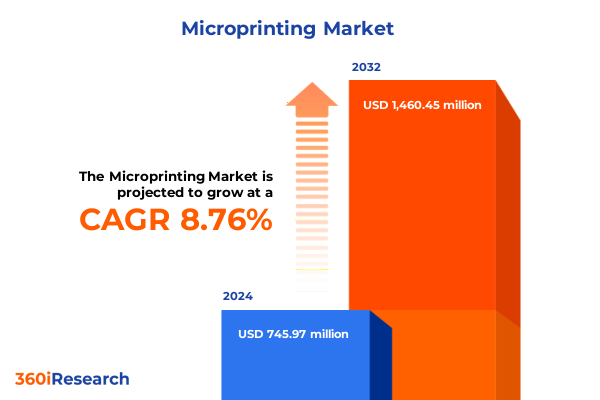

The Microprinting Market size was estimated at USD 810.20 million in 2025 and expected to reach USD 881.04 million in 2026, at a CAGR of 8.78% to reach USD 1,460.45 million by 2032.

Illuminating the Vital Role of Microprinting in Security, Authentication, and Packaging to Empower Next-Generation Anti-Counterfeiting Strategies

Microprinting is an advanced printing technique that leverages microscopic text and intricate patterns to embed information into substrates in a manner that is virtually imperceptible to the naked eye. Employed extensively by the U.S. Bureau of Engraving and Printing, microprinting features words such as “The United States of America” on the security thread of the redesigned $100 bill, creating a highly effective deterrent against counterfeiting and forgery. This approach not only enhances the resilience of banknotes but also integrates seamlessly with complementary security elements like color-shifting inks and watermarks, yielding a multifaceted barrier against illicit replication.

Beyond currency protection, microprinting has emerged as a cornerstone for safeguarding critical documents, pharmaceutical packaging, and high-value consumer goods. In the pharmaceutical sector, serial numbers and QR codes rendered through microprinting enable patient-level authentication and traceability across complex distribution channels, ensuring that only genuine medications reach end users. The precision of micro-embossing and magnetic ink technologies further extends the utility of microprinting, allowing brands to incorporate durable security features that withstand environmental stressors and handling. As global concerns around counterfeiting intensify, this technique has solidified its position as an essential tool for regulators, manufacturers, and security professionals seeking to uphold integrity in an increasingly digitized marketplace.

Industry observers note a steady increase in demand for high-resolution microprinting capabilities across financial documents, packaging, and label applications, as leading equipment providers have integrated microprinting modules into commercial printers. Xeikon, HP, Zebra, Ricoh, and many others now offer compatible solutions that seamlessly embed microprinting functions into standard production workflows. This convergence of security features with mainstream printing platforms has democratized access to anti-counterfeiting measures, enabling organizations of all sizes to benefit from the protective power of microscopic text.

Exploring Pivotal Technological and Regulatory Shifts Reshaping the Microprinting Landscape Across Diverse Industries and Market Needs

As industries evolve, microprinting has undergone transformative shifts driven by both technological breakthroughs and tightening regulatory frameworks. On the technological front, a diverse ecosystem of printing modalities-ranging from electrostatic processes to inkjet, laser, and thermal systems-now underpins microprinting applications. Within inkjet technologies, Continuous Inkjet and Drop On Demand methods have become foundational, with Drop On Demand further subdivided into Piezoelectric and Thermal modalities. Laser options have split along CO2 and fiber laser lines, each offering distinct advantages for substrate versatility, while thermal solutions, encompassing Direct Thermal and Thermal Transfer techniques, cater to specialized labeling and packaging demands. These differentiated pathways enable manufacturers to align microprinting precision with specific throughput, resolution, and material compatibility requirements.

Concurrently, regulatory mandates have intensified the urgency for robust security printing. Governments and international agencies have instituted serialization and unique device identification rules that require microscopic markings on pharmaceutical packages and medical devices. The FDA’s Drug Supply Chain Security Act, for example, stipulates product-level serialization with machine-readable and human-readable formats, compelling manufacturers to integrate microprinting into compliance workflows. In parallel, requirements for direct marking of reusable medical devices under 21 CFR 801.45 have accelerated adoption of on-device microprinting capabilities. These converging forces have propelled innovation in print head design, ink formulation, and process automation, ensuring that microprinting remains at the forefront of both security and regulatory compliance.

Evaluating the Far-Reaching Consequences of 2025 U.S. Tariff Policies on Microprinting Supply Chains, Material Costs, and Equipment Accessibility

The tariff environment in 2025 has introduced new variables that microprinting stakeholders must navigate to maintain cost efficiency and supply chain resilience. Following a series of executive orders, the Administration imposed a 25 percent tariff on aluminum imports and set a 25 percent levy on Canadian goods, alongside a 10 percent duty on Chinese products. While materials from Mexico and Canada enjoyed a temporary pause through April 2, 2025, under a USMCA-aligned delay, the looming reinstatement of these tariffs has prompted producers to reevaluate sourcing strategies. Substrates such as polymer films and specialized inks often cross North American borders, and any tariff reinstatement risks inflating input costs and elongating lead times as suppliers adjust to altered duty structures.

Equipment procurement has also felt the impact of reciprocal trade measures. Key components for high-precision microprinting apparatus-optical lenses, specialized print heads, and custom rollers-often originate in the EU or Asia, and proposals for up to 25 percent duties on select European-made printing machinery have sparked concerns about reduced accessibility and higher capital expenditures. Exporters of used sheetfed offset hardware have already been affected by elevated tariff rates in India and China, a trend that hints at potential collateral effects on secondary equipment markets for microprinting solutions. To counter these pressures, several microprinting providers are exploring “Plus One” sourcing frameworks, diversifying manufacturing footprints beyond traditional hubs and establishing regional hubs in Southeast Asia, Latin America, and Eastern Europe to mitigate future trade risks.

As material and equipment costs fluctuate, industry leaders are pivoting toward automation and process optimization tools that can absorb certain tariff-driven cost increases. Enhanced operational analytics, remote diagnostics, and predictive maintenance platforms allow microprinting operations to sustain high yield and reduce downtime, partially offsetting the tariff-induced upticks in logistical and input expenses.

Unearthing Comprehensive Segmentation Insights to Navigate Microprinting Markets Through Technology, Application, End-User, and Material Perspectives

A granular understanding of microprinting market dynamics requires a multifaceted segmentation lens that captures variations in technology, application, end-user, and material type. From the technology perspective, market participants can choose among electrostatic, inkjet, laser, and thermal systems, each presenting distinct operational parameters and resolution capabilities. Inkjet modalities further diverge into Continuous Inkjet and Drop On Demand, with the latter leveraging Piezoelectric and Thermal mechanisms to optimize droplet formation and substrate adhesion. Laser options are split between CO2 and fiber lasers, catering to diverse substrate sensitivities, while thermal approaches-Direct Thermal and Thermal Transfer-are favored for their substrate compatibility and simplified maintenance.

Application segmentation reveals the breadth of microprinting deployment, spanning authentication labels, currency protection, packaging security, and high-value security printing. Within packaging, demand is particularly pronounced in electronics, food, and pharmaceutical segments, where microprinting integrates with serialization barcodes and tamper-evident seals to ensure product integrity. End-user segmentation highlights the critical roles of financial institutions, government agencies, healthcare providers, and retail enterprises in driving microprinting adoption, each seeking tailored security and traceability attributes. Finally, the market’s material dimension encompasses metal, paper, and polymer substrates, requiring specialized inks, adhesives, and printer configurations to achieve durable, high-contrast microtext and patterns. The interplay of these segmentation axes underscores the need for adaptable printing platforms that can address nuanced performance, compliance, and cost objectives concurrently.

This comprehensive research report categorizes the Microprinting market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Printing Technology

- Material Type

- Technology

- Application

- End User

Examining Distinct Regional Dynamics and Growth Drivers Shaping Microprinting Adoption in the Americas, EMEA, and Asia-Pacific Regions

Regional landscapes exert a profound influence on microprinting market adoption, with distinct drivers emerging across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, a robust combination of regulatory oversight and legacy security printing infrastructure supports widespread deployment of microprinting in currency production, identity documents, and packaging authentication. North American manufacturers leverage advanced software integration and automation to meet stringent compliance mandates while optimizing throughput for high-volume label and security printing runs.

The Europe, Middle East & Africa region exhibits a mosaic of regulatory regimes and market maturity levels, with the European Union’s anti-counterfeiting directives fostering harmonized security standards across multiple member states. Governments in the Middle East are investing in next-generation identity and travel documents that integrate microprinting with biometric data, while African nations are increasingly adopting microprinting in banknotes and vital record management to combat forgery and enhance civic administration.

Asia-Pacific stands at the forefront of microprinting adoption, driven by extensive pharmaceutical serialization initiatives, a flourishing e-commerce sector that demands secure packaging solutions, and significant government investments in currency modernization projects. Rapid digitalization, rising consumer awareness of counterfeit risks, and growth in high-value manufacturing hubs create fertile ground for microprinting innovations. Collectively, these regional narratives shape a global market tapestry defined by regulatory nuance, technological investment, and evolving security imperatives.

This comprehensive research report examines key regions that drive the evolution of the Microprinting market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Microprinting Innovators Driving Breakthroughs in Security Printing, Packaging Integration, and High-Resolution Labeling Solutions

A cohort of specialized technology providers and legacy printing manufacturers is steering the evolution of microprinting capabilities. Companies such as Domino Printing Sciences and Source Technologies continue to push the boundaries of inkjet-based microtext resolution, developing customized print heads capable of sustaining minute droplet sizes at high throughput. Hewlett-Packard and Ricoh, recognized for their integrated digital printing platforms, have infused microprinting modules into production lines, enabling seamless toggling between standard and security-grade print jobs. Zebra Technologies and Matica Technologies have solidified their positions in the thermal market, with solutions like Matica’s XID8600 enabling single-sided microprinting on financial cards at speeds that meet industry-leading performance benchmarks.

Meanwhile, niche innovators such as MicroPhotonics and HologramScript specialize in combining microprinting with holographic overlays, creating multi-layered security features that are exceptionally resistant to replication. Brady Inc. and Videojet Technologies focus on regulatory-driven sectors like pharmaceuticals and medical devices, offering turnkey serialization systems that integrate microprinting with barcode verification and cloud-based traceability platforms. This rich tapestry of providers fosters a competitive environment in which continuous R&D investment, strategic partnerships, and cross-sector collaboration propel microprinting toward new applications and efficiency gains.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microprinting market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avery Dennison Corporation

- Brady Corporation

- De La Rue plc

- Domino Printing Sciences Public Limited Company

- DuPont de Nemours, Inc.

- Giesecke+Devrient GmbH

- HP Inc.

- IDEMIA Identity & Security SAS

- Koenig & Bauer AG

- MHM Holding GmbH

- Nitto Denko Corporation

- Orell Füssli Security Printing Ltd

- Ricoh Company, Ltd.

- SICPA Holding SA

- Thales Group

- Toppan Printing Co., Ltd.

- Videojet Technologies Inc.

- Xerox Corporation

- Zebra Technologies Corporation

Delivering Actionable Recommendations for Industry Leaders to Enhance Microprinting Efficiency, Mitigate Risks, and Capitalize on Emerging Opportunities

To capitalize on the growth trajectory of microprinting and secure long-term competitive advantage, industry leaders must pursue a series of targeted actions. First, investments in modular printing platforms capable of rapid reconfiguration will provide the flexibility needed to address both high-volume and high-security jobs without significant capital outlays. Integrating advanced analytics and real-time monitoring tools can further optimize yield and minimize downtime, effectively mitigating the impact of tariff-driven cost fluctuations and supply chain variability.

Second, stakeholders should cultivate strategic alliances across the value chain, partnering with substrate manufacturers, ink formulators, and software developers to co-innovate tailored solutions that align with emerging regulatory directives. Collaborative pilot programs and co-development initiatives can accelerate time to market for next-generation microprinting applications, such as smart packaging integrations and secure device marking in medical environments.

Finally, establishing regional service hubs and dual-sourcing agreements will reduce exposure to geopolitically driven trade disruptions. By diversifying manufacturing footprints and investing in localized production capabilities, organizations can ensure continuity of supply, control logistics costs, and maintain service excellence. These concerted measures will position industry leaders to not only withstand near-term headwinds but also harness evolving market opportunities with agility and confidence.

Unveiling a Rigorous and Transparent Research Methodology Underpinning the Microprinting Market Analysis with Robust Data Collection and Verification Practices

This analysis of the microprinting ecosystem is grounded in a rigorous, multi-tiered research methodology designed to deliver unbiased, actionable insights. Primary data collection encompassed in-depth interviews with key stakeholders, including equipment manufacturers, ink and substrate suppliers, regulatory experts, and end-user organizations across financial services, healthcare, and government. These firsthand perspectives were systematically triangulated with secondary sources such as peer-reviewed journals, industry white papers, and publicly available regulatory guidance documents.

Data validation and quality control protocols were applied at every stage, leveraging expert reviews and cross-functional workshops to ensure that findings accurately reflect current market conditions. Quantitative analyses incorporated transaction data, trade flow statistics, and patent filings to reveal adoption patterns and technology diffusion rates. Meanwhile, scenario modeling techniques were employed to assess the potential impact of tariff fluctuations and regulatory shifts on cost structures and competitive dynamics.

Throughout the research process, stringent confidentiality agreements and ethical guidelines were upheld to protect proprietary information and maintain the integrity of the analysis. The resulting framework provides a comprehensive, transparent foundation for strategic decision-making, enabling stakeholders to anticipate emerging trends, evaluate technology options, and optimize their microprinting investments with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microprinting market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microprinting Market, by Printing Technology

- Microprinting Market, by Material Type

- Microprinting Market, by Technology

- Microprinting Market, by Application

- Microprinting Market, by End User

- Microprinting Market, by Region

- Microprinting Market, by Group

- Microprinting Market, by Country

- United States Microprinting Market

- China Microprinting Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Concluding Insights Highlighting Core Findings, Strategic Implications, and Future Trajectories in the Evolving Microprinting Market Environment

The microprinting industry stands at a pivotal juncture, where advanced printing technologies, evolving regulatory landscapes, and dynamic geopolitical factors converge to shape future trajectories. Core findings underscore the critical importance of modular, high-resolution platforms that can pivot seamlessly between security and high-volume applications, supported by robust automation and analytics frameworks. Regulatory imperatives in pharmaceutical serialization and unique device identification are driving sustained investment in microprinting integration, while regional growth pockets-particularly in Asia-Pacific-offer substantial opportunities for market expansion.

Strategic implications point to the value of diversified sourcing networks, strategic alliances, and localized service capabilities as essential levers for maintaining supply chain resilience amid fluctuating tariff environments. Competitive differentiation will increasingly hinge on the ability to co-innovate with substrate and ink partners, delivering end-to-end solutions that preempt counterfeiting threats and comply with stringent standards. Looking ahead, emerging applications in smart packaging, medical device marking, and high-security credentialing are poised to unlock new demand streams, further broadening the microprinting value proposition.

As organizations navigate this complex tapestry of technological, regulatory, and market forces, they must balance near-term operational efficiencies with long-term strategic investments. By synthesizing the insights and recommendations presented here, stakeholders can chart a course that not only mitigates current challenges but also capitalizes on the transformative potential of microprinting innovations.

Engage with Ketan Rohom to Acquire Comprehensive Microprinting Market Intelligence and Empower Strategic Decision-Making Through a Tailored Research Partnership

To gain unparalleled insights into the microprinting market and fortify your organization’s strategic positioning, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s deep expertise in market intelligence and client-centric approach ensures each engagement is tailored to your specific objectives. By partnering with him, you unlock access to granular data sets, expert analyses, and customized deliverables designed to address your most pressing questions and growth aspirations. His collaborative methodology bridges the gap between raw data and actionable strategies, empowering you to make informed decisions that drive competitive advantage.

Whether you seek targeted go-to-market strategies, supplier benchmarking, or deep-dive case studies on cutting-edge microprinting technologies, Ketan will orchestrate a bespoke research roadmap aligned with your needs. His proven track record in translating complex market dynamics into clear, strategic recommendations makes him an invaluable resource for organizations aiming to navigate tariff uncertainties, leverage regional growth pockets, or integrate the latest security printing advancements. Initiating a dialogue with Ketan is the first step toward unlocking the full potential of microprinting innovations and seizing emerging opportunities.

Schedule a confidential consultation today to discuss how a tailored research partnership can elevate your market intelligence framework. Reach out to Ketan Rohom to explore customizable engagement options and secure the insights necessary to drive growth, optimize operations, and safeguard your brand’s integrity in the evolving microprinting landscape.

- How big is the Microprinting Market?

- What is the Microprinting Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?