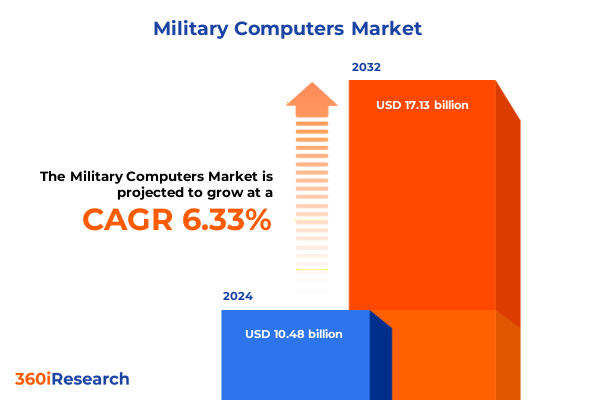

The Military Computers Market size was estimated at USD 11.08 billion in 2025 and expected to reach USD 11.71 billion in 2026, at a CAGR of 6.42% to reach USD 17.13 billion by 2032.

Setting the Strategic Foundation for Next-Generation Military Computing Amid Evolving Defense and Digital Warfare Demands

The rapid acceleration of digital transformation across defense sectors underscores the vital importance of next-generation military computing platforms. Embedded and rugged computing solutions now serve as the backbone of modern defense architectures, enabling mission-critical operations under the most demanding conditions. Against a backdrop of geopolitical tensions and emerging hybrid warfare techniques, the capacity to process information securely and in real time is no longer a luxury-it is an operational imperative. Military organizations must invest in computing systems that deliver high performance, reliability, and resilience even in contested or austere environments.

Moreover, the intersection of advanced technologies such as artificial intelligence, edge computing, and 5G integration has redefined the computational requirements for defense applications. This evolution demands a strategic reassessment of current computing assets, with greater emphasis on modularity, upgradability, and cyber hardening. As defense planners and technology stakeholders seek to maintain overmatch, a clear understanding of the market landscape and emerging trends is essential. In this context, an executive summary provides a concise yet comprehensive overview of pivotal shifts, key drivers, and strategic considerations shaping the future of military computers. By establishing this strategic foundation, organizations can align procurement, R&D, and deployment strategies to meet evolving mission demands.

Unveiling the Pivotal Technological and Strategic Shifts Reshaping Military Computer Capabilities for Future Defense Operations

Defense computing has entered a transformative era driven by rapid progress in networking, processing power, and software-driven architectures. Software-defined systems now enable dynamic reconfiguration of hardware resources in response to operational needs, ensuring maximum efficiency and adaptability. At the same time, edge computing has made it possible to distribute data processing across tactical nodes, drastically reducing latency and enhancing situational awareness for warfighters on the front lines. These shifts underscore a broader trend toward decentralization, where decision-making capabilities are pushed closer to the point of engagement.

Concurrently, the maturation of artificial intelligence and machine learning technologies is unlocking new possibilities for autonomous decision support, predictive maintenance, and anomaly detection. By integrating neural network models directly into rugged computing platforms, defense organizations can harness real-time data analytics even in disconnected or bandwidth-constrained settings. In parallel, quantum networking research promises to redefine secure communications, while advancements in encryption systems and firewall technologies bolster cyber defenses. Taken together, these technological inflection points are reshaping the defense landscape, requiring industry leaders to adopt a forward-looking posture that embraces innovation while safeguarding the integrity and resilience of critical computing infrastructures.

Analyzing the Multifaceted Impact of 2025 United States Defense Tariffs on Supply Chains Procurement and Operational Readiness

The implementation of United States defense-related tariffs in 2025 has exerted a pronounced influence on the military computing supply chain and procurement processes. By imposing higher duties on imported hardware components like specialized processors and networking equipment, these measures have elevated production costs for embedded and rugged computing systems. Consequently, defense contractors and original equipment manufacturers have sought to absorb or offset these increases through value engineering, strategic stockpiling, and renegotiated supplier contracts. Simultaneously, procurement timelines have experienced upward pressure as budgetary adjustments and cost reviews extend acquisition cycles.

In response, many stakeholders have accelerated efforts to diversify their supplier base, prioritizing domestic manufacturing partners and allied nations with favorable trade agreements. This pivot not only mitigates tariff-related risks but also strengthens supply chain resilience against future policy shifts. Moreover, increased collaboration between government agencies and private sector entities has led to the establishment of co-investment initiatives aimed at scaling up onshore production of critical components. While initial adjustments have posed challenges, these strategic realignments offer long-term benefits by fostering a more robust industrial ecosystem capable of sustaining defense computing requirements under evolving geopolitical and economic landscapes.

Revealing Critical Market Segmentation Insights Across Products Components Technologies Applications and End Users Driving Defense Computing Investments

A detailed examination of market segmentation reveals crucial insights into how different dimensions of military computing align with specific operational needs. In terms of product offerings, embedded computers have become essential for mission-critical control systems, while rugged computers deliver the durability required for harsh combat and field environments. Shifting focus to components, hardware elements such as memory modules, networking equipment, high-performance processors, and secure storage arrays form the foundational pillars of defense computing platforms. Complementing these physical assets, software solutions and specialized services encompass systems integration, lifecycle support, and cybersecurity hardening.

Turning to technological trends, advanced networking solutions including both 5G integration and emerging quantum networking prototypes are enabling faster, more secure data exchanges. Meanwhile, artificial intelligence capabilities-from machine learning algorithms deployed at the edge to sophisticated neural network inference engines-are empowering predictive analysis and autonomous operations. Cybersecurity solutions, spanning encryption systems to next-generation firewall deployments, remain critical to safeguarding mission integrity. Finally, data analytics frameworks that leverage predictive models and real-time processing pipelines are transforming decision support across intelligence, surveillance, and reconnaissance missions. When viewed through the lens of application, computing systems tailored for operational command and tactical engagements coexist with those optimized for inventory tracking, supply chain management, and high-stakes mission planning tasks such as intelligence gathering and strategic deployment. Moreover, segmentation by end user underscores the differentiated requirements of air, land, and sea forces-from aircraft systems and drone operations for the Air Force to ground control and remote operations in the Army, and shipboard as well as submarine systems in the Navy.

This comprehensive research report categorizes the Military Computers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Components

- Technology

- Application

- End-User

Examining Regional Dynamics and Emerging Opportunities in the Americas EMEA and Asia-Pacific Defense Computing Ecosystems

Regional dynamics play a pivotal role in shaping defense computing strategies and procurement priorities. In the Americas, the United States continues to lead in R&D investment and adoption of cutting-edge computing technologies, while Canada and key Latin American partners focus on interoperability and niche capabilities that complement allied defense postures. Cross-border collaboration and joint exercises drive demand for standardized embedded and rugged computing platforms that can operate seamlessly across diverse environments.

Across Europe, Middle East & Africa, defense modernization programs are gaining momentum, with NATO members investing in edge computing and AI-infused systems to enhance collective security. Simultaneously, Gulf Cooperation Council nations are expanding cybersecurity and networking infrastructures, recognizing the critical importance of protecting energy and transportation assets. In Africa, emerging defense budgets are gradually allocating resources toward resilient computing modules suitable for border security and peacekeeping operations.

In the Asia-Pacific region, strategic competition and rapid military modernization efforts are intensifying demand for advanced computing solutions. Major powers such as China and India are pursuing indigenous semiconductor and networking research to reduce reliance on imports, while allied nations like Japan and Australia emphasize secure supply chains and interoperability with U.S. platforms. As regional partnerships deepen, defense computing ecosystems must balance technological sovereignty with coalition readiness to address evolving security challenges.

This comprehensive research report examines key regions that drive the evolution of the Military Computers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Defense Computing Vendors and Strategic Collaborations Shaping the Next Evolution in Military Technology Integration

The defense computing landscape is dominated by a combination of traditional prime contractors and specialized technology providers, each leveraging unique strengths to capture market opportunities. Established defense integrators have deep expertise in mission system design and program management, enabling them to deliver comprehensive computing platforms that incorporate rugged hardware, bespoke software, and secure communications. Simultaneously, commercial technology firms contribute best-of-breed components-such as high-performance processors, advanced networking modules, and encryption systems-supplied through defense-focused business units.

Collaborative ventures and strategic partnerships are accelerating innovation, with joint projects spanning AI-driven analytics, quantum-resistant networking, and next-generation satellite communications. Additionally, a growing ecosystem of small and medium-sized enterprises is introducing niche solutions in areas such as edge AI inference engines, secure storage architectures, and adaptive cybersecurity toolchains. These companies often engage in co-development agreements with larger primes to integrate their technologies into broader defense programs. The resulting interplay of scale, specialization, and cross-industry collaboration is driving healthy competition while ensuring a diverse supplier base capable of meeting the stringent performance, reliability, and security requirements of modern military computing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Military Computers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aitech Defense Systems, Inc.

- AMDTEC Defence

- Amrel, Inc.

- Atos SE

- BAE Systems PLC

- Curtiss-Wright Corporation

- Elbit Systems Ltd

- Elron Electronic Industries Ltd

- General Dynamics Corporation

- Getac Technology Corp.

- Intel Corp

- Kontron AG

- L3 Technologies

- Northrop Grumman Corporation

- Panasonic Corporation

- Pentagon Technologies, LLC

- Raytheon Technologies Corporation

- Saab AB

- VarTech Systems Inc.

Delivering Proactive and Practical Strategic Recommendations to Enhance Resilience Innovation and Deployment of Advanced Military Computing Solutions

Industry leaders should prioritize the development of modular, open-architecture computing platforms that facilitate rapid upgrades and cross-domain interoperability. By adopting standardized hardware interfaces and software frameworks, organizations can mitigate obsolescence risks and streamline integration across heterogeneous systems. Furthermore, enhancing supply chain resilience through strategic onshoring and diversification of component manufacturers will safeguard against policy shifts and geopolitical disruptions.

Investment in artificial intelligence and edge computing capabilities will be essential to maintain real-time decision superiority. Organizations should foster partnerships with specialized AI research firms and leverage government-led innovation programs to accelerate prototyping and deployment. At the same time, strengthening cybersecurity defenses-especially through advanced encryption methods and adaptive firewall architectures-will protect critical data pipelines and uphold mission integrity. Additionally, workforce development initiatives that focus on emerging technology skills, such as quantum networking fundamentals and secure software engineering practices, will ensure that defense organizations possess the human capital required to fully exploit next-generation computing solutions.

Outlining a Robust and Transparent Research Framework Integrating Primary Interviews Secondary Data and Rigorous Analytical Techniques

This research leverages a comprehensive mixed-method methodology to ensure accuracy, depth, and actionable insight. The study begins with primary interviews conducted with senior defense technology executives, program managers, and subject matter experts across air, land, and maritime domains. These qualitative engagements are complemented by structured surveys targeting procurement officers and system integrators to gather quantitative perspectives on adoption drivers and barriers.

Secondary research encompasses an extensive review of open-source defense publications, governmental defense procurement records, industry white papers, and technology standards documents to validate and enrich primary findings. Data triangulation techniques are applied to cross-verify information from multiple sources, ensuring consistency and reliability. Furthermore, rigorous analytical frameworks-such as technology readiness assessments and risk impact matrices-are employed to evaluate the maturity and strategic implications of key computing solutions. The methodological rigor and transparent validation processes underpin the credibility of the insights presented throughout this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Military Computers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Military Computers Market, by Product Type

- Military Computers Market, by Components

- Military Computers Market, by Technology

- Military Computers Market, by Application

- Military Computers Market, by End-User

- Military Computers Market, by Region

- Military Computers Market, by Group

- Military Computers Market, by Country

- United States Military Computers Market

- China Military Computers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Concluding Insights on Strategic Imperatives for Adopting Advanced Military Computer Architectures in an Era Defined by Complexity and Innovation

As defense organizations confront an increasingly complex threat environment, the adoption of advanced military computer architectures emerges as a strategic imperative. The convergence of edge computing, AI-driven analytics, and hardened networking capabilities offers the promise of enhanced situational awareness, rapid decision-making, and operational resilience. However, realizing these benefits requires a holistic approach that addresses hardware modularity, software interoperability, and cybersecurity robustness in tandem.

By assessing the transformative shifts, tariff-induced pressures, and nuanced segmentation dynamics, decision-makers can align their investments with technologies that deliver immediate impact while supporting long-term modernization objectives. In this context, regional and vendor-specific insights guide tailored procurement strategies, ensuring that computing platforms meet performance, reliability, and security requirements. Ultimately, organizations that embrace these strategic imperatives will be well-positioned to maintain overmatch in the digital battlespace and to harness emerging innovations that define the future of defense computing.

Take Immediate Action to Secure Comprehensive Defense Computing Intelligence by Connecting with Ketan Rohom for Tailored Market Research Insights

If you are ready to gain unparalleled insights into the evolving world of defense computing and make informed strategic decisions, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Connecting with Ketan will enable you to secure the comprehensive market research report tailored specifically for military computer technologies. By leveraging this in-depth analysis, you will be positioned to anticipate emerging threats, capitalize on technological advancements, and ensure your organization remains at the forefront of defense innovation. Don’t miss the chance to transform your strategic approach with data-driven intelligence and expert guidance-contact Ketan today to access the critical insights that will shape the future of military computing solutions.

- How big is the Military Computers Market?

- What is the Military Computers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?