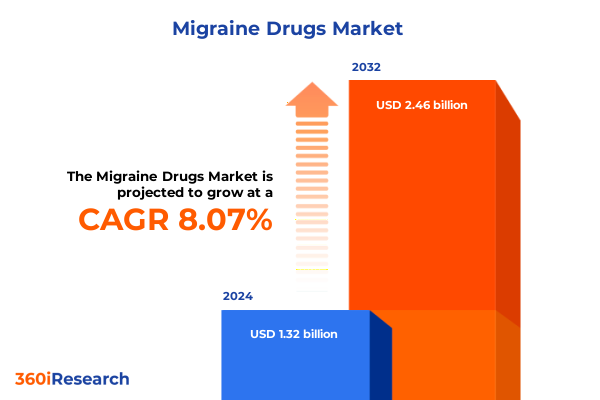

The Migraine Drugs Market size was estimated at USD 1.40 billion in 2025 and expected to reach USD 1.49 billion in 2026, at a CAGR of 8.34% to reach USD 2.46 billion by 2032.

Unveiling the Growing Global Migraine Burden, Emerging Disruptive Therapies, and Transformative Innovations Reshaping Patient Outcomes

The global burden of migraine has escalated dramatically over the past three decades, with prevalence rising from 732.6 million cases in 1990 to over 1.16 billion cases by 2021. This near doubling underscores the chronic and disabling nature of the condition, which accounts for significant years lived with disability across all regions of the world. Age-standardized prevalence rates have crept upward despite advances in treatment, reflecting both improved diagnostic awareness and the relentless impact of environmental, genetic, and lifestyle factors on headache disorders.

Within the United States, approximately 12% of the population lives with migraine, yet racial and socioeconomic disparities persist in diagnosis and care. Black and Latinx patients are less likely to receive timely diagnosis and access to appropriate therapies, resulting in prolonged suffering and reduced quality of life. Implicit provider biases, underrepresentation in clinical research, and barriers to specialist care exacerbate these inequities, calling for targeted efforts to enhance educational outreach, diversify trial enrollment, and expand community-based headache services.

Environmental triggers such as rapid barometric shifts, heat waves, and escalating air pollution further intensify migraine burden. Studies have linked a 10°F rise in temperature to a 6% increase in headache presentations, while wildfires and flooding events drive spikes in emergency department visits. These climate-related stressors add complexity to migraine management, emphasizing the need for adaptable treatment strategies that can mitigate both physiological and psychosocial drivers of attacks.

While traditional therapies have long centered on nonspecific pain relievers and vasoconstrictive agents, a wave of innovative, mechanism-based treatments has redefined the therapeutic landscape. The approval of eptinezumab as the first intravenous preventive therapy heralded the advent of calcitonin gene–related peptide monoclonal antibodies, offering rapid onset and sustained efficacy. Such breakthroughs reflect an era of precision-targeted biologics designed to address the underlying pathophysiology of migraine, elevating patient expectations around speed of relief and long-term outcomes.

Exploring Revolutionary Drug Classes, Precision Digital Health Platforms, and Patient-Centric Innovations Transforming the Migraine Treatment Ecosystem

Transformative gains in our understanding of migraine pathogenesis have propelled the emergence of monoclonal antibodies targeting calcitonin gene–related peptide pathways. Eptinezumab, the first intravenous preventive agent, demonstrated rapid benefit as early as day one post-infusion, marking a paradigm shift in clinical expectations for onset of efficacy. Subsequent launches of subcutaneous antibodies such as erenumab, fremanezumab, and galcanezumab have diversified administration options and dosing schedules, enabling tailored regimens that align with patient preferences and comorbidity profiles.

Building on the CGRP axis, oral gepants have revolutionized both acute and preventive care. Atogepant, the first oral CGRP receptor antagonist approved for episodic migraine prevention, demonstrated significant reductions in monthly migraine days in pivotal trials. Meanwhile, ubrogepant and rimegepant have provided rapid relief for acute attacks without vasoconstrictive side effects, broadening options for patients contraindicated for triptans.

Expanding the therapeutic arsenal, lasmiditan introduced a new class of acute treatment by agonizing 5-HT₁F receptors. Its centrally acting mechanism offers pain freedom without vascular constriction, making it particularly valuable for patients with cardiovascular risk who cannot use triptans. Clinical trials reported significant rates of two-hour pain freedom and relief from the most bothersome symptoms, albeit with side effects such as sedation that necessitate careful patient counseling regarding activities like driving for up to eight hours post-dose.

Ergot derivatives, notably dihydroergotamine, remain integral for refractory or prolonged attacks, with novel formulations like nasal sprays delivering rapid absorption and sustained relief for up to 48 hours. Despite their long safety record and efficacy in status migrainosus, ergot alkaloids require caution in patients with cardiovascular comorbidities and judicious use to avoid medication-overuse headaches, highlighting the importance of clinician vigilance and patient education.

Concurrently, digital health innovations are accelerating personalized migraine management. Telemedicine platforms have streamlined access to headache specialists, while mobile apps and wearable devices enable real-time monitoring of triggers, adherence, and treatment outcomes. Artificial intelligence–driven analytics are translating vast patient datasets into predictive insights, fostering proactive interventions and dynamic care adjustments that enhance both patient engagement and long-term disease control.

Assessing the Comprehensive Ripple Effects of the 2025 U.S. Trade Tariffs on Migraine Drug Supply Chains and Patient Access

Beginning April 2025, a sweeping 10% global tariff on nearly all imported goods into the United States, including critical active pharmaceutical ingredients, has placed immediate upward pressure on manufacturing costs. These duties, designed to bolster domestic production, have disrupted longstanding supply chains that depend heavily on sources in Asia and Europe, forcing pharmaceutical companies to reevaluate sourcing strategies and inventory buffers to mitigate vulnerability to escalating input prices.

The escalation of trade tensions between the United States and China has led to steep tariffs of up to 245% on key APIs originating from China and 20% on Indian imports. For generic migraine medications that rely on low-margin API procurement, these surcharges translate directly into higher production expenses. In contrast, branded products with greater gross margins may temporarily absorb a fraction of the added cost, though sustained duties risk being passed through to payers and patients, threatening access and compliance for price-sensitive populations.

Generics manufacturers, already operating on slender margins, face the acute risk of production shutdowns or consolidation, as the burden of import levies coupled with supply chain unpredictability undermines the viability of low-cost offerings. Without sufficient resilience, the sector may experience manufacturing discontinuations and drug shortages, eroding the foundation of affordable migraine care and compelling payers to pursue higher-cost branded alternatives, thereby inflating overall healthcare expenditures.

Amid this volatility, the push to onshore API and finished product manufacturing has intensified. Firms are evaluating nearshoring and domestic expansions to counteract tariff exposures, leveraging federal incentives and public-private partnerships to establish resilient production hubs. Although reshoring demands substantial capital investment and time, companies view this strategic pivot as essential for securing supply continuity and safeguarding patient access against future trade disruptions.

Deriving Actionable Insights from Multidimensional Segmentation of Migraine Therapies to Enhance Market Strategy and Patient Targeting

The migraine market’s segmentation by drug class reveals distinct trajectories for each category. Monoclonal antibodies targeting CGRP have captured premium positioning through their targeted mechanisms and favorable safety profiles. Oral gepants now complement these biologics by offering at-home preventive dosing without injections, while ditans and ergot derivatives remain pivotal for acute management. Traditional NSAIDs and triptans continue to serve as first-line options, particularly where cost considerations or patient preference warrant established therapies.

This comprehensive research report categorizes the Migraine Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Types

- Indication

- Patient Age Group

- Distribution Channel

- End User

Uncovering Distinct Regional Dynamics Across the Americas, Europe Middle East Africa, and Asia Pacific for Tailored Migraine Drug Approaches

In the Americas, the United States leads in adoption of advanced migraine therapies, driven by robust payer coverage and a high rate of specialist consultations. The prevalence of self-injectable CGRP inhibitors and oral gepants reflects a mature market that values rapid innovation, though access hurdles persist for underinsured segments. Canada’s public system offers a more centralized reimbursement review, creating opportunities for streamlined formulary inclusion of new agents.

This comprehensive research report examines key regions that drive the evolution of the Migraine Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Collaborations Driving the Next Wave of Migraine Treatment Development and Competitive Differentiation

Pfizer’s strategic acquisition of Biohaven Pharmaceuticals in 2022 consolidated a leading dual-action migraine portfolio under one roof, integrating NURTEC® ODT’s acute and preventive capabilities with zavegepant’s nascent intranasal profile. This move bolstered global commercialization reach and underscored the value of vertical integration in CGRP-targeted pipelines.

AbbVie’s QULIPTA™ atogepant has distinguished itself as the first oral CGRP receptor antagonist for episodic prevention, reflecting AbbVie’s expansion into migraine care alongside its existing therapies for chronic migraine and acute attacks. This diversification enhances patient choice and underscores the importance of treatment spectrum coverage in competitive differentiation.

Eli Lilly has championed the ditan class with REYVOW™ lasmiditan, addressing unmet need among patients with cardiovascular contraindications to vasoconstrictors. Lilly’s commitment to post-launch support and real-world evidence generation has helped to define lasmiditan’s clinical niche and optimize patient selection criteria.

Amgen and Novartis’s collaboration on Aimovig™ erenumab has shaped the monoclonal antibody landscape, establishing self-injectable prevention as a standard of care. Their joint efforts in patient support programs and outcome studies have accelerated adherence and underscored the strategic role of manufacturer-led access initiatives in sustaining long-term market growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Migraine Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca PLC

- Bausch Health Companies Inc.

- Dr. Reddy’s Laboratories Ltd.

- Eisai Co., Ltd.

- Eli Lilly and Company

- GlaxoSmithKline plc

- H. Lundbeck A/S

- Impel Pharmaceuticals Inc.

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Teva Pharmaceutical Industries Ltd.

Implementing Forward-Looking Recommendations to Strengthen Resilience, Drive Innovation, and Optimize Patient Access in the Migraine Drug Industry

Industry leaders should prioritize diversification of API sourcing and incorporation of multi-tiered supplier networks to mitigate tariff-induced disruptions. By balancing offshore and domestic production, organizations can maintain cost competitiveness while ensuring supply resilience. Concurrently, public-private partnerships and investments in local manufacturing infrastructure will be critical for long-term stability and regulatory alignment.

To capitalize on precision medicine trends, companies must integrate digital health solutions into their go-to-market strategies. Embedding mobile apps, remote monitoring, and AI-driven analytics into treatment protocols can enhance patient adherence, generate valuable real-world evidence, and differentiate product value propositions in payer negotiations.

Robust patient engagement programs, including financial support and education initiatives, will remain essential for unlocking access across diverse demographics. Proactive collaboration with advocacy groups and specialty societies can help address disparities, ensuring equitable distribution of novel therapies and optimizing outcomes across population segments.

Outlining Rigorous Research Methodology Integrating Primary Stakeholder Engagement and Data Triangulation for Comprehensive Insights

This analysis synthesized primary insights from expert interviews with neurologists, headache specialists, and industry executives, complemented by secondary research drawn from regulatory filings, patent databases, and peer-reviewed literature. Quantitative data were triangulated across multiple sources to validate market trends and cross-check tariff impacts, while qualitative findings were subjected to thematic coding to uncover strategic imperatives.

A rigorous protocol governed data collection, with standardized questionnaires deployed to capture clinician perspectives on treatment efficacy, safety, and adoption barriers. Ongoing consultations with trade policy analysts and supply chain experts informed the examination of tariff scenarios, enabling the construction of realistic cost-impact models and resilience frameworks.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Migraine Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Migraine Drugs Market, by Drug Class

- Migraine Drugs Market, by Types

- Migraine Drugs Market, by Indication

- Migraine Drugs Market, by Patient Age Group

- Migraine Drugs Market, by Distribution Channel

- Migraine Drugs Market, by End User

- Migraine Drugs Market, by Region

- Migraine Drugs Market, by Group

- Migraine Drugs Market, by Country

- United States Migraine Drugs Market

- China Migraine Drugs Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Drawing Strategic Conclusions on Market Evolution to Inform Next Steps in Migraine Management Innovation and Global Healthcare Impact

The migraine treatment landscape is at an inflection point, defined by the convergence of targeted biologics, small-molecule innovation, and digital health augmentation. Strategic investments in supply chain resilience, coupled with agile regulatory strategies, will determine competitive positioning in a market experiencing both tariff challenges and therapy diversification.

Seize the Opportunity to Engage with Ketan Rohom for Tailored Insights and Exclusive Access to the Comprehensive Migraine Market Research Report

For tailored strategies and deep dives into the competitive dynamics, regulatory shifts, and emerging opportunities within the migraine treatment space, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure your exclusive copy of the comprehensive market research report.

- How big is the Migraine Drugs Market?

- What is the Migraine Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?