offer a midpoint of cost and capability for mid-sized laboratories, and fully automated systems define the operational backbone of large-scale research institutions and commercial screening facilities.

This comprehensive research report categorizes the Microplate Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Detection Technology

- Well Format

- Automation Level

- End User

Uncovering Key Regional Dynamics Across the Americas Europe Middle East Africa and Asia Pacific Influencing Adoption and Growth of Microplate Systems

The Americas region continues to lead in microplate systems adoption, buoyed by the United States’ extensive network of biopharmaceutical research centers, government funding initiatives, and robust infrastructure for clinical diagnostics. In this market, customers demonstrate a strong inclination toward high-performance, fully integrated automation platforms that can streamline large-scale drug discovery and translational research. Meanwhile, Canada’s growing biotechnology sector prioritizes flexible solutions that can support both academic research and emerging biomanufacturing capabilities.

Europe, the Middle East, and Africa present a tapestry of maturity levels, with Western Europe at the vanguard of standardized laboratory automation deployment. Here, stringent regulatory frameworks and Health Technology Assessment processes drive demand for systems offering comprehensive data traceability. In contrast, research organizations in Eastern Europe are gradually upgrading from manual workflows to semi-automated setups, seeking cost-effective pathways to enhance throughput. Middle Eastern and African markets are nascent but exhibit rising interest in microplate solutions as investments in healthcare infrastructure and academic research accelerate.

Asia-Pacific reflects a dynamic growth story characterized by diverse market drivers. China and India lead in volume adoption, fueled by significant government R&D spending and an expanding contract research organization base. Japan and South Korea focus on cutting-edge applications in precision medicine, catalyzing demand for ultra-high-throughput and multiplexed detection technologies. Throughout the region, local manufacturers are gaining footholds by offering competitively priced systems tailored to regional specifications, creating a vibrant ecosystem of global and domestic players.

This comprehensive research report examines key regions that drive the evolution of the Microplate Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Microplate Systems Providers Highlighting Strategies Innovations Partnerships and Competitive Positioning in the Global Market

The microplate systems market is characterized by a mix of established multinational corporations and agile niche innovators, each pursuing distinct strategies to consolidate their positions. Leading global suppliers have expanded their portfolios through targeted acquisitions, integrating specialty plate readers and liquid handling modules to deliver comprehensive automation suites. Simultaneously, they are enhancing software capabilities, embedding data analytics and laboratory connectivity features to meet the evolving demands of digital laboratories.

Innovation partnerships are also proliferating, with equipment manufacturers collaborating closely with academic institutions and biotechnology firms to co-develop next-generation assay platforms. These alliances accelerate the translation of novel biomarkers and screening methodologies into commercially available products. Additionally, forward-looking companies are strengthening their service networks by offering predictive maintenance, remote diagnostics, and subscription-based consumable offerings, thereby fostering long-term customer loyalty. Emerging players are differentiating on cost-effectiveness and modular design, enabling end users to assemble bespoke systems that address specific throughput and budgetary constraints. Collectively, these competitive dynamics underscore a market in which technological leadership and customer-centric service models define the path to sustained growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microplate Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Corning Incorporated

- Danaher Corporation

- Dynex Technologies

- Hudson Robotics

- Lonza Group AG

- Merck KGaA

- Molecular Devices, LLC

- PerkinElmer, Inc.

- Tecan Group Ltd.

- Thermo Fisher Scientific Inc.

Strategic Actionable Recommendations for Industry Leaders to Navigate Evolving Challenges and Capture Growth Opportunities in the Microplate Systems Sector

Industry leaders must adopt multifaceted strategies to navigate the evolving microplate systems landscape and capitalize on growth opportunities. Strengthening supply chain resilience through diversified sourcing and regional manufacturing partnerships can mitigate the impact of import tariffs and geopolitical disruptions. By investing in modular and open-architecture platforms, providers can cater to a broader range of throughput requirements while enabling incremental upgrades that preserve existing infrastructure investments.

Developing comprehensive service and support networks is equally critical. Organizations should institute predictive maintenance programs that leverage IoT connectivity to minimize unplanned downtime and ensure consistent assay performance. Collaborating with contract research organizations and biotechnology incubators on joint innovation projects can yield co-branded assay kits and tailored automation workflows, reinforcing customer relationships and unlocking new revenue streams. Furthermore, engaging proactively with regulatory bodies to advocate for supportive policies and streamlined equipment qualification processes will help establish industry standards and facilitate global market access.

Comprehensive Research Methodology Detailing Data Sources Analytical Techniques Validation Processes and Quality Assurance Measures

This research report synthesizes insights derived from a rigorous methodology that blends extensive secondary research with targeted primary engagements. Secondary information was sourced from peer-reviewed journals, industry white papers, patent filings, and publicly available regulatory databases to establish a comprehensive understanding of technology trajectories and market dynamics. This foundational data was augmented by in-depth interviews with executives from leading equipment manufacturers, procurement specialists at academic and commercial laboratories, and experts from contract research organizations, ensuring that qualitative perspectives enriched quantitative findings.

Data triangulation techniques were employed to reconcile divergent viewpoints, while analytical frameworks such as SWOT analysis and Porter’s Five Forces provided structured evaluation of competitive pressures and strategic imperatives. All findings underwent multiple rounds of validation through expert panel reviews and consistency checks to guarantee the highest levels of accuracy and objectivity. Quality assurance measures, including cross-verification of proprietary databases and adherence to ethical research standards, underpin the report’s credibility and utility for decision makers seeking actionable intelligence in the microplate systems domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microplate Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microplate Systems Market, by Product Type

- Microplate Systems Market, by Detection Technology

- Microplate Systems Market, by Well Format

- Microplate Systems Market, by Automation Level

- Microplate Systems Market, by End User

- Microplate Systems Market, by Region

- Microplate Systems Market, by Group

- Microplate Systems Market, by Country

- United States Microplate Systems Market

- China Microplate Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Conclusive Perspectives Synthesizing Key Findings and Strategic Imperatives Underpinning the Future Trajectory of Microplate Systems Innovations

The findings presented in this executive summary illuminate a microplate systems industry in the midst of profound transformation, shaped by technological innovation, regulatory shifts, and evolving customer expectations. The segmentation analysis underscores the heterogeneity of end-user needs, from low-throughput academic applications to ultra-high-throughput pharmaceutical screening, highlighting the necessity for adaptable platforms. Meanwhile, the regional insights reveal divergent adoption curves, with established markets demanding integrated, data-centric solutions and emerging regions prioritizing cost-effective access to automation.

Competitive dynamics are intensifying as incumbents pursue inorganic growth through acquisitions and collaborations, while emerging players leverage modular designs to capture niche use cases. The implications of tariff policies have prompted a reevaluation of supply chain strategies and a renewed emphasis on domestic manufacturing capacities. Against this backdrop, industry participants who embrace digital integration, foster strategic partnerships, and maintain operational agility will be best positioned to sustain momentum and drive innovation. Together, these insights provide a roadmap for navigating the future trajectory of microplate systems and capturing the value embedded in this dynamic ecosystem.

Engage Directly with Associate Director Ketan Rohom to Obtain Exclusive Insights and Secure Your Customized Market Research Report on Microplate Systems

Engaging with Ketan Rohom as your point of contact ensures a seamless and personalized experience in accessing the report that will serve as the cornerstone for strategic decision making in microplate systems. Leveraging his deep understanding of market trends and buyer needs, he is equipped to guide you through the report’s extensive insights, address any specific inquiries regarding technology evaluations or competitive benchmarks, and facilitate customized service packages that align with your research priorities. By initiating a conversation with Ketan Rohom, you gain direct access to expert consultation that can amplify your return on investment, accelerate time to actionable intelligence, and unlock the full potential of the microplate systems landscape. Reach out today to secure your copy of this definitive market research report and position your organization at the forefront of innovation and growth.

- How big is the Microplate Systems Market?

- What is the Microplate Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?