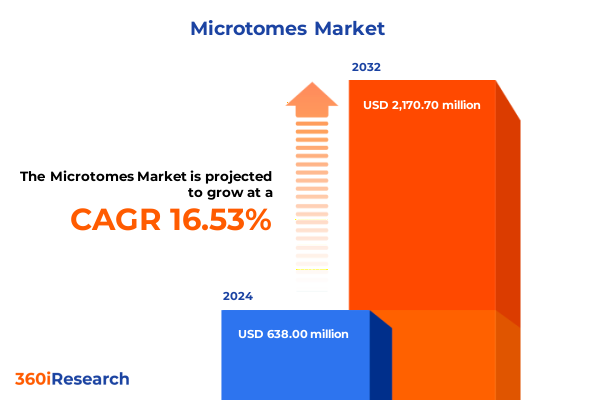

The Microtomes Market size was estimated at USD 735.76 million in 2025 and expected to reach USD 855.35 million in 2026, at a CAGR of 16.71% to reach USD 2,170.69 million by 2032.

Unlocking the Core Principles and Evolutionary Significance of Microtome Technology for High-Precision Sectioning in Modern Analytical Workflows

The evolution of microtome technology underpins breakthroughs across life sciences, pathology, and materials research. As laboratory protocols demand ever-greater precision and reproducibility, microtomes have transitioned from manual instruments to highly automated analytical workhorses. Modern workflows integrate digital imaging and software-driven sectioning controls, enabling researchers to produce tissue and material slices with nanometer-level consistency. This progression has been fueled by interdisciplinary collaboration among engineers, biologists, and clinical experts, ensuring that each advancement addresses real-world challenges.

With global research institutions expanding their focus on molecular and ultrastructural analysis, the capabilities of microtomes have become critical. From enabling genomic mapping in histopathology to facilitating nanoparticle characterization in materials science, the instrument’s versatility supports a spectrum of applications. Consequently, decision-makers in both academia and industry are reevaluating laboratory infrastructure investments to incorporate next-generation microtome systems. This shift reflects the instrument’s indispensable role in driving high-throughput workflows, minimizing sample preparation bottlenecks, and elevating the overall quality of analytical outcomes.

Exploring Pivotal Technological Innovations and Industry Paradigm Shifts Shaping the Future of Precision Sectioning Techniques with Microtomes

In recent years, transformative innovations have redefined the landscape of microtome design and functionality. Automated blade advance systems and digital torque controls now facilitate unparalleled accuracy, reducing operator variability and enhancing throughput. Meanwhile, advances in blade coatings and ceramic composites have extended blade longevity, improving reproducibility for delicate specimens. These technological leaps are complemented by integration with laboratory information management systems (LIMS), allowing seamless data exchange and traceability across sample preparation processes.

Moreover, there is a growing emphasis on miniaturization and portability, as point-of-care diagnostics and field research demand compact form factors without compromising performance. High-precision vibratomes now incorporate temperature stabilization and vibration dampening technologies, ensuring structural integrity in sensitive samples. Simultaneously, ultramicrotome platforms equipped with cryogenic capabilities are unlocking new frontiers in cryo-electron microscopy. Taken together, these paradigm shifts underscore a broader industry movement toward smarter, more adaptable instruments that address the evolving needs of complex analytical environments.

Assessing the Far-Reaching Effects of Recent United States Tariff Measures on the Microtome Supply Chain and Manufacturing Economics

The imposition of new United States tariffs in early 2025 has exerted a cumulative effect on the global microtome supply chain and manufacturing economics. Heightened duties on imported steel and precision instrument components have increased input costs for original equipment manufacturers. Consequently, increased production expenses have prompted manufacturers to reevaluate component sourcing strategies, accelerating shifts toward regionalized supply chains located within tariff-exempt trade zones.

This realignment has led to two parallel outcomes: manufacturers are negotiating long-term agreements with domestic suppliers to mitigate tariff exposure, while simultaneously exploring tariff-rebate programs under existing trade agreements. These adaptive strategies have alleviated some cost pressures, yet they have also introduced new complexities in quality assurance and lead-time management. As a result, both instrument providers and end users are prioritizing supply chain resilience and transparency to navigate the evolving regulatory environment.

Deriving Strategic Insights from Multidimensional Market Segmentation Across Product Variants, Applications, End Users, and Distribution Avenues

Insights drawn from a detailed examination of product type, application, end user, and distribution channel segmentation reveal the multifaceted dynamics shaping the microtome market. Based on Product Type, the market study spans cryostat microtomes, rotary microtomes, ultramicrotomes and vibratomes, highlighting distinct performance attributes and cost considerations across each variant. Based on Application, the market analysis distinguishes between forensic, histopathology, pharmaceutical research, and broader research applications, underscoring how specialized requirements drive equipment selection. Based on End User, the study addresses the needs of academic and research institutes, forensic laboratories, hospitals and diagnostic labs, and pharmaceutical and biotech companies, illuminating divergent purchasing cycles and service expectations. Based on Distribution Channel, evaluation of direct sales, distributors, and online sales channels brings to light the evolving procurement models and service delivery frameworks that influence both market access and after-sales support.

Taken together, these segmentation insights emphasize the importance of tailoring product portfolios and commercial strategies to the unique priorities of each segment. By aligning instrument development and marketing efforts with the nuanced requirements of different laboratories and research facilities, manufacturers can optimize their engagement strategies and foster deeper customer relationships.

This comprehensive research report categorizes the Microtomes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

- Distribution Channel

Unveiling Regional Market Dynamics Across Americas, Europe Middle East & Africa, and Asia Pacific Highlighting Strategic Growth Drivers

A comprehensive assessment of the regional landscape illuminates distinct growth drivers and adoption patterns across the Americas, Europe Middle East & Africa, and Asia Pacific. In the Americas, the confluence of strong research funding, advanced clinical trial infrastructure, and an emphasis on precision medicine has fueled robust demand for high-performance microtome systems. Meanwhile, in Europe Middle East & Africa, stringent regulatory frameworks and established academic research networks underpin steady investment in laboratory modernization efforts. In this region, collaborative research consortia and public-private partnerships have accelerated the uptake of advanced sectioning technologies across both biomedical and materials science domains.

Conversely, the Asia Pacific region is witnessing rapid expansion fueled by government-sponsored research initiatives, increasing healthcare infrastructure expenditure, and the emergence of new biotechnology clusters. In particular, rising demand in countries undergoing laboratory capacity growth has prompted manufacturers to tailor entry-level and mid-range solutions with localized service networks. Taken as a whole, these regional insights demonstrate the need for region-specific product adaptations, service models, and partnership frameworks to effectively capture growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Microtomes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Landscape Dynamics and Differentiated Value Propositions of Leading Manufacturers in the Microtome Domain

Leading players have adopted a range of strategic initiatives to differentiate their offerings and sustain competitive advantage. Some have focused on expanding their global service footprints, ensuring rapid response times and comprehensive maintenance programs for critical instruments. Others have invested heavily in digital platforms that integrate sample preparation workflows with analytical software, thereby enhancing user experience and data continuity. In parallel, strategic partnerships with research institutions and diagnostic centers have enabled co-development of application-specific protocols, accelerating time to insight for end users.

Furthermore, product portfolio diversification has emerged as a key driver of competitive positioning. Companies offering modular microtome systems that can be upgraded with advanced modules such as cryogenic stages or automated imaging attachments are gaining traction among budget-conscious laboratories seeking scalability. As the competitive landscape continues to evolve, firms prioritizing end-to-end solutions, holistic training programs, and turnkey installation services are poised to capture sustained market share and reinforce brand loyalty.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microtomes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amos Scientific Pty Ltd

- Boeckeler Instruments Inc.

- Bright Instruments Ltd.

- CellPath Ltd.

- Diapath S.p.A.

- Epredia

- Histo-Line Laboratories

- Hitachi High-Technologies Corporation

- Leica Biosystems

- MEDITE GmbH

- RWD Life Science Co., Ltd.

- Sakura Finetek

- Shimadzu Corporation

- SLEE medical GmbH

- Thermo Fisher Scientific Inc.

Implementing Proactive Strategic Initiatives for Industry Leaders to Navigate Disruptions, Enhance Innovation, and Drive Sustainable Growth

Industry leaders must adopt a proactive approach to navigate ongoing disruptions and capture emerging growth opportunities. First, strengthening research and development pipelines by fostering cross-disciplinary collaborations will enable the creation of next-generation instruments tailored to complex applications. Second, diversifying component sourcing through multi-tier supplier networks and near-shoring initiatives can provide critical insulation from trade-related volatility. Third, enhancing digital capabilities by embedding advanced analytics and remote monitoring features into instrument platforms will improve uptime and customer satisfaction.

In addition, forging strategic partnerships with academic and clinical research centers can accelerate protocol development and drive early adoption of novel sectioning methodologies. Finally, implementing customized service and training programs will deepen customer engagement, ensuring end users derive maximum value from their investments. By executing these recommendations in concert, industry stakeholders can reinforce resilience, stimulate innovation, and achieve sustainable growth in a rapidly evolving market landscape.

Detailing Robust Research Methodology Incorporating Primary Engagements and Secondary Data Triangulation to Ensure Analytical Rigor

This report is founded on a rigorous research framework combining extensive secondary research, primary interviews, and meticulous data validation processes. Secondary research involved comprehensive reviews of scientific journals, regulatory filings, and industry white papers to establish a solid baseline of technological trends and regulatory developments. Simultaneously, primary research was conducted through in-depth interviews with senior executives, laboratory directors, and procurement specialists, providing firsthand perspectives on purchasing criteria, application challenges, and service expectations.

Collected data underwent a structured triangulation process to reconcile insights from multiple sources and ensure consistency. Quantitative findings were cross-validated against publicly available financial reports and company disclosures, while qualitative observations were corroborated through expert validation workshops. Throughout this process, stringent quality control measures were applied, including peer review of analytical methodologies and iterative refinements based on stakeholder feedback. This methodological rigor guarantees that the report’s findings and recommendations are both reliable and actionable for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microtomes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microtomes Market, by Product Type

- Microtomes Market, by Application

- Microtomes Market, by End User

- Microtomes Market, by Distribution Channel

- Microtomes Market, by Region

- Microtomes Market, by Group

- Microtomes Market, by Country

- United States Microtomes Market

- China Microtomes Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Strategic Observations Emphasizing Preparedness and Innovation Imperatives for Stakeholders in the Microtome Ecosystem

In conclusion, the microtome landscape is characterized by accelerating technological innovation, evolving regulatory dynamics, and shifting supply chain paradigms. As laboratories worldwide pursue higher throughput and precision, microtome platforms will continue to play a pivotal role in advancing scientific discovery. By leveraging the insights presented in this report, stakeholders can make informed decisions regarding product development, strategic partnerships, and operational investments. Ultimately, success will hinge on the ability to balance agility with technical excellence, ensuring instruments not only meet current needs but also anticipate future analytical challenges.

Engaging Directly with Associate Director Ketan Rohom to Secure Comprehensive Market Intelligence and Tailored Strategic Guidance

To secure an in-depth exploration of emerging trends, supply chain dynamics, and strategic imperatives in the microtome market, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through tailored market intelligence that aligns with your organization’s objectives and operational requirements. By partnering with Ketan, you can access exclusive insights, custom data packages, and expert advisories designed to inform critical investment decisions and product development roadmaps. Reach out today to transform industry challenges into actionable growth strategies by obtaining the comprehensive microtome market research report.

- How big is the Microtomes Market?

- What is the Microtomes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?