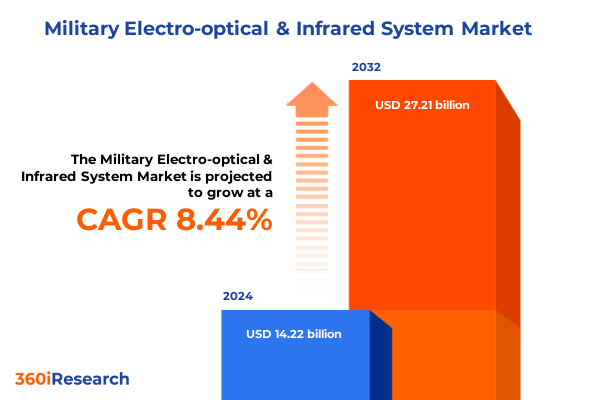

The Military Electro-optical & Infrared System Market size was estimated at USD 15.32 billion in 2025 and expected to reach USD 16.53 billion in 2026, at a CAGR of 8.55% to reach USD 27.21 billion by 2032.

Illuminating the Critical Role and Evolving Landscape of Military Electro-Optical and Infrared Systems in Defense

Military electro-optical and infrared systems represent a cornerstone of modern defense capabilities, seamlessly integrating light and thermal sensing technologies to deliver unparalleled situational awareness. These sophisticated solutions enable operators to detect, identify, and track targets under challenging environmental and battlefield conditions where conventional optics fall short. Over the past decade, they have evolved from early-generation thermal imagers and basic night vision devices into advanced multi-spectral sensor suites, combining long-wave infrared, mid-wave infrared, and short-wave infrared modalities to enhance precision and reliability.

This introduction sets the stage for an in-depth exploration of the critical drivers shaping the electro-optical and infrared landscape. By examining emerging technologies, evolving threat profiles, and shifting procurement priorities, readers will gain a holistic understanding of how these systems underpin modern defense strategies. In doing so, this executive summary highlights the dynamic interplay between innovation, policy, and operational requirements, laying the groundwork for actionable insights.

Decisive Technological Innovations Strategic Priorities and Threat Dynamics Reshaping Electro-Optical and Infrared Defense Solutions

The military electro-optical and infrared domain is undergoing transformative shifts driven by rapid technological breakthroughs, changing threat environments, and strategic realignments. On the technological front, the integration of artificial intelligence and machine learning into sensor suites is revolutionizing image processing and target recognition, enabling real-time decision support even in complex scenarios. Concurrently, the miniaturization of components through advances in semiconductor fabrication and microoptics is facilitating the deployment of compact, lightweight systems across rapidly proliferating unmanned platforms.

Strategically, defense priorities are migrating toward distributed sensing architectures and networked operations, amplifying the importance of interoperable electro-optical and infrared payloads. This shift is further accelerated by emerging peer and near-peer competitions that demand persistent surveillance capabilities and resilient sensor fusion. Moreover, intensified focus on countering asymmetric threats has galvanized investments in mobile and portable imaging systems, underscoring the need for rapid response and flexible deployment. These converging trends underscore a landscape in which adaptability and technological edge define operational superiority.

Analyzing the Far-Reaching Consequences of 2025 U.S. Tariff Adjustments on Electro-Optical and Infrared Supply Chain Dynamics

In 2025, the United States implemented a series of tariff adjustments targeting key components and subassemblies used in electro-optical and infrared systems. These measures aimed to bolster domestic manufacturing, reduce reliance on foreign suppliers, and incentivize investment in local production facilities. While the tariffs have stimulated increased capital allocation toward U.S.-based semiconductor fabs and optics manufacturers, they have also introduced complexity across global supply chains, impacting procurement timelines and cost structures.

Companies have responded by reevaluating sourcing strategies, prioritizing suppliers that offer end-to-end traceability and compliance with the new tariff regime. Collaborative ventures between established defense primes and domestic component specialists have gained traction, as stakeholders seek to mitigate risks associated with supply disruptions. At the same time, certain international suppliers have adjusted their market strategies by relocating assembly lines to tariff-free jurisdictions or negotiating tariff exemptions for technologies deemed critical to allied defense objectives. These developments collectively underscore an evolving ecosystem in which tariff policy is a key determinant of supply chain resilience and strategic positioning.

Uncovering Core Segmentation Dynamics Across System Types Components Technologies Wavelengths Applications and Platforms Shaping Strategic Decisions

Core insights into market segmentation reveal distinct dynamics across system architectures, component portfolios, technological modalities, spectral bands, mission profiles, and deployment platforms. When examining system architectures, imaging systems represent a diverse array of Charge-Coupled Device cameras, Complementary Metal-Oxide-Semiconductor sensors, infrared imaging suites with long-wave, mid-wave, and short-wave bands, and specialized thermal imaging cameras that cater to high-sensitivity detection needs. In parallel, non-imaging mechanisms such as fiber optic gyro inertial measurement units, laser rangefinders, and Lidar systems provide critical targeting, navigation, and motion stabilization functions.

Component analysis underscores the interplay between human-machine interfaces such as LCD and OLED displays, optical subsystems comprising fixed and variable-focus lenses, and sensor modules that integrate infrared and optical detectors for multi-spectral fusion. From a technology standpoint, developments in laser-based designators, microoptics, night vision amplification, and thermal imaging elements have accelerated system performance, particularly in low-light and no-light scenarios. Spectral segmentation emphasizes far-infrared, near-infrared, ultraviolet, and visible bands, enabling tailored solutions for detection, identification, and environmental monitoring. Functional applications span beyond surveillance and target acquisition into fields such as fire control, intelligence gathering, communications support, and navigational assistance, while platform segmentation differentiates solutions optimized for aerial assets like fighter jets, helicopters, and UAVs, ground units including armored vehicles and infantry, as well as maritime vessels from submarines to surface ships. This multilayered framework illuminates where synergies exist, guiding investment decisions and technology roadmaps.

This comprehensive research report categorizes the Military Electro-optical & Infrared System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Component

- Technology

- Wavelength

- Application

- Platform

Delineating Regional Variations and Strategic Imperatives Across the Americas EMEA and Asia-Pacific Defense Electro-Optical Markets

Regional distinctions shape both procurement priorities and technological preferences within the electro-optical and infrared sector. Across the Americas, North American defense agencies exhibit strong demand for integrated sensor suites that support joint all-domain operations, while Latin American nations increasingly seek cost-effective imaging solutions for border security and counter-narcotics efforts. In contrast, Europe, the Middle East, and Africa present a spectrum of requirements-from high-end reconnaissance payloads driven by peer rivalries in Europe to lightweight, portable systems tailored to expeditionary forces and terrain-specific operations in the Middle East and African theaters.

Asia-Pacific markets manifest robust investment cycles fueled by ongoing regional tensions and force modernization initiatives. Nations in this region prioritize scalable architectures that can be rapidly upgraded with next-generation sensors and data links, reflecting the strategic imperative of maintaining technological parity. Moreover, partnerships between domestic defense firms and global technology providers have surged, enabling localized production and technology transfer. These geographical insights reveal how operational doctrines, geopolitical factors, and budgetary constraints converge to influence acquisition strategies in each region.

This comprehensive research report examines key regions that drive the evolution of the Military Electro-optical & Infrared System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Defense Contractors and Innovative Technology Pioneers Shaping the Future of Military Electro-Optical and Infrared Systems

The competitive landscape of military electro-optical and infrared systems is dominated by a blend of traditional defense primes and agile specialized innovators. Established industry leaders leverage integrated portfolios, extensive R&D capabilities, and global support networks to deliver end-to-end solutions, often bundled with advanced analytics and systems integration services. Meanwhile, niche technology firms capitalize on breakthroughs in semiconductor design, micro-optics, and sensor fusion algorithms to introduce modular payloads that can be rapidly adapted to emerging mission requirements.

Strategic partnerships and joint ventures have become commonplace, with large primes aligning with start-ups and research institutes to expedite the development of next-generation sensor arrays, AI-driven target recognition, and resilient communications links. Such collaborations not only accelerate time-to-market but also mitigate risk by distributing project responsibilities across complementary expertise domains. As competition intensifies, the ability to demonstrate proven performance in live operational environments and offer scalable upgrade paths has emerged as a key differentiator, shaping procurement decisions in major defense programs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Military Electro-optical & Infrared System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SAS

- Amentum Services, Inc.

- Anduril Industries, Inc.

- Aselsan A.S.

- BAE Systems PLC

- Bharat Electronics Ltd.

- CONTROP Precision Technologies Ltd.

- Corning Incorporated

- Elbit Systems Ltd.

- General Dynamics Corporation

- Hensoldt AG

- HGH Infrared Systems by TTP PLC

- IMSAR LLC

- Israel Aerospace Industries Ltd.

- Kollmorgen Corporation

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems Ltd.

- Raytheon Technologies Corporation

- Rheinmetall AG

- Saab AB

- Safran Group

- Teledyne Technologies Incorporated

- Thales Group

- The Boeing Company

Charting Actionable Strategic Pathways for Defense Industry Leaders to Capitalize on Emerging Electro-Optical and Infrared Opportunities

Industry leaders seeking to maintain or establish a competitive edge must pursue a multifaceted strategic agenda. First, sustained investment in breakthrough technologies-such as integrated photonics, AI-driven image analysis, and advanced materials-will be essential to deliver the performance gains required for next-generation sensor architectures. Equally important is the diversification of supply chains through domestic partnerships, supplier development programs, and contingency planning, thereby enhancing resilience against geopolitical disruptions and policy shifts.

Furthermore, forging cross-domain alliances with software developers, cybersecurity experts, and data analytics firms can amplify the value proposition of sensor systems by embedding robust data protection measures and enabling real-time intelligence fusion. Leaders should also embrace modular design principles and open architectures, facilitating rapid technology insertion and lifecycle extension. By adopting these strategies, organizations can navigate evolving requirements, streamline acquisition cycles, and secure long-term relevance in an increasingly contested defense environment.

Detailing a Rigorous Research Framework Integrating Primary Stakeholder Insights and Secondary Intelligence for Robust Analytical Integrity

Our research methodology adhered to a rigorous framework combining primary engagement and secondary intelligence to ensure analytical integrity. Primary inputs were secured through in-depth discussions with senior defense procurement officials, system integrators, and technical experts in electro-optical and infrared sensor design. These interviews provided firsthand perspectives on operational requirements, procurement roadblocks, and technology adoption timelines. Concurrently, secondary sources-including technical journals, patent filings, regulatory filings, and open-source intelligence-were systematically reviewed to corroborate insights and identify emerging trends.

Quantitative data points were validated through cross-referencing multiple independent sources, ensuring consistency and reliability. The research also incorporated scenario-based analyses to explore the implications of policy shifts, technological breakthroughs, and geopolitical events. This dual-pronged approach enabled a balanced and nuanced understanding of market dynamics, equipping decision-makers with actionable intelligence free from bias and unsupported conjecture.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Military Electro-optical & Infrared System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Military Electro-optical & Infrared System Market, by System Type

- Military Electro-optical & Infrared System Market, by Component

- Military Electro-optical & Infrared System Market, by Technology

- Military Electro-optical & Infrared System Market, by Wavelength

- Military Electro-optical & Infrared System Market, by Application

- Military Electro-optical & Infrared System Market, by Platform

- Military Electro-optical & Infrared System Market, by Region

- Military Electro-optical & Infrared System Market, by Group

- Military Electro-optical & Infrared System Market, by Country

- United States Military Electro-optical & Infrared System Market

- China Military Electro-optical & Infrared System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Synthesizing Strategic Imperatives and Sectoral Insights to Accelerate Decision-Making in Military Electro-Optical and Infrared Programs

The confluence of advancing sensor technologies, shifting geopolitical priorities, and evolving procurement policies underscores a pivotal moment for military electro-optical and infrared systems. As defense establishments transition toward networked, multi-domain operations, the value of interoperable, adaptable sensor suites will only intensify. Navigating this complex landscape requires a clear grasp of segmentation nuances, regional imperatives, supply chain challenges, and competitive dynamics.

By synthesizing these elements, this report provides a roadmap for aligning product development, strategic partnerships, and investment decisions with long-term defense objectives. Stakeholders who leverage the insights presented herein will be better positioned to anticipate operational needs, mitigate procurement risks, and drive technological innovation that secures strategic advantage. Ultimately, the future of military electro-optical and infrared systems will be shaped by organizations that blend technical prowess with strategic foresight and supply chain resilience.

Engage with Ketan Rohom to Secure Authoritative Insights and Drive Your Strategic Advantage Through Comprehensive Market Research

To unlock unparalleled insights into the competitive landscape and future trajectories of military electro-optical and infrared systems, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His deep expertise in defense technology research ensures that you will receive tailored guidance, comprehensive briefing sessions, and exclusive access to premium data sets that can inform your strategic planning and positioning.

By partnering with Ketan, you can secure a bespoke presentation of findings, detailed technical appendices, and ongoing support for interpreting the report’s implications. This collaboration will empower your organization to make informed procurement decisions, refine product roadmaps, and accelerate time to deployment with confidence. Reach out today to discuss licensing options and explore flexible delivery formats designed to meet your unique requirements.

- How big is the Military Electro-optical & Infrared System Market?

- What is the Military Electro-optical & Infrared System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?