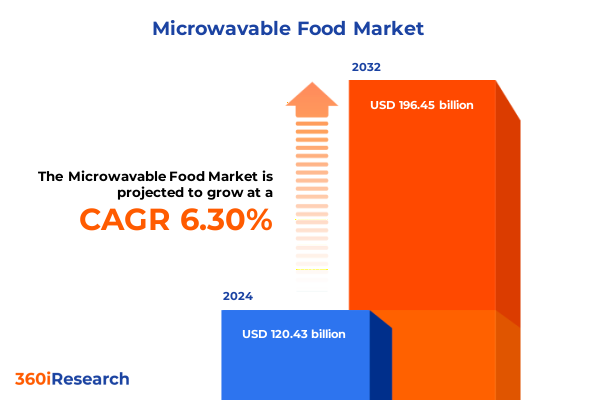

The Microwavable Food Market size was estimated at USD 126.54 billion in 2025 and expected to reach USD 132.97 billion in 2026, at a CAGR of 6.48% to reach USD 196.45 billion by 2032.

Redefining Quick Dining Experiences with Next-Generation Microwavable Meals Designed to Cater to Diverse Consumer Lifestyles and Preferences

The microwavable food category has transcended its origins as merely a convenience-driven solution, emerging as a versatile offering that aligns closely with the demands of contemporary consumers. What began as heat-and-eat meals designed primarily to save time has evolved into a broad portfolio of products that cater to diverse dietary and lifestyle preferences, including high-protein entrées, vegetable-forward side dishes, and gourmet-inspired snack bowls. As at-home consumption patterns continue to diversify, manufacturers are leveraging advanced processing techniques and ingredient innovations to deliver a dining experience that rivals a restaurant, all within a matter of minutes. This shift is not just a matter of product reformulation; it represents a deeper transformation in how consumers view microwavable options. Gone are the days when such meals were seen as compromise; today’s offerings are celebrated for their ability to blend quality, nutrition, and speed, reflecting a broader trend toward meals that are as convenient as they are perceptually elevated.

Moreover, the demographic landscape of microwavable food consumption has expanded significantly over the past few years. Millennials and younger generations, often characterized as time-strapped yet health-conscious, have played an outsized role in driving innovation in this space. At the same time, aging populations in key markets are turning to microwavable formats for their ease of preparation and portion control benefits. Paired with a growing culture of remote work and flexible lifestyles, these shifts have fueled demand for products that transcend the traditional workday lunch or quick dinner scenario, extending into breakfast, late-night snacks, and even dessert. As the category matures, brands that can successfully navigate these changing consumer expectations-without compromising on taste, nutritional integrity, or sustainability-will be best positioned to capture the next wave of growth.

Emerging Consumer Priorities, Technological Innovations, and Sustainability Imperatives Driving a Paradigm Shift in the Microwavable Food Industry

The microwavable food industry is in the midst of a profound metamorphosis driven by three interrelated forces: shifting consumer values, breakthroughs in processing and packaging technologies, and a heightened emphasis on sustainability. Consumers today are far more discerning, demanding not only convenience but also transparency around ingredient sourcing, clean-label formulations, and environmentally responsible packaging. Brands have responded by adopting new processing methods that preserve flavor and nutrient profiles while extending shelf life, enabling a seamless balance between freshness and convenience. This technological leap has enabled the introduction of microwave-specific packaging solutions, such as high-barrier films that facilitate crisp textures and proprietary steam-release mechanisms that ensure optimal heating.

Concurrently, sustainability has emerged as a non-negotiable pillar of innovation, prompting companies to redesign their supply chains and packaging systems. Manufacturers are investing in recyclable and compostable materials while optimizing logistics to reduce carbon emissions per unit shipped. In some cases, initiatives such as closed-loop packaging recovery programs and partnerships with recycling organizations have become critical differentiators, resonating strongly with eco-conscious consumers.

These transformative shifts are not isolated trends but rather a convergence of evolving consumer mindsets and technological capabilities. As a result, the category has emerged from its convenience-only roots to embrace a new paradigm-one in which premium taste, functional benefits, and sustainable credentials converge to create truly next-generation microwavable experiences.

Evaluating the Comprehensive Effects of 2025 US Import Tariff Adjustments on Ingredient Sourcing, Pricing Dynamics, and Supply Chain Resilience

The United States’ tariff adjustments enacted in 2025 have introduced new complexities in the sourcing and cost structures of microwavable food manufacturers. Tariffs on key raw materials, including imported grains, specialty flours, and select packaging substrates, have elevated input costs and compelled many companies to reassess their procurement strategies. Consequently, there has been a noticeable pivot toward domestic suppliers, where shorter lead times and reduced logistical hurdles offer a buffer against volatile international trade dynamics. However, this shift has not been without its trade-offs; domestic materials can carry premium pricing, requiring brands to make strategic decisions about recipe reformulation, product positioning, and potential margin compressions.

On the packaging front, levies on plastic resins and certain aluminum-based films have accelerated the adoption of alternative materials. Some manufacturers have embraced advanced paper-based laminates and mono-material pouches to mitigate tariff-induced cost increases, though these materials often demand significant capital investments to retool existing production lines.

Supply chain agility has thus become a critical competency. Companies that have invested in real-time visibility systems, multi-sourcing arrangements, and agile production planning are better positioned to navigate tariff volatility. At the same time, manufacturers are exploring collaborative frameworks with suppliers to lock in preferential rates and shared risk agreements, ensuring that the impact of further tariff fluctuations can be managed proactively rather than reactively.

Unpacking Market Dynamics through Product, Packaging, and Distribution Segmentation Reveals Critical Growth and Consumer Engagement Drivers

A nuanced understanding of the microwavable food market emerges through an integrated view of three key segmentation frameworks-product type, packaging type, and distribution channel-which collectively illuminate consumer preferences and operational imperatives. When analyzed by product type, the category encompasses Frozen Entrees subdivided into Family Pack and Single Serve options, Microwaveable Snacks further differentiated into Nachos, Popcorn, and Snack Bowls, Microwaveable Soups segmented into Broth Based Soups and Cream Soups, and Microwaveable Vegetables broken down into Green Vegetables, Mixed Vegetables, and Root Vegetables. Each subsegment reflects distinct consumption occasions, nutritional priorities, and portion control considerations, revealing that while family packs dominate weeknight dinners, single-serve and snack formats are rapidly gaining traction among on-the-go professionals and younger consumers.

Turning to packaging type, the market is characterized by flexible formats-Bag options including Resealable Bag and Tear Open Bag, Bowl formats spanning Paper Bowl and Plastic Bowl, Cup choices in Foam Cup and Plastic Cup, and Tray configurations incorporating Cardboard Tray and Plastic Tray. Innovations in packaging materials and microwave-specific design features directly influence product performance, consumer convenience, and end-of-life recyclability. Brands that successfully integrate high-barrier, sustainable materials without compromising user experience are gaining a decisive edge.

Finally, distribution channels underscore the shifting paths to market. Convenience Stores remain a critical point of impulse purchase, while Online Retail models-comprising Direct To Consumer and Third Party Retailers-have emerged as powerful platforms for subscription-based offerings and personalized promotional bundles. Specialty Stores such as Gourmet Shops and Health Food Stores cater to premium and health-oriented niches, driving brand differentiation through curated assortments and experiential retail moments. This holistic segmentation lens unlocks strategic growth insights for manufacturers and retailers alike.

This comprehensive research report categorizes the Microwavable Food market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Distribution Channel

Comparative Analysis of Microwavable Food Adoption Patterns and Regional Consumer Preferences Across Americas, Europe Middle East Africa, and Asia-Pacific Markets

Regional market behaviors in microwavable food reveal distinct demand drivers and competitive dynamics across the Americas, Europe Middle East and Africa, and Asia-Pacific regions. In the Americas, robust labor force participation rates combined with a cultural affinity for convenient dining options have cemented microwavable products as pantry staples. Health-forward reformulations emphasizing reduced sodium, organic ingredients, and plant-based proteins resonate strongly in urban centers, while family-oriented meal solutions maintain broad appeal in suburban and rural markets.

In Europe Middle East and Africa, a tapestry of regulatory environments, culinary traditions, and economic variances shapes category evolution. Western European markets are early adopters of novel packaging technologies and premium ingredients, reflecting high consumer willingness to pay for clean-label, sustainable offerings. Meanwhile, emerging economies in the region often prioritize affordability and shelf stability, prompting localized product adaptations. In the Middle East and North Africa, heritage flavors and halal certification requirements drive product customization, while distribution infrastructure enhancements are expanding market reach beyond major metropolitan hubs.

The Asia-Pacific region stands out for its rapid urbanization, rising disposable incomes, and digital connectivity, which have catalyzed a surge in single-serve meals, particularly in East Asian markets with strong microwavable rice and noodle traditions. Southeast Asian consumers are likewise embracing eclectic flavor profiles and snack formats, supported by robust e-commerce platforms and expanding cold-chain logistics. Across all regions, cross-border partnerships and licensing deals are enabling faster market entry and localized innovation, underscoring the strategic importance of regional insights for global market participants.

This comprehensive research report examines key regions that drive the evolution of the Microwavable Food market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Overview Highlighting Strategic Initiatives, Innovation Pipelines, and Partnership Models of Leading Microwavable Food Manufacturers

The competitive milieu of the microwavable food industry is defined by a blend of established food conglomerates and agile emerging players, each striving to capture consumer mindshare through differentiated offerings. Leading the charge, several global manufacturers have doubled down on R&D investments to refine ingredient sourcing, enhance nutritional profiles, and pioneer advanced packaging solutions. Strategic partnerships with ingredient innovators and packaging specialists have become commonplace, enabling faster commercialization of cutting-edge formats that deliver crisp texture and even heating.

In parallel, a wave of nimble startups has disrupted the category by focusing on niche positioning-whether through plant-based formulations, gourmet-inspired meal kits, or regional flavor portfolios tailored to specific demographics. These challengers leverage direct-to-consumer channels and social media-driven marketing to cultivate dedicated followings, forcing incumbents to elevate their digital engagement strategies.

Private-label offerings have also gained momentum, with leading retailers engineering exclusive microwavable lines that undercut premium brands on price while delivering competitive taste and quality. This has intensified the pressure on branded players to articulate clear value propositions, whether it be through provenance claims, ethical sourcing certifications, or curated flavor experiences. The interplay among these varied competitors has fueled relentless innovation, compelling all market participants to reassess their go-to-market strategies and product roadmaps.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microwavable Food market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ajinomoto Co., Inc.

- Amy’s Kitchen, Inc.

- B&G Foods, Inc.

- Campbell Soup Company

- Conagra Brands, Inc.

- General Mills, Inc.

- McCain Foods Limited

- Nestlé S.A.

- The Hain Celestial Group, Inc.

- The Kraft Heinz Company

- Tyson Foods, Inc.

Strategic Imperatives and Tactical Approaches to Drive Market Share Growth, Operational Efficiency, and Brand Loyalty in the Evolving Microwavable Food Sector

To thrive in the rapidly evolving microwavable food sector, industry players must embrace a multifaceted strategic playbook. First, fortifying supply chain resilience through diversified sourcing networks and real-time analytics is essential to mitigate input cost volatility and tariff-driven disruptions. Manufacturers should establish collaborative agreements with key suppliers, incorporating shared risk and incentive structures that align long-term objectives.

Simultaneously, investment in sustainable packaging innovation is non-negotiable. Companies must accelerate the adoption of mono-material constructions and certified compostable films while engaging in awareness campaigns that educate consumers on proper disposal practices. By positioning sustainability as a core brand pillar, organizations can deepen consumer loyalty and unlock incremental shelf-space support from environmentally conscious retailers.

On the product front, a dual focus on health-forward formulations and flavor innovation will be critical. Enriching offerings with functional ingredients-such as protein isolates, fermented elements, and adaptogenic extracts-addresses growing consumer demand for nutrition with tangible benefits. At the same time, culinary collaborations and limited-edition flavor launches can generate buzz and drive trial, particularly within the snack and soup subsegments.

Finally, an omnichannel go-to-market strategy that integrates digital-first initiatives with brick-and-mortar distribution will optimize reach and engagement. Leveraging data-driven personalization, subscription services, and targeted promotions can amplify direct-to-consumer penetration, while strategic shelf positioning and in-store activations will maintain visibility in traditional retail environments. By aligning operational agility with consumer-centric innovation, industry leaders can secure sustainable growth in this dynamic category.

Robust Research Framework Combining Primary Interviews, Comprehensive Desk Research, and Advanced Analytical Techniques to Validate Microwavable Food Market Insights

The research framework underpinning this analysis integrates a rigorous blend of qualitative and quantitative approaches to deliver robust, actionable insights. Primary research initiatives involved in-depth interviews with a spectrum of stakeholders, including food technologists, supply chain executives, packaging engineers, and senior marketing leaders. These engagements provided firsthand perspectives on emerging innovation themes, sourcing challenges, and consumer response to new product trials.

Complementing primary inputs, secondary research encompassed an exhaustive review of company disclosures, trade journals, regulatory filings, and government statistical databases. Technical white papers and patent registries were examined to track developments in processing technologies and packaging materials. Additionally, sentiment analysis of social media channels and consumer forums offered real-time indicators of evolving preferences and unmet need states.

Quantitative validation was achieved through a comprehensive survey of end consumers, designed to capture purchase behaviors, occasion-based usage patterns, and willingness to pay for health and sustainability attributes. Data triangulation techniques ensured consistency across multiple data sets, while advanced analytical tools were deployed to model correlations between demographic variables and consumption drivers. This methodological synergy ensures that the findings presented herein are both empirically grounded and strategically relevant.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microwavable Food market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microwavable Food Market, by Product Type

- Microwavable Food Market, by Packaging Type

- Microwavable Food Market, by Distribution Channel

- Microwavable Food Market, by Region

- Microwavable Food Market, by Group

- Microwavable Food Market, by Country

- United States Microwavable Food Market

- China Microwavable Food Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 2226 ]

Summative Reflections on Industry Trajectories, Critical Success Factors, and the Road Ahead for Microwavable Food Innovation and Market Expansion

The microwavable food industry stands at a pivotal juncture, shaped by dynamic consumer expectations, regulatory shifts, and technological breakthroughs. As tariffs recalibrate cost structures, companies with agile supply chains and proactive sourcing strategies will navigate disruption more effectively. Segmentation insights highlight the necessity of tailored product and packaging solutions, while regional analyses underscore the diverse market entry and growth strategies required across global geographies. Against this backdrop, competitive pressures from both established conglomerates and innovative challengers will continue to spur rapid evolution, demanding that brands remain vigilant, creative, and consumer-centric. Looking ahead, success will hinge on the ability to harmonize convenience with quality, sustainability with performance, and operational efficiency with continuous innovation.

Connect with Ketan Rohom Today to Gain Exclusive Strategic Insights and Secure Your Comprehensive Microwavable Food Market Research Report Purchase

Don’t let opportunity pass you by. For bespoke insights tailored to your strategic objectives, reach out to Ketan Rohom, Associate Director of Sales and Marketing, who can provide a personalized consultation to review key findings and demonstrate how this comprehensive microwavable food market research report can inform your decision-making. Whether you seek deeper analysis of tariff impacts, segmentation dynamics, or regional growth patterns, Ketan will guide you through the report’s most critical takeaways and outline flexible purchasing options designed to meet your budget and timelines. Engage with an expert who understands the nuances of evolving consumer preferences and supply chain challenges; take the first step toward gaining a competitive edge in the microwavable food sector today

- How big is the Microwavable Food Market?

- What is the Microwavable Food Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?