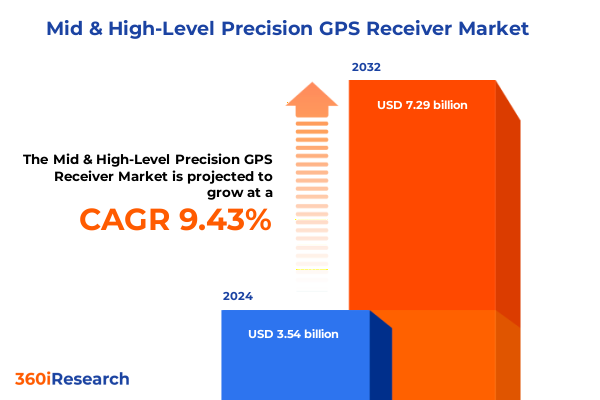

The Mid & High-Level Precision GPS Receiver Market size was estimated at USD 3.87 billion in 2025 and expected to reach USD 4.23 billion in 2026, at a CAGR of 9.45% to reach USD 7.29 billion by 2032.

Unveiling the Strategic Significance and Transformative Potential of Mid and High-Level Precision GPS Receivers in Modern Industrial Applications

Mid and high-level precision GPS receivers have emerged as indispensable tools for industries that demand accuracy beyond consumer-grade positioning. Distinguished by their ability to deliver centimeter-level accuracy, these receivers harness advanced satellite augmentation techniques and sophisticated signal processing algorithms to serve applications ranging from land surveying and agriculture to autonomous vehicle navigation and defense operations. Unlike entry-level GPS modules, mid and high-level precision receivers integrate multi-frequency GNSS tracking, real-time kinematic corrections, and post-processed positioning services to minimize error sources such as atmospheric interference, multipath effects, and satellite clock deviations.

In today’s landscape of rapid digital transformation and heightened operational complexity, organizations are pursuing strategic investments in precision positioning to drive efficiency, reduce costs, and unlock new capabilities. Precision GPS receivers underpin mission-critical workflows by enabling automated machine control in agriculture enterprises, precise asset mapping for construction firms, and reliable navigation for drone operators. Furthermore, government agencies and military organizations leverage these systems to ensure national security and infrastructure resilience, while transportation and logistics providers utilize them to optimize routing and fleet management.

This executive summary offers a structured analysis of the forces shaping the mid and high-level precision GPS receiver market. It synthesizes transformative shifts in technology and regulation, examines the cumulative effect of recent United States tariffs, highlights segmentation landscapes and regional dynamics, profiles leading industry participants, and presents actionable recommendations. By distilling complex data into strategic insights, this document equips decision-makers with the clarity required to navigate evolving market realities and capitalize on emerging opportunities.

Examining the Paradigm Shifts and Innovation Drivers Reshaping Precision GPS Technology Adoption Across Critical Industrial and Commercial Sectors

The precision GPS receiver landscape is undergoing a fundamental transformation, propelled by advances in multi-constellation GNSS integration, cloud-based correction services, and miniaturization of receiver hardware. As receivers evolve to support signals from GPS, GLONASS, Galileo, and BeiDou simultaneously, their positioning accuracy and reliability have improved dramatically. At the same time, cloud-connected correction services have shifted computational burdens from onboard processors to scalable data centers, enabling real-time kinematic (RTK) and precise point positioning (PPP) applications with minimal latency.

Emerging use cases are accelerating adoption across sectors. In precision agriculture, seeding and fertilization operations now rely on centimeter-level guidance to optimize yields and reduce chemical inputs. Construction firms deploy machine control systems that integrate high-accuracy receivers with autonomous earthmoving equipment, achieving unparalleled grading precision. Drone operators leverage compact high-level GPS modules for aerial surveying and infrastructure inspection, while intelligent transportation systems and autonomous vehicles employ dynamic correction networks to navigate complex urban environments safely.

In parallel, the regulatory environment and industry standards are aligning to support precision positioning at scale. Government-led augmentation systems and performance requirements for safety-critical navigation applications are driving investments in receiver certification and interoperability testing. As a result, the market is responding with ecosystems that couple hardware innovation with robust software platforms, creating an integrated value chain that propels further breakthroughs in both capabilities and adoption.

Unraveling the Effects of 2025 United States Tariffs on Precision GPS Supply Chains, Cost Structures, and Competitiveness in Global Markets

The introduction of targeted United States tariffs in early 2025 has had a pronounced impact on the global precision GPS receiver supply chain and competitive dynamics. These measures, aimed at a select range of electronic components and finished receiver assemblies, have imposed additional duties that raise procurement costs for manufacturers relying on international sourcing. As duties are applied uniformly across specific product categories, assembled units incorporating multiple tariff-impacted components face cost escalations that can exceed two tenths of the base import value.

Supply chain stakeholders have responded by reevaluating supplier portfolios and sourcing strategies. Original equipment manufacturers have accelerated dual-sourcing initiatives, identifying alternative suppliers in geographically diversified regions to mitigate tariff exposure. In some cases, production lines have shifted closer to end-user markets through nearshoring efforts, reducing lead times and dampening the impact of import duties. However, these adjustments often introduce complexities related to quality validation, logistics coordination, and regulatory compliance in new jurisdictions.

Price pressures resulting from tariff-induced cost increases have compelled companies to reassess product positioning and value propositions. Some providers have opted to absorb a portion of the added expense to maintain competitive end-user pricing, while others have segmented product lines by differentiating service levels and support offerings. This recalibration of pricing strategies underscores the broader need for agile cost management, robust supplier relationships, and proactive engagement with policy developments to safeguard profitability and market positioning in a persistently volatile trade environment.

Inspiring Strategic Clarity Through Detailed Product, Technology, and End User Segmentation Insights Within the Precision GPS Receiver Market Landscape

A nuanced understanding of product segmentation reveals critical insights into how mid and high-level precision GPS receivers address distinct operational requirements. Base station units, designed for fixed-station applications, are further categorized into fixed and mobile stations to serve permanent installations and vehicle-tethered monitoring posts respectively. Conversely, rover receivers offer portability, with configurations tailored to handheld survey tasks, unmanned aerial vehicle (UAV) mounting for aerial mapping, and vehicle-mounted installations for on-the-move data collection.

Technology segmentation highlights the array of augmentation and correction methods driving accuracy improvements. Differential GPS (DGPS) solutions encompass ground-based DGPS networks and satellite-based augmentation systems (SBAS), each providing systematic error correction across broad regions. Precise point positioning (PPP) services, available in post-processed and real-time formats, deliver high-precision results without the need for local base stations, making them ideal for remote or rapidly deployed use cases. Network RTK configurations and single-base RTK setups complete the technology spectrum, offering near-instantaneous corrections for applications where latency and consistency are paramount.

End user segmentation underscores the diverse market drivers fueling demand. Agriculture enterprises adopt precision seeding and guidance solutions to maximize yield and resource efficiency. Construction firms integrate receiver systems into automated machinery for excavation and grading operations. Drone operators rely on compact rovers for aerial data acquisition. Government agencies and military organizations deploy robust, certified units for critical infrastructure monitoring and defense positioning. Surveying services utilize portable and vehicle-mounted rovers for topographic and cadastral mapping, while transportation and logistics providers harness integrated GNSS modules to streamline fleet tracking and route optimization.

This comprehensive research report categorizes the Mid & High-Level Precision GPS Receiver market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- End User

Highlighting Distinct Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East & Africa, and Asia-Pacific Precision GPS Markets

Regional dynamics exert a profound influence on precision GPS receiver adoption and innovation, with distinct factors shaping performance expectations and investment decisions. In the Americas, extensive infrastructure modernization initiatives and broad-based digitization of agricultural practices drive robust demand. North American producers focus on integrating seamless connectivity between equipment, cloud platforms, and mobile interfaces, while Latin American markets emphasize cost-effective receiver solutions adapted to variable connectivity conditions.

Within Europe, the Middle East, and Africa, regulatory frameworks and defense spending fuel market trajectories. European Union member states pursue harmonized standards for safety-critical navigation, enabling interoperability across national augmentation systems. In the Middle East, high-profile infrastructure projects and smart city initiatives incorporate precision positioning for asset management, while African governments prioritize surveying services and mineral exploration operations that depend on reliable GNSS guidance.

Asia-Pacific markets are characterized by rapid urbanization, expansive telecommunications infrastructure rollouts, and a burgeoning focus on resource extraction industries. Countries across the region invest heavily in mass transit and smart grid programs, necessitating high-accuracy positioning for system deployment and maintenance. Meanwhile, mining operations deploy ruggedized receiver systems in remote environments to enhance safety and operational efficiency. Cost sensitivity and a vibrant local manufacturing ecosystem further distinguish the Asia-Pacific landscape, fostering a diverse supplier base and competitive pricing dynamics.

This comprehensive research report examines key regions that drive the evolution of the Mid & High-Level Precision GPS Receiver market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Differentiators Among Major Precision GPS Receiver Manufacturers and Technology Providers Worldwide

The competitive landscape is anchored by a cohort of leading technology providers whose portfolios span receiver hardware, software platforms, and integrated solutions. One global pioneer has solidified its position through comprehensive network RTK services and strategic partnerships with telecommunication operators to extend correction coverage. Another prominent provider has differentiated via multi-constellation chipsets and cloud-based PPP offerings, enabling seamless cross-border positioning for international survey and agriculture enterprises.

A third market force leverages its heritage in optical and laser scanning to develop hybrid receiver solutions that fuse high-accuracy GNSS data with terrestrial measurement technologies, appealing to construction and infrastructure monitoring segments. Additionally, a longstanding European specialist focuses on modular receiver architectures, facilitating rapid hardware upgrades and customization for defense and government contracts. These incumbents continually invest in research and development to maintain technological leadership and address emerging use cases.

Simultaneously, a number of fast-growing challengers are gaining traction by emphasizing affordability, ease of deployment, and open-source integration. These emerging players target small to mid-size surveyors, UAV service providers, and specialty construction firms with streamlined product lines and developer-friendly APIs. Their ascent underscores a broader trend toward democratized access to high-precision positioning, as well as the importance of ecosystem partnerships across software, hardware, and telecommunication domains.

This comprehensive research report delivers an in-depth overview of the principal market players in the Mid & High-Level Precision GPS Receiver market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AVMAP Satellite Navigation Inc.

- CHC Navigation (China) Navigation, Inc.

- ComNav Technology Ltd.

- Furuno Electric Co., Ltd.

- Geneq Inc.

- Hemisphere GNSS Inc.

- Hexagon AB

- Hi-Target Navigation Technology Corporation

- JAVAD GNSS Inc.

- Leica Geosystems

- Magellan Systems Japan Inc.

- NavCom Technology, Inc.

- RACELOGIC Ltd.

- Raytheon Technologies Corporation

- Satlab Geosolutions AB

- Septentrio NV

- Stonex S.r.l.

- Topcon Corporation

- Trimble Inc.

Delivering Actionable Strategic Recommendations to Empower Industry Leaders in Navigating Opportunities and Challenges in the Precision GPS Receiver Sector

To capitalize on emerging market opportunities, industry leaders should channel investments toward integrated hardware and software ecosystems. By forging alliances with cloud service providers and software developers, manufacturers can facilitate seamless data workflows from the field to analytics platforms, enhancing value propositions for end users. Pursuing open APIs and SDKs will further attract a developer community that can expand functionality and foster localized innovation.

Strengthening supply chain resilience is equally critical. Companies should evaluate dual- and multi-source strategies, combining strategic partnerships in low-cost regions with localized manufacturing capabilities near key markets. This balanced approach can reduce tariff exposure, shorten lead times, and maintain quality standards. Robust supplier relationship management and digital tracking of component provenance will help mitigate geopolitical and logistical disruptions.

Prioritizing comprehensive aftermarket services, including training, remote support, and certification programs, will drive customer retention and recurring revenue. Developing modular upgrade pathways ensures that installed base receivers can access the latest signal correction services without full hardware replacements. Finally, engaging proactively with standards bodies and regulatory agencies will position organizations to influence emerging performance requirements and maintain compliance as performance thresholds tighten.

Detailing a Rigorous Research Methodology Integrating Qualitative and Quantitative Data to Validate Precision GPS Market Insights with Expert Triangulation

The foundation of this research rests on a multi-layered approach, beginning with comprehensive secondary research that encompasses technical white papers, public standards documentation, and leading industry publications. Credible sources of GNSS performance data and augmentation service specifications were systematically reviewed to establish a baseline understanding of evolving receiver capabilities and market dynamics.

Primary research efforts involved structured interviews with senior executives, R&D managers, and end-user decision-makers across agriculture, construction, surveying, and transportation segments. These interviews provided direct insights into unmet needs, performance trade-offs, and procurement considerations. In addition, expert panel workshops convened system integrators and regulatory specialists to validate preliminary findings and refine segmentation frameworks.

Quantitative surveys conducted with equipment manufacturers and distributors yielded data on technology adoption rates, regional deployment patterns, and service preferences. Responses were carefully triangulated with company disclosures, patent filings, and trade association reports to ensure consistency and mitigate biases. Cutting-edge analytical tools, including geospatial analytics and network modeling, were applied to interpret complex interactions between supply chain variables and end-user requirements.

This rigorous methodology underpins the credibility of the insights presented. By integrating qualitative depth with quantitative validation and by maintaining transparent audit trails throughout the research process, the analysis delivers actionable intelligence that stakeholders can trust to inform strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Mid & High-Level Precision GPS Receiver market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Mid & High-Level Precision GPS Receiver Market, by Product

- Mid & High-Level Precision GPS Receiver Market, by Technology

- Mid & High-Level Precision GPS Receiver Market, by End User

- Mid & High-Level Precision GPS Receiver Market, by Region

- Mid & High-Level Precision GPS Receiver Market, by Group

- Mid & High-Level Precision GPS Receiver Market, by Country

- United States Mid & High-Level Precision GPS Receiver Market

- China Mid & High-Level Precision GPS Receiver Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

Reinforcing Key Takeaways and Strategic Imperatives Shaping the Future Trajectory of Mid and High-Level Precision GPS Receiver Technologies

As the precision GPS receiver market continues to evolve, organizations that understand and anticipate these shifts will be best positioned to thrive. Technological innovations such as multi-constellation integration, cloud-based correction services, and miniaturized hardware are redefining performance expectations. At the same time, regulatory landscapes and trade policy developments, including the 2025 tariff measures, are reshaping supply chain architectures and cost structures.

Segmentation analysis illuminates the diverse needs across product types, from fixed and mobile base stations to handheld, UAV-mounted, and vehicle-mounted rovers. Technology pathways-whether through DGPS, PPP, or RTK variants-offer tailored solutions for latency-sensitive tasks, remote deployments, and broad-area coverage. Meanwhile, end users ranging from agriculture enterprises and construction firms to government agencies and logistics providers underscore the market’s multifaceted demand drivers.

Regional distinctions in the Americas, EMEA, and Asia-Pacific emphasize the importance of localized strategies, from regulatory compliance to infrastructure investments. Competitive positioning is defined by leaders who marry advanced hardware with software ecosystems, as well as challengers who democratize access through affordability and open integration. By following the strategic recommendations outlined-encompassing ecosystem partnerships, supply chain diversification, and aftermarket service expansion-industry participants can convert insights into sustained competitive advantage.

In sum, this executive summary distills complex market dynamics into clear, strategic imperatives. Organizations equipped with these insights will be prepared to navigate uncertainty, harness technological breakthroughs, and capture the full potential of mid and high-level precision GPS receiver technologies.

Secure Your Competitive Edge by Partnering with Ketan Rohom to Access Comprehensive Precision GPS Market Insights and Drive Informed Decision Making

To transform strategic aspirations into measurable outcomes, engage directly with Ketan Rohom, Associate Director, Sales & Marketing. His expertise in precision GPS receiver market dynamics ensures that you receive tailored guidance and comprehensive intelligence designed to address your organization’s specific challenges and growth objectives. By partnering with Ketan Rohom, you gain privileged access to in-depth analysis, actionable insights, and detailed scenario planning that can drive competitive differentiation and accelerate decision cycles.

Enlist expert support to leverage the latest intelligence on supply chain resilience, emerging technology adoption, and regional expansion strategies. Ketan Rohom will work closely with your leadership team to outline a customized research package, aligning deliverables with your investment priorities and timeline requirements. This collaborative approach guarantees that the final report not only informs strategic planning but also empowers execution with precision and confidence.

Seize the opportunity to secure your advantage in the rapidly evolving precision GPS receiver market. Reach out today to arrange a consultation, explore sample chapters, and define the scope of your comprehensive market research engagement.

- How big is the Mid & High-Level Precision GPS Receiver Market?

- What is the Mid & High-Level Precision GPS Receiver Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?