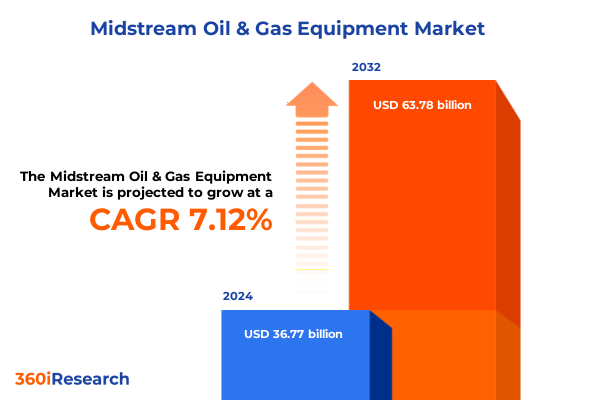

The Midstream Oil & Gas Equipment Market size was estimated at USD 39.43 billion in 2025 and expected to reach USD 41.64 billion in 2026, at a CAGR of 7.11% to reach USD 63.78 billion by 2032.

Exploring the evolving dynamics of equipment-driven efficiency in midstream oil and gas operations and strategic insights for stakeholders

The midstream oil and gas sector serves as the indispensable link between upstream exploration and downstream consumption, relying on a sophisticated array of equipment to manage the seamless movement, processing, and storage of hydrocarbons. At its core, this segment encompasses the critical infrastructure-from compressors that maintain the flow of natural gas through vast pipelines to heat exchangers that regulate temperature profiles in separation and dehydration units. Each piece of machinery plays a pivotal role in preserving product integrity, optimizing operational efficiency, and minimizing environmental impact, all while adhering to stringent safety and regulatory standards.

Against a backdrop of accelerating global energy demand, evolving environmental policies, and rapid technological innovation, stakeholders are under increasing pressure to modernize existing assets and integrate advanced solutions for predictive maintenance and digital monitoring. This executive summary provides a concise yet comprehensive overview of the most influential trends and forces reshaping the midstream equipment landscape. Readers will gain insight into transformative market dynamics, the ramifications of newly enacted U.S. tariffs, granular segmentation perspectives, regional demand drivers, and competitive strategies adopted by leading manufacturers. The ensuing sections culminate in actionable recommendations for industry leaders, an outline of the research framework underpinning our analysis, and a clear call to action for securing the full report.

Unveiling paradigm shifts reshaping equipment utilization and technological adoption within the midstream oil and gas value chain

The midstream oil and gas equipment market is undergoing a fundamental shift driven by the convergence of digital innovation, decarbonization imperatives, and evolving project economics. Industry players are increasingly adopting predictive analytics and IoT-enabled condition monitoring to reduce unplanned downtime and extend asset life cycles. This shift toward data-driven maintenance is complemented by modularization strategies, where preassembled units accelerate installation timelines and mitigate on-site labor constraints in remote geographies.

Meanwhile, environmental considerations are spurring the integration of low-emission compressors and advanced separation technologies that can minimize flaring and methane slip. These developments are further supported by collaborative partnerships between equipment manufacturers and software providers, aiming to deliver holistic solutions that encompass both hardware performance and digital service offerings. Such alliances are redefining competitive positioning, as firms strive to offer integrated product-as-a-service models that align with operator preferences for outcome-based contracting.

Assessing the comprehensive repercussions of newly instituted United States tariffs on midstream equipment suppliers and operators

In 2025, newly enacted U.S. tariffs on specific steel and alloy imports have introduced notable headwinds for equipment manufacturers and end users across the midstream segment. These levies, targeting heavy-duty pipeline fittings, pressure vessels, and specialized steel castings, have elevated input costs, prompting many suppliers to reposition sourcing strategies toward domestic mills or tariff-exempt jurisdictions. The pass-through of increased raw material expenses has placed pressure on profit margins, particularly for smaller vendors that lack the scale to absorb price fluctuations or renegotiate long-term contracts with upstream purchasers.

Operators, in response, are reevaluating total cost of ownership models, prioritizing equipment designs that emphasize reduced maintenance intervals and extended service life over lower upfront costs. This strategic pivot has accelerated interest in high-performance alloys and composite materials that, although more expensive initially, deliver lower lifecycle expenditure. Additionally, joint purchasing consortia have emerged as a mechanism to leverage collective bargaining power, enabling mid-sized operators to counterbalance tariff-driven cost escalation.

Decoding critical market segmentation intricacies across equipment types, material selections, applications, end uses, and distribution pathways

The landscape of midstream equipment is defined by multifaceted segmentation analyses that reveal nuanced technology adoption patterns and material preferences. When dissecting the market by equipment type, compressors-spanning centrifugal and reciprocating designs-are recognized for their centrality in pipeline transport, while filters, differentiated into bag and cartridge modalities, are gaining prominence in stringent particulate removal applications. Heat exchangers, whether plate configurations or shell-and-tube assemblies, are evaluated on thermodynamic efficiency and ease of cleaning, and pumps, encompassing centrifugal and positive displacement technologies, are selected based on throughput variability and viscosity tolerance. Separators bifurcate into two-phase and three-phase units, each calibrated to specific feed compositions, whereas valves, including ball, butterfly, check, and gate variants, are appraised for actuation speed, leak integrity, and pressure rating.

Material type analysis further refines procurement decisions, as carbon steel remains prevalent for standard pressure conditions, nickel alloys are deployed in high-temperature or corrosive environments, and stainless steel secures a foothold where contamination risks must be minimized. Application-based segmentation-covering dehydration, fractionation, gas processing, pipeline transportation, and storage and terminal functions-highlights diverse performance benchmarks and regulatory interfaces. From an end-use perspective, crude oil infrastructure demands robust solids handling, whereas natural gas networks emphasize compressor reliability and hydrate inhibition. Finally, distribution dynamics span OEM channels for new build projects and aftermarket pathways for retrofit or replacement components, with the latter gaining traction amid the drive to optimize existing facilities.

This comprehensive research report categorizes the Midstream Oil & Gas Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Material Type

- Application

- End Use

- Distribution Channel

Exploring differentiated regional dynamics influencing midstream equipment demand and investment patterns across key global territories

Regional dynamics play a defining role in shaping investment priorities and technology adoption across the midstream equipment arena. In the Americas, the maturation of shale-driven pipelines has spurred demand for high-capacity centrifugal compressors and advanced filtration systems designed to accommodate variable feed compositions. The confluence of regulatory scrutiny on methane emissions and the imperative to extend the service life of aging infrastructure has also accelerated the uptake of predictive maintenance platforms.

Across Europe, the Middle East & Africa, the strategic interplay between traditional hydrocarbon exporters and renewable energy policies informs equipment preferences, with an emphasis on high-efficiency heat exchangers and modular skid systems that can be redeployed across diverse project scopes. The regional emphasis on local content requirements in several Gulf Cooperation Council member states has yielded collaborations with domestic fabricators and joint ventures aimed at localizing supply chains. In Asia-Pacific, burgeoning pipeline expansion in Southeast Asia and Australia’s export-focused LNG terminals have catalyzed procurement of high-pressure valves and robust three-phase separators, alongside growing interest in digital twins to simulate operational scenarios and optimize throughput in real time.

This comprehensive research report examines key regions that drive the evolution of the Midstream Oil & Gas Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategic initiatives, collaborative ventures, and competitive positioning of leading midstream equipment manufacturers and service providers

Key players are navigating a competitive landscape defined by strategic partnerships, technology licensing agreements, and targeted investments in digital platforms. The leading compressor manufacturers have entered into long-term service alliances with large pipeline operators to deliver performance guarantees tied to uptime metrics and maintenance outcomes. At the same time, filter specialists have secured patent rights for next-generation media that offer superior particulate capture with lower pressure drop, positioning them as preferred suppliers for high-purity gas processing facilities.

Meanwhile, heat exchanger fabricators are collaborating with computational fluid dynamics experts to refine shell-and-tube bundle configurations, reducing fouling rates and energy consumption. In the pump segment, original equipment manufacturers are integrating remote diagnostics into positive displacement units, enabling real-time monitoring of vibration and temperature anomalies. Valve suppliers are likewise consolidating after-sales service networks to provide rapid emergency support across major pipeline corridors. Collectively, these initiatives underscore a market in which differentiation is increasingly achieved through holistic solutions that combine mechanical robustness with digital oversight.

This comprehensive research report delivers an in-depth overview of the principal market players in the Midstream Oil & Gas Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ariel Corporation

- Atlas Copco AB

- Baker Hughes Company

- Caterpillar Inc.

- Chart Industries Inc.

- Emerson Electric Co.

- Flowserve Corporation

- General Electric Company

- Honeywell International Inc.

- KBR Inc.

- Linde plc

- Mitsubishi Heavy Industries Ltd

- NOV Inc.

- Parker Hannifin Corporation

- Schlumberger Limited

- Siemens Energy AG

- Solar Turbines Incorporated

- Sulzer Ltd

- TechnipFMC plc

- Wood PLC

Presenting actionable recommendations to empower industry leaders in optimizing midstream equipment operations, supply chains, and strategic investments

To stay ahead of market disruptions and regulatory shifts, industry leaders should prioritize the integration of predictive maintenance frameworks that harness real-time sensor data and machine learning algorithms. Embedding these capabilities early in the procurement cycle enables operators to transition from reactive servicing to condition-based interventions, thereby reducing downtime and extending equipment life. Furthermore, sourcing strategies must be recalibrated in light of evolving tariff landscapes; leveraging diversified vendor portfolios and establishing strategic stockholding arrangements can mitigate supply chain shocks and ensure project continuity.

Executives should also explore modular equipment solutions that accelerate installation schedules and simplify future capacity expansions. By standardizing skid designs across multiple sites, organizations can streamline commissioning workflows and accelerate return on investment. In parallel, forging collaborative partnerships with technology providers will be critical to deliver integrated hardware-software offerings that address both performance and compliance requirements. Ultimately, a proactive approach that blends operational excellence with strategic procurement and digitalization will empower stakeholders to navigate uncertainty and capture emergent opportunities.

Detailing rigorous research methodologies, data collection frameworks, and analytical approaches underpinning the midstream equipment market analysis

This analysis is grounded in a rigorous research methodology that combines primary and secondary data collection with robust triangulation protocols. Primary insights were garnered through in-depth interviews with C-level executives, technical directors, and field engineers across pipeline operators, equipment manufacturers, and engineering procurement contractors. These qualitative engagements provided nuanced perspectives on technology adoption drivers, procurement challenges, and service expectations.

Secondary research entailed a systematic review of public filings, regulatory white papers, proprietary patent databases, and peer-reviewed technical journals to verify equipment specifications, material performance characteristics, and emerging innovations. Data points were cross-validated through multiple independent sources to ensure consistency. Finally, analytical frameworks such as SWOT assessments and Porter’s Five Forces were applied to distill competitive dynamics and risk factors, while scenario modeling techniques were used to evaluate potential impacts of policy, tariff, and technological shifts on equipment lifecycles.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Midstream Oil & Gas Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Midstream Oil & Gas Equipment Market, by Equipment Type

- Midstream Oil & Gas Equipment Market, by Material Type

- Midstream Oil & Gas Equipment Market, by Application

- Midstream Oil & Gas Equipment Market, by End Use

- Midstream Oil & Gas Equipment Market, by Distribution Channel

- Midstream Oil & Gas Equipment Market, by Region

- Midstream Oil & Gas Equipment Market, by Group

- Midstream Oil & Gas Equipment Market, by Country

- United States Midstream Oil & Gas Equipment Market

- China Midstream Oil & Gas Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing critical insights and strategic imperatives to navigate the evolving midstream equipment landscape with confidence and foresight

The midstream oil and gas equipment landscape is in the midst of a profound transformation, driven by digitalization, environmental stewardship, and shifting trade policies. Stakeholders that embrace predictive maintenance, modular design philosophies, and strategic sourcing will be best positioned to mitigate cost pressures and operational risks. Regional nuances-from the Americas’ shale infrastructure to emerging export corridors in Asia-Pacific-demand tailored solutions that align with local regulatory and commercial imperatives.

Leading manufacturers that invest in holistic service ecosystems and foster collaborative innovation with software partners will differentiate themselves in an increasingly outcome-orientated market. As regulatory bodies tighten emissions thresholds and tariffs recalibrate supply chains, the ability to pivot swiftly-supported by real-time data and scenario planning-will determine long-term competitiveness. By synthesizing the insights presented in this summary, decision-makers can craft resilient, future-proof strategies that harness the full potential of the midstream equipment domain.

Connect with Ketan Rohom to access comprehensive midstream equipment research insights and elevate strategic decision-making with tailored market intelligence

We invite you to partner with Ketan Rohom, whose deep expertise in midstream oil and gas market dynamics can guide you through the complexities of equipment selection, regulatory navigation, and strategic investment prioritization. Engage directly to secure tailored research deliverables that align with your unique operational objectives and risk profile. By initiating this conversation, you will gain access to in-depth technical insights, comparative supplier analyses, and forward-looking assessments that empower decisive action in a competitive landscape. Reach out today to transform data into opportunity and ensure your organization remains resilient and adaptive amid evolving market conditions.

- How big is the Midstream Oil & Gas Equipment Market?

- What is the Midstream Oil & Gas Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?