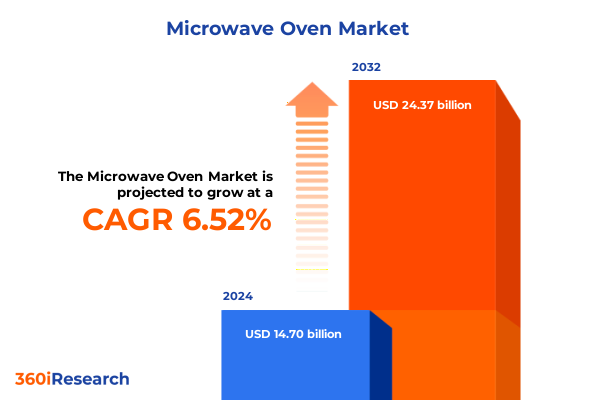

The Microwave Oven Market size was estimated at USD 15.61 billion in 2025 and expected to reach USD 16.58 billion in 2026, at a CAGR of 6.57% to reach USD 24.37 billion by 2032.

Exploring the Dynamics of the Microwave Oven Market as It Enters a New Era of Innovation, Efficiency, and Consumer-Centric Evolution in 2025 and Beyond

As the microwave oven market continues to evolve, it has become a nexus of rapid technological innovation and shifting consumer expectations. What once began as a convenient method for reheating leftovers has matured into a dynamic appliance segment driven by demands for smarter functionality, enhanced energy efficiency, and seamless integration into connected living environments. Today’s consumers expect more than fast cooking; they seek intuitive interfaces, versatile cooking modes, and designs that complement modern kitchen aesthetics. This punctuates the imperative for industry stakeholders to understand the complex interplay of technological advancements, regulatory changes, and competitive dynamics shaping the marketplace.

In parallel, broader industry forces are converging to redefine the role of the microwave oven in both household and commercial settings. Rising interest in healthier meal preparation techniques is catalyzing the adoption of convection and grill variants, while the ascent of e-commerce and direct-to-consumer models is transforming traditional distribution paradigms. These converging currents are ushering in an era of heightened product differentiation, where value propositions are measured not just by price and capacity but also by connectivity, user experience, and sustainability credentials. This introduction lays the groundwork for a deep dive into the transformative shifts, policy-driven influences, and strategic imperatives that will chart the future of the microwave oven landscape.

Disruptive Technological and Consumer Behavior Shifts Reshaping the Global Microwave Oven Landscape for the Next Decade

In recent years, the microwave oven sector has undergone transformative shifts that extend far beyond incremental performance improvements. A surge in digital integration has introduced IoT connectivity and app-enabled cooking presets, empowering end users with remote monitoring and granular control over power output and cooking modes. At the same time, consumer preferences are evolving, with health-conscious individuals gravitating toward convection and steam-assisted features that preserve nutrients and reduce oil usage. This technological pivot has elevated segment differentiation, compelling manufacturers to layer advanced sensors, AI-based cooking algorithms, and interactive touch interfaces into their product portfolios.

Simultaneously, sustainability has emerged as a critical vector of innovation. Stricter global energy efficiency standards and heightened environmental awareness are pressuring OEMs to develop products that minimize standby power consumption and leverage eco-friendly materials. As a result, new design architectures are prioritizing energy-efficient magnetrons, recyclable plastics, and modular components to extend product lifecycles and simplify end‐of‐life processing. These shifts are mirrored by evolving retail strategies, where partnerships with smart home ecosystem providers and subscription-based maintenance services are creating novel revenue streams.

These disruptive forces are converging to reshape competitive dynamics. Legacy players are being challenged by agile entrants and cross-industry alliances that bring fresh perspectives on user experience and digital monetization. Competitive advantage now hinges on the ability to anticipate and adapt to these tectonic shifts, underscoring the need for strategic foresight, robust R&D investments, and collaborative innovation models.

Unpacking the Comprehensive Effects of 2025 United States Tariff Measures on Microwave Oven Supply Chains, Cost Structures, and Competitive Positioning

Against this backdrop of rapid innovation, the imposition of new United States tariffs in early 2025 has introduced a fresh layer of complexity into the supply chain calculus. These measures, targeting key components such as imported magnetrons, specialized semiconductor control boards, and select electronic assemblies, have exerted upward pressure on input costs. As a consequence, many manufacturers have been compelled to reevaluate sourcing strategies, with some electing to diversify supplier bases or to shift manufacturing capacity to tariff-exempt jurisdictions.

Meanwhile, the structure of the tariffs, applied at differentiated rates depending on the country of origin, has amplified the strategic importance of origin-based procurement decisions. Firms that historically relied on East Asian suppliers have been negotiating long-term contracts with Southeast Asian and Eastern European partners to mitigate cost volatility. At the same time, the pass-through of increased component prices to end users has raised retail price points, testing consumer elasticity in both household and commercial segments. This has driven some organizations to explore value engineering and component localization as levers to preserve margin integrity.

In addition, secondary impacts have materialized in aftermarket services and warranty provisioning. Higher replacement part costs have led service divisions to optimize repair processes, lean on predictive maintenance analytics, and bundle extended warranties to balance cost recovery with customer retention. Together, these cumulative tariff effects underscore the need for agile supply chain management, dynamic pricing strategies, and deeper collaboration across the value chain to navigate the evolving regulatory terrain.

Decoding Consumer Preferences and Industry Priorities Through Multifaceted Segmentation Analyses in the Microwave Oven Sector to Drive Strategic Differentiation

The modern microwave oven market is characterized by an intricate web of segmentation layers that reveal divergent growth drivers and consumer priorities. On the basis of product type, convection microwave ovens are commanding greater attention for their ability to bake and roast with precision, grill microwave ovens attract consumers seeking versatile meal preparation options, and solo microwave ovens continue to deliver essential heating performance at accessible price points. When considering wattage or power output, models ranging between 800 and 1200 watts have become the mainstream choice, underpinned by a balance of cooking speed and energy consumption; lower-powered units remain popular in compact living spaces and entry-level price segments, while high-wattage models exceeding 1200 watts cater to performance-driven commercial kitchens and premium household installations.

Installation mode further differentiates the market, as built-in microwaves offer a seamless aesthetic in contemporary kitchens, countertop units provide flexible placement and ease of relocation, and over-the-range configurations integrate ventilation solutions to optimize space utilization. Control feature segmentation also shapes user experience, with analog interfaces delivering straightforward dial-and-knob operation for cost-conscious buyers, and digital touch controls appealing to tech-savvy consumers who value programmable presets, precise timer settings, and backlit displays.

Equally significant is the end-user dimension. Household customers prioritize compact design, intuitive operation, and safety features, while commercial segments such as cafeterias, hotels, and restaurants demand robust stainless-steel interiors, high-usage durability, and advanced cooking modes tailored to volume preparation. Finally, distribution channels delineate market access pathways: offline specialty stores and supermarkets remain vital for hands-on product examination and immediate acquisition, whereas brand websites and e-commerce platforms are fueling growth through personalized offers, subscription-based add-ons, and direct engagement with brand communities. These layered insights provide a roadmap for companies to align their product and go-to-market strategies with the nuanced expectations of target audiences.

This comprehensive research report categorizes the Microwave Oven market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Wattage/Power Output

- Installation Mode

- Control Feature

- End-User

- Distribution Channel

Regional Growth Dynamics Highlighting Divergent Demand Patterns and Regulatory Influences Across Americas, EMEA, and Asia-Pacific Microwave Appliance Markets

Examining regional dynamics reveals three distinct theaters of growth and competitive intensity. In the Americas, robust consumer spending and renovation cycles in mature markets are sustaining steady demand for premium and smart microwave ovens, while governments’ incentive programs for energy-efficient appliances are fueling upgrades in retrofit applications. Against this positive backdrop, North American appliance makers are deepening partnerships with home builders and online subscription services to maximize touchpoints and drive recurring revenue through ancillary offerings.

Europe, the Middle East, and Africa present a mosaic of regulatory frameworks and consumer expectations. Western European markets operate under stringent energy labeling and eco-design directives, prompting manufacturers to showcase low-standby-power modes and recyclable componentry. In contrast, Middle Eastern commercial segments are investing heavily in high-capacity, high-power units to meet large-scale catering needs, and parts of Africa are witnessing entry-level adoption of cost-effective solo microwave ovens amid rising urbanization. Navigating this complexity requires a localized approach, balancing compliance with targeted marketing strategies that resonate with divergent purchasing criteria.

Asia-Pacific remains the fastest-growing region, driven by expanding middle-class populations, increasing disposable incomes, and rapidly evolving e-commerce infrastructures. Urban households in China, India, and Southeast Asia are embracing multifunctional appliances with intelligent cooking controls and app integration. At the same time, Japan and South Korea continue to lead in premium innovation, with household brands leveraging advanced sensor technologies to introduce next-generation models. Together, these regional insights underscore the importance of tailoring product design, pricing models, and channel partnerships to the specific competitive and regulatory contexts of each geographic cluster.

This comprehensive research report examines key regions that drive the evolution of the Microwave Oven market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Intelligence on Leading Microwave Oven Manufacturers Driving Innovation, Market Penetration, and Strategic Partnerships to Sustain Competitive Advantage

Market leadership in the microwave oven arena is increasingly defined by the ability to innovate across both hardware and software ecosystems. Established appliance giants have bolstered R&D pipelines to embed IoT connectivity and AI-driven cooking algorithms into their latest portfolios, while leveraging global manufacturing footprints to optimize cost structures and accelerate time-to-market. These incumbents are also forging strategic alliances with technology providers, integrating voice-activated platforms and mobile app ecosystems to deliver seamless user experiences aligned with broader smart home strategies.

Meanwhile, specialized electronics firms and start-ups are carving out niche positions through rapid prototyping and agile product cycles. By focusing on modular design principles, these smaller players can introduce upgrades to control interfaces, sensor packages, and energy management features more frequently than their larger rivals. Such agility enables them to capture early adopters and exert competitive pressure, prompting legacy brands to accelerate their own innovation cadences.

At the same time, distribution powerhouses are consolidating market influence through exclusive partnerships and direct-to-consumer channels. Retailers operating omnichannel platforms are offering end-to-end services, from virtual kitchen planning to post-purchase installation and maintenance. This blurs traditional boundaries between manufacturing and retail, requiring every player in the ecosystem to cultivate collaborative relationships and redefine value propositions in an interconnected marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Microwave Oven market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alto-Shaam Inc.

- Amica Group

- Arçelik A.Ş.

- Avanti Products, LLC

- Brandt

- Breville Group

- Electrolux AB

- Faber Group

- Godrej & Boyce Mfg. Co. Ltd.

- Gorenje

- Haier Group

- Hamilton Beach Brands, Inc.

- Hisense International Co., Ltd.

- Illinois Tool Works Inc.

- LG Electronics Inc.

- Midea Group Co. Ltd.

- Miele & Cie KG

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- SMEG S.p.A.

- Solwave Inc.

- Sub-Zero Group, Inc.

- Toshiba Lifestyle Products and Services Corporation

- Vatti Corporation Limited

- Whirlpool Corporation

Strategic Imperatives and Operational Playbooks for Industry Leaders Seeking Sustainable Growth Amid Evolving Market Volatility and Consumer Expectations

In an environment defined by rapid technological change and regulatory complexity, industry leaders must adopt a portfolio of strategic imperatives to drive sustainable growth. First, investing in modular R&D architectures will enable faster iteration of product features while mitigating the risk of obsolescence. By designing magnetron and control board modules that can be updated independently, firms can respond nimbly to evolving consumer demands and regulatory mandates without overhauling entire product lines.

Second, forging end-to-end supply chain transparency initiatives will be critical to managing the ripple effects of tariff fluctuations and component shortages. Advanced analytics and digital twins can empower procurement teams to simulate sourcing scenarios, anticipate cost impacts, and secure alternative suppliers in a fraction of the time required by traditional processes. Complementing this, dynamic pricing engines can adjust retail and commercial rates in real time, preserving margins and optimizing revenue streams.

Third, expanding value-added service portfolios through subscription models, extended warranties, and predictive maintenance offerings can transform one-time appliance sales into recurring revenue opportunities. This service-centric approach not only deepens customer engagement but also generates actionable usage data to inform future product development. Finally, cultivating cross-industry collaborations with smart home providers and energy management platforms will amplify product value propositions, driving adoption among tech-savvy, sustainability-focused consumers.

Robust Qualitative and Quantitative Research Frameworks Underpinning the Analytical Rigor of Our Comprehensive Microwave Oven Market Assessment

This analysis is grounded in a rigorous research framework that combines qualitative and quantitative methodologies to ensure analytical integrity. Primary inputs included in-depth interviews with industry executives, procurement specialists, and channel partners, providing first-hand perspectives on supply chain vulnerabilities, product innovation roadmaps, and end-user preference shifts. Complementing these insights, extensive secondary research was conducted, encompassing trade association publications, regulatory filings, and patent databases to track emerging technologies and policy developments.

Quantitative data was sourced from a combination of verified point-of-sale tracking, historical shipment volumes, and manufacturer revenue disclosures, triangulated to identify trend inflection points and validate segmentation hypotheses. Advanced data modeling techniques, including scenario analysis and sensitivity testing, were employed to assess the potential impact of tariff variations and macroeconomic shifts on cost structures and pricing strategies. This multipronged approach ensures that the findings presented herein are both comprehensive and robust, equipping stakeholders with a reliable decision-making foundation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Microwave Oven market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Microwave Oven Market, by Product Type

- Microwave Oven Market, by Wattage/Power Output

- Microwave Oven Market, by Installation Mode

- Microwave Oven Market, by Control Feature

- Microwave Oven Market, by End-User

- Microwave Oven Market, by Distribution Channel

- Microwave Oven Market, by Region

- Microwave Oven Market, by Group

- Microwave Oven Market, by Country

- United States Microwave Oven Market

- China Microwave Oven Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesis of Market Forces, Innovation Trajectories, and Strategic Takeaways Shaping the Future Trajectory of the Global Microwave Oven Industry

Bringing together the multifaceted insights of this report, it is evident that the microwave oven market stands at a critical juncture where innovation, regulatory forces, and evolving consumer behaviors converge. Technological advancements in AI-driven cooking algorithms and IoT integration are redefining product value propositions, while heightened sustainability expectations and energy efficiency mandates are reshaping design priorities. Against this backdrop, the 2025 tariffs introduced in the United States underscore the importance of agile supply chain strategies and localized sourcing decisions to mitigate cost pressures.

The nuanced segmentation analysis reveals that success in this segment will depend on a precise alignment of product features with the distinct preferences of household and commercial end users, as well as a channel strategy that balances the immediacy of offline retail with the personalized engagement of e-commerce. Regionally, manufacturers must tailor approaches that reflect the regulatory and cultural particularities of the Americas, EMEA, and Asia-Pacific markets. Competitive positioning will hinge on sustained R&D investment, modular design approaches, and collaborative, service-centric business models that extend value beyond the point of sale.

Ultimately, navigating this complex landscape requires a holistic perspective that integrates market intelligence, operational agility, and strategic foresight. The insights and recommendations presented throughout this executive summary serve as a roadmap for stakeholders aiming to capture growth opportunities, mitigate emerging risks, and secure a leadership position in the global microwave oven industry.

Engage Ketan Rohom for Exclusive Access to Tailored Strategic Insights and Actionable Intelligence on the Microwave Oven Market Landscape

To unlock the full suite of strategic intelligence contained within our comprehensive microwave oven market report, reach out to Ketan Rohom, Associate Director of Sales & Marketing. By engaging directly with Ketan, you gain access to a tailored conversation that aligns the report’s insights with your organization’s unique priorities. Whether you’re seeking deeper exploration of tariff impacts, granular segmentation breakdowns, or customized regional analyses, Ketan will connect you with the precise data and expert guidance needed to inform critical decisions. Elevate your market positioning and accelerate growth by leveraging this personalized consultation; contact Ketan today to secure your copy of the report and transform informed intelligence into decisive action

- How big is the Microwave Oven Market?

- What is the Microwave Oven Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?