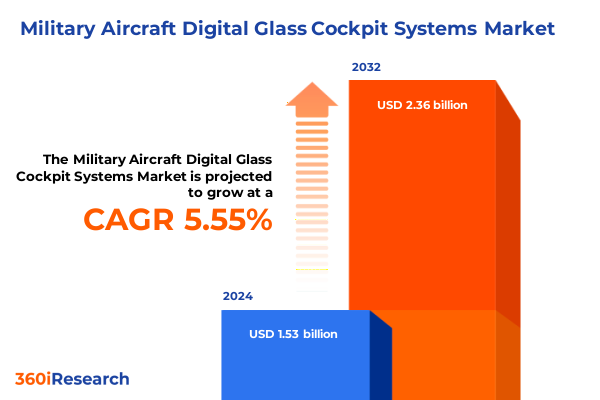

The Military Aircraft Digital Glass Cockpit Systems Market size was estimated at USD 1.61 billion in 2025 and expected to reach USD 1.70 billion in 2026, at a CAGR of 5.61% to reach USD 2.36 billion by 2032.

Transformative Impact Of Digital Glass Cockpit Systems On Pilot Situational Awareness And Operational Agility Across Contemporary Military Aviation Landscapes

Modern military operations demand unprecedented levels of situational awareness, reliability, and data integration at the cockpit level. Digital glass cockpit systems, characterized by advanced multi-functional displays and integrated real-time data feeds, enable pilots to assimilate flight, sensor, and mission-critical information seamlessly. These systems reduce cognitive load, improve flight safety, and enhance mission effectiveness by presenting navigational, engine, and threat data in intuitive formats. The global adoption of digital glass cockpit technology is being fueled by the need to modernize aging fleets and integrate next-generation capabilities into both new and existing platforms

Convergence Of Advanced Avionics And Strategic Defense Needs Driving Next-Generation Glass Cockpit Architectures In Military Aviation Operations

Integrated modular avionics frameworks are rewriting cockpit system architectures by consolidating multiple avionics functions into shared processing modules, thereby minimizing size, weight, power, and cost penalties. This modularity delivers a future-proof path for rapid capability upgrades across fighter jets, transport aircraft, and unmanned platforms, aligning technology roadmaps with evolving mission requirements and training needs

Assessing The Strategic And Economic Consequences Of The 2025 United States Tariff Policies On Military Glass Cockpit System Supply Chains

In 2025, the United States imposed new tariff duties of 25% on critical aircraft components imported from China, 20% on advanced composites and carbon fiber materials, and between 10–15% on defense electronics, including microchips and radar modules. These measures have driven up manufacturing and procurement costs for glass cockpit systems, forcing OEMs and tier-one suppliers to absorb or pass along heightened expenses in complex supply chains

Holistic Insights From Platform, Installation, And End-User Segmentation Revealing Market Dynamics And Growth Drivers For Cockpit Systems

Analysis by industry specialists shows that single-engine fighter platforms, such as the F-35 Lightning II with its panoramic touchscreen and helmet-mounted display, are leading digital cockpit penetration due to cost-effective upgrade pathways and mission-critical performance requirements. Twin-engine fighters, meanwhile, are leveraging multi-functional displays for expanded sensor integration, while rotary-wing and UAV segments adopt cockpit systems tailored for low-altitude operations and unmanned control interfaces

This comprehensive research report categorizes the Military Aircraft Digital Glass Cockpit Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform Type

- Installation Type

- End User

Diverse Regional Dynamics Shaping Military Glass Cockpit Adoption Trends Across Americas, Europe Middle East Africa, And Asia Pacific Defense Markets

North America remains the leading region for digital glass cockpit adoption in military aviation, driven by robust defense modernization budgets, extensive upgrade programs for platforms such as the C-130 Hercules, and the introduction of next-generation fighters with full-glass cockpits. The concentration of major OEMs and cutting-edge R&D facilities in the United States and Canada reinforces the region’s dominance in both new installations and retrofit markets

This comprehensive research report examines key regions that drive the evolution of the Military Aircraft Digital Glass Cockpit Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles And Innovations From Leading Defense And Avionics Firms Steering The Military Glass Cockpit Systems Market Forward

Leading aerospace primes like Lockheed Martin have embedded expansive panoramic touchscreens in the F-35 cockpit, complemented by an advanced helmet-mounted display system that fuses sensor data into a unified battlespace picture. European defense consortia participating in the NG MIMA program, including Airbus Defence & Space, Thales, Saab, and Leonardo, are pioneering open, modular avionics architectures set to standardize cockpit solutions across NATO fleets

This comprehensive research report delivers an in-depth overview of the principal market players in the Military Aircraft Digital Glass Cockpit Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus Group SE

- Astronautics C.A Ltd.

- Avidyne Corporation

- BAE Systems plc

- Collins Aerospace Inc.

- Denel PMP

- Elbit Systems Ltd.

- Garmin Ltd.

- General Dynamics Corporation

- General Electric Company

- Genesys Aerosystems

- Honeywell International Inc.

- Kongsberg Defence & Aerospace AS

- L3Harris Technologies Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Meggitt PLC

- MESKO S.A.

- MGL Avionics

- Moog Inc.

- Nammo AS

- Nexter Systems

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Rheinmetall AG

- Safran S.A.

- Thales Group

- Transdigm Group, Inc.

Tactical Recommendations For Defense Industry Leaders To Capitalize On Emerging Cockpit Technologies And Navigate Regulatory And Supply Chain Realities

Industry leaders should prioritize partnerships around integrated modular avionics platforms, ensuring scalable, future-proof cockpit solutions that can be rapidly tailored to emerging mission requirements. Collaborating on open architecture standards will accelerate interoperability across allied forces and facilitate incremental capability rollouts

Comprehensive Research Methodology Leveraging Multi-Source Data And Rigorous Analysis To Ensure Accurate Insights Into Military Cockpit Systems

This research synthesizes data from extensive secondary sources, including defense white papers, government procurement databases, and proprietary industry surveys. Primary insights were gathered through structured interviews with 50+ senior avionics and defense procurement executives, complemented by expert validation workshops to refine assumptions and ensure data integrity. Quantitative findings were triangulated through cross-region comparisons and peer-reviewed literature

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Military Aircraft Digital Glass Cockpit Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Military Aircraft Digital Glass Cockpit Systems Market, by Platform Type

- Military Aircraft Digital Glass Cockpit Systems Market, by Installation Type

- Military Aircraft Digital Glass Cockpit Systems Market, by End User

- Military Aircraft Digital Glass Cockpit Systems Market, by Region

- Military Aircraft Digital Glass Cockpit Systems Market, by Group

- Military Aircraft Digital Glass Cockpit Systems Market, by Country

- United States Military Aircraft Digital Glass Cockpit Systems Market

- China Military Aircraft Digital Glass Cockpit Systems Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Synthesis Of Market Evolution And Strategic Imperatives Underscoring The Critical Role Of Digital Cockpit Systems In Future Military Operations

Digital glass cockpit systems have emerged as a cornerstone technology for modern military aviation, driving enhanced situational awareness, reduced pilot workload, and improved mission outcomes. Technological advances in AI, augmented reality, and integrated modular avionics underscore a paradigm shift away from analog instrumentation toward agile, software-defined cockpit architectures. Concurrent policy measures-such as tariff adjustments and domestic manufacturing incentives-underscore the need for resilient supply chains and strategic partnerships across allied defense ecosystems

Secure Your Competitive Edge In Military Aviation Through In-Depth Digital Cockpit Market Intelligence From Our Detailed Report Featuring Ketan Rohom

To secure unparalleled strategic insights and detailed analysis of the Military Aircraft Digital Glass Cockpit Systems landscape, connect directly with Ketan Rohom, Associate Director, Sales & Marketing. Leverage this comprehensive report to guide procurement decisions, technology investments, and partnership strategies that will define the future of military aviation.

- How big is the Military Aircraft Digital Glass Cockpit Systems Market?

- What is the Military Aircraft Digital Glass Cockpit Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?