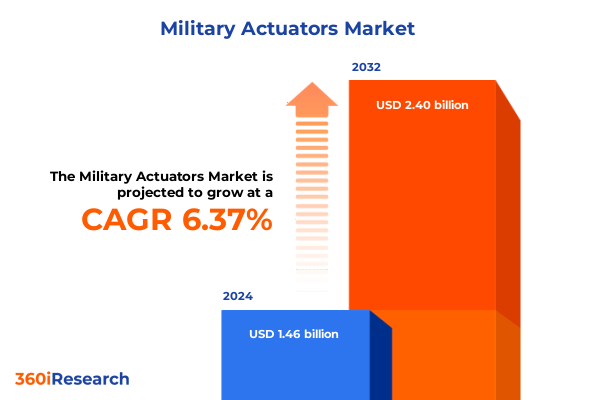

The Military Actuators Market size was estimated at USD 1.55 billion in 2025 and expected to reach USD 1.64 billion in 2026, at a CAGR of 6.43% to reach USD 2.40 billion by 2032.

Exploring the Critical Role of Military Actuators in Advancing Defense Capabilities and Shaping Future Strategic Readiness in Global Security Environments

The military actuator sector stands at a pivotal juncture, where technological breakthroughs and evolving defense strategies converge to redefine operational capabilities. As global security landscapes become increasingly complex, actuators-components that translate electrical, hydraulic, or pneumatic energy into mechanical motion-have emerged as critical enablers of precision, responsiveness, and resilience across air, land, and maritime platforms. Their role extends from adjusting aircraft control surfaces mid-flight to deploying weapon systems with exacting timing, underscoring the integration of advanced materials science, power management, and digital controls within defense supply chains.

Navigating this dynamic environment requires not only an appreciation of current performance benchmarks but also an understanding of future trajectories. Decision-makers must grapple with intensifying demands for lighter, more energy-efficient, and software-enabled solutions that can withstand harsh operational conditions. Meanwhile, defense budgets and procurement protocols are adapting to fiscal pressures and geopolitical considerations, prompting manufacturers to refine their offerings and develop end-to-end service capabilities. The subsequent sections delve into this landscape’s most consequential shifts, tariff impacts, segmentation nuances, regional variations, and strategic imperatives-offering a cohesive primer for stakeholders tasked with shaping the next generation of military actuator systems.

Unveiling the Technological, Strategic, and Supply Chain Transformations Revolutionizing Military Actuator Development and Deployment Dynamics Worldwide

Over the past decade, the military actuator industry has undergone transformative shifts driven by digitalization, materials innovation, and supply chain realignments. First, the infusion of smart electronics and sensor networks has elevated actuators from purely mechanical devices to intelligent systems capable of real-time diagnostics, predictive maintenance, and adaptive control. This convergence with the Internet of Military Things has not only enhanced combat vehicle reliability but also introduced new cybersecurity imperatives as adversaries target embedded firmware for disruption.

Moreover, advances in additive manufacturing have accelerated prototyping cycles and enabled complex geometries that reduce weight without sacrificing structural integrity. High-performance composites and novel alloys deliver enhanced thermal stability and fatigue resistance, meeting the rigorous demands of high-altitude aircraft and next-generation naval vessels. As a result, manufacturers are collaborating with defense laboratories to co-develop materials and streamline qualification processes, ensuring rapid transition from bench to battlefield.

Concurrently, supply chain diversification has intensified, spurred by concerns over single-source dependencies and regional trade tensions. Military planners are increasingly favoring multi-tiered sourcing strategies, pairing established Western suppliers with emerging local fabricators in key allied markets. This approach mitigates interruption risks while satisfying offset requirements. Collectively, these technological and strategic shifts are reshaping value chains, fostering ecosystems where integration, agility, and interoperability define competitive advantage.

Assessing the Cumulative Effects of 2025 United States Trade Policies on Military Actuator Procurement Costs and Global Supply Chain Resilience

In 2025, cumulative United States trade policy measures have significantly influenced the procurement and cost structures of military actuators. Building on tariff escalations initiated under Section 301 in prior administrations, the current administration has extended duties on critical actuator components-ranging from precision gear assemblies to specialized alloys-targeting imports from non-allied suppliers and jurisdictions with state-backed manufacturing subsidies. This multi-tiered tariff regime has increased landed costs for foreign-sourced parts by up to 15 percent, prompting defense OEMs to reassess supply chain footprints and inventory strategies.

Consequently, program offices managing fighter jet upgrades and armored vehicle retrofits have encountered budgetary pressures as price adjustments ripple through annual defense appropriations. To offset these effects, some primes have negotiated volume-based rebates with domestic actuator producers, while others accelerated investments in localized manufacturing hubs under the Defense Production Act framework. Meanwhile, allied governments have initiated reciprocal duties, adding complexity to multinational joint ventures and cross-border maintenance contracts.

Despite these headwinds, the military actuator sector has demonstrated resilience by leveraging modular architectures and standardized interfaces that simplify technology insertion and reduce customization costs. Suppliers offering integrated lifecycle support-including condition monitoring software and predictive analytics-have capitalized on heightened demand for risk-mitigation services. As the tariff landscape continues to evolve, stakeholders are positioned to optimize through proactive sourcing models, hedging strategies, and strategic partnerships that balance cost discipline with the imperative for cutting-edge performance.

Deriving Actionable Insights from Market Segmentation by Type, Offering, Drive Mechanism, Phase Configuration, and Application Spectrum

Analyzing the market through distinct segmentation lenses reveals nuanced demand drivers and areas of innovation. When viewed by type, electric actuators have gained prominence in scenarios requiring precise motion control and low acoustic signature, while hydraulic units remain indispensable for heavy-lift applications due to their superior power density. Pneumatic systems continue to serve rapid-response use cases, particularly in robotic maintenance platforms where quick actuation and inherent compliance are advantageous. Shifting between aftermarket services and original equipment manufacturing offerings underscores the lifecycle focus of defense customers, who increasingly value retrofit solutions, on-site calibration, and extended warranty packages alongside new-build delivery.

Drive type segmentation-linear versus rotary-further differentiates the market. Linear actuators dominate applications demanding direct push-pull force generation, such as landing gear deployment, whereas rotary mechanisms excel in delivering continuous torque for turret rotation and sail handling on naval vessels. Phase configuration adds another layer, as single-phase units provide simplified subsystem integration for smaller unmanned systems, and three-phase architectures deliver high-throughput power for large-scale platforms. Finally, examining applications across aircraft control surfaces, land vehicle turret systems, naval vessel hatch operations, factory-floor automation, and advanced weapon systems highlights how platform requirements dictate actuator performance profiles-from response speed and positional accuracy to environmental ruggedization.

This comprehensive research report categorizes the Military Actuators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Offering

- Drive Type

- Phase Type

- Application

Illuminating Regional Dynamics and Strategic Drivers Shaping Military Actuator Demand across the Americas, EMEA, and Asia-Pacific Theaters

Regional dynamics play a pivotal role in shaping procurement strategies and innovation trajectories. In the Americas, defense budgets in North and South America reflect a dual focus on modernizing legacy fleets and investing in unmanned systems. The United States remains the epicenter of R&D spending, with program offices pushing for indigenous actuator solutions that align with broader industrial base revitalization goals. Latin American countries, meanwhile, pursue incremental upgrades to armored vehicles and maritime patrol assets, often through competitive tenders that emphasize total lifecycle cost and local content incentives.

Across Europe, the Middle East, and Africa, offset obligations and collaborative development programs are central to procurement decisions. European alliances foster cross-national research consortia devoted to next-generation material formulations and digital twins for actuator verification. Meanwhile, Gulf states leverage sovereign wealth funds to underwrite advanced naval vessel acquisitions, integrating actuator systems capable of extended endurance under harsh environmental conditions. In Africa, procurement volumes remain modest but provide opportunities for modular, easily maintainable actuators tailored to emerging security needs.

In the Asia-Pacific theater, rapid military modernization in India, China, Japan, and South Korea drives robust actuator demand. Regional OEMs are enhancing local production capacities through joint ventures, supported by offset mandates and technology transfer agreements. Growth in amphibious vehicle programs and surveillance drone fleets has underscored the importance of corrosion-resistant coatings and miniaturized actuator designs. Collectively, these regional insights affirm that geopolitical priorities, industrial policy, and platform mix will continue to dictate actuator market evolution.

This comprehensive research report examines key regions that drive the evolution of the Military Actuators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Defense and Industrial Players Steering Innovation and Collaborations to Advance Military Actuator Capabilities in Competitive Market Landscapes

Key industry players are leveraging core competencies and strategic partnerships to advance military actuator capabilities. Established defense-grade actuator manufacturers are intensifying investments in digital control modules and cybersecurity safeguards, integrating end-to-end monitoring solutions to meet stringent MIL-STD requirements. Concurrently, major industrial conglomerates with dual-use portfolios are expanding their presence in defense through targeted acquisitions of specialized actuator firms, enabling cross-pollination of automotive and aerospace technologies.

Alliances between actuator OEMs and system integrators are gaining traction, as collaborative programs streamline qualification cycles and align roadmaps with defense prime contractors. Innovation hubs co-located with testing facilities allow companies to validate prototypes under simulated operational stresses, catalyzing rapid iteration. Moreover, several leading players are piloting servitization models, bundling predictive maintenance platforms and training services that extend beyond traditional warranty periods. This shift reflects a broader trend toward outcome-based contracting, where performance guarantees and uptime metrics dictate supplier selection.

By centering R&D on materials like high-temperature composites and magnetic bearings, industry champions are pushing performance ceilings while addressing weight and energy-efficiency mandates. As consolidation intensifies and technology roadmaps converge, the competitive landscape will increasingly reward those that can deliver integrated systems, cross-domain interoperability, and lifecycle value in equal measure.

This comprehensive research report delivers an in-depth overview of the principal market players in the Military Actuators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMETEK, Inc.

- Arkwin Industries, Inc.

- Beaver Aerospace & Defense, Inc.

- Creative Motion Control

- Curtiss-Wright Corporation

- Eaton Corporation plc

- Elektro-Metall Export GmbH

- Honeywell International Inc.

- Kyntronics

- Meggitt PLC

- Moog Inc.

- Parker Hannifin Corporation

- Raytheon Technologies Corporation

- Safran S.A.

- Sierramotion by Allied Motion Technologies

- Thales Group

- Triumph Group, Inc.

- Ultra Motion

- Venture Mfg. Co.

- Woodward, Inc.

Strategic Imperatives and Operational Tactics for Industry Stakeholders to Capitalize on Emerging Trends and Strengthen Market Positioning in Military Actuators

Industry leaders must adopt a multi-pronged strategy to harness emerging trends and fortify market positions. Investing in modular, open-architecture actuator designs will facilitate rapid technology infusion and reduce obsolescence risks, ensuring compatibility with evolving control networks. Simultaneously, enhancing supply chain agility through dual-sourcing arrangements and strategic inventory prepositioning can mitigate the impact of trade policy fluctuations and component shortages.

Development roadmaps should prioritize digital service offerings, including remote diagnostics, predictive maintenance analytics, and firmware-over-the-air updates that diminish downtime and optimize total lifecycle value. Partnerships with cybersecurity specialists will be essential to safeguard connected actuators from potential exploitation, aligning with defense cyber resilience mandates. Moreover, forging co-development agreements with allied nations can accelerate access to localized manufacturing capabilities, satisfy offset requirements, and bolster interoperability across coalition forces.

Finally, embedding sustainability principles into design and production-notably through recyclable materials and energy-efficient motor technologies-will resonate with environmental stewardship goals increasingly prevalent in defense procurement. By executing these recommendations, stakeholders can position themselves at the forefront of innovation, risk management, and value creation in the military actuator ecosystem.

Detailing the Rigorous Multimethod Research Framework Employed to Synthesize Primary, Secondary, and Expert Data on Military Actuator Markets

The findings presented throughout this report are underpinned by a robust research methodology combining primary and secondary intelligence. Primary research encompassed structured interviews with senior procurement officers within defense ministries, in-depth discussions with R&D leads at tier-one system integrators, and technical workshops featuring actuator design engineers. These engagements provided firsthand perspectives on performance requirements, procurement cycles, and emerging innovation pathways.

Secondary research involved comprehensive reviews of defense white papers, technical standards, and patent filings to map technology trajectories and material advancements. Industry conferences and symposium proceedings were analyzed to capture evolving threat scenarios and operational concepts influencing actuator specifications. Supplementing these inputs, proprietary supply chain databases and trade policy repositories were consulted to quantify tariff impacts and sourcing dynamics.

Data triangulation and cross-validation techniques ensured consistency and reliability, with quantitative insights corroborated against expert viewpoints. The cumulative approach yielded a holistic view of market drivers, competitive behaviors, and risk factors that shape the military actuator landscape today.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Military Actuators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Military Actuators Market, by Type

- Military Actuators Market, by Offering

- Military Actuators Market, by Drive Type

- Military Actuators Market, by Phase Type

- Military Actuators Market, by Application

- Military Actuators Market, by Region

- Military Actuators Market, by Group

- Military Actuators Market, by Country

- United States Military Actuators Market

- China Military Actuators Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding Perspectives on the Trajectory of Military Actuator Technologies and Strategic Considerations for Sustained Competitive Advantage

In an era marked by rapid technological advancement and shifting geopolitical balances, military actuators have emerged as critical enablers of defense platform performance and mission success. The convergence of smart electronics, innovative materials, and strategic supply chain realignments has redefined expectations for actuator agility, reliability, and security. Meanwhile, trade policies and regional dynamics continue to influence sourcing decisions and cost structures, underscoring the need for proactive risk management and collaborative innovation.

As stakeholders navigate the complexities outlined herein, the imperative for modular design, digital services, and lifecycle support becomes clear. Companies that embrace open architectures, diversify their supplier networks, and invest in advanced analytics will be best positioned to meet tomorrow’s defense requirements. Ultimately, the trajectory of the military actuator market will be determined by those who can unite technological prowess with strategic foresight, delivering solutions that uphold operational readiness across the spectrum of defense missions.

Empowering Strategic Procurement and Market Intelligence Through Expert Guidance from Ketan Rohom to Fuel Informed Defense Equipment Investments and Growth

To secure unparalleled insights and strategic clarity in the evolving military actuator domain, prospective stakeholders and procurement leaders are invited to connect with Ketan Rohom, Associate Director, Sales & Marketing, whose deep expertise and consultative approach can steer decision-makers toward informed investments and operational excellence. Engaging with Ketan provides direct access to tailored briefings, competitive benchmarking, and customized intelligence that align cutting-edge technological developments with program-specific requirements.

Through a dialogue with Ketan Rohom, organizations can discover how to translate granular market intelligence into actionable roadmaps, optimize sourcing strategies, and anticipate future defense procurement shifts. This partnership offers a gateway to proprietary methodologies, exclusive data analyses, and a comprehensive market research report that equips teams with the foresight and confidence needed to outpace competitors and ensure mission readiness.

- How big is the Military Actuators Market?

- What is the Military Actuators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?